The millage rate is a determining factor in the calculation of taxes. (annual) how your property taxes compare based on an assessed home value of $250,000.

Reverse Mortgage Advocates Focus On All The Cool Things That Can Be Done With Them They Dont Focu Buying Your First Home Home Loans Real Estate Investing

The median property tax on a $235,600.00 house is $2,473.80 in the united states.

Richmond property tax calculator. It is set by the richmond county property appraisal office and the board of tax assessors. Actual property tax assessments depend on a number of variables. How can i obtain help with my property tax bill in richmond county, staten island borough?

This property tax calculator is intended for approximation purposes only. City of richmond hill flag. Locate and visit the new york city department of finance’s website.

Ajax, onamherstburg, onarnprior, onatikokan, onaurora. Richmond hill property tax calculator 2021. Taxes for your home's assessed value of $500,000.

Current tax rates sales tax: 134 rows annual property taxes are likewise quite high, as the median annual property tax paid by homeowners in arlington county is $6,001. The city of richmond hill is located in the regional municipality of york and is home to over 195k residents.

City of richmond 2.00% *. Richmond hill real estate prices have increased by 15% from. Late payment penalties will apply to 2021 tax instalments.

The city of richmond is located south of vancouver in the metro vancouver regional district and is home to over 198k residents. The median property tax in fort bend county, texas is $4,260 per year for a home worth the median value of $171,500. Chesterfield county has one of the highest median property taxes in the united states, and is ranked 470th of the 3143 counties in order of.

For a more detailed explanation of county property tax. Taxes for your home's assessed value of $250,000. The only exception to this is for boats, which must be registered with the virginia department of wildlife resources (dwr) or the u.s.

* tax as a percentage of market for owner occupied properties only. It is major income for most of the municipalities and one of the biggest tax burdens for individuals, which can reach several thousand dollars per year. Calculating your richmond hill property tax due.

These agencies provide their required tax rates and the city collects the taxes on their behalf. Taxes for your home's assessed value of $1,000,000. Chesterfield county levies a tax each calendar year on personal property with “situs” in the county:

The current millage rate is 4.132. These documents are provided in adobe acrobat pdf format for printing. Virginia tax code requires that all properties currently must be assessed for taxation at 100% of market value.

The median property tax in chesterfield county, virginia is $1,964 per year for a home worth the median value of $235,600. Taxes are calculated based on 10.5% of the retail value multiplying by the millage rate of your tax district. Start looking for your property tax bill on the website of the department in charge of collecting the tax, which in this case is the new york city department of finance.

Here is a table breaking down the property taxes of each canadian province: Property tax on boats and motors are paid one year in advance. Land transfer tax asking price go land transfer tax:

City millage rate based on the house value of $250,000 for select years. Beginning january 31, 2021, interest on unpaid taxes will be applied monthly. Fort bend county has one of the highest median property taxes in the united states, and is ranked 57th of the 3143 counties in order of median property taxes.

See also our bc property transfer tax calculator and faq! Chesterfield county collects, on average, 0.83% of a property's assessed fair market value as property tax. Richmond real estate prices have not changed significantly from november 2019 to november 2020 and the average price of a house in richmond is $972k.

Fort bend county collects, on average, 2.48% of a property's assessed fair market value as property tax. The assessment process statutory role of the township assessor the whole property tax process can be very confusing and frustrating. The tax year 2019 is payable in year 2020.

2.100% of assessed home value. All taxpayers with an outstanding balance of $10 or more will receive a reminder notice early in december 2020. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in chesterfield county.

A mill is 1/10 of $.01 or $1 per $1,000 of assessed value. Examples are shown below with and without seniors discount. The median property tax on a $99,300.00 house is $1,042.65 in the united states.

If you are registering your boat or motor for the first time in south carolina you will need to provide the auditor’s office a copy of the title or a bill of sale. The population of richmond hill increased by 5% from 2011 to 2016. Total sales tax rate 8.25% * includes 25% earmarked for economic development by the richmond development corporation.

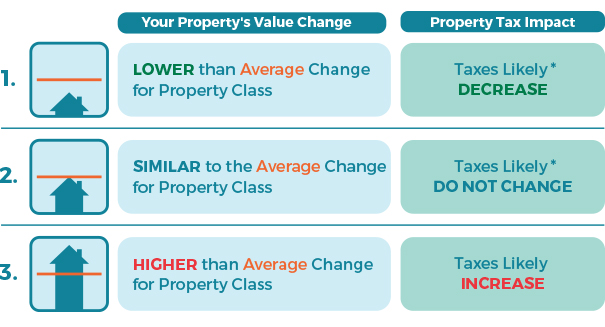

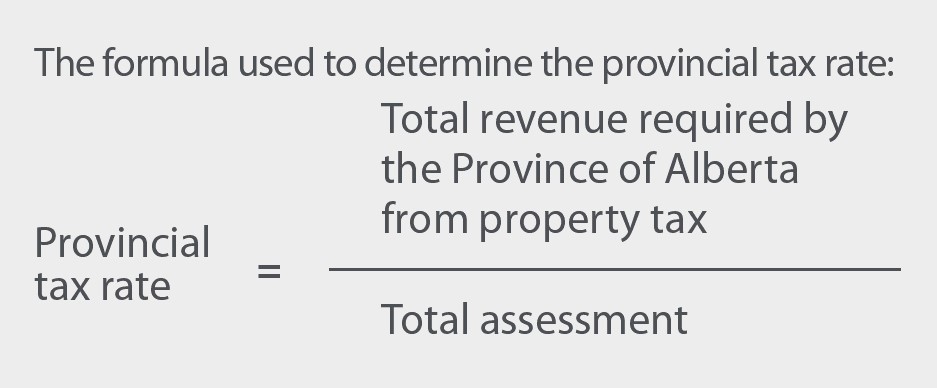

Your annual property taxes collected by the city of richmond funds municipal services and other taxing agencies such as the province of bc (school tax), translink, bc assessment authority, metro vancouver and the municipal finance authority. Millage rates are set by the authorities of each taxing jurisdiction:the One of our goals is to make sure we provide the information you need related to this process, so that you feel as comfortable as possible with how your assessment is determined and what your options are for resolving any issues that you.

In city of richmond the reassessment process takes place every two years. Tax relief programs are available in city of richmond, which may lower the property's tax bill. A simple percentage used to estimate total property taxes for a home.

All property owners in richmond hill must pay their property taxes. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in richmond county. Actual property tax assessments depend on a number of variables.

Richmond property tax calculator 2021. 2.160% of assessed home value. All property must first be registered with the virginia department of motor vehicles (dmv).

Rhprealtorscom Search Results Richmond American Homes Model Homes Front Porch Seating

Property Tax Calculation – Youtube

Propertytax

Mehangai Ki Maar Essay In 2021 Essay Writing Tips Conference Planning Essay

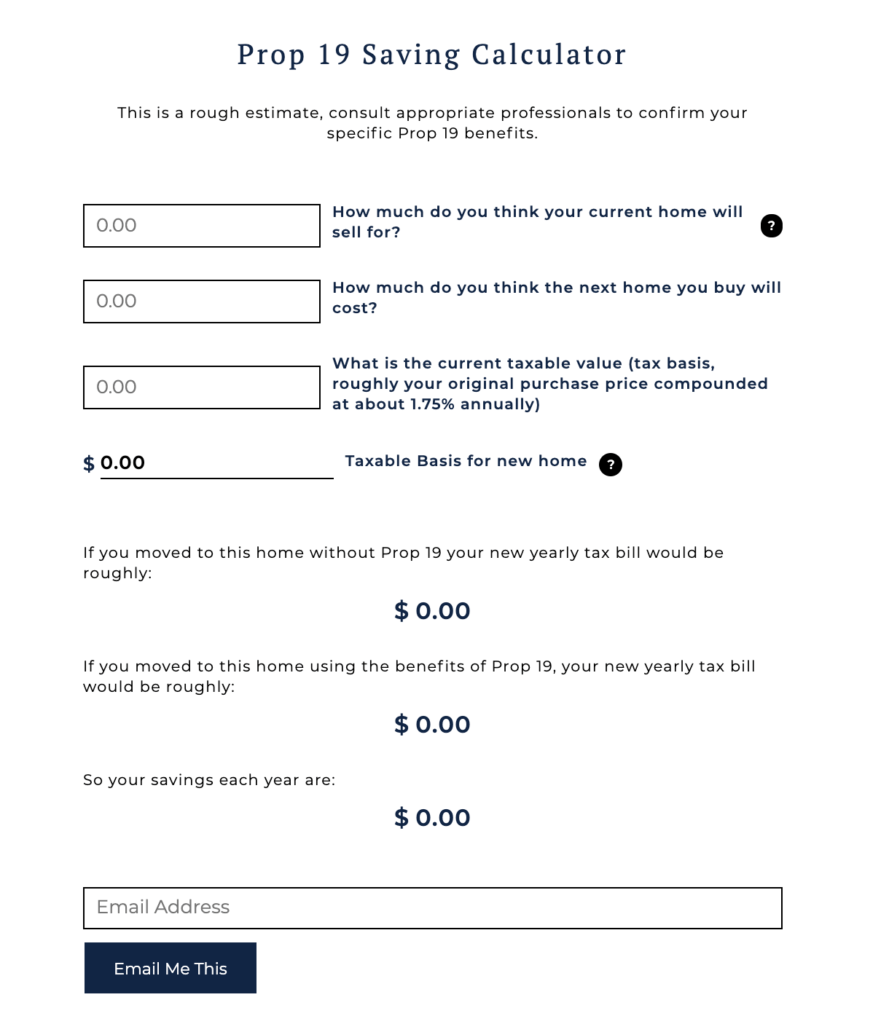

Prop 19 Property Tax Portability Arrives In California –

Following A Recent Council Approval Canadian City Of Richmond Hill Will Be Exploring Providing Crypto Asset Pr Property Investor Property Tax Mortgage Payment

Herbal Supplement Business Plan In 2021 Essay Writing Writing Services Essay

Tax Preparation Services 4 Mistakes In Wealth Planning — Hit The Like Repin Button If You Dont Mind Income Tax Return Income Tax Income Tax Preparation

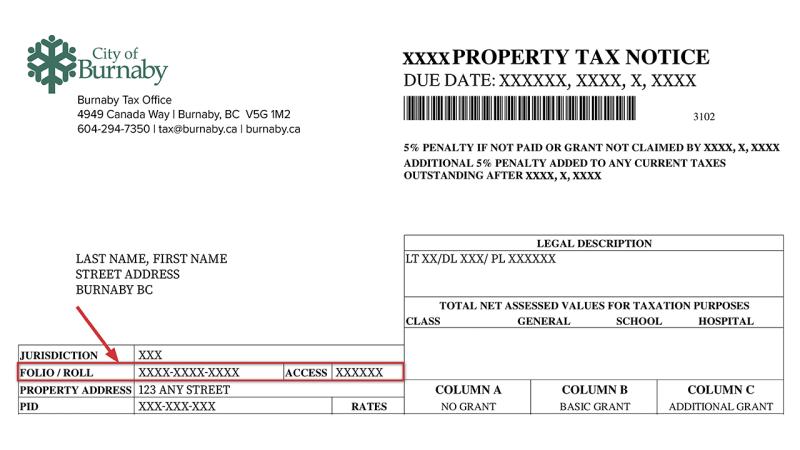

Where Do I Find My Folio Number And Access Code Myrichmond Help

How To Read Your Property Tax Bill Oconnor Property Tax Reduction Experts Property Tax Tax Tax Reduction

Property Tax Tax Rate And Bill Calculation

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

How To Pay City Of Burnaby

Heres How Mississaugas Property Taxes Compare To Other Ontario Cities

Ontario Cities With The Five Lowest Property Tax Rates – Loans Canada

Richmond Property Tax 2021 Calculator Rates – Wowaca

4uagmek1d-lwjm

The Property Tax Equation

Obx Chamber On Twitter Obx Words Chamber