Pierce county property tax appeals snohomish county property tax appeals. In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order to enjoy the tax reduction and other benefits available.

News Flash Snohomish County Wa Civicengage

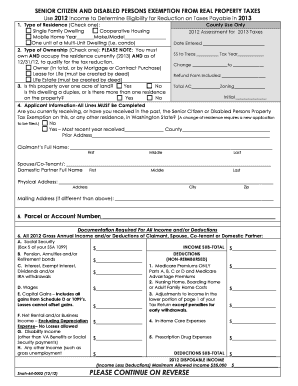

Property tax levies eligible for exemption there are three levels of exemption depending on your final calculated combined disposable income.

Snohomish property tax exemption. Be property tax exempt through snohomish county. The city of arlington and snohomish county have approved this property tax exemption for use in arlington. I am the property owner at the above address, and this is my only residence.

I am directly billed by the city of lynnwood for water/sewer or storm water. Senior citizen and/or disabled persons. The law requires the following:

For instance, all homeowners age 65 or older are exempt from state property taxes. The total combined, gross household income limit (including social security and / or disability payments) for the program is $35,000 or less. Snohomish county assessor 3000 rockefeller avenue everett, wa 98201 phone:

Senior citizen / disabled person property tax deferral program If you own and occupy a residence or mobile home and were 61 or older by december 31, 2012 or are retired because of disability you may qualify for an exemption or a reduction of your 2013 property tax. Seniors with net taxable income of $12,000 or less on their combined (taxpayer and spouse) federal income tax return are exempt from all property taxes on their principal residence.

The preference provides a local property tax exemption for new industrial or. Some taxpayers may qualify for tax exemptions or tax deferrals. Snohomish county property tax exemptions.

Getting a homestead exemption may also help protect your home from being repossessed in the case of a property tax lien due to unpaid snohomish county property taxes or other types of other debt. Own and occupy a multiple or mobile unit property where the city provides the service, but you are not directly billed by the city. Property tax exemption & deferral programs.

The exemption division is responsible for the administration of various programs available to property owners to help reduce property taxes. Exemptions generally provide a reduction in the amount of taxes due, whereas deferrals provide temporary relief by applying the deferred taxes as a lien against the. Creation of a minimum of 25 new full time jobs, paying at least $18.00 an hour.

• i have attached a current copy of my property tax exemption approval letter from snohomish county or a printout from snohomish county website showing my exemption level. I have been granted a property tax exemption by the snohomish county assessor's office. In these areas, approved multifamily projects are exempt from ad valorem property taxes for a period of eight or 12 years, per rcw 84.14.

To secure the longer exemption period, the property must meet a minimum affordable housing standard. 21 rows the property is approved for exemption in total as a very low income housing facility. See addendum a for 2021 legislative changes.

I have attached a current copy of my proof of exemption with snohomish co. I have entered my property tax exemption level in the space above. Applications accepted 10/1 to 11/1 each year.

2

Snohomishgranicuscom

About Efile Snohomish County Wa – Official Website

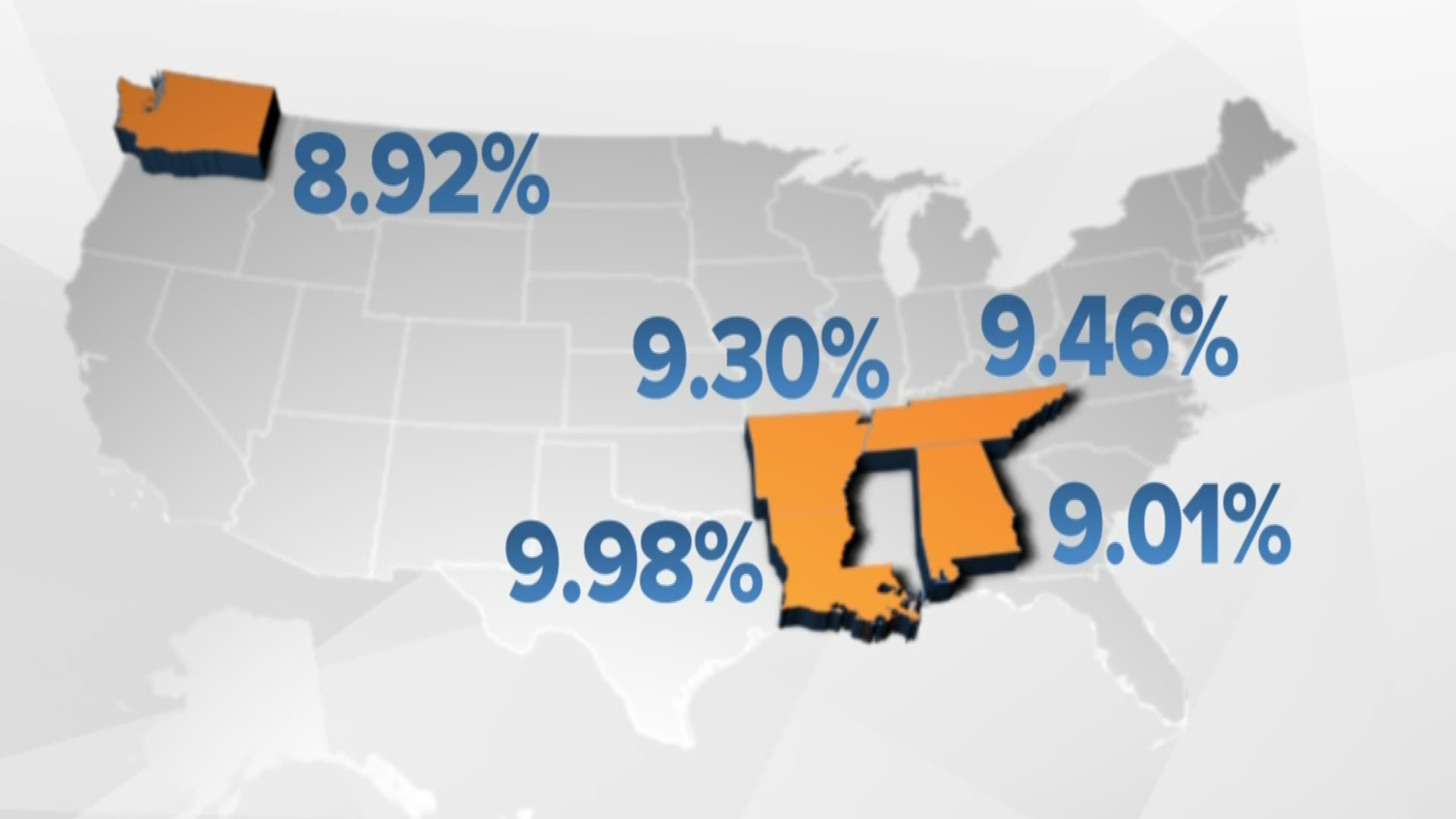

More Property Tax Relief On The Way For 13 Counties In Washington King5com

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnetcom

Fillable Online Assessor Snoco Snohomish County Assessor Senior Exemption Form Fax Email Print – Pdffiller

2

Mrscorg

2

2

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnetcom

Snohomish County Property Tax Exemptions Everett Helplink

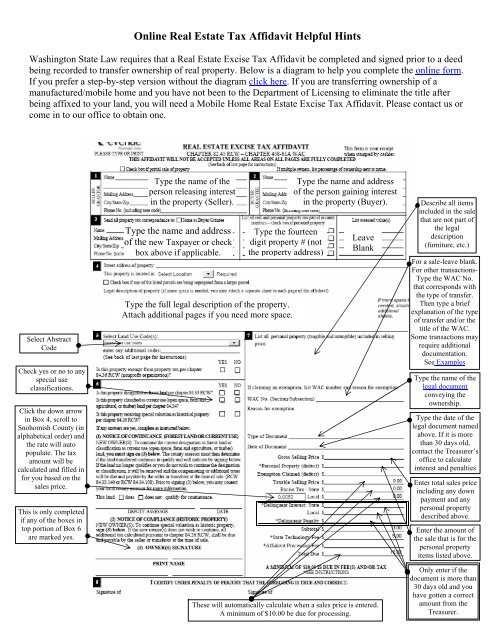

Online Real Estate Tax Affidavit Helpful Hints – Snohomish County

News Flash Snohomish County Wa Civicengage

Snohomishwagov

2

Snohomishgranicuscom

2

News Flash Snohomish County Wa Civicengage