The combined rate used in this calculator (8.6%) is the result of the washington state rate (6.5%), the pasco tax rate (2.1%). The 98665, vancouver, washington, general sales tax rate is 8.4%.

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

On top of that is a 0.3 percent lease/vehicle.

Wa car sales tax calculator. But since cities and counties collect additional sales taxes on top of that rate, rates are typically. Use our auto sales tax calculator to estimate rates. The updated excise tax rates will take into account the fuel efficiency of motor vehicles as mandated by title v of the cleanenergy dc omnibus.

The combined rate used in this calculator (8.4%) is the result of the washington state rate (6.5%), and in some case, special rate (1.9%). Find your state below to determine the total cost of your new car, including the car tax. Look up a tax rate.

Any caravan defined as 'a trailer (including a camper trailer) permanently fitted for human habitation in the course of a journey' is exempt from the payment of vehicle licence. 17 aug 2021 qc 16608. In addition, washington county taxes are applied as well at a rate of 0.3 percent of the sales price.the tax money collected is allocated toward various state funded services like road maintenance.

The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Auto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator. This level of accuracy is important when determining sales tax rates.

The state of washington taxes all sales of automobiles at a rate of 6.5 percent, which is the standard retail sales tax. The state’s base sales tax rate is 6.5%. Obtain an estimate of the excise tax by using the online excise tax calculation tool.

How 2021 sales taxes are calculated for zip code 99301. Washington has a 6.5% statewide sales tax rate , but also has 218 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 2.252% on. This link opens in a new window.

Car loan calculator detailed for washington. Our calculator has recently been updated to include both the latest federal tax rates, along with the latest state tax rates. $30,000 × 8% = $2,400.

According to the sales tax handbook, a 6.5 percent sales tax rate is collected by washington state. Vehicle licence duty calculator (2021/2022) driver and vehicle services is required by the duties act 2008 to collect vehicle licence duty when a vehicle is licensed or its licence is transferred. Karmart volkswagen 1725 bouslog road directions burlington,.

Dol fees are about $ 613 on a $ 39750 vehicle based on a flat fees that fluctuate depending on vehicle. You are able to use our washington state tax calculator to calculate your total tax costs in the tax year 2021/22. Washington state auto loan calculator we can help calculate monthly auto loan payments specifically for washington residents.

Our calculations include wa state fees and tax estimates so you have a better idea of your monthly car payments. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. The 99301, pasco, washington, general sales tax rate is 8.6%.

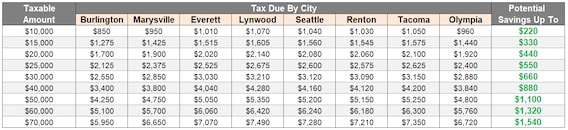

Use our online sales tax calculator, then speak with the auto finance experts at our vw dealer near marysville, wa. How 2021 sales taxes are calculated for zip code 98665. Find a ram truck or jeep suv at our burlington dealer that fits your budget with low car sales tax rates.

Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees. Dealer 4 day ago the state of washington taxes all sales of automobiles at a rate of 6.5 percent, which is the standard retail sales tax.in addition, washington county taxes are applied as well at a rate of 0.3 percent of the sales price.the tax money collected is allocated toward various state funded services like road. As a result of recent regulatory changes, dc dmv has revised the calculations for motor vehicle excise taxes.

Curious about car sales tax in washington? You’ll find rates for sales and use tax, motor vehicle taxes, and lodging tax. Our calculator has been specially developed in order to provide the users of the calculator with not only.

Search by address, zip plus four, or use the map to find the rate for a specific location. When you enter the street address, the calculator uses geolocation to pinpoint the exact tax jurisdiction. This calculator helps you to calculate the tax you owe on your taxable income.

Car Tax By State Usa Manual Car Sales Tax Calculator

Auto Sales Tax Calculator Buy A Vw Near Marysville Wa

Mka7r8ijnvvd2m

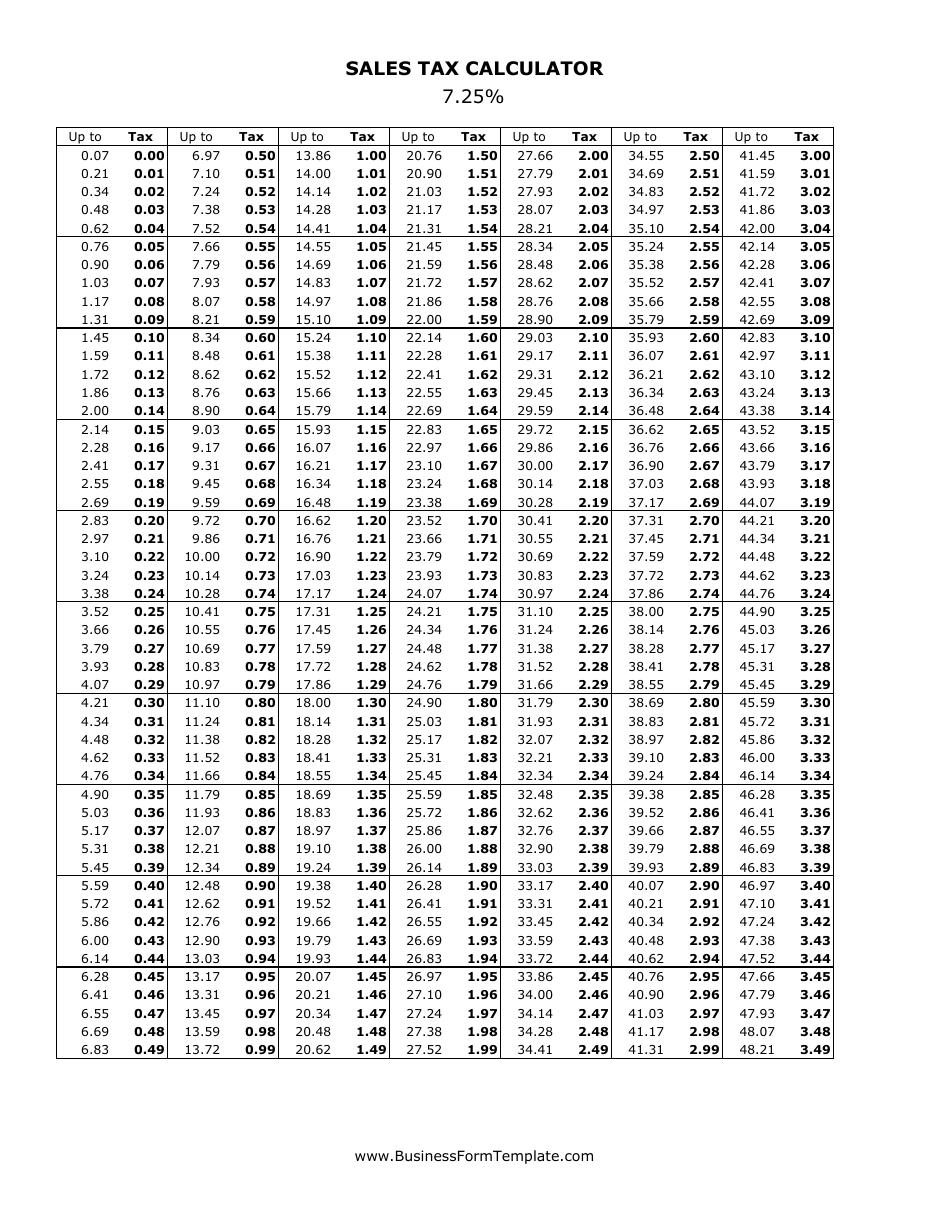

725 Sales Tax Calculator Download Printable Pdf Templateroller

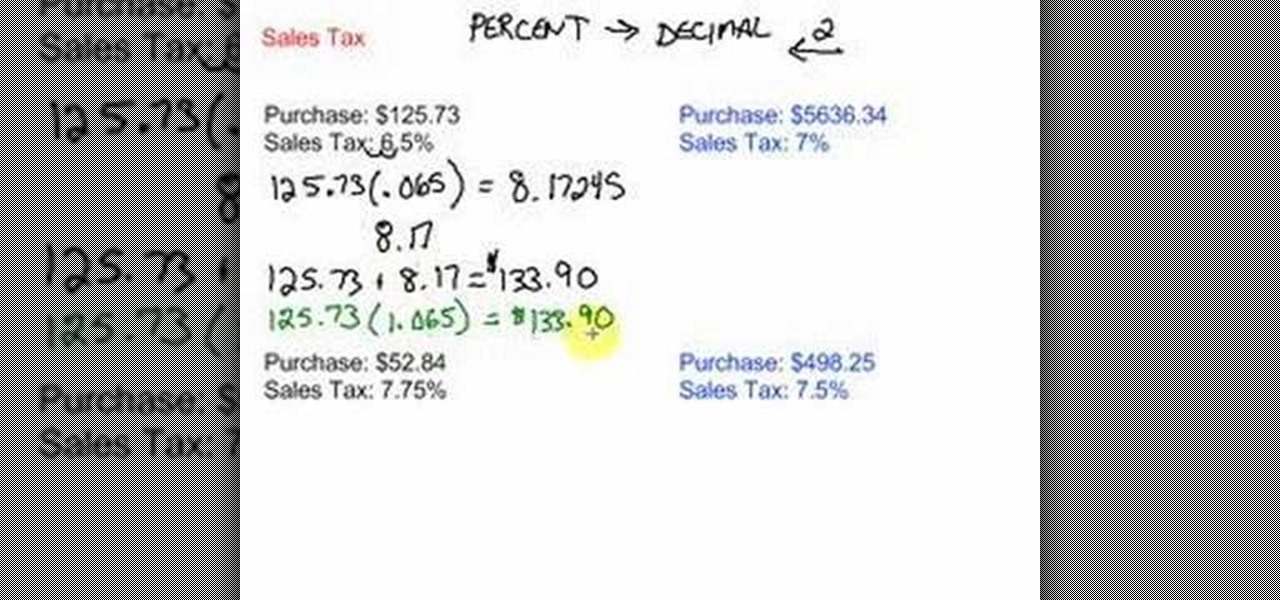

How To Figure Out And Calculate Sales Tax Math Wonderhowto

How To Calculate Cannabis Taxes At Your Dispensary

How To Calculate Sales Tax – Video Lesson Transcript Studycom

How To Calculate Cannabis Taxes At Your Dispensary

Contoh Surat Lamaran Kerja Via Email Yang Menarik Dan Profesional Marketing Komunikasi Kantor Perusahaan

States With Highest And Lowest Sales Tax Rates

Free Business Sales Tax Calculator – Calculate Your Tax Now With Clickfunnels

Tennessee Sales Tax – Small Business Guide Truic

Sales Tax Calculator

Sales Tax Calculator For Purchase Plus Tax Or Tax-included Price

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Calculate Sales Tax Backwards From Total

Sales Tax Calculator

Accounting Wallpapers Live Accounting Wallpapers Xuz412 Accounting Accounting Firms Business Method

Which Cities And States Have The Highest Sales Tax Rates – Taxjar