Louis county will have a 0.5 percent transit sales and use tax and a $20 vehicle excise tax. How does a tax lien sale work?

County Land Explorer

The minnesota department of revenue will administer these taxes.

St louis county mn sales tax. This rate includes any state, county, city, and local sales taxes. Credit cards for all tax payments when credit cards are used, customer will pay official payments a service fee of 2.50% of the payment amount for each payment transaction, with a minimum service fee of $3.95 for the following payment types: Let more people find you online.

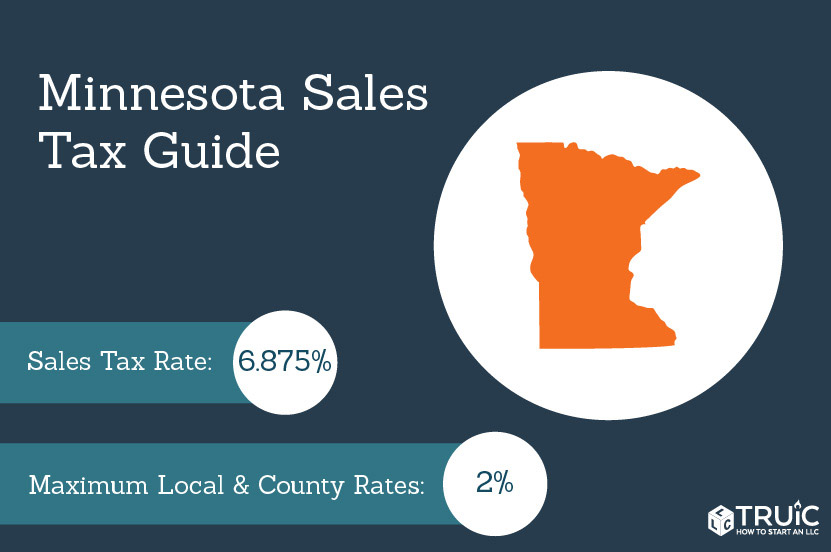

Start yours with a template!. Saint louis county in minnesota has a tax rate of 7.38% for 2022, this includes the minnesota sales tax rate of 6.88% and local sales tax rates in saint louis county totaling 0.5%. Louis county board enacted this tax, along with an excise tax of $20 on motor vehicles sold by licensed dealers, beginning in april 2015.

Louis county auditor 100 n. Mail payment and property tax statement coupon to: Use leading seo & marketing tools to promote your store.

Enjoy the pride of homeownership for less than it costs to rent before it's too late. This rate includes any state, county, city, and local sales taxes. The local sales tax rate in st louis county is 0%, and the maximum rate (including minnesota and city sales taxes) is 8.875% as of november 2021.

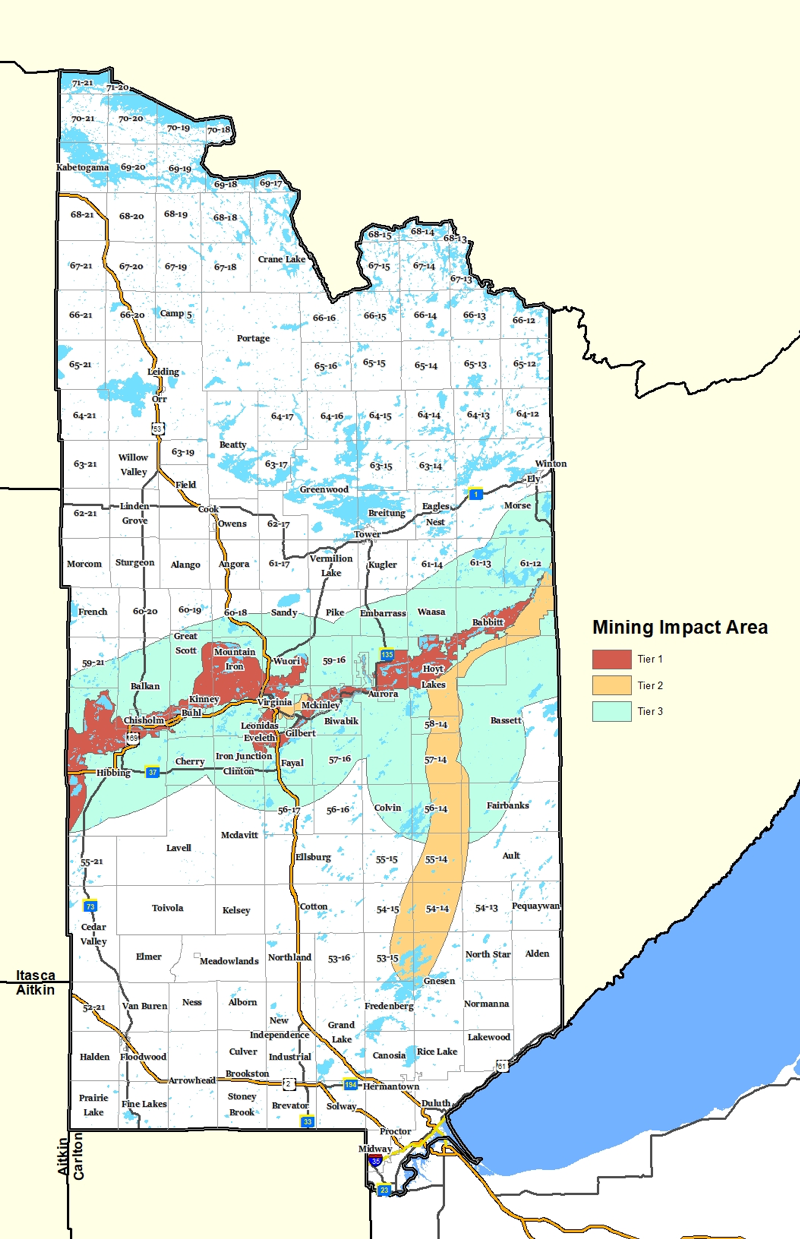

Revenues will fund the projects identified in the st. The minimum combined 2021 sales tax rate for st louis county, minnesota is. There is no known legal access.

Use leading seo & marketing tools to promote your store. Tax forfeited land, managed and offered for sale by st. Some cities and local governments in st louis county collect additional local sales taxes, which can be as high as 3.5%.

The buyer of the tax lien has the right to collect the lien, plus interest based on the official specified interest. State of minnesota department of natural resources approval is also necessary for certain parcels (on water,. Sign up today because the best tax deals might.

This parcel is approximately 40 acres and is crossed in the northeast by about 1,450 feet of the little fork river. Ad earn more money by creating a professional ecommerce website. 2020 rates included for use while preparing your income tax deduction.

This is the total of state and county sales tax rates. Let more people find you online. 2020 rates included for use while preparing your income tax deduction.

Louis county planning and community development department for. The certificate is then auctioned off in saint louis county, mn. Starting april 1, 2015, st.

Louis county greater mn transportation sales and use tax transportation improvement plan adopted december 2, A list of land for potential sale is prepared by the land & minerals department and submitted for county board approval. The latest sales tax rate for saint louis park, mn.

Louis county has a higher sales tax than 71% of minnesota's other cities and counties. Ad earn more money by creating a professional ecommerce website. Start yours with a template!.

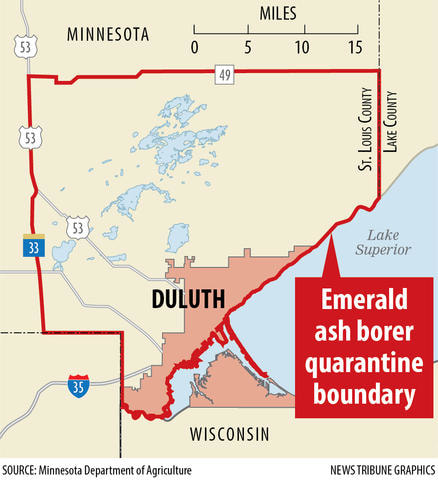

Louis county collects a 0.5% local sales tax, the maximum local sales tax allowed under minnesota law. Louis county courthouse 100 north 5th avenue west duluth, mn 55802. The minnesota state sales tax.

The latest sales tax rate for proctor, mn. The st louis county sales tax is 2.263%.

Property Tax Reports

Economic Development Plan Slc Mn

St Louis County Sets Levy Equating To 17 Increase For Property Owners In 2022 Duluth News Tribune

St Louis County Mn

County Board Meetings – St Louis County Minnesota

Pay For

Employment

2

St Louis County Mn

Minnesota Sales Tax Rates By City County 2021

Data – Geospatial

St Louis County Minnesota

Tourism Taxes

St Louis County Mn School District Map English As A Second Language At Rice University

Wq0wgawobocrhm

County Google Earth

Purchasing

Minnesota Sales Tax – Small Business Guide Truic

2