Interest continues to accrue until the taxes are paid in full. Online payments may include a service fee.

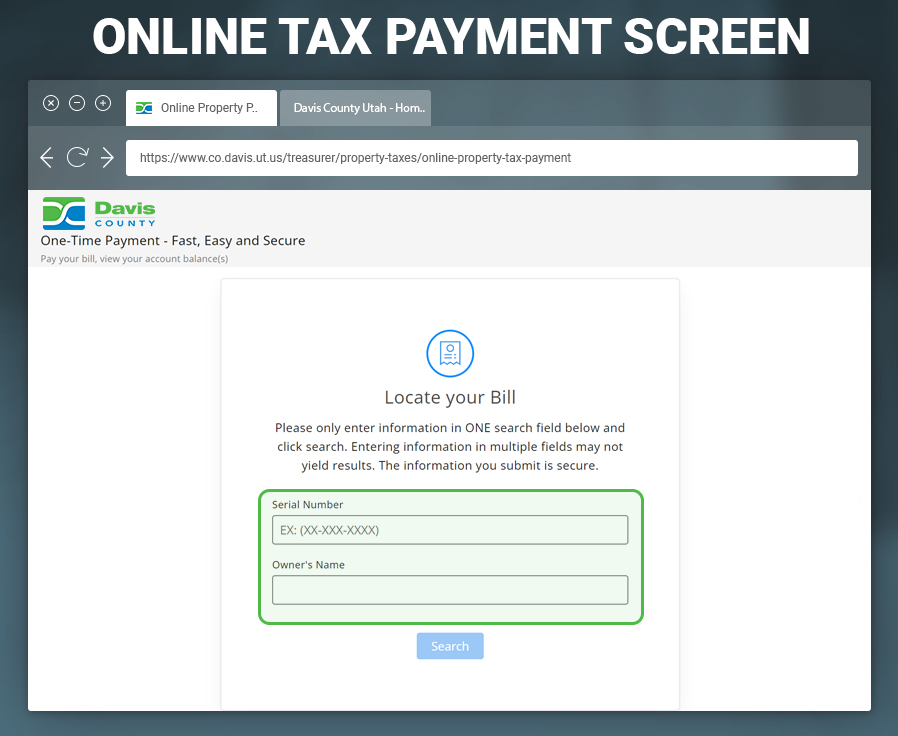

Online Property Tax Payment

Louis county residents and the county is encouraging people to avoid the line and pay online.

Pay utah state property taxes online. Paying your taxes online payment information: This web site allows you to pay your utah county real and business personal property taxes online using credit cards, debit cards or electronic checks. Louis county encourages residents to pay personal property & real estate taxes online.

Have your account number handy! Follow the instructions at tap.utah.gov. If your taxes are still delinquent on june 1st, you are subject to a 3% penalty.

You will need your property serial number(s). If you pay the first half of your taxes by april 30th, but fail to pay the second half by october 31st, the unpaid portion is subject to 1% interest per month. The online price of items or services purchased.

At the end of your transaction, you will be provided immediate payment confirmation and an option to print a receipt for your records. Electronic check flat fee (online only) $3.00 for payments under $10,000, $15.00 for payments $10,000 and over. We have arranged with instant payments to offer this service to you.

Please note that for security reasons, taxpayer access point is not available in most countries outside the united states. You may also mail your check or money order payable to the “utah state tax commission” with your return. Make your check payable to “summit county treasurer.” postmark by november 30 and mail to:

The median annual property tax paid by homeowners in utah county is $1,517. See also payment agreement request; You can pay online with an echeck or credit card through taxpayer access point (tap).

Online real estate property tax payment system. Read this page and click on “continue” below. What you need to pay online :

Property taxes can be paid online by credit card. The kansas property tax payment application allows taxpayers the opportunity to make property tax payments on their desktop or mobile device. Morning scheduled maintenance is from 5:55 am to 7:00 am mst on sunday and from 5:25 am to 6:00 am mst on wednesday and friday.

Residents can pay their personal property and real estates taxes. Your property serial number look up serial number. Total rates in utah county, which apply to assessed value, range from.

100 east center street suite 1200 provo, utah 84606 phone number: To pay real property taxes : You must pay the amount due now by the due date to avoid additional penalty and.

If you do not have these, please request a duplicate tax notice here. Please note that you must know your seven digit account number to proceed. Taxpayers paying online receive immediate confirmation of the payment(s) made.

The treasurer's office sends out the final tax bill, receives property tax payments, and distributes the funds to the various taxing entities. Our online payment system is available 24 hours a day, 7 days a week (system may be temporarily unavailable between 12:00 am and 3:00 am due to system updates). What you need to pay online :

You may pay your tax online with your credit card or with an electronic check (ach debit). This web site allows you to pay your utah county real property taxes online using credit cards, debit cards or electronic checks. We have arranged with secure instant payments to offer this service to you.

Other options include you choosing an amount to be printed on the coupon and there will also be a blank place to fill in any amount you. You must know your seven digit account number to proceed. We will accept the amount due now or new balance that is shown on your tax bill.

This website is not available during scheduled system maintenance. Printed booklets will be mailed out to you by january 2022. Coupon amount will be your 2021 taxes divided by 9 months.

Confirmation acknowledges receipt of your. You may also pay with an electronic funds transfer by ach credit. These payment options are administered by a private company contracting with davis county.

The county commission approves the annual budget for county agencies and, acting as the board of equalization, hears appeals that do not fall within the typical appeal and hearing structure.

Pay Taxes Utah County Treasurer

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared – The New York Times

State Tax Forms Print – Fill Online Printable Fillable Blank Pdffiller

Utah State Tax Commission Official Website

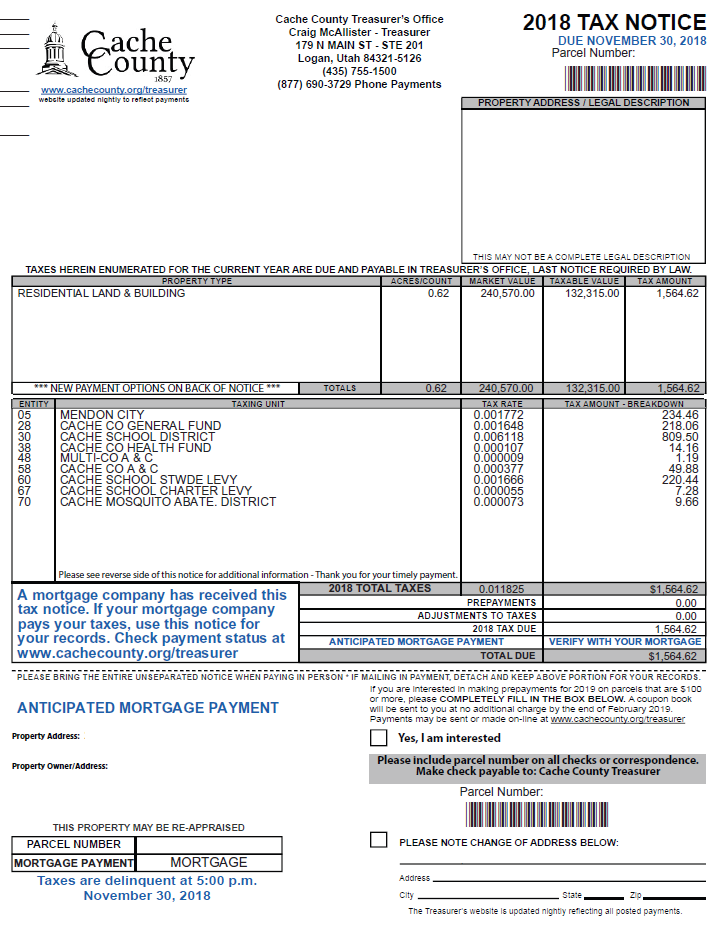

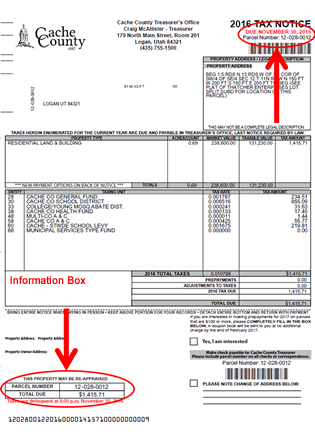

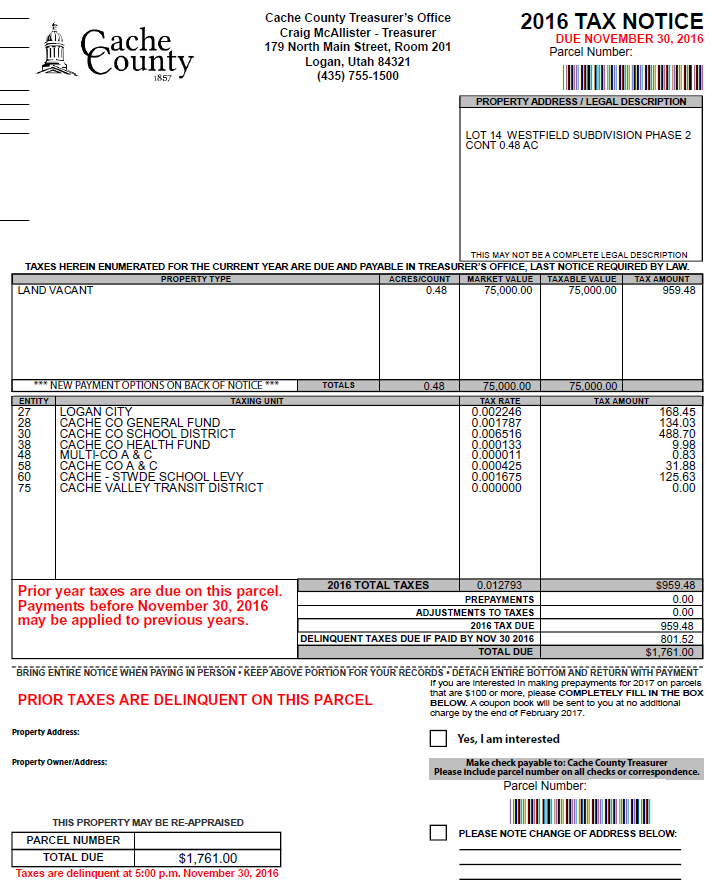

Official Site Of Cache County Utah – Paying Property Taxes

Business Tangible Personal Property Taxes Tax Foundation

Payments

Utah State Tax Commission Official Website

Property Tax Calculator – Smartasset

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Taxes In The United States – Wikipedia

Pay Taxes Utah County Treasurer

Official Site Of Cache County Utah – Paying Property Taxes

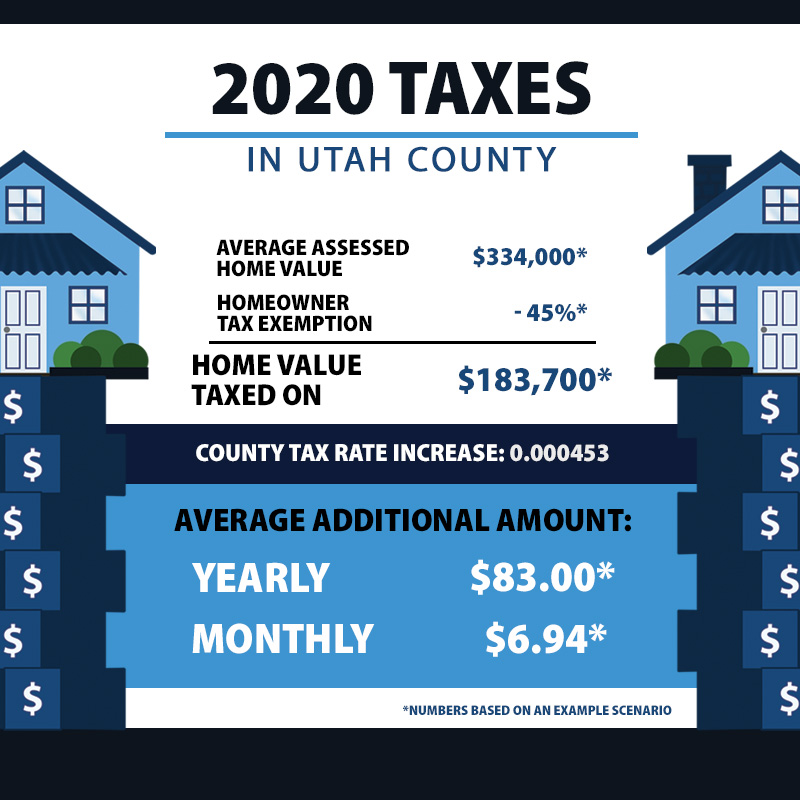

2020 Taxation Information

Wheres My State Refund Track Your Refund In Every State

Official Site Of Cache County Utah – Paying Property Taxes

Official Site Of Cache County Utah – Paying Property Taxes

Utah Property Taxes Utah State Tax Commission

States With Highest And Lowest Sales Tax Rates