6 Places To Look For A cost with insurance.

Online insurance provider websites

When looking for information about the cost of all-on-4 dental implants with insurance coverage, turning to online insurance provider websites can be a convenient first step. These websites typically offer tools and resources to help individuals understand their coverage options and calculate potential costs associated with specific procedures. By navigating through the information provided on these platforms, individuals can gain valuable insights into the extent of insurance coverage for procedures like all-on-4 dental implants, helping them make informed decisions regarding their healthcare needs and financial planning.

Through online insurance provider websites, individuals can also explore the various plans and policies available to them, including specific details about coverage for dental procedures such as all-on-4 dental implants. By inputting relevant information about their insurance coverage and desired procedure, individuals can receive customized cost estimates and policy recommendations tailored to their needs. This accessibility to personalized information can empower individuals to navigate the complexities of insurance coverage more effectively, providing them with a valuable resource for managing their healthcare expenses and making informed decisions about their treatment options.

Comparison websites

When considering the expenses related to medical procedures like the gastric balloon, the cost can vary significantly. If you are exploring the option of getting a gastric balloon and want to understand how insurance can help cover some of these expenses, utilizing comparison websites can be a valuable tool. These platforms allow you to input your specific insurance information and compare how different providers may help offset the gastric balloon cost with insurance.

In addition to comparing insurance coverage for procedures like the gastric balloon, these comparison websites can also provide insight into the overall value and quality of the services offered by different healthcare providers. By utilizing these online tools, you can make informed decisions about your healthcare needs and find the most cost-effective options available to you in terms of gastric balloon cost with insurance.

Insurance brokers or agents

When faced with the daunting prospect of expensive medical procedures such as wisdom tooth removal cost without insurance, seeking the guidance of seasoned professionals in the insurance industry can be invaluable. These experts possess a wealth of knowledge and experience that can help individuals navigate the complexities of healthcare coverage options and find the most cost-effective solutions for their specific needs.

Insurance brokers or agents act as trusted advisors, offering personalized assistance in evaluating insurance policies and identifying the most suitable plans to address individual healthcare concerns. By leveraging their expertise and industry insights, individuals can make informed decisions that not only provide financial protection against unforeseen medical expenses like wisdom tooth removal but also ensure comprehensive coverage for all their healthcare needs.

Insurance company customer service

When faced with questions or concerns regarding your insurance coverage, having easy access to responsive and efficient customer service is paramount. It can make a significant difference in resolving issues promptly and effectively. For instance, if you are unsure about the tooth filling cost with insurance or need clarification on the coverage details, a knowledgeable and helpful customer service team can provide the assistance you need.

Good customer service from an insurance company can also alleviate stress and confusion, particularly during the claims process. Whether you are filing a claim for a dental procedure like a tooth filling or for any other medical expenses, having a supportive customer service team willing to guide you through the process can streamline the experience and ensure that you receive the benefits you are entitled to.

Employer benefits package

Employer benefits packages often include options for health, life, and disability insurance for employees. These packages typically vary based on the size and type of the company, with larger corporations tending to offer more comprehensive coverage. Employees may have the opportunity to enroll in these insurance plans during specific enrollment periods designated by the employer.

In addition to insurance coverage, employer benefits packages may also include perks such as retirement savings plans, wellness programs, and other incentives to attract and retain talent. These packages are designed to provide a sense of security and well-being for employees, while also offering cost-effective options for both the employer and the employee.

Local insurance offices

When searching for insurance options, it can be beneficial to consider local insurance offices. These establishments often provide personalized services and a face-to-face interaction that some individuals may find reassuring. By visiting a local insurance office, clients can discuss their insurance needs with a licensed agent who can offer tailored advice based on specific circumstances.

Local insurance offices have the advantage of being easily accessible in case any issues or questions arise regarding insurance policies. Clients can develop a direct relationship with their agent, which can lead to more efficient communication and quicker resolution of any concerns. Additionally, visiting a local office can provide a sense of security knowing that there is a physical location to visit for in-person assistance with insurance matters.

• Local insurance offices offer personalized services and face-to-face interactions

• Clients can discuss their insurance needs with licensed agents for tailored advice

• Easily accessible for any issues or questions regarding insurance policies

• Develop a direct relationship with agents for efficient communication

• Provides a sense of security knowing there is a physical location for in-person assistance

Family and friends recommendations

When it comes to selecting an insurance provider, seeking advice from family and friends can be invaluable. Their firsthand experiences and insights can offer a unique perspective that may not be found elsewhere. Hearing about the quality of customer service, claims process, and overall satisfaction from those close to you can help guide your decision-making process.

Additionally, recommendations from family and friends can provide a sense of trust and reassurance when choosing an insurance company. Knowing that someone you trust has had a positive experience with a particular provider can instill confidence in your choice. This personal touch can go a long way in helping you feel more secure in your decision.

Social media groups or forums

Social media groups or forums serve as virtual communities where individuals can discuss and seek advice on various topics, including insurance. Users share their experiences, recommendations, and queries regarding insurance providers, coverage options, and claim processes. Participation in these groups can provide valuable insights and firsthand accounts that may not be readily available elsewhere. It is essential to exercise caution and verify any information obtained from these platforms, as opinions shared may vary in accuracy and relevance to individual circumstances.

Engaging in discussions within social media groups or forums can also help individuals stay informed about the latest trends and developments in the insurance industry. Members often share news articles, informative posts, and updates on policy changes that could impact insurance coverage and pricing. By actively participating in these online communities, individuals can expand their knowledge base and make more informed decisions when it comes to selecting insurance products that align with their specific needs and budgets.

Insurance industry publications

When looking for valuable insights and updates about insurance trends and policies, turning to industry publications can be instrumental. These publications offer in-depth analyses, expert opinions, and the latest news shaping the insurance landscape. From articles on emerging technologies in underwriting to regulatory changes impacting coverage options, these resources provide a comprehensive view of the insurance sector.

For professionals seeking to stay informed and enhance their expertise in the field, subscribing to reputable insurance industry publications is crucial. By regularly consuming content from these sources, individuals can broaden their knowledge base, stay ahead of industry shifts, and gain a competitive edge in navigating the complexities of insurance products and services. Whether delving into risk management strategies or exploring innovative insurance solutions, these publications serve as indispensable tools for staying informed and well-equipped in the ever-evolving insurance sector.

Personal finance websites

When navigating the world of personal finance, accessing reputable resources is crucial for making informed decisions. Many individuals turn to personal finance websites for guidance on managing their finances effectively. These websites often provide valuable insights on budgeting, investing, debt management, and insurance options, offering a comprehensive overview of financial topics that may impact one’s overall financial well-being.

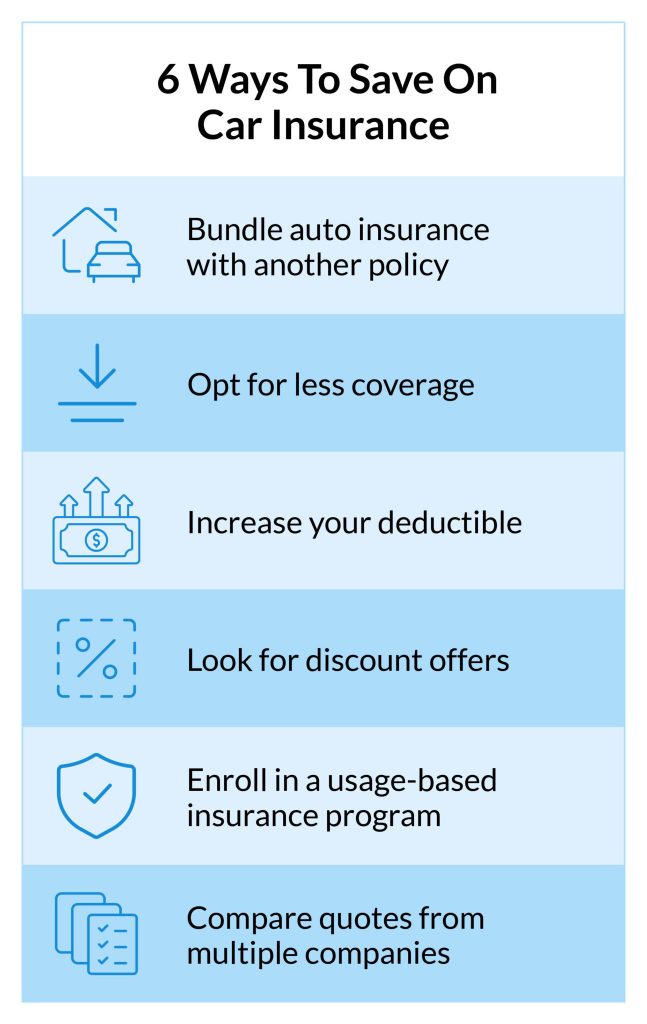

Personal finance websites can be particularly helpful for individuals seeking tips on how to save money on insurance premiums. By exploring these websites, individuals can gain a better understanding of insurance products, coverage options, and potential discounts available in the market. Additionally, personal finance websites often feature articles and guides that highlight the importance of insurance planning as part of a broader financial strategy, emphasizing the significance of protecting one’s assets and loved ones through appropriate insurance coverage choices.