Property owners who are behind in their taxes are encouraged to make payments throughout the year to catch up and keep their property out of the sale. This is the total of state and county sales tax rates.

Taxable Sales Down In Many St Louis Areas – Show Me Institute

The minimum combined 2021 sales tax rate for st louis county, missouri is.

St louis county sales tax 2021. The minimum combined 2021 sales tax rate for st louis county, minnesota is. The median property tax in st. Louis county taxable sales never recovered from the great recession.

The 2018 united states supreme court decision in south dakota v. The combined rate used in this calculator (9.238%) is the result of the missouri state rate (4.225%), the 63119's county rate (2.263%), the saint louis tax rate (1.5%), and in some case, special rate (1.25%). The average cost of nursing homes in saint louis county is$405,570per month.

The local sales tax rate in st louis county is 2.263%, and the maximum rate (including missouri and city sales taxes) is 9.988% as of november 2021. Louis county collects, on average, 1.25% of a property's assessed fair market value as property tax. Another is inflation eating up the gas tax which hadn’t ben raised in 25 years until this october.

Louis county will get to keep more of the sales tax revenue they generate under a bill signed friday by gov. Statewide sales/use tax rates for the period beginning may, 2021: Ad a tax advisor will answer you now!

Saint louis county, mo sales tax rate. Louis county is known for its spectacular natural beauty, lakes and trout streams. Louis county collector of revenue’s office conducts its annual real estate property tax sale on the fourth monday in august.

Louis county, missouri is $2,238 per year for a home worth the median value of $179,300. Clarkson eyecare, llc case no. Much of the area has been built on the history of logging and the abundance of iron ore.

Statewide sales/use tax rates for the period beginning october, 2021: The st louis county sales tax rate is %. Learn more about our history, public services and working with our.

A portion of the state’s gas ax is distributed to counties. Louis county, missouri nancy ylvisaker et al. Questions answered every 9 seconds.

The current total local sales tax rate in saint louis, mo is 9.679%. Statewide sales/use tax rates for the period beginning april, 2021: This is the total of state and county sales tax rates.

Ad a tax advisor will answer you now! On average, consumers rate nursing homes in saint louis county3.2out of 5 stars. Louis county is the largest county east of the mississippi river.

The current total local sales tax rate in saint louis county, mo is 7.738%. 101 rows how 2021 sales taxes are calculated for zip code 63138. In the circuit court of st.

The missouri state sales tax rate is currently %. Better rated regions includesaint louis citywith an average rating of3.2out of 5 stars. Louis county has one of the highest median property taxes in the united states, and is ranked 348th of the 3143 counties.

Over the past year, there have been 46 local sales tax rate changes in missouri. Questions answered every 9 seconds. The 63119, saint louis, missouri, general sales tax rate is 9.238%.

Has impacted many state nexus laws and sales tax. Click any locality for a full breakdown of local property taxes, or visit our missouri sales tax calculatorto lookup local rates by zip code. If you need access to a database of all missouri local sales tax rates, visit the sales tax data page.

Payment may be made with a credit/debit card or cashier’s check. Jefferson city • certain cities in st. The december 2020 total local sales tax rate was also 9.679%.

The december 2020 total local sales tax rate was 7.613%. How 2021 sales taxes are calculated for zip code 63119. In real dollars taxable sales and use are down 18% from 2000 levels.

Located in the arrowhead region of northeastern minnesota, st. The st louis county sales tax rate is %. What is the sales tax rate in st louis county?

2021 missouri sales tax changes. This table lists each changed tax jurisdiction, the amount of the change, and the towns and cities in which the modified tax rates apply. , mo sales tax rate.

The minnesota state sales tax rate is currently %. It will change the way a countywide. Saint louis, mo sales tax rate.

Louis county is asking people who live there to avoid the lines and pay online. Statewide sales/use tax rates for the period beginning july, 2021: This page will be updated monthly as new sales tax rates are released.

Collector Of Revenue – St Louis County Website

Pay For

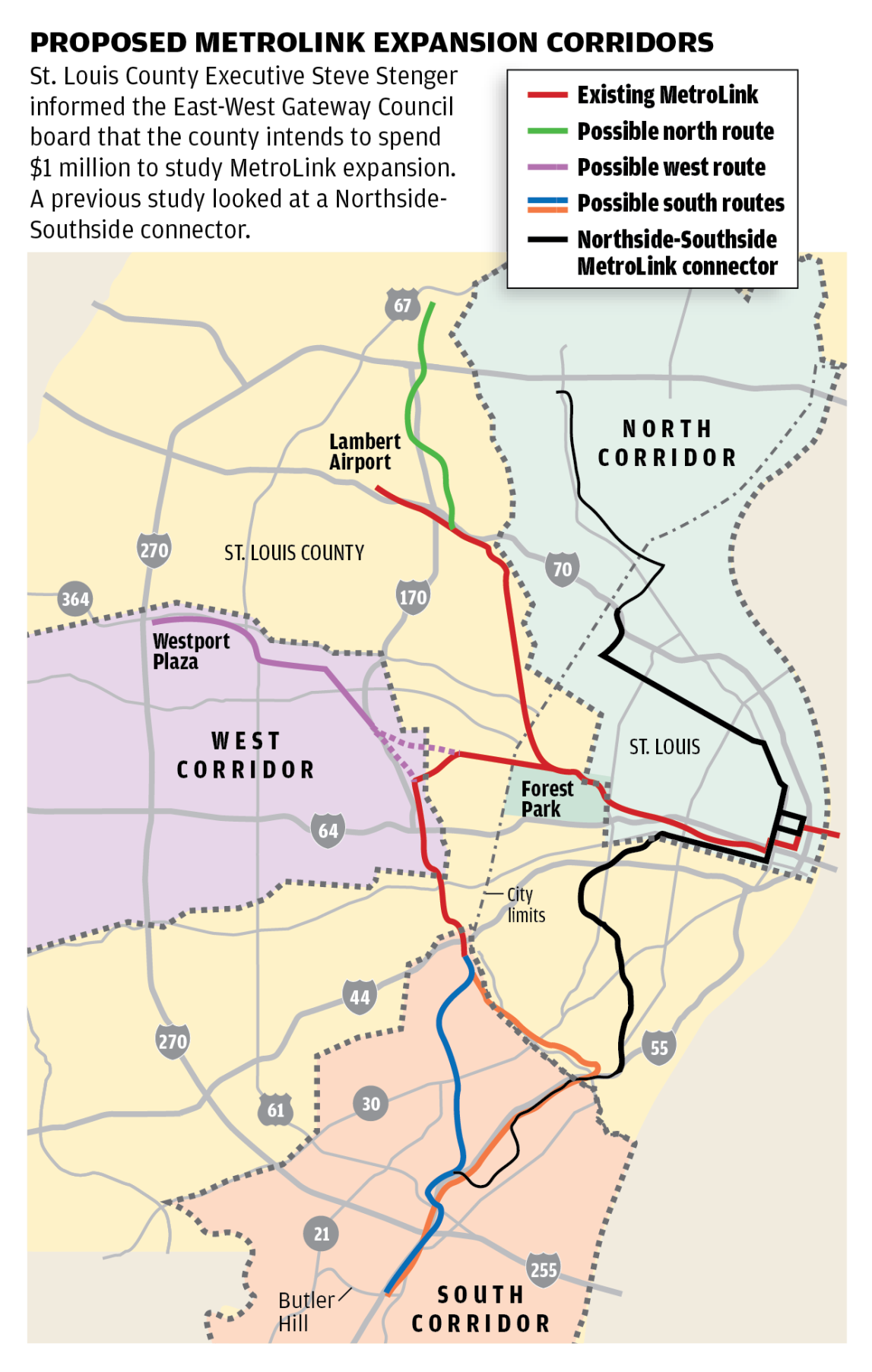

St Louis County Faces Steep Odds Getting Metrolink On Expansion Track Metro Stltodaycom

Housing Authority Of St Louis County Building Our Communities For Over Sixty Years

1967 St Louis Cardinals World Series Ticket Print Vintage Etsy In 2021 Cardinals World Series World Series Tickets Ticket Printing

Print Tax Receipts – St Louis County Website

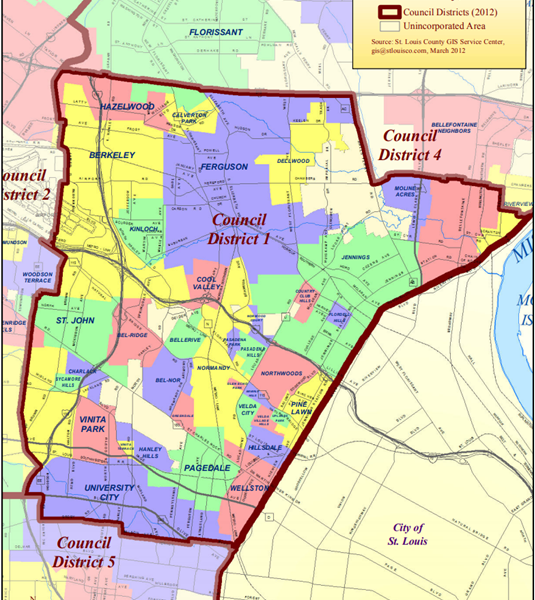

St Louis County Municipalities And Better Together 4 Things To Know

St Louis County Minnesota

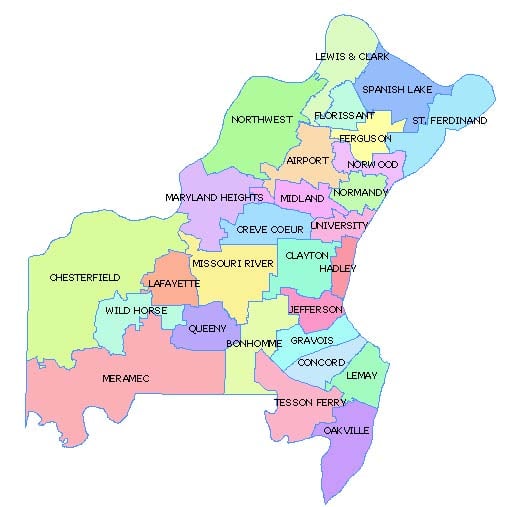

Township-by-township Results For St Louis County Executive Race Politics Stltodaycom

Real Property Tax Sale – St Louis County Website

Special Election In St Louis County – Missouri Libertarian Party

County Land Explorer

Schroedingers Tax Hike Tax Economics Business Finance

2

From The Smallest Of Details To The Grandest Of Entryways Absolutely Nothing In Your New Home Will Feel Less Than Perfect In 2021 Builder New Construction New Homes

Pin On 432 Parkland

St Louis Economic Development Partnership – St Louis Economic Development Partnership

Revenue – St Louis County Website

Tax Forfeited Land Sales In 2021 St Louis County Pike Lake Land For Sale