Selling a car in the “golden state” starts with preparing it for sale. Complete the online notice of transfer and release of liability within 10 days of the sale.

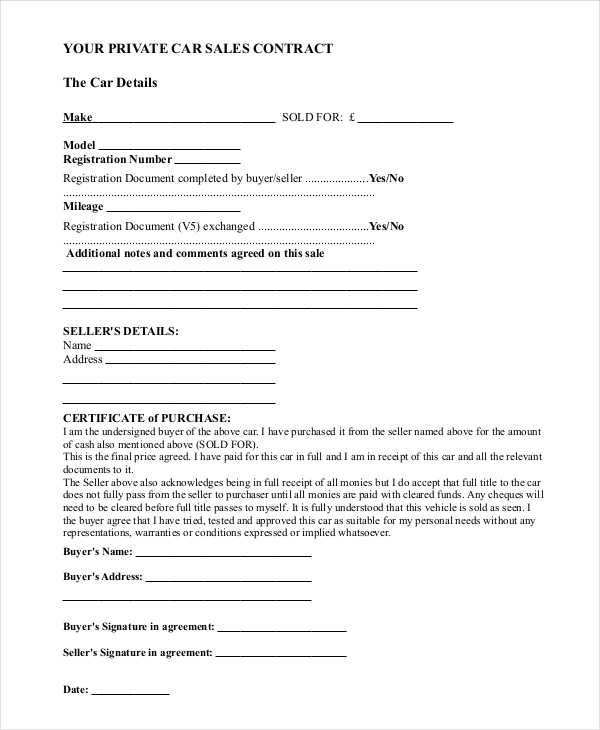

Free Vehicle Private Sale Receipt Template – Pdf Word Eforms

A release of liability form ca is usually attached to your title.

Who pays sales tax when selling a car privately in california. By law a dealer has 20 days to send your title transfer and sales tax to the secretary of state s office. Once you've sold your vehicle and provided all required documents to the buyer, you'll need to notify the ca department of motor vehicles (dmv) that you no longer own the car. The tax due in is called use tax rather than sales tax, but the tax rate is the same:

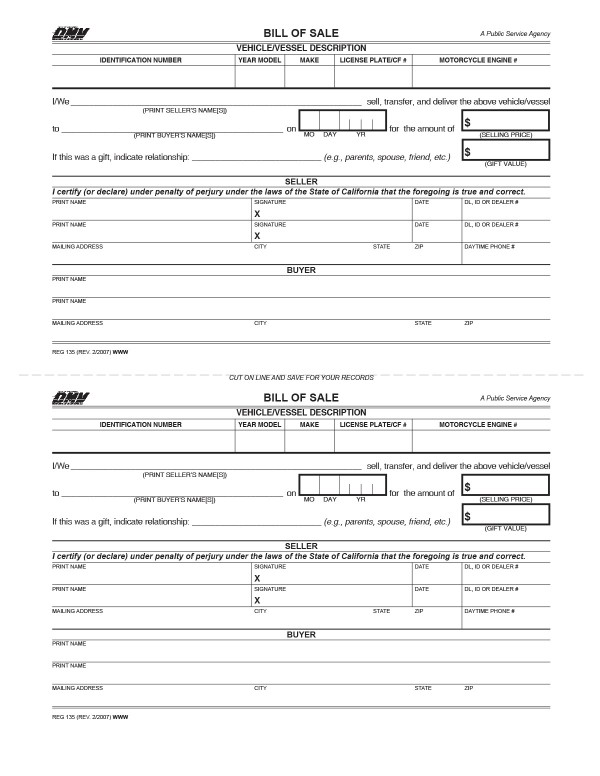

Yes you must pay sales tax when you buy a used car if you live in a state that has sales tax. The vehicle’s title (sometimes referred to as a pink slip), signed by the person selling the car. First, you should gather the required dmv forms.

A few such rules include the smog certificate, release of liability and the california pink slip. For a vehicle transfer that occurs from january 1, 2021 through december 31, 2030, any vehicle of model year 2011 or newer (2012, 2013, etc.) will require an odometer disclosure. The process to sell a used car out of state, like the process of buying a car in the same manner, depends somewhat upon the state in which you live.

California collects a 7.5% state sales tax rate on the purchase of all vehicles, of which 1.25% is allocated to county governments. The car was a family transfer sold between a parent, child, grandparent, grandchild,. Don t be surprised by the sales tax when selling or buying a business.

Local governments, such as districts and cities can collect additional taxes on the sale of vehicles up to 2.5%, in addition to the state tax. Sellers name, buyers name, date of sale, make/model/year of vehicle, and conditions of sale. You can pay the tax to the dmv when you register the car in california.

In such a sale, the buyer must pay the required state tax on the transaction when he or she registers the car with the department of motor vehicles. You can calculate your local use tax rate here. Starting on january 1, 2031, any vehicle that is.

Dmv.org shows you where to look up your state’s new car sales. Otherwise, selling cars in california is similar to selling vehicles in any other state. Yes, sales tax on the sale of a business.

California sales tax generally applies to the sale of vehicles, vessels, and aircraft in this state from a registered dealer. If you buy a vehicle in california, you pay a 7.5 percent state sales tax rate regardless of the vehicle you buy. When you purchase a vehicle through a private sale you must pay the associated local and state taxes.

In most states, you’ll need to bring your bill of sale and signed title to the department of motor vehicles (dmv) or motor vehicle registry agency to pay your taxes and obtain your registration, new title, and plates. The national highway traffic safety administration’s (nhtsa) odometer disclosure requirements were updated in december 2020 impacting certain private vehicle sales in california: However, you do not pay that tax to the car dealer or individual selling the car.

According to nj.com, the state assesses a 6.625 percent sales tax on the purchase price of any used or new vehicle. When george harrison wrote his famously catchy song “taxman” back in 1966, it was considered a protest against england’s arguably excessive tax structure. Once you’ve done that, you’ll need to decide where to sell it.

Who's paying what & where. Let’s talk about car sales tax. If you're selling a used car privately in california, there are a few different laws to know.

It also depends upon the state that the car is going to, as there may be a buy car out of state tax for the vehicle's new owner to deal with. The buyer must pay 95 to the secretary of state and a tax to the department of revenue. If you buy a used car from a private party sale in california, you may have to pay a “use tax.” a use tax is similar to a sales tax and collected for the use, storage or consumption of personal property (including vehicles) in california.

You may be exempt from a use tax in california if: Tax obligation when you buy a car through a private sale. For more information, visit the tax guide for purchases of vehicles, vessels, and aircraft on the cdtfa website.

Next, is to get a state inspection, as well as a smog certification. 6.35% or 7% if the car ' s value is more than $50,000. Be based upon the purchase price of the car, minus whatever sales tax you paid to another state.

However, if you bought it for $14,000 and sold it for $15,000, earning a $1,000 capital gain, you would report this on your tax return, using schedule d on form 1040 that's. Options include private buyers, dealers, scrapyards, and donating it to a charity. Once the lienholder reports to flhsmv that the lien has been satisfied the title can be transferred.

California sales tax on car purchases according to the sales tax handbook , the california sales tax for vehicles is 7.5 percent. He must produce a sales receipt from you. Buyers have 10 days after purchasing the vehicle to transfer ownership from the seller to themselves, and sellers have 5 days after the sale to report the transfer of ownership to dmv.

Car sales tax across canada: To calculate how much sales tax you’ll owe, simply multiple the vehicle’s price by 0.06625. For example, a $15,000 car will cost you $993.75 in state sales tax.

When you purchase a vehicle through a private sale, you must pay the associated local and state taxes. There is also a 50 dollar emissions testing fee which is applicable to the sale of a vehicle. You will pay it to your state's dmv when you register the vehicle.

The receipt can be hand written and must contain: Yes, you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. So if you bought the car for $14,000 and sold it for $8,000, you would have a capitol loss of $6,000.

If you purchased the vehicle in another state you should pay the sales tax in that state and bring proof of. 2018 taxes and business vehicles. Subtract what you sold the car for from the adjusted purchase price.

Local governments can take up to 2.5 percent for a vehicle's sales tax along with. You would not have to report this to the irs. Do you have to pay tax on car rental or lease payments?

Free Vehicle Private Sale Receipt Template – Pdf Word Eforms

Tax King Inc Is A Small Accounting Firm We Offer Financial And Business Management Services To The Cost Accounting Bookkeeping Services Accounting And Finance

California Bill Of Sale Form For Cars

Pin On Luxury Real Estate

How To Register Vehicles Purchased In Private Sales – California Dmv

How To Use A California Car Sales Tax Calculator

California Vehicle Tax Everything You Need To Know

Free 8 Sample Car Sale Contract Forms In Pdf Ms Word

How To Transfer The Title Of A Car Yourmechanic Advice

Trade In Car Or Sell It Privately – The Math Might Surprise You

All About Bills Of Sale In California The Facts And Forms You Need

Free Printable Free Car Bill Of Sale Template Form Generic Sample Printable Legal Forms For Attorney Lawye Bill Of Sale Template For Sale Sign Templates

Get Our Example Of Sales Rep Commission Template For Free Contract Template Agreement Sales Agent

California Bill Of Sale Form For Cars

Get The Right Deals For Car For Sale In Madera Cars For Sale Used Car Prices Volvo Dealership

How To Transfer The Title Of A Car Yourmechanic Advice

Important Tax Information For Used Vehicle Dealers – California Dmv

Onstar Business Model Canvas Business Model Canvas Dental Business Business Model Canvas Examples

California Used Car Sales Tax Fees 2020 Everquote