Property Tax Consultant License

Tx property tax ce requirements: Support property tax reform that keeps intact the georgia constitutional requirement of fair and equal taxation for all taxpayers. Advisor Consultant Tax Consulting…

Personal Property Tax Relief Richmond Va

Mayor levar stoney’s administration opposed the changes to the program. Effective january 1, 2020, the yearly income allowable increased to $60,000 and the net worth allowable increased to…

Pay Utah State Property Taxes Online

Interest continues to accrue until the taxes are paid in full. Online payments may include a service fee. Online Property Tax Payment Louis county residents and the county…

Property Tax Assistance Program California

Ohp technical assistance bulletin #14 mills act property tax abatement program purpose of the mills act program economic incentives foster the preservation of residential neighborhoods and the revitalization…

Property Tax Rates Philadelphia Suburbs

Pennsylvania is ranked 1120th of the 3143 counties in the united states, in order of the median amount of property. The median property tax in philadelphia county, pennsylvania…

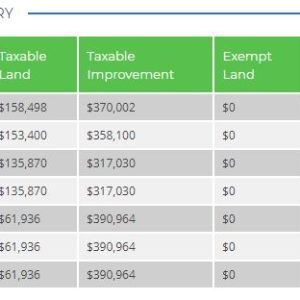

Property Tax Records Frisco Tx

You can see all factors used to determine the tax bill and find more information on your property of interest by opening the full property report. Frisco property…

Coweta County Property Tax Exemptions

Property tax reductions ccda may offer property tax savings for a negotiated period based on the company’s job creation, capital investment and average wage. When/how can homeowners apply…

Texas Property Tax Loans Arlington

We then customize a repayment schedule that accounts for the needs and circumstances of every unique client. A property tax loan from property tax loan pros in texas…

Pay Indiana Property Taxes Online

For personal property and mobile home judgment information and amounts only contact: Innkeeper form 2018 property taxes in cass county will be due, spring may 10, 2021 and…

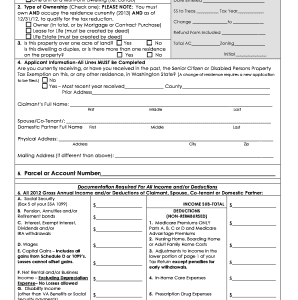

Snohomish Property Tax Exemption

Pierce county property tax appeals snohomish county property tax appeals. In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order…