The city of milwaukee assessor’s office typically performs a citywide revaluation every year. , wi sales tax rate.

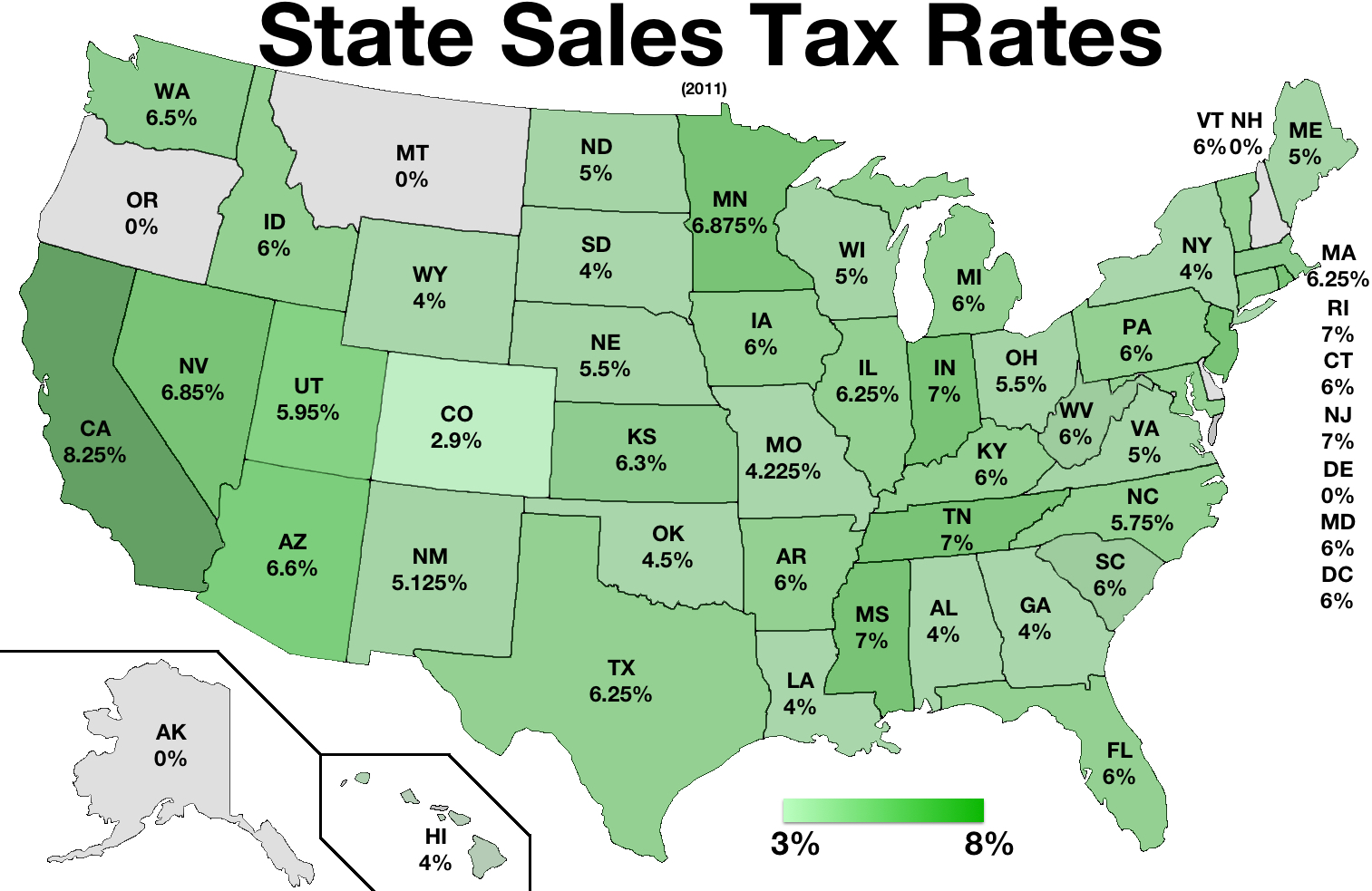

Which Cities And States Have The Highest Sales Tax Rates – Taxjar

Wisconsin (wi) sales tax rates by city.

Milwaukee wi sales tax rate 2021. This is the total of state and county sales tax rates. The decreased rate applies as follows: Wisconsin has recent rate changes (wed apr 01 2020).

The table below shows wisconsin's tax rates as of tax year 2020 (filed in 2021) and their respective brackets. There is no applicable city tax or special tax. In wisconsin, the seller is responsible for paying the tax.

This tax is applied based on income brackets, with rates increasing for higher levels of income. For tax rates in other cities, see wisconsin sales taxes by city and county. These revaluations result in changes to the assessed values for most properties.

The minimum combined 2021 sales tax rate for milwaukee county, wisconsin is. The median wisconsin property tax is $3,007.00, with exact property tax rates varying by location and county. As milwaukee common council president cavalier johnson peers into the city’s future, he is sure of one thing:

The current total local sales tax rate in milwaukee, wi is 5.500%. State & county tax rate*** gross tax rate state credit net tax rate** 1984: 2021 real property assessment information.

The wisconsin state sales tax. The result would be a county rate of 6% and a city rate of 6.5%. If the purchase price and sales price were the same, you might pay around $11,110 in capital gains tax in wisconsin.

The december 2020 total local sales tax rate was 5.600%. The 5.5% sales tax rate in milwaukee consists of 5% wisconsin state sales tax and 0.5% milwaukee county sales tax. In another scenario, if you’re married and filing jointly but you and your spouse make $200,000 annually, your taxes will be higher.

Please refer to the wisconsin website for more sales taxes information. 5% is the smallest possible tax rate (brookfield, wisconsin) 5.1%, 5.5%, 5.6%, 6% are all the other possible sales tax rates of wisconsin cities. And to get the revenue, milwaukee will need to find a way to repair.

The state of wisconsin charges the transfer tax based on the sale price. Depending on local municipalities, the total tax rate can be as high as 5.6%. 2021 wisconsin state sales tax rates the list below details the localities in wisconsin with differing sales tax rates, click on the location to access a supporting sales tax calculator.

How much are transfer taxes in wisconsin? 2021 social security payroll tax (employee portion) medicare withholding 2021 (employee portion) wisconsin individual income tax. Individual income tax rate decrease (2021 wis.

Thus, if the sale price is $250,000, a transfer tax of $750 is due. In 2011, only four communities in wisconsin had local wheel taxes and by february 2022, that number will grow to 44, including milwaukee and dane counties and. The assessor’s office will be performing a maintenance assessment.

With local taxes, the total sales tax rate is between 5.000% and 5.500%. Sales tax also exists in milwaukee to partially. The local sales tax rate in milwaukee county is 0.5%, and the maximum rate (including wisconsin and city sales taxes) is 5.5% as of november 2021.

For 2021, the city of milwaukee is not doing a revaluation. Here’s a quick and easy way to estimate your capital gains tax liability. 6.75% is the highest possible tax rate (lake delton, wisconsin)

Wisconsin state rate(s) for 2021. What is the sales tax rate? You can print a 5.5% sales tax table here.

The state sales tax rate in wisconsin is 5.000%. Costs of sale (transactional expenses & commissions): They charge at a rate of $0.30 for every $100 (or fraction thereof) of the purchase price.

Select the wisconsin city from the list of popular cities below to see its current sales tax rate. There is a statewide income tax in wisconsin. For that future to be a good one, the city is going to need additional revenue.

The wisconsin sales tax is a 5% tax imposed on the sales price of retailers who sell, license, lease, or rent tangible personal property, certain coins and stamps, certain leased property affixed to realty, or certain digital goods, or sell, license, perform, or furnish taxable services in. Exemptions to the wisconsin sales tax will vary by state. The wisconsin (wi) state sales tax rate is currently 5%.

Our payroll software is quickbooks compatible and can export payroll data to quickbooks. And (j)3., effective for taxable years beginning after december 31, 2020) the individual income tax rate for the third bracket has been decreased from 6.27 percent to 5.3 percent. The wisconsin sales tax rate is 5% as of 2021, with some cities and counties adding a local sales tax on top of the wi state sales tax.

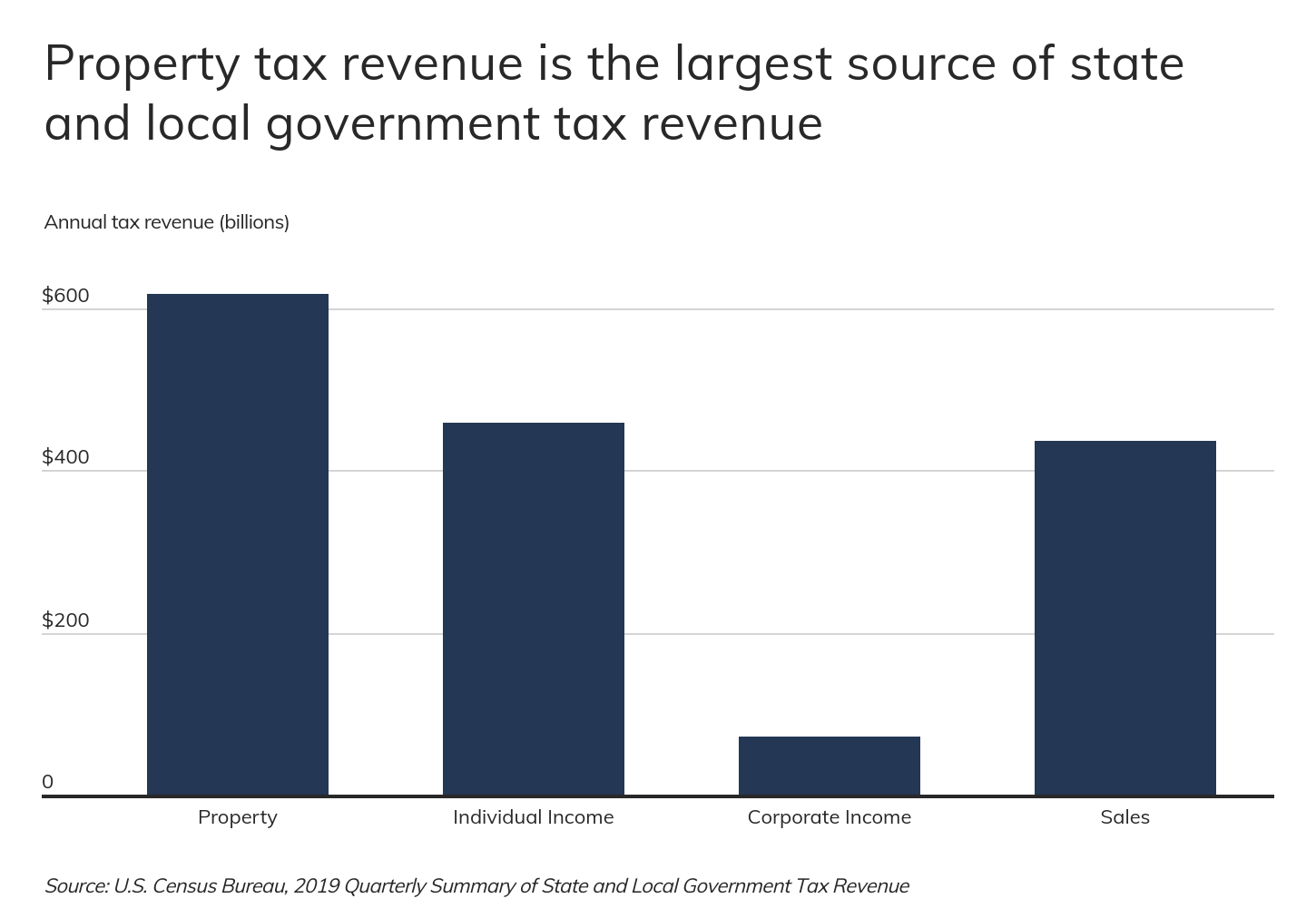

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom

Wisconsin Sales Tax Rates By City County 2021

Sales Taxes In The United States – Wikiwand

North Central Illinois Economic Development Corporation – Property Taxes

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom

Sales Taxes In The United States – Wikiwand

Wisconsin Sales Tax – Small Business Guide Truic

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom

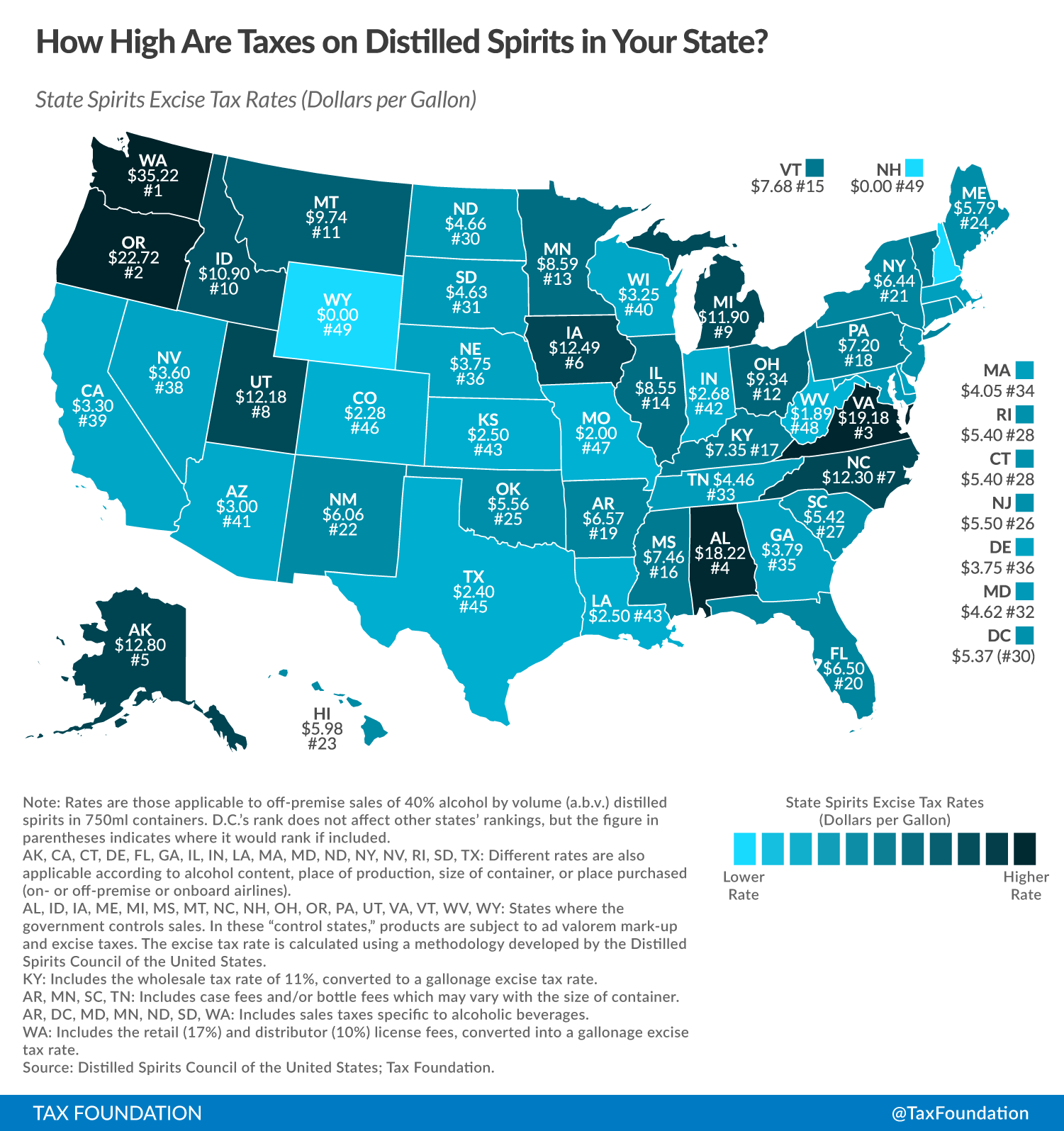

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic – Distillery Trail

Which Cities And States Have The Highest Sales Tax Rates – Taxjar

The Cities With The Highest And Lowest Property Taxes Real Estate Buffalonewscom

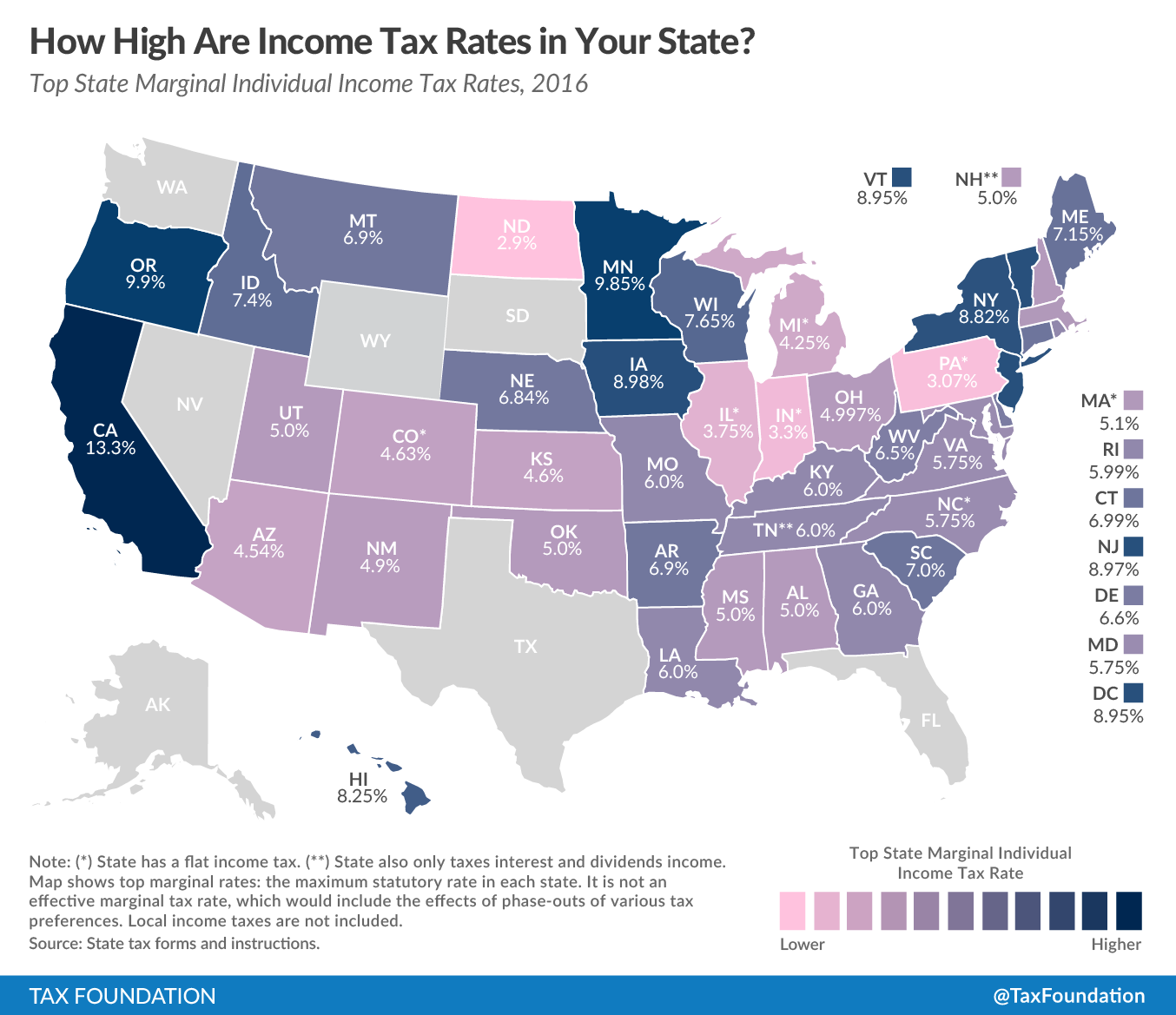

A Glide Path To A 3 Percent Flat Income Tax Maciver Institute

How To Calculate Sales Tax Definition Formula Example

Wisconsin Sales Use Tax Guide – Avalara

Sales Taxes In The United States – Wikiwand

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Wisconsin Sales Tax – Taxjar

How To Calculate Sales Tax – Video Lesson Transcript Studycom