Counties in new mexico collect an average of 0.55% of a property's assesed fair market value as property tax per year. Counties in maryland collect an average of 0.87% of a property's assesed fair market value as property tax per year.

Kern-county Property Tax Records – Kern-county Property Taxes Ca

Tax rate tax amount ;

Monterey county property tax rate 2020. Monterey county collects, on average, 0.51% of a property's assessed fair market value as property tax. Effective july 1, 2018, the consolidated oversight board for the county of monterey was established in accordance with the california health and safety code § 34179(j) to oversee the activities of the ten redevelopment successor agencies in monterey county, thereby replacing all other redevelopment successor agency oversight boards. Tax amount varies by county.

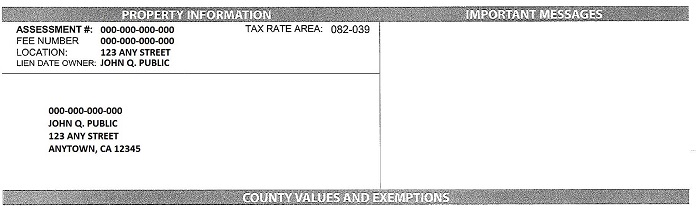

When looking at your tax bill, it shows that you have both an asmt number and a fee number. Carmel unified series 2010 & 2016 ref: 19 will give you a tax break if you sell your home, allowing you to transfer your existing property tax rate (in theory lower than the taxes on the new place) to the property you purchase.

The average yearly property tax paid by monterey county residents amounts to about 3.71% of their yearly income. The median property tax in new mexico is $880.00 per year for a home worth the median value of $160,900.00. To calculate the amount of transfer tax you owe, simply use the following formula:

Monterey county weekly | editorial board, october 8, 2020 yes on proposition 19 | property tax breaks for seniors if you’re 55 or older, prop. Monterey county is ranked 314th of the 3143 counties for property taxes as a percentage of median income. Property tax relief is available in monterey county, for example through exemptions and special programs, and may lower the property's tax bill.

City level tax rates in this county apply to assessed value, which is equal to the sales price of recently purchased homes. $1.10 for each $1,000* identify the full sale price of the property. (all service fees are assessed by our credit card vendor, not the county of monterey.) note:

The median property tax in monterey county, california is $2,894 per year for a home worth the median value of $566,300. The ad valorem property taxes comprise almost 90% of the overall property tax bill. Counties in illinois collect an average of 1.73% of a property's assesed fair market value as property tax per year.

Identify the total amount of your state, county, city transfer tax. The median property tax in montana is $1,465.00 per year for a home worth the median value of $176,300.00. Sacramento county is located in northern california and has a population of just over 1.5 million people.

You can use the california property tax map to the left to compare monterey county's property tax to other counties in california. Transfer tax can be assessed as a percentage of the property’s final sale price or simply a flat fee. Some cities and local governments in monterey county collect additional local sales taxes, which can be as high as 3.25%.

Illinois has one of the highest average property tax rates in the country, with only six states levying higher property taxes. A “yes” vote supported authorizing a sales tax increase from 0.5% to 1% for 20 years generating an estimated additional $600,000 per year, thereby increasing the total sales tax rate in gonzales from 8.25% to 8.75%. The median property tax in illinois is $3,507.00 per year for a home worth the median value of $202,200.00.

For more details about the property tax rates in any of california's counties, choose the county from the interactive map or the list below. The median property tax in maryland is $2,774.00 per year for a home worth the median value of $318,600.00. The 9.25% sales tax rate in monterey consists of 6% california state sales tax, 0.25% monterey county sales tax, 1.5% monterey tax and 1.5% special tax.

California has 58 counties, with median property taxes ranging from a high of $5,500.00 in marin county to a low of $953.00 in modoc county. The property tax rate in the county is 0.78%. It's also home to the state capital of california.

How much is property tax in monterey county? New mexico has one of the lowest median property tax rates in the united states, with only eight states collecting a lower median property tax than. Tax amount varies by county.

Monterey pen ccd 2002b 2013 ref ab & 2016ref: The sales tax jurisdiction name is monterey conference center facilities district, which may refer to a local government division. Counties in montana collect an average of 0.83% of a property's assesed fair market value as property tax per year.

2

Kern-county Property Tax Records – Kern-county Property Taxes Ca

Home Monterey County Norml

Contra-costa-county Property Tax Records – Contra-costa-county Property Taxes Ca

Kern-county Property Tax Records – Kern-county Property Taxes Ca

2021 Best Places To Live In Monterey County Ca – Niche

Contra-costa-county Property Tax Records – Contra-costa-county Property Taxes Ca

Property Tax By County Property Tax Calculator Rethority

Contra-costa-county Property Tax Records – Contra-costa-county Property Taxes Ca

Contra-costa-county Property Tax Records – Contra-costa-county Property Taxes Ca

Contra-costa-county Property Tax Records – Contra-costa-county Property Taxes Ca

Property Tax By County Property Tax Calculator Rethority

Search Page – Mbc

Home Monterey County Norml

Property Tax By County Property Tax Calculator Rethority

Lewis County Tennessee Property Taxes – 2021

2

Kern-county Property Tax Records – Kern-county Property Taxes Ca

Property Tax By County Property Tax Calculator Rethority