Prorated tax if you buy or sell a vehicle during the year, the vehicle will be subject to a. Personal property taxes are assessed on any vehicle, motorcycle, boat, trailer, camper, aircraft, motor home, or mobile home owned and registered as being garaged in richmond county as of january 1 st of each tax year.

15 Strawberry St Richmond Va 23220 – Realtorcom

Please include 10% with your payment.

Pay personal property tax richmond va. An ordinance introduced monday says. Richmond plans to give city taxpayers an extra month to pay personal property taxes after it issued bills last week giving residents less than two weeks to pay. Richmond city council is the governing legislative institution of richmond, virginia and it represents residents in creating and amending local laws, providing government policy and oversight, and establishing the annual richmond government budget.

Directly from your bank account (direct debit) ach credit initiated from your bank account; To pay your 2019 or newer property taxes online, visit the ray county collector’s website.all city of richmond delinquent taxes (2018 and prior) must be paid to the city of richmond collector prior to paying 2019 or. The money you set aside for property taxes funds state institutions such as schools, hospitals, libraries, fire departments, etc.

A vehicle has situs for taxation in the county, or if it is registered to a county address with the virginia department of motor vehicles. Business personal property tax business personal property tax is a tax on the furniture, fixtures, machinery, and tools used in a business, trade, or profession. Payment of the personal property tax is normally due each year by october 5 (see tax bill for due date).

You can make personal property and real estate tax payments by phone. There are no processing fees. You can also safely and securely view your bill online, consolidate your tax bills into one online account, set up notifications and reminders to be sent to your email or mobile phone, schedule payments, create an online wallet, and pay with one click using credit/debit or your checking account.

The rate is set annually by the york county board of supervisors in the month of may. Vehicle decals are not required in loudoun county. Pay online or view other payment options.

Is more than 50% of the depreciation. If you can answer yes to any of the following questions, your vehicle is considered by state law to have a business use and does not qualify for personal property tax relief. Interest will accrue each month, starting november 1, 2021, on unpaid balances.

The tax is assessed by the commissioner of the revenue, and collected by the treasurer. Taxpayers can pay online through paymentus. Every homeowner needs to pay property tax annually to help the state they live in function properly.

Be it property taxes, utility bills, tickets or permits and licenses, you can find them all on papergov. Personal property taxes are due may 5 and october 5. The personal property tax rate for 2021 is $4 per $100 of assessed value.

In order to determine the tax bill, your local tax assessor’s office takes into account the property’s assessed value, the current assessment rate, as well as any tax exemptions or abatements for that property. You will have the opportunity to review the total amount due with the convenience fee prior to payment submission. All required personal property tax bills due must be paid in full.

If payment is late, a 10% late payment penalty is assessed on the unpaid original tax balance. Based on the type of payment(s) you want to make, you can choose to pay by these options: Is more than 50% of the vehicle's annual mileage used as a business expense for federal income tax purposes or reimbursed by an employer?

Click here for council information, members, legislation, meetings, laws, charter, and more! Proration of personal property tax. The governing body of any county, city or town may provide by ordinance for the levy and collection of personal property tax on motor vehicles, trailers, semitrailers, and boats which have acquired a situs within such locality after the tax day for the balance of the tax year.

Personal property taxes are billed once a year with a december 5 th due date. City of richmond 2019 and newer property taxes (real estate and personal property) are billed and collected by the ray county collector. The county accepts visa, mastercard, american express, discover card and electronic checks.

Your tax account number, which is located in the upper right corner of each tax statement. Pay personal property taxes online in city of richmond seamlessly with papergov. Henrico county now offers paperless personal property and real estate tax bills!

It is important accurate payment information be provided, which includes the. The assessment on these vehicles is determined by the commissioner of the revenue. Interest at a rate of 10% per annum is added beginning the 1st day of the month following the original due date.

While you will be paying fees to chesterfield county, the full amount of the convenience fee is passed to municipal services bureau (msb) as the provider of this. Any unpaid balance now includes a 10% penalty. The amount each property owner pays differs based on the value of their house.

There is a convenience fee for these transactions.</p>estimated reading time: The 2021 personal property taxes were due october 5, 2021. You have the option to pay by credit card or electronic check.

3110 E Broad St Richmond Va 23223 – Realtorcom

Pin On Bigmoney

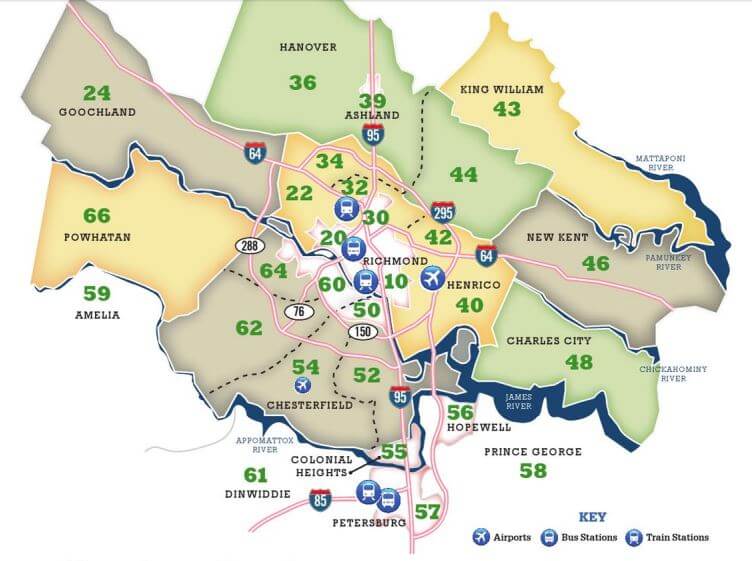

Guide-to-richmond-area-mls-real-estate-zones Mr Williamsburg

2919 E Marshall St Richmond Va 23223 – Realtorcom

Sppup1jikcqccm

1307 Decatur St Richmond Va 23224 – Realtorcom

Try The 4-both Method To De-clutter Your Living Room Place 4 Boxes On The Ground Let One Box Be Your Trash Investment Firms Investing Real Estate Investing

2321 Hanover Ave Richmond Va 23220 – Realtorcom

Pin On Vintage Tobacco Tins

416 N 27th St Richmond Va 23223 – Realtorcom

Bankruptcy Lawyer Richmond Va Tax Attorney Attorneys Intellectual Property Law

1307 Decatur St Richmond Va 23224 – Realtorcom

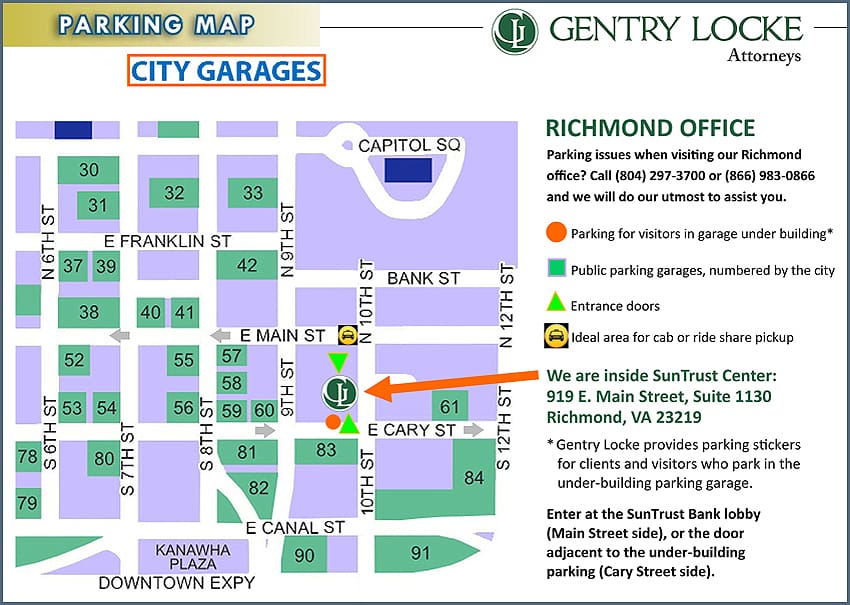

Visiting Our Richmond Office – Gentry Locke Attorneys

2712 4th Ave Richmond Va 23222 – Realtorcom

416 N 27th St Richmond Va 23223 – Realtorcom

2229 Monument Ave Richmond Va 23220 – Realtorcom

114 E Blake Ln Richmond Va 23224 – Realtorcom

3120 W Grace St Richmond Va 23221 – Realtorcom

Investment Plan Housing For All In 2022interest Deduction For First Home Buyers More Fdi Double Interest Deductio Investing Segmentation First Home Buyer