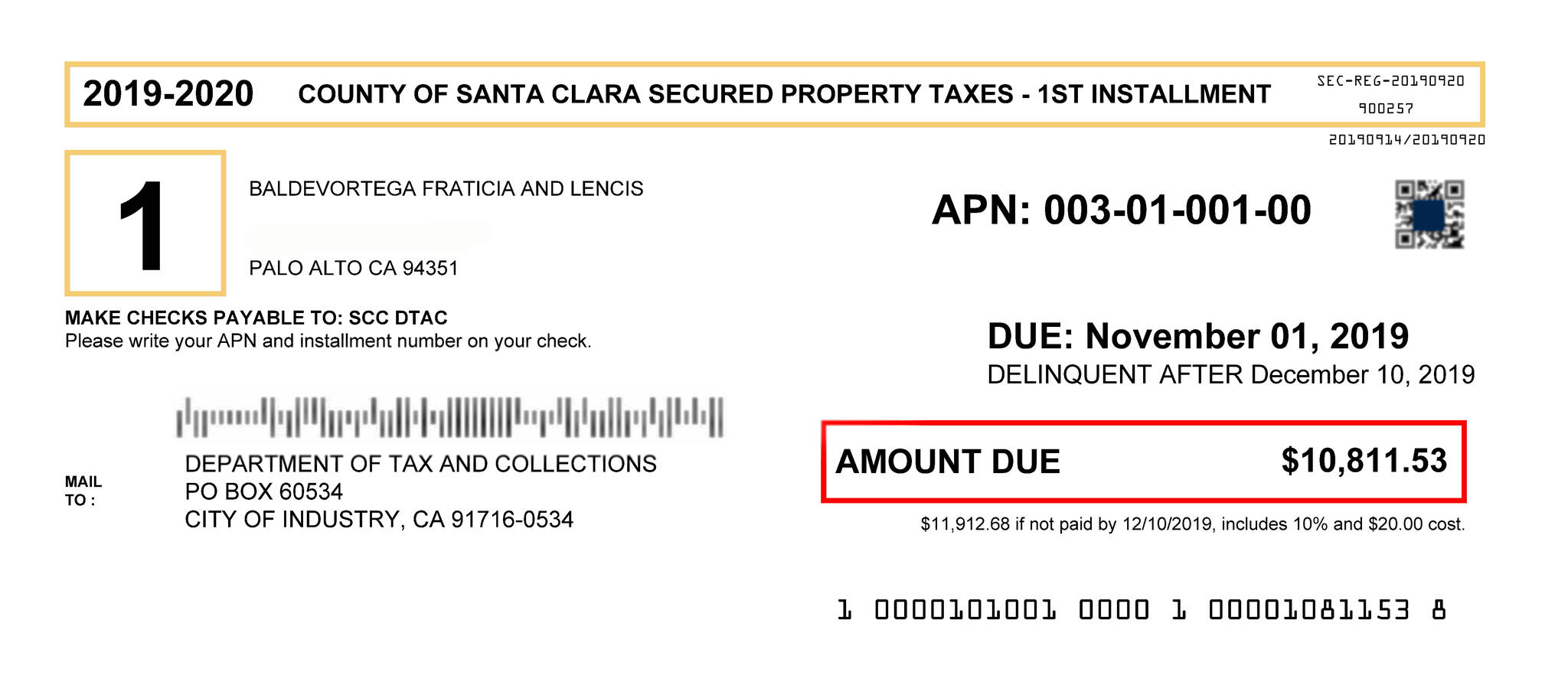

The first installment is due and payable on november 1, and The schedule for when property taxes are due in santa clara county is not intuitive and confuses most people, at least initially.

Santa Clara County Cant Change When Property Taxes Are Due But It May Waive Late Fees San Jose Inside

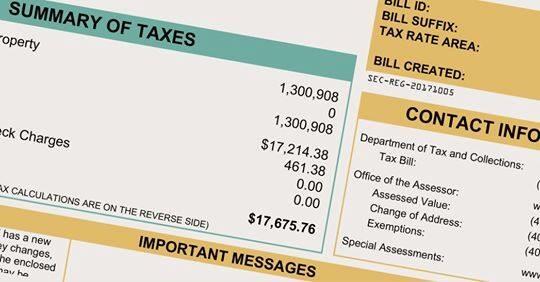

The county of santa clara department of tax and collections (dtac) representatives are reminding property owners that the second installment of the 2019/2020 property taxes is due starting february 1 and becomes delinquent if not paid by 5 p.m.

Santa clara property tax due date. County of santa clara compilation of tax. January 1 lien date—the day your property’s value is assessed. The tax calendar is as follows:

Due dates of property taxes. When are unsecured property taxes due in santa clara county? Secured taxes are due in two installments.

Unsecured property annual tax bills are mailed are mailed in july of every year. December 10 last day to pay first installment without penalties. April 1 due date for filing statements for business personal property, aircraft and boats.

Taxes will not be prorated due to the sale or disposal of taxable personal property after the lien date. Proposition 13, the property tax limitation initiative, was approved by california voters in 1978. California property taxes professionals douglas h.

On monday, april 12, 2021. Due date for filing statements for business personal property, aircraft and boats. The fiscal year for santa clara county taxes starts july 1st.

This is the date when taxes for the next fiscal year become a lien on the property. According to officials who spoke with us about the looming deadline, they just. Unsecured taxes are due on lien date, january 1, of each year and become delinquent after august 31.

Lien date for next assessment roll year. April 10 last day to pay second installment without penalties. Hoover tower at stanford university, one of the major property owners in santa clara county.

Property owners who cannot pay at this time can request a penalty cancellation online. On friday, april 10, 2020. October tax bills are mailed.

October 19, 2020 at 12:00 pm. April 10 what if i can’t pay? Lake november 30 sierra september 15 lassen november 30 siskiyou november 30 los angeles ;

But there’s a little less time for property taxes. *february 15 deadline to file exemption claims timely and receive full exemption. Santa clara county’s due date for property taxes is what it is.

If the date falls on a saturday, sunday or a legal holiday, the property statement can be submitted on the next business day. You can also make partial payments until your balance is paid in full, but the full balance needs to be paid by june 30. If date falls on saturday, sunday or legal holiday, mail postmarked on the next business day shall be deemed on time.

The taxes are due on august 31. Real estate tax bills for secured real estate such as houses, condos, land are mailed in october of each year. When is santa clara county property tax due?

Imperial november 30 santa barbara november 30 inyo ; If a payment is received after that date with no usps postmark, or if the postmark is illegible, the payment will be considered late and. And it’s still april 10.

Madera november 30 sonoma november 30 marin It limits the property tax rate to 1% of assessed value (ad valorem property tax), plus the rate necessary to fund local voter‐approved debt. Andersen douglas andersen, tax partner april 6, 2020 california property taxes are generally due in two installments, on december 10th, and april 10th, of each year.

Disposal, removal, or sale of the property after the january 1st lien date will not affect the tax bill. That’s not because our local tax collectors are unsympathetic. Tax collectors in the vast majority of bay area and california counties are reminding people that property taxes are still due on friday, april 10.

Dear neighbors, the county of santa clara department of tax and collections (dtac) representatives remind property owners that the first installment of the 2019/2020 property taxes becomes delinquent if not paid by 5 p.m. Property tax calendar all taxes. Business property owners must file a property statement each year detailing the cost of all supplies, machinery, equipment, leasehold improvements, fixtures and land owned.

Property taxes in california are jointly administered by the board of equalization and the 58 county assessors. The owner of personal property as of january 1st is responsible for the unsecured tax bill. Kern november 30 santa cruz november 30 kings ;

Property taxes are due in two installments about three months apart, although there is nothing wrong with paying the entire bill at the first installment. November 1 first installment is due. The forms should be submitted after april 10.

February 1 second installment is due. Bay area county tax collectors say residential and.

2

Santa Clara County Assessors Office – E-filing

Property Tax Deadlines – Andy Real Estate

When Are Property Taxes Due In Santa Clara County – Valley Of Hearts Delight Blog

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

Payment Information For Santa Clara County Property Tax Due Dates

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments – County Of San Luis Obispo

2

First Installment Of Santa Clara Countys 20192020 Property Taxes Due Starting November 1 County Of Santa Clara Nextdoor Nextdoor

Property Taxes – Department Of Tax And Collections – County Of Santa Clara

Property Tax Distribution Schedule – Controller-treasurer Department – County Of Santa Clara

Property Tax Email Notification – Department Of Tax And Collections – County Of Santa Clara

Property Taxes – Department Of Tax And Collections – County Of Santa Clara

Property Taxes – Department Of Tax And Collections – County Of Santa Clara

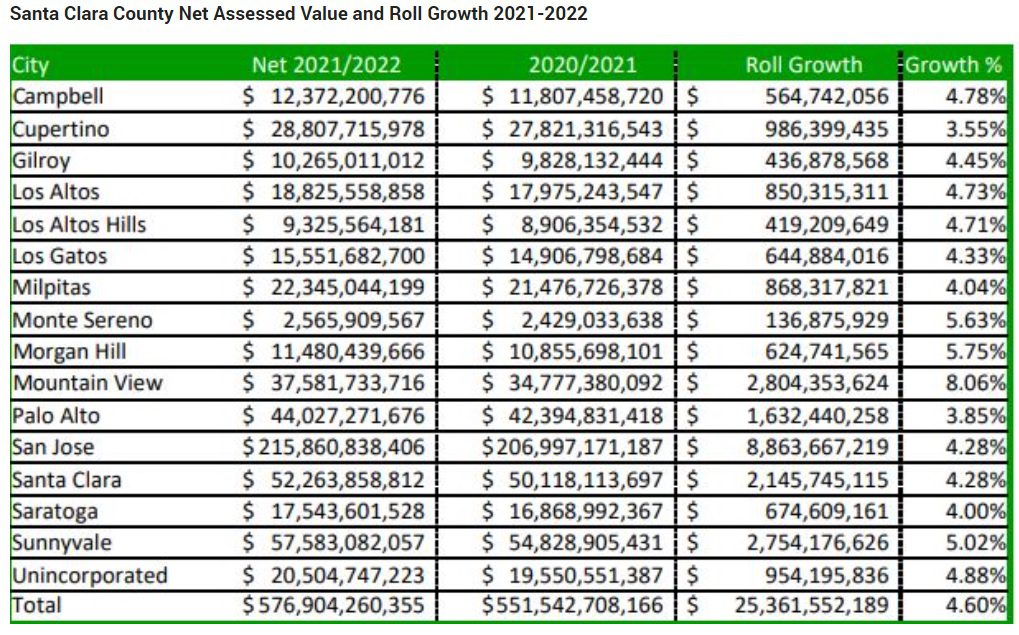

Santa Clara County Sees Increase In Value Of Taxable Properties – San Jose Spotlight

Pay Property Tax Online Santa Clara County – Property Walls

2

Understanding Californias Property Taxes

Reminder First Installment Of 2018-2019 Property Taxes Due Nov 1 County Of Santa Clara Nextdoor Nextdoor