A salary of $50,000 in omaha, nebraska should increase to $100,790 in sanibel, florida (assumptions include homeowner, no child care, and taxes are not considered. Omaha, nebraska vs sanibel, florida.

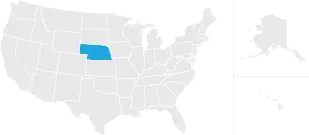

Sales Taxes In The United States – Wikiwand

The latest sales tax rates for cities starting with 'a' in nebraska (ne) state.

Omaha ne sales tax calculator. How does sales tax in omaha compare to the rest of nebraska? The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. In 2012, nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable.

Rates include state, county, and city taxes. The omaha, nebraska sales tax is 7.00%, consisting of 5.50% nebraska state sales tax and 1.50% omaha local sales taxes.the local sales tax consists of a 1.50% city sales tax. This sales tax rate calculator is powered by the same technology used by sales tax software, except that this tool does not scrub the provided address against the us postal service database.use it to calculate sales tax for any address in the united states.

This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs. Groceries are exempt from the omaha and nebraska state sales taxes Nebraska provides no tax breaks for social security benefits and military pensions while real estate is assessed at 100% market value.

The omaha sales tax rate is %. Sales tax in omaha, nebraska, is currently 7%. Ad start your dropshipping storefront.

Ad start your dropshipping storefront. The minimum combined 2021 sales tax rate for omaha, nebraska is. Does nebraska have personal property tax on vehicles?

Utilize leading marketing tools to boost your business and get found online. The nebraska (ne) state sales tax rate is currently 5.5%. You can print a 7% sales tax table here.for tax rates in other cities, see nebraska sales taxes by city and county.

However, the tax paid is now uniform throughout the state and only three types of local. Current local sales and use tax rates and other sales and use tax information The 7% sales tax rate in omaha consists of 5.5% nebraska state sales tax and 1.5% omaha tax.

At that rate, a homeowner with a home worth $200,000 would pay $4,120 annually in. 2021 cost of living calculator: The current total local sales tax rate in omaha, ne is 7.000%.

It’s perfect if you need to lookup the tax rate for a specific address or zip code. Taxes and spending in nebraska. This is the total of state, county and city sales tax rates.

The sales tax rate for omaha was updated for the 2020 tax year, this is the current sales tax rate we are using in the omaha, nebraska sales tax comparison calculator for 2022/23. The december 2020 total local sales tax rate was also 7.000%. The 2018 united states supreme court decision in south dakota v.

You can use our nebraska sales tax calculator to look up sales tax rates in nebraska by address / zip code. Calculation of the general sales. Utilize leading marketing tools to boost your business and get found online.

The average effective property tax rate in sarpy county is 2.06%. You can find more tax rates and allowances for omaha and nebraska in the 2022 nebraska tax tables. Nebraska has a 5.5% statewide sales tax rate , but also has 295.

Depending on local municipalities, the total tax rate can be as high as 7.5%, but food and prescription drugs are exempt. How 2021 sales taxes are calculated in omaha. 50% to the county treasurer of each county, amounts in the same proportion as the most recent allocation received by each county from the highway allocation.

The omaha, nebraska, general sales tax rate is 5.5%.depending on the zipcode, the sales tax rate of omaha may vary from 5.5% to 7% every 2021 combined rates mentioned above are the results of nebraska state rate (5.5%), the omaha tax rate (0% to 1.5%). There is no county sale tax for omaha, nebraska.there is no special rate for. To use our nebraska salary tax calculator, all you have to do is enter the necessary details and click on the calculate button.

After 1% is retained by the county treasurer the distribution of funds collected for the motor vehicle fee are:. If this rate has been updated locally, please contact us and we will update the sales tax rate for omaha, nebraska. The motor vehicle tax and motor vehicle fee replaced the property tax levied on motor vehicles beginning jan.

Sarpy county is part of the omaha metropolitan area and has the highest property tax rates of any nebraska county. The nebraska state sales and use tax rate is 5.5% (. After a few seconds, you will be provided with a full breakdown of the tax you are paying.

The omaha sales tax is collected by the merchant on all qualifying sales made within omaha; Motor vehicle fee is based upon the value, weight and use of the vehicle and is adjusted as the vehicle ages. The nebraska sales tax rate is currently %.

101 rows sales tax calculator of 68137, omaha for 2021. The nebraska state sales and use tax rate is 5.5% (.055). 33.20 cents per gallon of regular gasoline and diesel.

The county sales tax rate is %. Omaha in nebraska has a tax rate of 7% for 2022, this includes the nebraska sales tax rate of 5.5% and local sales tax rates in omaha totaling 1.5%. , 5.5% rate card 6% rate card 6.5% rate card 7% rate card 7.25% rate card 7.5% rate card 8% rate card , nebraska jurisdictions with local sales and use tax local sales and use tax rates effective january 1, 2021 local sales and use tax rates effective april 1, 2021

There is no applicable county tax or special tax.

Property Tax Calculator Property Tax Guide Rethority

Nebraska Sales And Use Tax Rates Lookup By City Zip2tax Llc

Dynamics Nav Us Sales Tax Stoneridge Software

Location Matters Effective Tax Rates On Manufacturers By State Tax Foundation

Property Tax Calculator Property Tax Guide Rethority

Nebraska Sales Tax Rates By City County 2021

Sales Tax Tax Calculations Omaha Ne

Property Tax Calculator Property Tax Guide Rethority

Sales Taxes In The United States – Wikiwand

Nebraska Income Tax Calculator – Smartasset

How To Register For A Sales Tax Permit In Nebraska Taxjar Blog

Nebraska Income Tax Calculator – Smartasset

Sales Taxes In The United States – Wikiwand

Nebraska Sales Tax – Taxjar

Nebraska Sales Tax – Small Business Guide Truic

Location Matters Effective Tax Rates On Manufacturers By State Tax Foundation

Which Cities And States Have The Highest Sales Tax Rates – Taxjar

Sales Taxes In The United States – Wikiwand

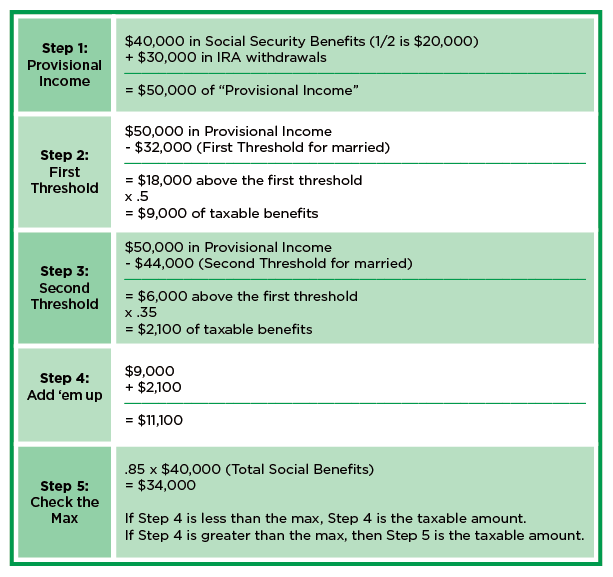

Taxable Social Security Calculator