How 2021 sales taxes are calculated in anaheim. There is no applicable city tax.

Transfer Tax – Who Pays What In Orange County California

There are a total of 513 local tax jurisdictions across the state, collecting an average local tax of 2.492%.

Sales tax calculator anaheim. Look up the current sales and use tax rate by address The anaheim sales tax rate is %. The december 2020 total local sales tax rate was also 7.750%.

0.25% to 1% is the county sales tax rate, and 0.5% to 1% is special rates in some special cases. Food and prescription drugs are exempt from sales tax. There is no city sale tax for

Decide what drinks your business plans to sell, and learn the licenses you need. As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate. Cities and/or municipalities of california are allowed to collect their own rate that can get up to 1.75% in city sales tax.

For tax rates in other cities, see california sales taxes by city and county. In all, there are 10 official income tax brackets in california, with rates ranging from as low as 1% up to 13.3%. Upon processing, you will be able to see the price before tax.

As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate. Method to calculate van nuys sales tax in 2021. The current total local sales tax rate in anaheim, ca is 7.750%.

The businesses listed also serve surrounding cities and neighborhoods including los angeles ca, santa ana ca, and long beach ca. For this to work, you will be asked to provide your total receipt amount and then choose the applied rate from the list. How to use anaheim sales tax calculator?

Lowest sales tax (7.25%) highest sales tax (10.75%) california sales tax: You can print a 7.75% sales tax table here. With local taxes, the total sales tax rate is between 7.250% and 10.750%.

The base state sales tax rate in california is 6%. 101 rows how 2021 sales taxes are calculated for zip code 92806. The state general sales tax rate of california is 6%.

Putting different, the reverse calculator calculates the amount before the sales tax is imposed. Your anaheim cafe or restaurant may require a general license for all types of alcoholic beverages, or a license just for beer and wine. The california sales tax rate is 6.5%, the sales tax rates in cities may differ from 6.5% to 11.375%.

The california sales tax rate is 6.5%, the sales tax rates in cities may differ from 6.5% to 11.375%. As part of the mental health services act, this tax provides funding for mental health programs in the state. Depending on local sales tax jurisdictions, the total tax rate can be as high as 10.25%.

There is no applicable city tax. The results of california state rate is 6% and every 2021 combined rates are mentioned in the sales tax list. Every 2021 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25% to 1%), the california cities rate (0% to 1.75%), and.

Calculate sales tax free rates. We found 3000 results for sales tax calculator in or near anaheim, ca. Technically, tax brackets end at 12.3% and there is a 1% tax on personal income over $1 million.

The 7.75% sales tax rate in anaheim consists of 6% puerto rico state sales tax, 0.25% orange county sales tax and 1.5% special tax. Sales tax anaheim california, the general sales tax rate is 6%. 1.75% lower than the maximum sales tax in ca.

The 7.75% sales tax rate in anaheim consists of 6% california state sales tax, 0.25% orange county sales tax and 1.5% special tax. Local tax rates in california range from 0.15% to 3%, making the sales tax range in california 7.25% to 10.25%. Below you can find the general sales tax calculator for anaheim city for the year 2021.

Anaheim, california and brentwood, california. This table shows the total sales tax rates for all cities and towns in orange county, including all local taxes. The county sales tax rate is %.

So, this is how the reverse sales tax calculator works. You can print a 7.75% sales tax table here. The california sales tax rate is 6.5%, the sales tax rates in cities may differ from 6.5% to 11.375%.

The average sales tax rate in california is 8.551%. 2021 cost of living calculator for taxes: Method to calculate anaheim sales tax in 2021.

Sales tax calculator | sales tax table sales tax table. The mandatory local rate is 1.25% which makes the total minimum combined sales tax rate 7.25%. California has a 6% sales tax and orange county collects an additional 0.25%, so the minimum sales tax rate in orange county is 6.25% (not including any city or special district taxes).

California city & county sales & use tax rates (effective october 1, 2021) these rates may be outdated. This is the total of state, county and city sales tax rates. For tax rates in other cities, see puerto rico sales taxes by city and county.

As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate. The average sales tax rate in california is 8.551% Our premium cost of living calculator includes, state and local income taxes, state and local sales taxes, real estate transfer fees, federal, state, and local consumer taxes (gasoline, liquor, beer, cigarettes), corporate taxes, plus auto sales, property.

This is a custom and easy to use sales tax calculator made by non other than 360 taxes. Method to calculate orange county sales tax in 2021. This rate is made up of a base rate of 6%, plus california adds a mandatory local rate of 1.25% that goes directly to city and county tax officials.

Enter your “amount” in the respected text field choose the “sales tax rate” from… The anaheim, california, general sales tax rate is 6%.depending on the zipcode, the sales tax rate of anaheim may vary from 7.75% to 8% every 2021 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25% to 1%), and in some case, special rate (0.5% to 1.5%). 101 rows how 2021 sales taxes are calculated for zip code 92850.

The average sales tax rate in california is 8.551%. For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. Average sales tax (with local):

The minimum combined 2021 sales tax rate for anaheim, california is. The california state sales tax rate is 7.25%. Anaheim sales tax rate may vary from 7.75% to 8% and it depending on zip code.

California (ca) sales tax rates by city (a) the state sales tax rate in california is 7.250%. California has state sales tax of 6% , and allows local governments to collect a local option sales tax of up to 3.5%. Wine, cider, or spirits, you’re likely going to need some type of beverage alcohol license.

The california sales tax rate is currently %.

Food And Sales Tax 2020 In California Heather

How To Calculate Sales Tax Sales Tax Tax Sales And Marketing

Discount Calculator Httpssalecalccomdiscount Discount Calculator Sales Tax Calculator

Food And Sales Tax 2020 In California Heather

How To Calculate Sales Tax Methods Examples – Video Lesson Transcript Studycom

Sales Tax – Anaheim Tax Services Ca

Understanding Californias Property Taxes

Which Cities And States Have The Highest Sales Tax Rates – Taxjar

California Income Tax Rapidtax

Understanding Californias Property Taxes

Anaheim Ca Tax Preparation And Planning Anaheim Income Tax

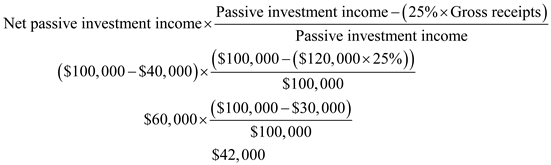

Solved Calculate Anaheim Corporations Excess Net Passive Income Cheggcom

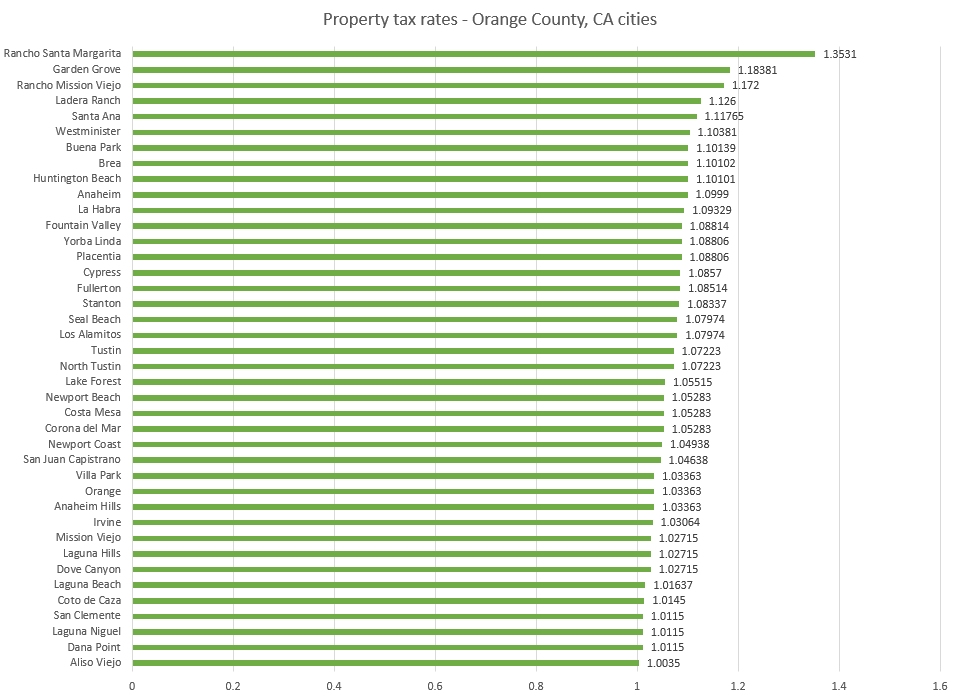

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

California Sales Tax Rates By City County 2021

Sales Tax – Anaheim Tax Services Ca

825 Sales Tax Calculator Template Tax Printables Sales Tax Calculator

56 Sales Tax Calculator Template Sales Tax Calculator Tax

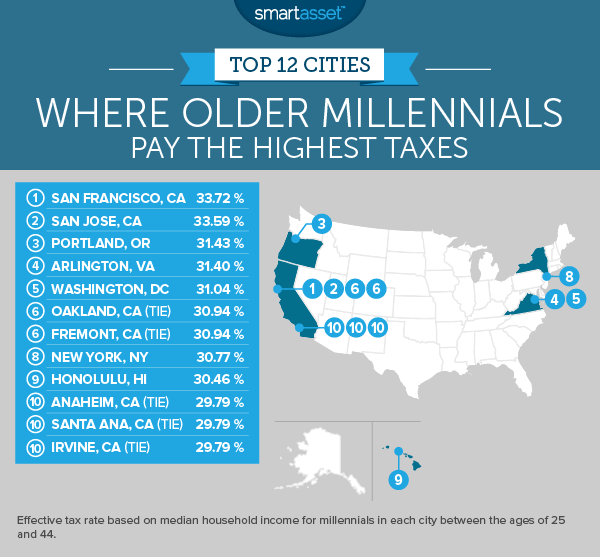

Where Millennials Pay The Highest Taxes – 2017 Edition – Smartasset

Understanding Californias Property Taxes