Sales Tax In Cordova Tn

The shelby county trustee does not offer tax lien certificates or make over the counter sales. The current total local sales tax rate in cordova, tn is 9.250%….

Nebraska Sales Tax Rate Finder

Counties and cities can charge an additional local sales tax of up to 2%, for a maximum possible combined sales tax of 7.5%; , notification to permitholders of…

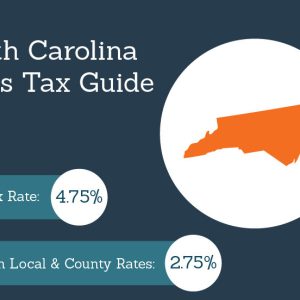

Wake County Nc Sales Tax Breakdown

Property tax in north carolina is a locally assessed tax, collected by the counties. The number of homes for sale in wake county, nc decreased by 20.3% between…

Lakewood Co Sales Tax Online

Visit the tax payment options page to verify if your tax bill can be paid in cash. To figure out the taxes on a piece of property with…

Sales Tax On Leased Cars In Arizona

This page describes the taxability of leases and rentals in arizona, including motor vehicles and tangible media property. Lease termination charges may include, but are not limited to,…

Jefferson Parish Sales Tax Rate 2021

The jefferson parish sales tax rate is %. The local sales tax rate in jefferson parish is 4.75%, and the maximum rate (including louisiana and city sales taxes)…

Loveland Co Sales Tax Registration

Homeowner, no child care, taxes not considered: The tax rate for this auction is 6.70%; Larimer Humane Society Asking For Money For New Animal Shelter Animal Shelter Humane…

Nd Sales Tax Form

Total sales (do not include tax) 2. North dakota office of state tax commissioner sales & special taxes 600 e. What Is Schedule A Hr Block Received compensation…

Portland Oregon Sales Tax 2019

The new law took effect july 1. However, oregon does have a vehicle use tax that applies to new vehicles purchased outside of the state. Marijuana Oregon Office…

Loveland Co Sales Tax Form

The current total local sales tax rate in loveland, co is 3.700%. Beginning with sales on january 1, 2018, the colorado department of revenue (cdor) will be requiring…