Salestaxhandbook has an additional three kansas sales tax. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the kansas sales tax.

Kansas Resale Certificate – Fill Out And Sign Printable Pdf Template Signnow

How to enroll in the amazon tax exemption program.

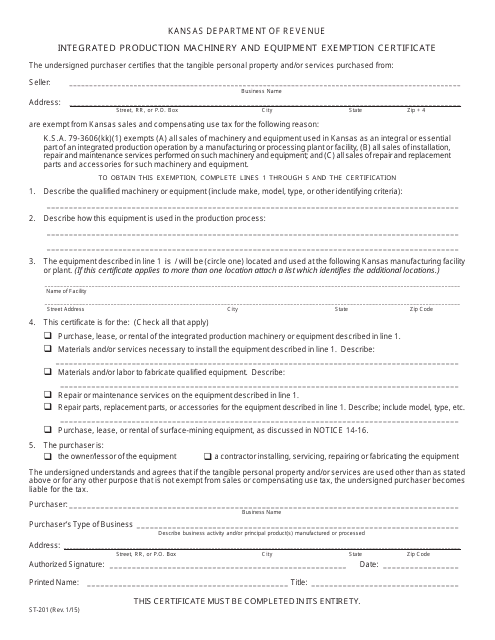

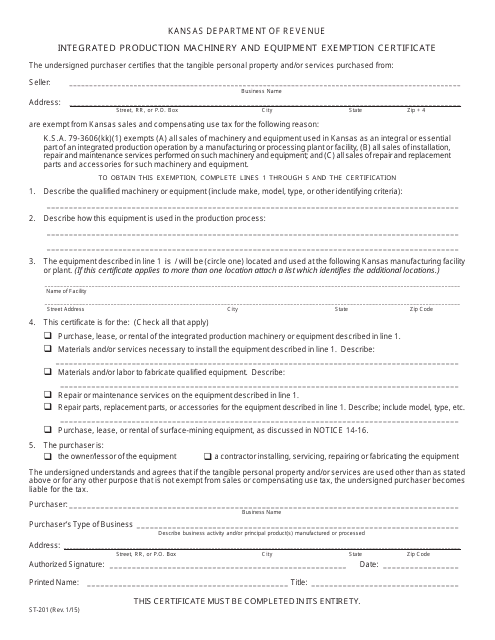

Kansas sales tax exemption form st-201. Purchased from a vending machine are taxable. For a kansas sales tax exemption certificate to be provided to vendors for university purchases or for information regarding the university's sales tax exemption status in other. For other kansas sales tax exemption certificates, go here.

Dealer/purchaser declaration of exemption for certainvehicles and aircraft sold to nonresidents for removal from kansas (exemption requirements and instructions for completion on page 2) section a: The buyer completes and furnishes the exemption certificate, and the seller keeps the certificate on file with other sales tax records. Presents to a retailer to claim exemption from kansas sales or use tax.

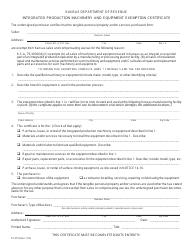

Kansas department of revenue warehouse machinery and equipment exemption certificate the undersigned purchaser certifies that the tangible personal property and/or services purchased from: Any retailer, including banks, pawn shops, collectors, dealers, etc. Simply complete this form and submit it with your purchase.

These and similar items sold at retail are subject to sales tax. The contents should not be used as authority to support a technical position. Buyer must have a kansas sales tax account number, except in drop shipment situations.

File withholding and sales tax online. A resale exemption certificate has two requirements: Individual tribes within the state of kansas are exempt from state sales tax.

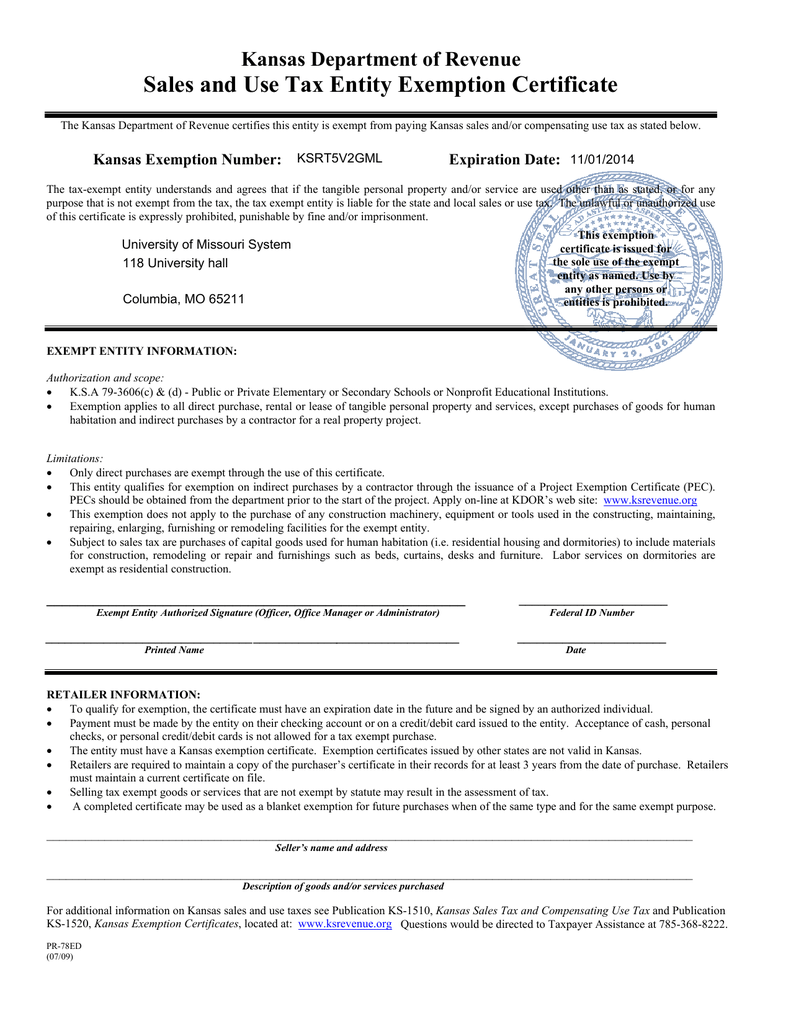

Box city state zip + 4 is exempt from kansas sales and compensating use tax for the following reason (check one box): It explains the exemptions currently authorized by kansas law and includes the exemption certificates to use. This booklet is designed to help businesses properly use kansas sales and use tax exemption certificates as buyers and as sellers.

Must collect sales tax on the total gross receipts received Nonprofit groups or organizations exempt by law from collecting tax on their retail sales of tangible personal property. An exemption certificate must be completed in its

The information provided in this article regarding kansas manufacturing sales tax exemptions has been obtained from. It shows why sales tax was not charged on a retail sale of goods or taxable services. Items delivered to an enrolled tribal member living on the enrolled tribal member’s reservation are also exempt from kansas sales tax, i.e.

Accept the terms & conditions, if authorized to do so In the usual course of the buyer’s business; Click for menu manufacturing machinery and equipment sales tax exemption sales tax exemption for.

All sales tax refunds are limited to kansas’s statute of limitations of 36 months. Description of vehicle or aircraft. Log in to amazon.com and place your cursor over “your account” on the top right corner of the screen;

How to use sales tax exemption certificates in kansas. It is designed for informational purposes only. Only those businesses and organizations that are registered to collect kansas sales tax and provide their kansas sales tax registration number on this form may use it to purchase inventory without tax.

Coins, bullion, stamps, antiques and collectibles. Are exempt from kansas sales and compensating use tax for the following reason: If you are a contractor purchasing goods for either resale or in order to build something, you do not need to pay taxes on the items.

Other kansas sales tax certificates: The local taxes are required by law to be administered by the kansas department of revenue and are added to the state rate to arrive at the total sales tax percentage collected by kansas retailers from their customers. Learn more about manufacturer / processor sales tax exemption number?

For other kansas sales tax exemption certificates, go here. Items purchased must be for resale. Purchase orders showing an exemption from the sales or use tax based on this certificate must contain the address of the project where the property will be used, as well as the name and

This is a streamlined sales tax certificate, which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the streamlined sales and use tax agreement.please note that kansas may have specific restrictions on how exactly this form can be used. An enrolled pbpn member living on pbpn reservation qualifies for exemption. The contractor must use a separate form st‑120.1, contractor exempt purchase certificate, for each project.

Businesses with a general understanding of kansas sales tax rules and regulations can avoid costly errors.

Kansas Business Development Incentives

Kansas Manufacturing Sales Tax Exemptions Smartsave

Lvcountyedorg

Ksrevenueorg

Zillionformscom

Sales And Use Tax Entity Exemption Certificate Kansas Department Of Revenue

Sales Taxes In The United States – Wikipedia

Ksrevenueorg

Assetsmcnicholscom

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Exemption Certificates Pub Ks-1520 – Kansas Department Of

Form St-201 Download Fillable Pdf Or Fill Online Integrated Production Machinery And Equipment Exemption Certificate Kansas Templateroller

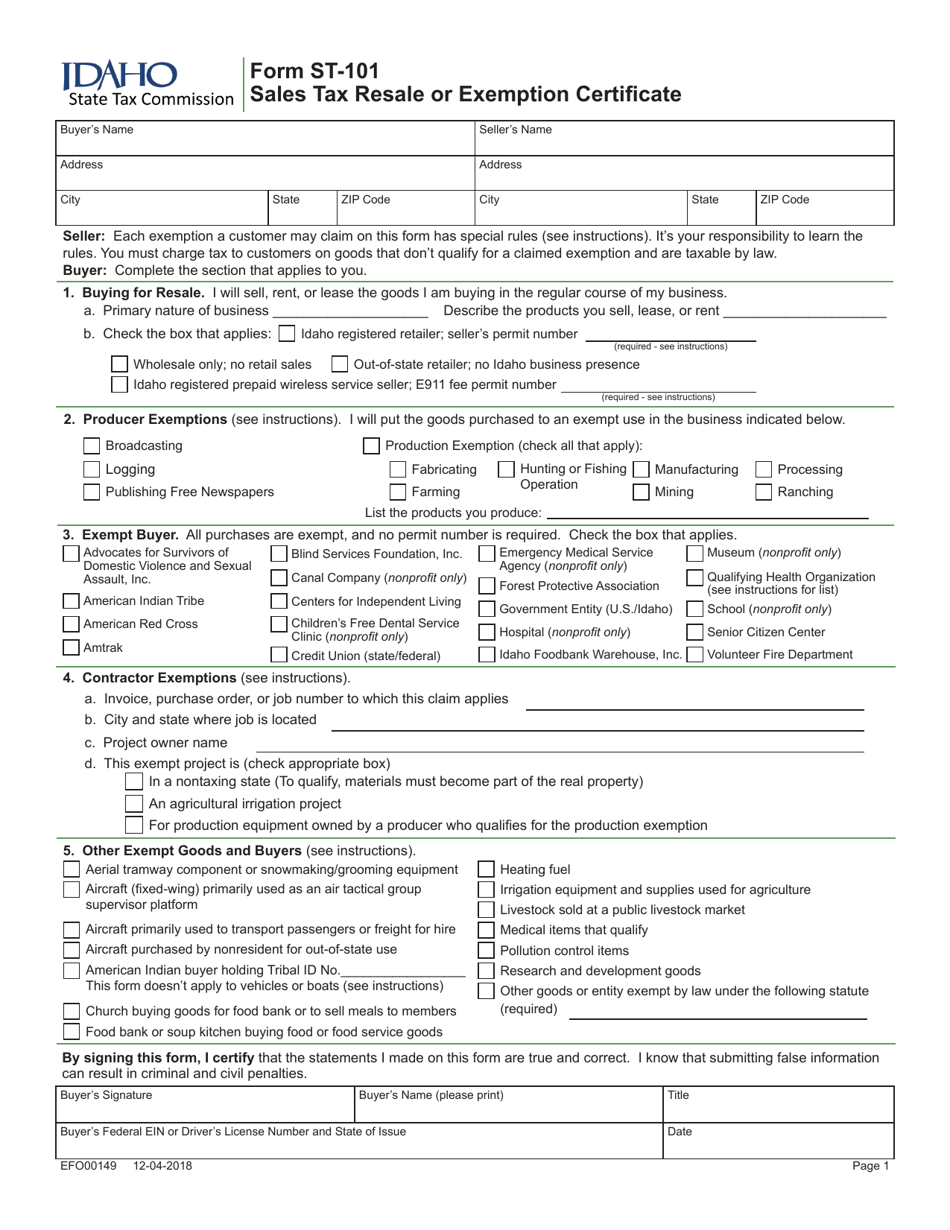

Form St-101 Download Fillable Pdf Or Fill Online Sales Tax Resale Or Exemption Certificate Idaho Templateroller

Form St-8b Fillable Affidavit Of Delivery Of A Motor Vehicle Semitrailer Pole Trailer Or Aircraft To A Nonresident Of Kansas

Form St-201 Download Fillable Pdf Or Fill Online Integrated Production Machinery And Equipment Exemption Certificate Kansas Templateroller

Ksrevenueorg

Ksrevenueorg

How To Get A Sales Tax Exemption Certificate In Colorado – Startingyourbusinesscom

Zillionformscom