Postmarks are imprints on letters, flats, and parcels that show the name of the united states postal service (usps) office that accepted custody of the mail, along with the state, the zip code, and the date of mailing. The property tax highlights publication includes information on the following:

307 N San Mateo Dr San Mateo Ca 94401 – Realtorcom

The 1st installment is due and payable on november 1.

San mateo tax collector property tax. Property tax business license property tax and business license. San mateo county tax collector. Chat with a live agent;

Property tax forms | controller's office. Additional information on local and state government issues can be found at the legislative analyst’s office. The county manager's office provides instructions and forms for the assessment appeals process.

As a property owner of san mateo county, you may have wondered how your tax dollars are distributed. Taxing authority rate assessed exemptions taxable total tax; As with real property, the assessed value of mobile homes cannot be increased by more than 2% annually unless there is a change in ownership or new construction.

Newly purchased mobile homes, and those on permanent foundations, are subject to property taxes. The following are questions we often receive from san mateo county unsecured property owners. Financial information for the fiscal year.

The assessor's office website provides an explanation of the assessment appeals process (external link). A summary of the property tax process in san mateo county. You also may pay your taxes online by echeck or credit card.

Pdf demystifying the california property tax apportionment system 2.72 mb. Paid view bill bill information. 3, 2021, san mateo county requires everyone to wear a face covering while indoors, per the local health order.

If a payment is received after the delinquency date, with. The tax is a lien that is secured by the land/structure even though no document was officially recorded. Older mobile homes bought before june 30, 1980 generally are not subject to property taxes.

Office of the treasurer & tax collector. Disabled veterans of military service may be eligible for up to a $224,991* property tax exemption. Of december 10th to make your payment before a 10% penalty is added to your bill.

Pdf understanding california's property taxes 644.9 kb. What period of time does an unsecured tax bill cover? Taxing authority rate assessed exemptions taxable total tax;

Parcel #, account #, address. The interest rate for taxes postponed under ptp is 7 percent per year. A property tax postponement lien will be recorded on the home.

This means that if the taxes remain unpaid after a period of 5 years, the property may be sold to cover the taxes owed. When is the unsecured tax assessed? What are unsecured property taxes?

If a calamity such as fire, earthquake or flood damages or destroys your property, you may be eligible for property tax relief, provided the loss exceeds $10,000. The 2nd installment is due and payable on february 1. Although schools continue to receive the largest portion of your tax dollars, changes in state laws

Click here to start a live chat with tax collector staff. Home property tax placing special assessments. The following chart provides some helpful tax distribution and service information.

The following are questions we often receive from san mateo county property owners. How are the unsecured tax amounts determined? San mateo county secured property tax bill is payable in two installments:

Secured tax roll the term secured simply means taxes that are assessed against real property, (e.g., land or structures). Property tax refunds generally result from reassessment of your property. The grace period on the 2nd installment expires.

The chart illustrates the distribution of the 1% ad valorem tax (based on the assessed value). Pdf common claims about proposition 13 6.92 mb. Avoid penalties by understanding postmarks.

Historical trends on assessed values and property tax revenues within the county. Property tax payments must be received or postmarked by the delinquency date to avoid penalties. Once the assessor or the assessment appeals board makes the decision to reduce the assessed value.

Click here to start a live chat with tax collector staff. However, you have until 5:00 p.m. Property tax account at 104 avalon dr.

2

San Mateo County Postpones Property Tax Due Date Until May 4 Palo Alto Daily Post

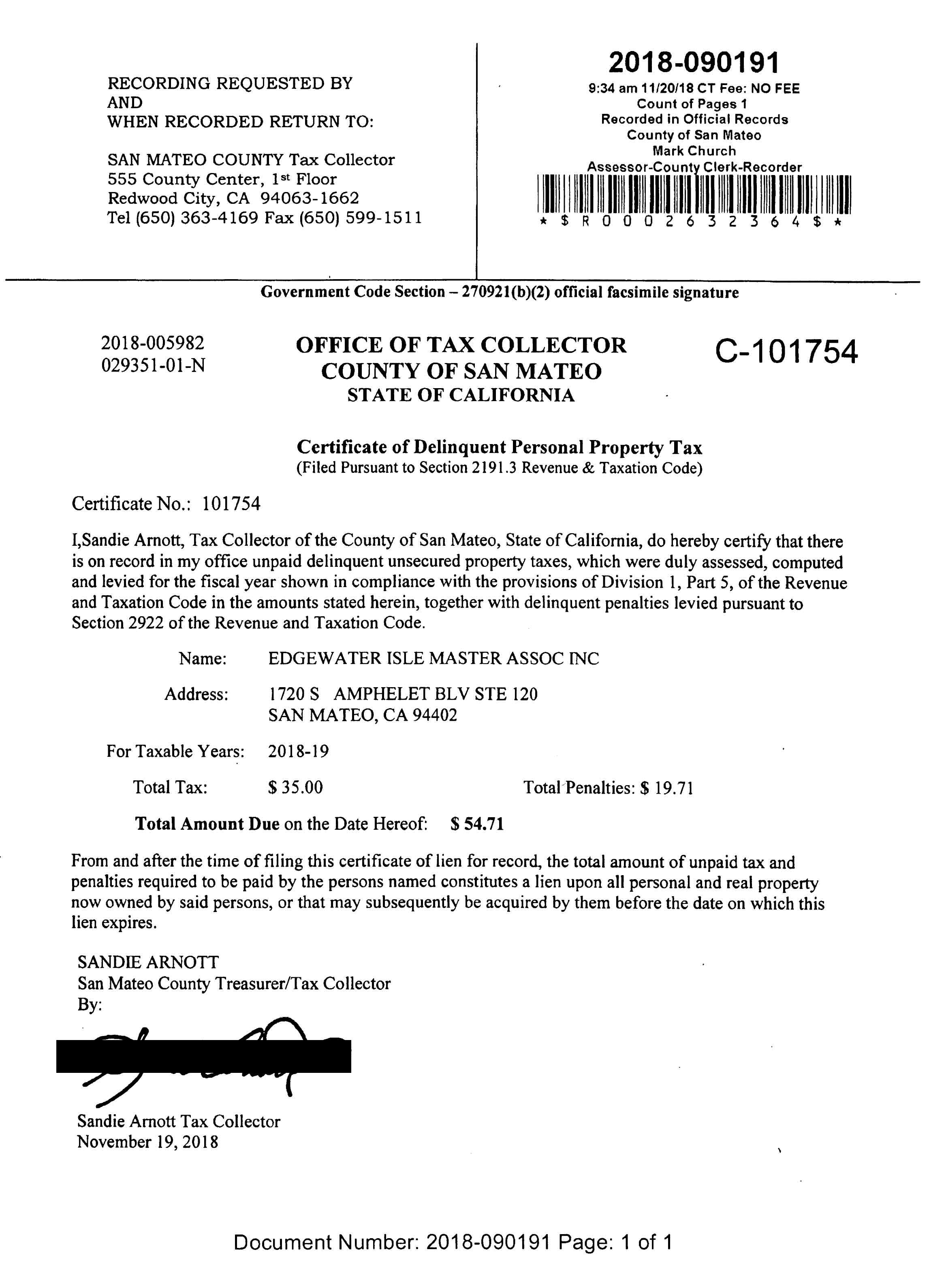

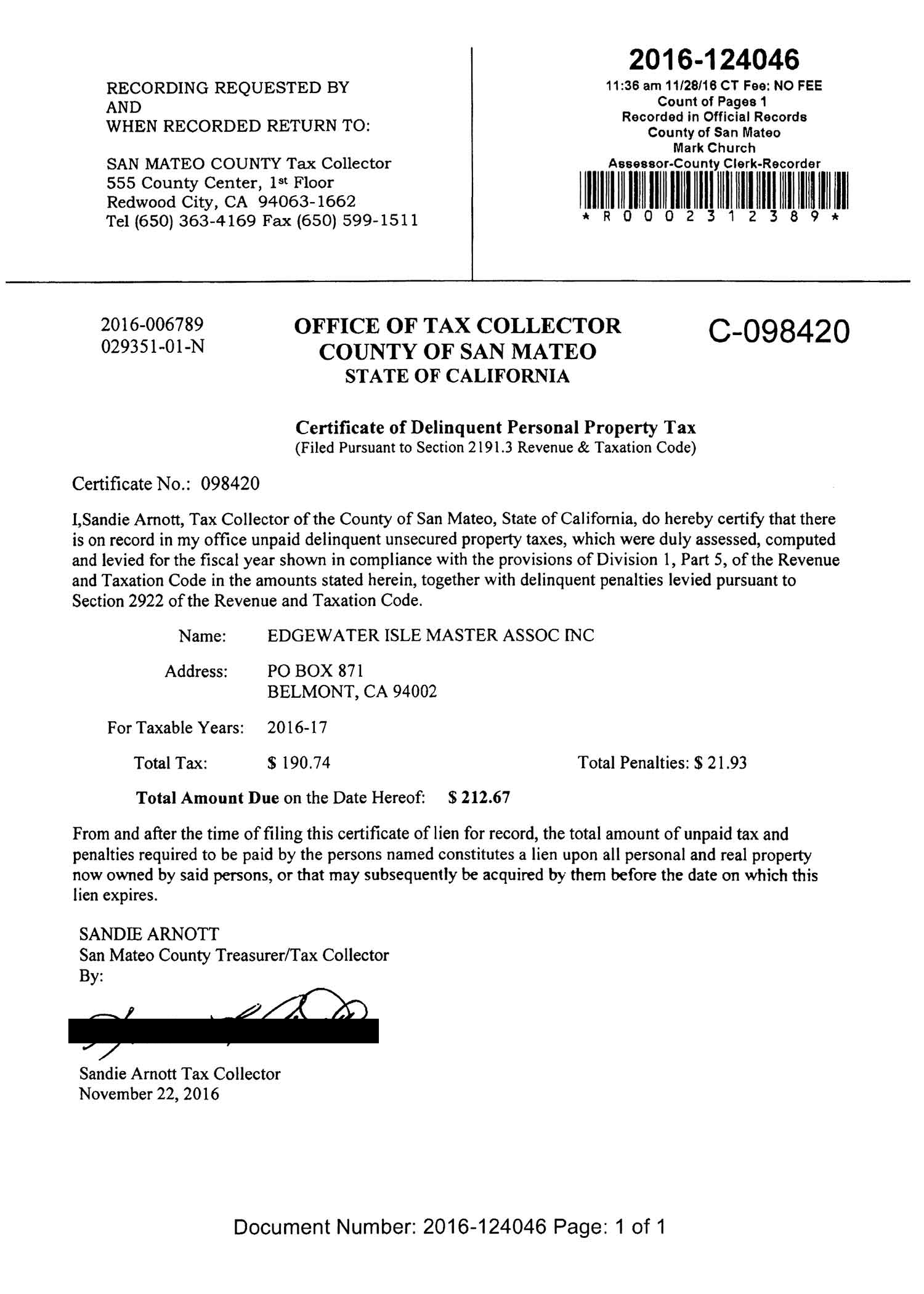

San Mateo County Issues Liens Against Master Association

Secured Property Taxes Tax Collector

2 S Delaware St San Mateo Ca 94401 – Realtorcom

San Mateo Evangelista Mateo Evangelista San Mateo Evangelista San Mateo Apostol

Secured Property Taxes Tax Collector

San Mateo County Ca Goes Live With Taxsys Business Wire

Search – Taxsys – San Mateo Treasurer-tax Collector

Secured Property Taxes Tax Collector

San Mateo County Community Boundaries Planning And Building

2

San Mateo County Health Campus County Managers Office

San Mateo County Issues Liens Against Master Association

Gis Information Services

2018 Property Tax Highlights Publication Press Release Controllers Office

San Mateo County Property Values Reach Record High For 11th Year In A Row

Census 2020 – Organizations Funded In San Mateo County County Managers Office

July 26 2021 County Of San Mateo Requires Face Coverings Solely At County-operated Facilities County Managers Office