Enter your annual income, taxes paid & rrsp contribution into our calculator to estimate your return. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

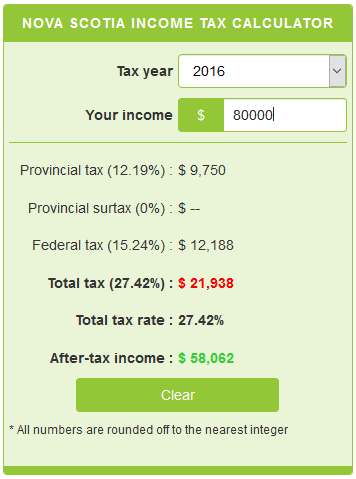

Nova Scotia Income Tax Calculator – Calculatorscanadaca

Ensure that the “find subtotal (before tax)” tab is selected.

Ontario ca sales tax calculator. California has a 6% statewide sales tax rate , but also has 513 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 2.492% on top. For further information about eligibility or the terms used in the calculator, please see our frequently asked questions here. To calculate the subtotal amount and sales taxes from a total:

Revenues from sales taxes such as the hst and rst are expected to total $28.1 billion, or 26.5% of all of ontario’s taxation revenue, during the 2019 fiscal year. Check how much taxes you need to pay on cerb, crsb, cesb & crb and much more. Calculate the tax savings your rrsp contribution generates.

Amount without sales tax + hst amount = total amount with sales taxes. For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The ontario sales tax rate is %.

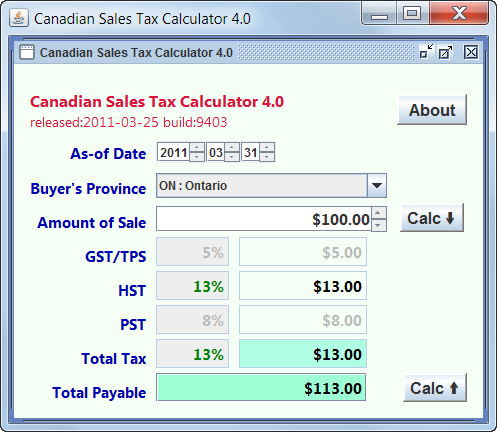

Sales taxes in ontario where changed in 2010 then instead of gst and pst was introduced harmonized sales tax (hst). The amount of taxable income that applies to the first tax bracket at 5.05% is increasing from $44,740 to $45,142. The ontario basic personal amount was $10,783 in.

Ontario revenues from sales taxes. The second tax bracket at 9.15% is increasing to an upper range of $90,287 from the previous $89,482. The current total local sales tax rate in ontario, ca is 7.750%.

On july 1st, 2010 hst (harmonized sales tax) replaced existing 8%. Sales tax calculator 2021 for ontario. Ad understand your sales tax issues with real, personalized help from a pro.

Total price is the final amount paid including sales tax. History of sales taxes in ontario. For help, please contact tax credits phone duty:

Your 2020 ontario income tax refund could be even bigger this year. Harmonized sales tax (hst) in ontario what is the current (2021) hst rate in ontario? Hst tax calculation or the harmonized sales tax calculator of 2021, including gst, canadian government and provincial sales tax (pst) for the entire canada, ontario, british columbia, nova scotia, newfoundland and labrador

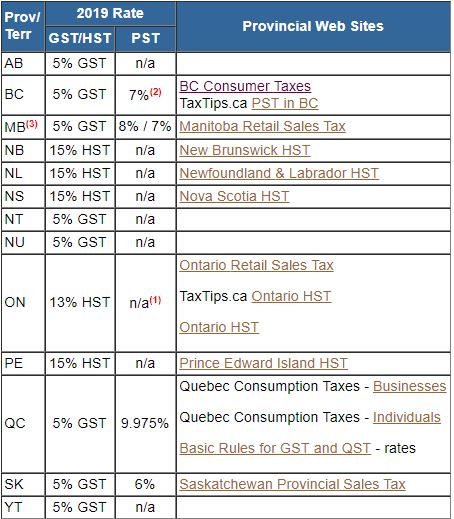

The california sales tax rate is currently %. The following table provides the gst and hst. Also is a tool for reverse sales tax calculation.

California city & county sales & use tax rates (effective october 1, 2021) these rates may be outdated. This is the total of state, county and city sales tax rates. 5% federal part and 8% provincial part.

Every 2021 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25% to 1%), the california cities rate (0% to 1.75%), and. 14 rows gst/hst provincial rates table. Easy income tax calculator for an accurate ontario tax return estimate.

Calculate your combined federal and provincial tax bill in each province and territory. The minimum combined 2021 sales tax rate for ontario, california is. Current (2021) hst rate in ontario province is 13% :

The december 2020 total local sales tax rate was also 7.750%. The state general sales tax rate of california is 6%. Tax credit estimates prepared by ontario creates may vary from those of the calculator based on information contained in a tax credit application.

Look up the current sales and use tax rate by address Press “calculate” and you’ll see the tax amount(s) as well as the grand total (subtotal + taxes) appear in the fields below. For state, use and local taxes use state and local sales tax calculator.

Canadian corporate tax rates for active business income. If you make $52,000 a year living in the region of ontario, canada, you will be taxed $11,432.that means that your net pay will be $40,568 per year, or $3,381 per month. Cities and/or municipalities of california are allowed to collect their own rate that can get up to 1.75% in city sales tax.

Calculate a simple single sales tax and a total based on the entered tax percentage. Your average tax rate is 22.0% and your marginal tax rate is 35.3%.this marginal tax rate means that your immediate additional income will be taxed at this rate. Ontario's indexing factor for 2021 is 0.9%.

Ontariotaxcalculator is a simple, efficient and easy to use tool in ontario to calculate sales tax hst. Sales taxes make up a significant portion of ontario’s budget. Amount without sales tax x (hst rate/100) = amount of hst in ontario.

Net price is the tag price or list price before any sales taxes are applied. Ad understand your sales tax issues with real, personalized help from a pro. Formula for calculating hst in ontario.

The county sales tax rate is %.

How And Why To Calculate Your Marginal Tax Rate Deliberatechangeca

Land Transfer Tax And Cmhc Calculators For Your Website Ratehubca

Canadian Gst Hst Pst Tpstvqqst Sales Tax Calculator

Taxtipsca – 2019 Sales Tax Rates For Pst Gst And Hst In Each Province

Ontario Income Tax Calculator – Calculatorscanadaca

Taxtipsca – 2021 Sales Tax Rates – Pst Gst Hst

Taxtipsca – Ontario 2019 2020 Income Tax Rates

Bc Sales Tax Gst Pst Calculator 2021 Wowaca

Taxtipsca – Canadian Tax Calculator For Prior Years Includes Most Deductions And Tax Credits

91762 Sales Tax Rate – Ca Sales Taxes By Zip

Ontario Sales Tax Hst Calculator 2021 Wowaca

Gst Calculator Goods And Services Tax Calculation

Ontario Property Tax – Rates Calculator Wowaca

Ontario Hst Calculator 2020 – Hstcalculatorca

Quebec Sales Tax Gst Qst Calculator 2021 Wowaca

Ontario Income Tax Calculator Wowaca

Canada Sales Tax Gsthst Calculator Wowaca

Income Tax Calculator – Calculatorscanadaca

Pst Calculator – Calculatorscanadaca