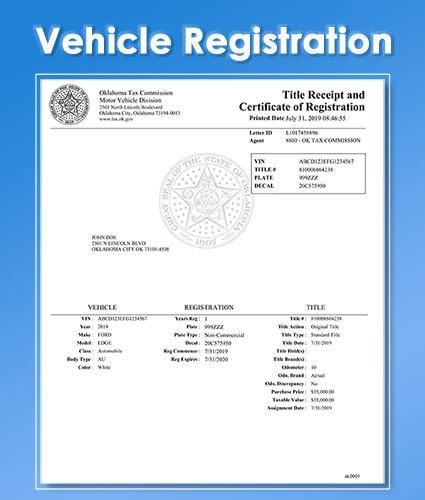

Oklahoma are not assessed oklahoma excise tax, provided they title and register in their state of residence. Vehicle tax or sales tax, is based on the vehicle's net purchase price.

How To Calculate Cannabis Taxes At Your Dispensary

$20.00 on the 1st $1500.00 of value + 3.25% of the remainder.

Oklahoma car sales tax calculator. Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax; Excise tax on boats and outboard motors is based on the manufacturer's original retail selling price of the unit. The excise tax for new cars is 3.25%, and for used cars, the tax is $20.00 for the first $1500.00 and 3.25% on the remainder of the sale price.

With local taxes, the total sales tax rate is between 4.500% and 11.500%. Most vehicles, all terrain vehicles, boats or outboard motors are assessed excise tax on the basis of 7.75% for vehicle over $50,000.

Counties and cities can charge an additional local sales tax of up to 6.5%, for a maximum possible combined sales tax of 11%; This is only an estimate. Dealership employees are more in tune to tax rates than most government officials.

Standard vehicle excise tax is assessed as follows: Your exact excise tax can only be calculated at a tag office. The cost for the first 1,500 dollars is a flat 20 dollar fee.

Our sales tax calculator will calculate the amount of tax due on a transaction. In addition to taxes, car purchases in oklahoma may be subject to other fees like. When a vehicle is purchased under current law, a sales tax of 1.25 percent is levied on the full price of the car.

However it must be noted that the first 1,500 dollars spent on the vehicle would not be taxed in the usual way; Cities and/or municipalities of oklahoma are allowed to collect their own rate that can get up to 5.1% in city sales tax. This is the largest of oklahoma’s selective sales taxes in terms of revenue generated.

Select view sales rates and taxes, then select city, and add percentages for total sales tax rate. Once you have the tax. The state sales tax rate in oklahoma is 4.50%.

Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20% of the average retail value of the car, regardless of condition. If you are unsure, call any local car dealership and ask for the tax rate. 4.25% motor vehicle document fee.

The oklahoma (ok) state sales tax rate is currently 4.5%. If the purchased price falls within 20% of the. The actual excise tax value is based on the blue book value as established by the vehicle identification number (vin).

The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Oklahoma has a lower state sales tax than 88.5%. The state general sales tax rate of oklahoma is 4.5%.

Motor vehicle taxes in oklahoma are both selective sales taxes on the purchase of vehicles and ongoing taxes on wealth, the value of the vehicles. Auto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator. 3.25% of the purchase price (or taxable value, if different) used vehicle:

There is no special rate for bixby. It's fairly simple to calculate, provided you know your region's sales tax. Every 2021 combined rates mentioned above are the results of oklahoma state rate (4.5%), the county rate (0% to 3%), the oklahoma cities rate (0% to 5.1%).

The bixby, oklahoma, general sales tax rate is 4.5%.the sales tax rate is always 8.917% every 2021 combined rates mentioned above are the results of oklahoma state rate (4.5%), the county rate (0.367%), the oklahoma cities rate (4.05%). The calculator can also find the amount of tax included in a gross purchase amount. Oklahoma collects a 3.25% state sales tax rate on the purchase of all vehicles.

How 2021 sales taxes are calculated in bixby. Oklahoma has a 4.5% statewide sales tax rate , but also has 356 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 3.205% on top. Senate bill 1619, authored by sen.

Sales tax calculator | sales tax table the state sales tax rate in oklahoma is 4.500%. Oklahoma’s motor vehicle taxes are a combination of an excise (sales) tax on the purchase of a vehicle and an annual registration fee in lieu of ad valorem (property) taxes. The oklahoma state sales tax rate is 4.5%, and the average ok sales tax after local surtaxes is 8.77%.

Find your state below to determine the total cost of your new car, including the car tax. Together, these two motor vehicle taxes produced $728 million in 2016, 5 percent of all tax revenue in the state. This method is only as exact as the purchase price of the vehicle.

Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees. The sales tax rate for the sooner city is 4.5%, however for most road vehicles, there is a motor vehicles excise tax assessed at the time of sale or when the new oklahoma car title is issued in the new owner's name. $30,000 × 8% = $2,400.

Until 2017, motor vehicles were fully exempt from the sales tax, but under hb 2433 , the exemption was partially lifted and motor vehicles became subject to a 1.25. However, in addition to that rate, oklahoma has some of the highest local sales taxes in the country,. Depending on local municipalities, the total tax rate can be as high as 11.5%.

6.35% for vehicle $50k or less. Whether you live in tulsa, broken bow or oklahoma city, residents are required to pay oklahoma car tax when purchasing a vehicle.

Understanding Californias Sales Tax

Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

Free Duplicate Copies Of Vehicle Registrations Now Available Online News Mcalesternewscom

Car Tax By State Usa Manual Car Sales Tax Calculator

Understanding Californias Sales Tax

Oklahoma State Tax Hr Block

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

How To Calculate Sales Tax – How To Find Out How Much Sales Tax – Sales Tax Calculation – Youtube

Car Tax By State Usa Manual Car Sales Tax Calculator

Nj Car Sales Tax Everything You Need To Know

States With Highest And Lowest Sales Tax Rates

Wisconsin Sales Tax – Small Business Guide Truic

Whats The Car Sales Tax In Each State Find The Best Car Price

Connecticut Sales Tax Calculator Reverse Sales Dremployee

How To Calculate Cannabis Taxes At Your Dispensary

Sales Tax Calculator For Purchase Plus Tax Or Tax-included Price

Car Tax By State Usa Manual Car Sales Tax Calculator