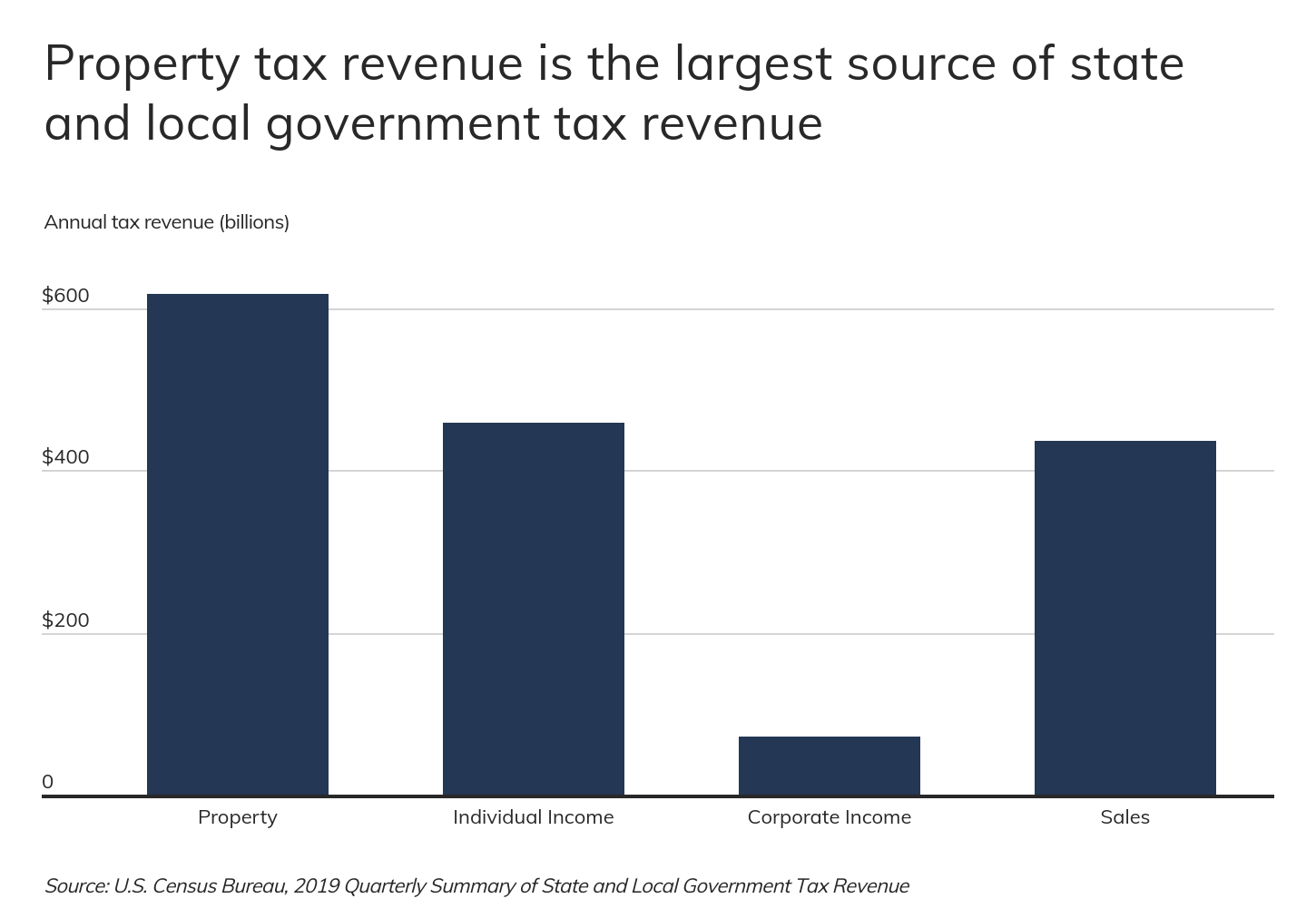

There are a total of eighteen states with higher marginal corporate income tax rates then nebraska. This is the total of state, county and city sales tax rates.

2

Nebraska sales tax changes effective july 1, 2019.

Omaha ne sales tax rate 2019. 1.5 percent in omaha, ashland, bellevue, bennington, blair, fort calhoun, fremont. Boost your business with wix! The county sales tax rate is %.

In addition to that, many cities collect their own sales taxes with rates up to 2.50%. Higher sales tax than 69% of nebraska localities. The nebraska state sales and use tax rate is 5.5% (.055).

Ad with secure payments and simple shipping you can convert more users & earn more!. The 7% sales tax rate in omaha consists of 5.5% nebraska state sales tax and 1.5% omaha tax. The minimum combined 2021 sales tax rate for omaha, nebraska is.

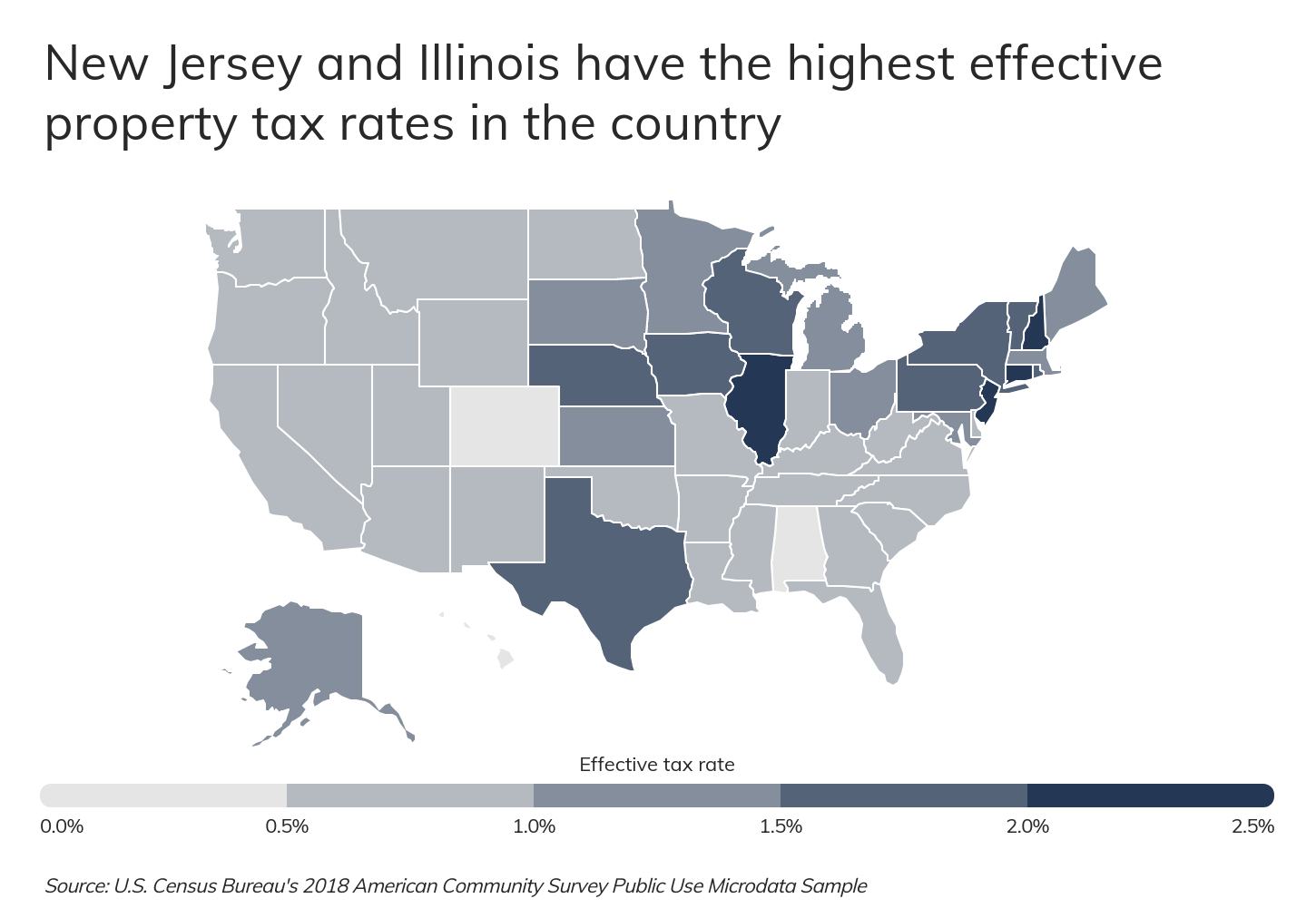

The 5.5% sales tax rate in offutt a f b consists of 5.5% nebraska state sales tax. At that rate, a homeowner with a home worth $200,000 would pay $4,120 annually in property taxes. The average effective property tax rate in sarpy county is 2.06%.

The nebraska state sales tax rate is 5.5%, and the average ne sales tax after local surtaxes is 6.8%. Nebraska collects a state corporate income tax at a maximum marginal tax rate of 7.810%, spread across two tax brackets. Corporations (domestic and foreign), limited liability partnerships, and limited liability companies are required to submit a tax report or annual report due no later than april 15 of each required reporting year.

The local sales tax rate is 1 percent in eagle and greenwood; Ad with secure payments and simple shipping you can convert more users & earn more!. Several local sales and use tax rate changes take effect in nebraska on july 1, 2019.

The table below shows the total state and city sales tax rates for the largest cities in nebraska. You can print a 7% sales tax table here. The nebraska department of revenue is responsible for publishing the.

For tax rates in other cities, see nebraska sales taxes by city and county. 2% lower than the maximum sales tax in ne. In counties containing a city of the metropolitan class, 18% is allocated to the county and 22% to the city or village.

The omaha sales tax rate is %. Valuation, taxes levied and tax rate data Nebraska (ne) sales tax rates by city (a) the state sales tax rate in nebraska is 5.500%.

Table 5 — local sales tax rates (continued) jurisdiction effective date rate jurisdiction effective date rate jurisdiction effective date rate % % % rev. The nebraska state tax tables for 2019 displayed on this page are provided in support of the 2019 us tax calculator and the dedicated 2019 nebraska state tax calculator.we also provide state tax tables for each us state with supporting tax calculators and finance calculators tailored for each state. Build the online store that you've always dreamed of.

Foreign and domestic corporations filing llc/llp filings. There is no applicable county tax, city tax or special tax. Sarpy county is part of the omaha metropolitan area and has the highest property tax rates of any nebraska county.

Build the online store that you've always dreamed of. The state sales tax in nebraska is 5.50%. Local sales taxes may result in a higher percentage.

If the tax district is not in a city or village 40% is allocated to the county and; There is no applicable county tax or special tax. Language other than english spoken at home, percent of persons age 5 years+, 2015.

Counties and cities in nebraska are allowed to charge an additional local sales tax on top of the state sales tax. 18% is allocated to the city or village, except that: Boost your business with wix!

The current total local sales tax rate in omaha, ne is 7.000%. The nebraska sales tax rate is currently %. Raising the state’s sale tax rate from its current 5.5 cents per dollar is probably easier politically, added sen.

With local taxes, the total sales tax rate is between 5.500% and 8.000%. The state capitol, omaha, has a. Coleridge, nehawka, and wauneta will each levy a new 1% local sales and use tax while the city of st.

What Can You Maybe Expect After 8 – 10 Years Of Ownersh Homeowner 10 Years About Me Blog

New Ag Census Shows Disparities In Property Taxes By State

Cell Phone Taxes And Fees 2021 Tax Foundation

2

2020 Nebraska Property Tax Issues Agricultural Economics

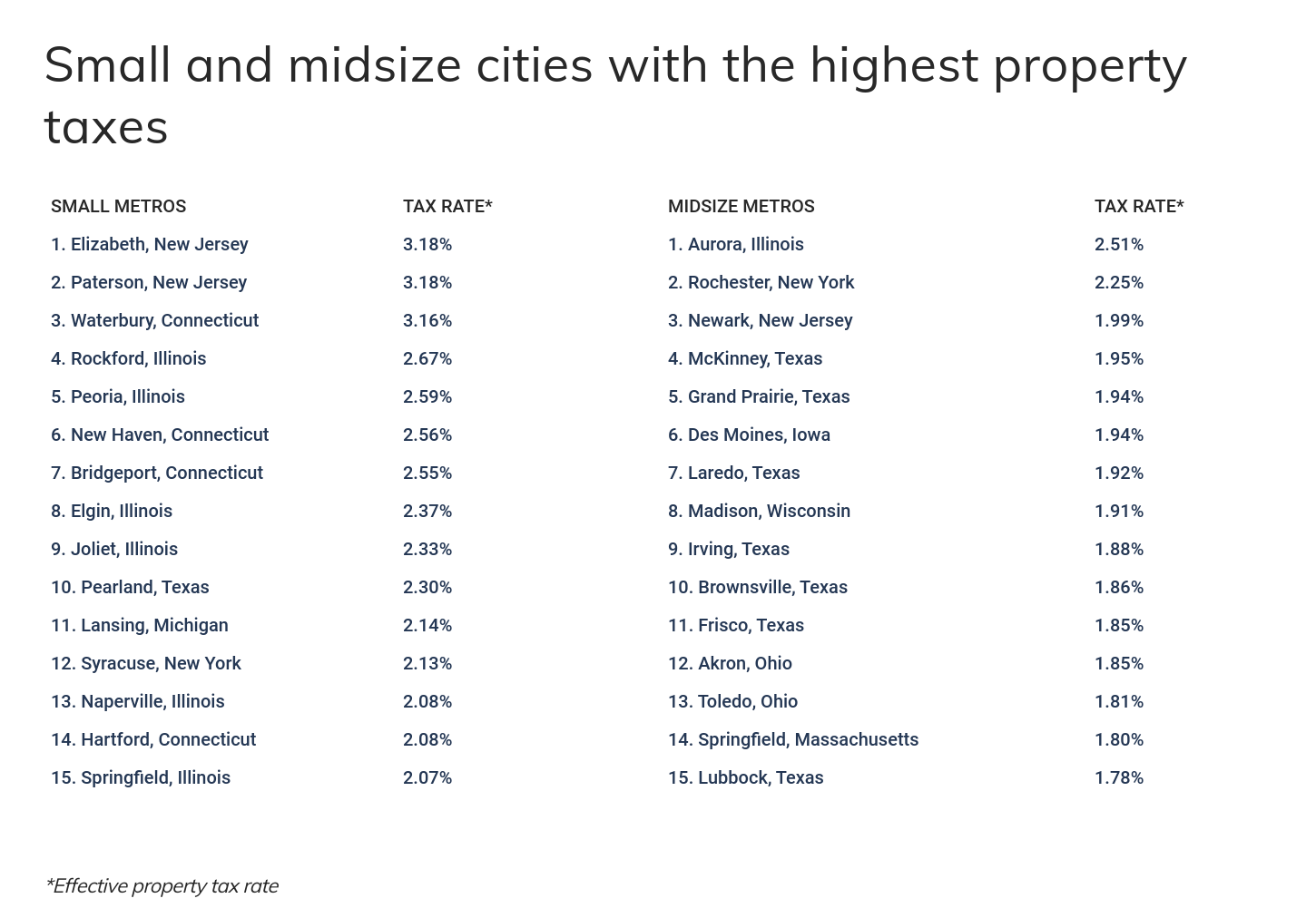

The Cities With The Highest And Lowest Property Taxes Real Estate Napavalleyregistercom

How To Calculate Sales Tax – Youtube

How Tax Information Appears On The Receipts Of Major Grocery Download Table

Iowa Sales Tax – Taxjar

Cell Phone Taxes And Fees 2021 Tax Foundation

Georgia Sales Tax Rates By City County 2021

Nebraska Income Tax Calculator – Smartasset

The Cities With The Highest And Lowest Property Taxes Real Estate Napavalleyregistercom

Lincoln To See New Sales Tax Revenue Starting October 1

How Tailwind Has Exploded My Pinterest Traffic In Just A Couple Months Increase Traffic Pinterest Tailwind Pinterest Traffic Traffic Increase Blog Traffic

2

The Cities With The Highest And Lowest Property Taxes Real Estate Napavalleyregistercom

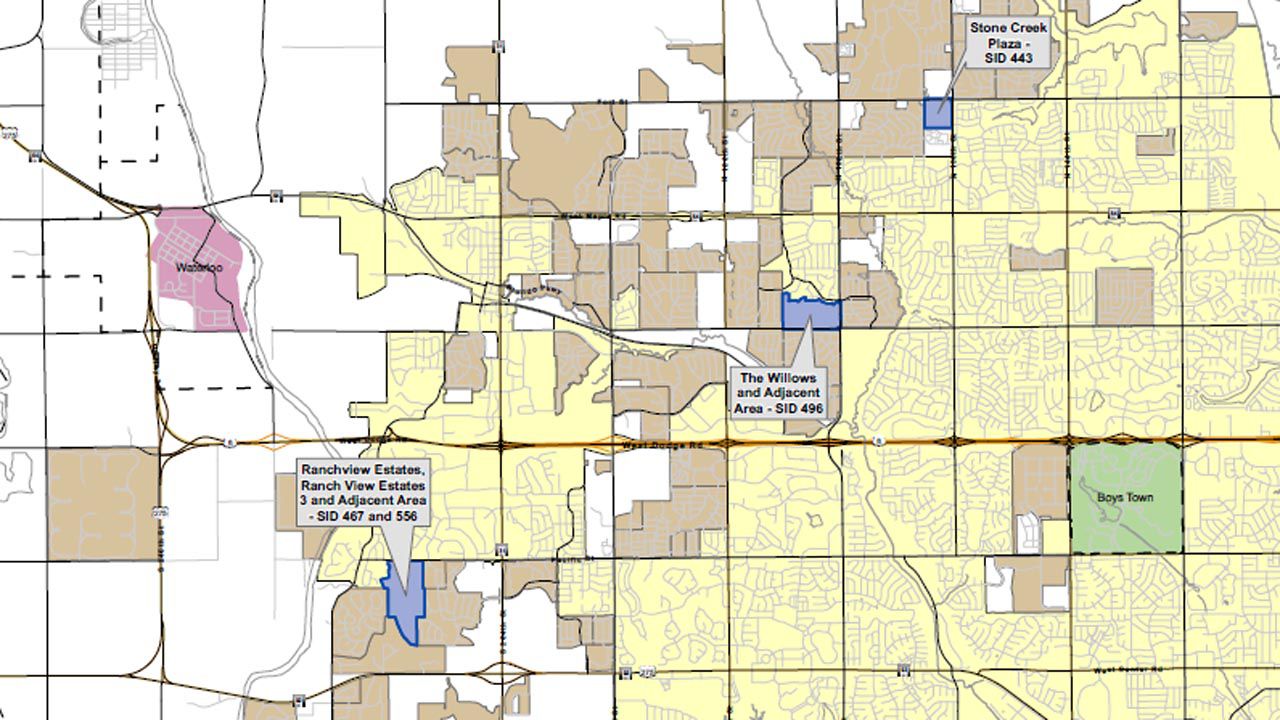

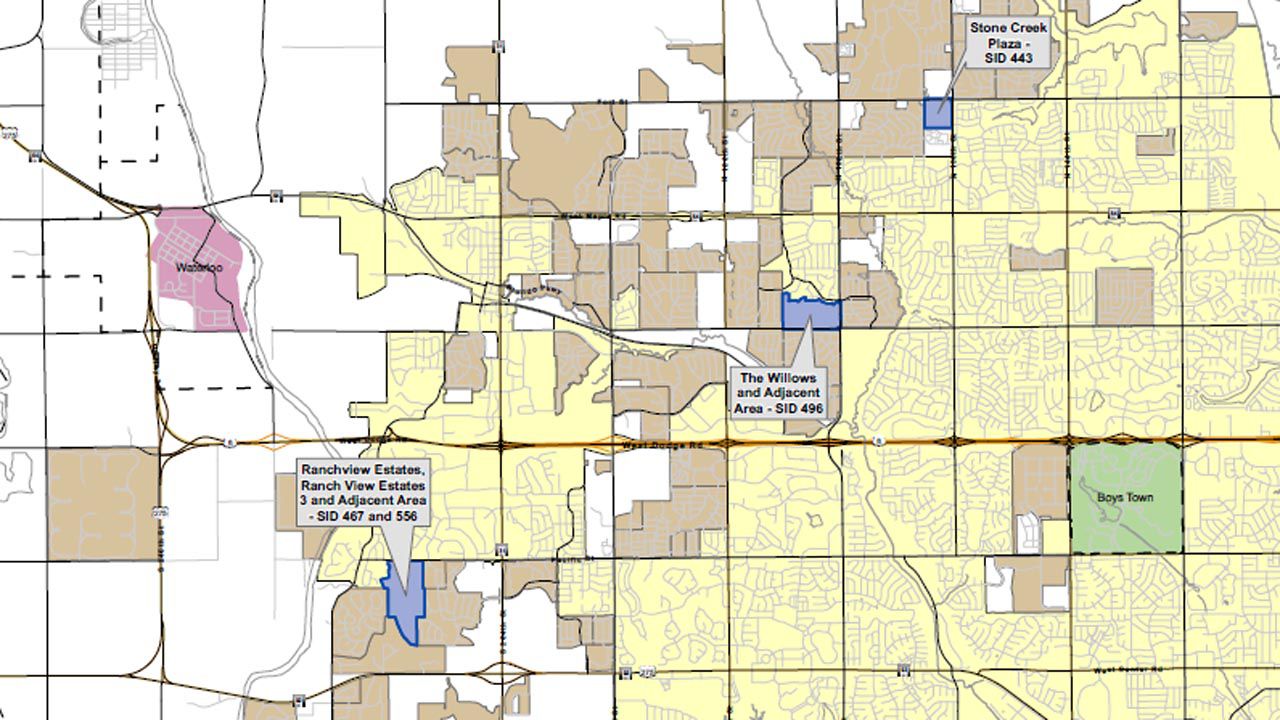

Mayor Proposes Omaha Annexations

Nebraska Income Tax Calculator – Smartasset