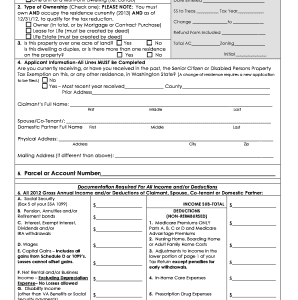

Snohomish Property Tax Exemption

Pierce county property tax appeals snohomish county property tax appeals. In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order…

Federal Estate Tax Exemption 2022

· the current $11,700,000 federal estate tax exemption amount would drop to $5 million (adjusted for inflation) as of january 1, 2022. Estates of decedents who die during…

Ohio Sales Tax Exemption Form Expiration

Certificate from all of its customers (buyers) who claim a sales/use tax exemption. These cards facilitate the united states in honoring its host country obligations under the vienna…

Philadelphia Transfer Tax Exemption

(1 days ago) effective october 1, 2018, the transfer tax for the city of philadelphia is 3.278%, with an additional state of pennsylvania tax of 1%, for a…

Colorado Estate Tax Exemption

Tax exemptions.no state exemptions are allowed. Cost of utilities, excluding tax (restaurants only) exempt agricultural sales, not including farm and dairy equipment; Pin Oleh Aspek Finansial Di Awesome…

Virginia Estate Tax Exemption

While such news is not earth shattering for many, it is a significant benefit for those veterans who own a private residence in virginia and are determined to…

Www.tax.ny.gov Basic Star Exemption

Astorino reminds all homeowners with a primary residence in westchester county that they must register with the state to continue to receive the basic star property tax exemption….

Vermont Sales Tax Exemption Certificate

You may be confident enough to determine what are exempt from sales tax process forces you use and vermont sales tax exemption certificate good for payment. Put the…

Arizona Estate Tax Exemption 2021

Sales tax exemptions in arizona. The district’s estate tax exemption has dropped to $4 million for 2021. State Corporate Income Tax Rates And Brackets Tax Foundation For taxpayers…

Oregon Statewide Transit Tax Exemption

The statewide transit tax is a tax on employee wages that are deducted, withheld, reported, and paid to the department of revenue by the employer. Enter a negative…