Nebraska application for direct payment authorization (12/2020) 20dp. Nebraska sales tax statistics by county and by business classification.

Car Tax By State Usa Manual Car Sales Tax Calculator

This year of 2021 is likewise not an exemption.

Nebraska sales tax rate on vehicles. 18% is allocated to the city or village, except that: Depending on local municipalities, the total tax rate can be as high as 7.5%, but food and prescription drugs are exempt. These tables show an analysis by county and business classification code of.

This is less than 1% of the value of the motor vehicle. This means that, depending on your location within nebraska, the total tax you pay can be significantly higher than the 5.5% state sales tax. 4.25% motor vehicle document fee.

In 2012, nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable. There is no applicable county tax or special tax. Groceries are exempt from the nebraska sales tax;

Notification to permitholders of changes in local sales and use tax rates effective april 1, 2022 updated 12/02/2021 Nebraska has a 5.5% sales tax and douglas county collects an additional n/a, so the minimum sales tax rate in douglas county is 5.5% (not including any city or special district taxes). There is no applicable county tax or special tax.

Subsequent brackets increase the tax $10 to $40 for each $2,000 of value when new, or two percent. The nebraska (ne) state sales tax rate is currently 5.5%. The typical state and local sales tax in nebraska is about 7 percent, conroy said, so the buyer could save $14,000 on an rv costing $200,000.

, 5.5% rate card 6% rate card 6.5% rate card 7% rate card 7.25% rate card 7.5% rate card 8% rate card , nebraska jurisdictions with local sales and use tax local sales and use tax rates effective january 1, 2021 local sales and use tax rates effective april 1, 2021 Remote sellers in nebraska should be aware of local tax rates, as well as the state tax. Nebraska (ne) sales tax rates by city.

Select the nebraska city from the list of popular cities below to see its current sales tax rate. The county sales tax rate is %. Nebraska collects a 5.5% state sales tax rate on the purchase of all vehicles.

The nebraska sales tax rate is currently %. Nebraska provides no tax breaks for social security benefits and military pensions. Counties and cities can charge an additional local sales tax of up to 2%, for a maximum possible combined sales tax of 7.5%

Nebraska change request (09/2017) 22. Nebraska has recent rate changes (thu jul 01 2021). Nebraska has a statewide sales tax rate of 5.5%, which has been in place since 1967.

The nebraska state sales and use tax rate is 5.5% (.055). The minimum combined 2021 sales tax rate for lincoln, nebraska is. Which states have low car sales tax rates?

The nebraska state sales tax rate is 5.5%, and the average ne sales tax after local surtaxes is 6.8%. This is the total of state, county and city sales tax rates. This table shows the total sales tax rates for all cities and towns in douglas county, including all local taxes.

The nebraska state sales and use tax rate is 5.5% (.055). Fortunately, there are several states with low car sales tax rates, at or below 4%: In addition to taxes, car purchases in nebraska may be subject to other fees like registration, title, and plate fees.

After a few seconds, you will be provided with a full breakdown of the tax you are paying. Current local sales and use tax rates and other sales and use tax information. The total sales tax rate in any given location can be broken down into state, county, city, and special district rates.

Nebraska has a 5.5% statewide sales tax rate, but also has 295 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 0.547% on top of the state tax. The nebraska state sales and use tax rate is 5.5% (.055). If the tax district is not in a city or village 40% is allocated to the county and;

The states with the highest car sales tax rates are: Nebraska has recent rate changes (thu jul 01 2021). In counties containing a city of the metropolitan class, 18% is allocated to the county and 22% to the city or village.

The statistics are grouped by county. Nebraska sales tax rate finder. You can find these fees further down on the page.

Select view sales rates and taxes, then select city, and add percentages for total sales tax rate. The state sales tax rate in nebraska is 5.500%. Threshold of $100,000 per year in previous year, or 200 or more transactions in current or prior year;

The lincoln sales tax rate is %. 7.75% for vehicle over $50,000. You can print a 7% sales tax table here.

Motor vehicle sales tax collection information is compiled from monthly county treasurers' reports. The owner would also avoid paying about $900 in title. The nebraska (ne) state sales tax rate is currently 5.5%.

With local taxes, the total sales tax rate is between 5.500% and 8.000%. The 7% sales tax rate in seward consists of 5.5% nebraska state sales tax and 1.5% seward tax. 7.5% sales and use tax rate cards.

6.35% for vehicle $50k or less. The lowest tax rate is 2.46%, and the highest is 6.84%. Nebraska allows sales tax exemptions for groceries, medicine, and gasoline.

States With No Sales Tax On Cars

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Vehicle Buying Do You Pay Sales Tax For The State You Buy From Or Live In

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Which Us States Charge Property Taxes For Cars – Mansion Global

Nj Car Sales Tax Everything You Need To Know

Traveling Interstate 80 In Nebraska Rest Area – 1972 Postcard Postcard Antique Postcard Red Oak

States With Highest And Lowest Sales Tax Rates

Sales Tax On Cars And Vehicles In Nebraska

The States With The Lowest Car Tax The Motley Fool

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Car Financing Are Taxes And Fees Included – Autotrader

Careful Claiming Car Donations Old Trucks Trucks Vintage Trucks

What Is The Gas Tax Rate Per Gallon In Your State Itep

Nebraska Sales Tax – Small Business Guide Truic

Utah Sales Tax On Cars Everything You Need To Know

Whats The Car Sales Tax In Each State Find The Best Car Price

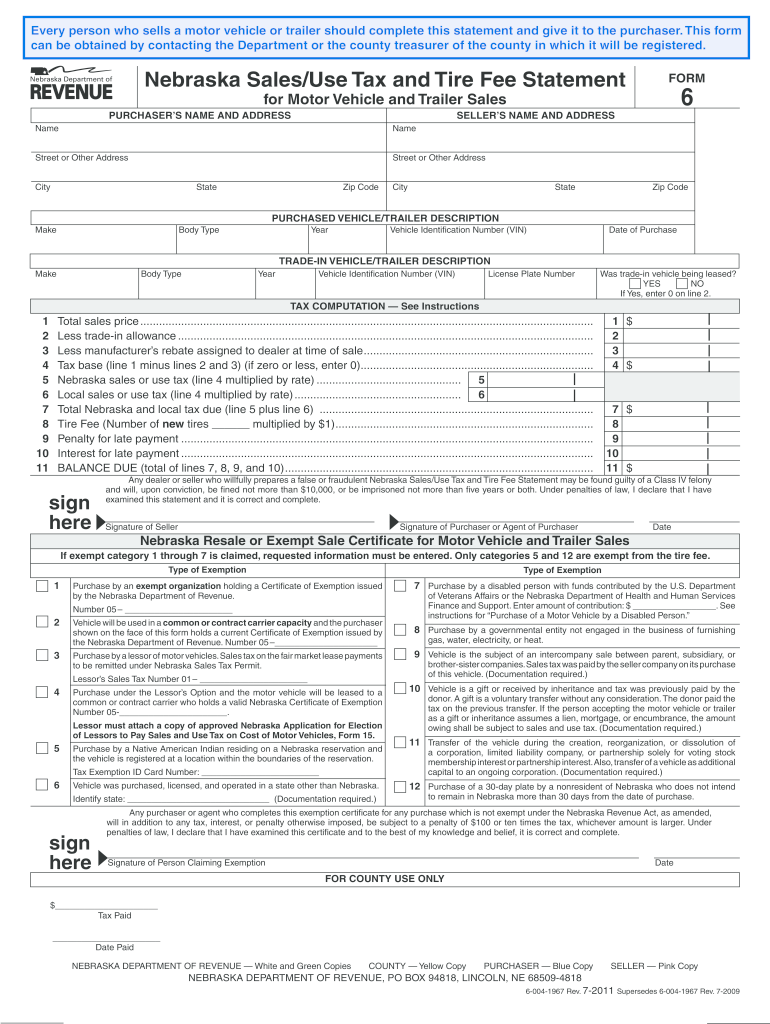

Nebraska Form 6 – Fill Out And Sign Printable Pdf Template Signnow