When you have an escrow account, which is normally required for loans with less than 20 percent. Town officials miscalculated the mill rate, a measurement that determines what residents need to.

States With Highest And Lowest Sales Tax Rates

the amounts shown are based on percentages derived from the approved fy19 town of hampden budget.

Maine property tax calculator. Town of fryeburg is a locality in oxford county, maine.while many other municipalities assess property taxes on a county basis, town of fryeburg has its own tax assessor's office. Find your maine combined state and local tax rate. The median property tax on a $248,400.00 house is $2,608.20 in the united states.

Counties in maine collect an average of 1.09% of a property's assesed fair market value as property tax per year. Property tax rates in maine are well above the u.s. This map shows effective 2013 property tax rates* for 488 maine cities and towns.

I created this page after constantly googling the rates. The state of maine publishes this information in a pdf, but wanted to be able to sort by mil rate, county, growth rate, and current mil rate. The current rate for transfer tax is $2.20 per every five hundred dollars of consideration.

Local tax rates in maine range from 5.50%, making the sales tax range in maine 5.50%. To use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). The base state sales tax rate in maine is 5.5%.

For example, a city that has a local assessed valuation of $100 million and. Provided are descriptions of the three key exemptions related to municipal property tax enacted by maine law (title 36, m.r.s.a.). The state has an average effective property tax rate of 1.30%.

In order to impose this tax, the government of auburn. (each spending category below corresponds to a town budget category). Buying property is a process that involves many expenses.

A veteran regardless of age becomes eligible for a $25,000 exemption if the veteran has served at least 90 days of active service and has served in a combat zone. The statewide median rate is $14.30 for every $1,000 of assessed value. How property tax is calculated in auburn, maine.

Property tax fairness credit program: 27 rows maine relocation services local tax rates. These rates are used to calculate interest on overdue payments owed by taxpayers to maine revenue services, as well as to calculate interest on overdue refunds owed by mrs to taxpayers.

Our maine property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in maine and across the entire united states. The median property tax in maine is $1,936.00 per year for a home worth the median value of $177,500.00. These rates do not apply with respect to the taxes imposed pursuant to 36 m.r.s., chapters 105 (municipal property taxes.

The state’s average effective property tax rate is 1.30%, while the national average is currently around 1.07%. If the tax rate is $18.62 per $1,000 and your property’s value is $200,000 then your tax bill would be $3,724. Maine is ranked number twenty out of the fifty states, in order of the average amount of property taxes collected.

The property tax rate (also known as a mil rate) is the amount per $1,000 dollars of property value which is used to calculate your tax bill. Property taxes in maine are an important source of revenue for local governments and school districts. If your property is located in a different oxford county city or town, see that page to find your local tax assessor.

Summarythis bill provides enhanced property tax exemptions for certain veterans. In calculating a property tax rate, the portland city council determines the amount of revenue needed to be raised by the property tax to fund all of our municipal services. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in cumberland county.

The interactive calculator below allows property tax payers to enter the amount of their annual bill to learn how those dollars are allocated to various town expenses. Are you looking to move to a town or city in maine, but also want to get a sense of what the property tax (or mil rate) is?you’ve come to the right place. Buckfield — a $3 drop in the property tax rate was simply too good to be true.

At the median rate, the tax bill on a. That means that, on average, mainers pay 1.30% of their home’s value in property taxes. Auburn, maine calculates its property taxes by requiring property owners to pay a set percentage of the appraised value.

The amount of annual rent paid which constitutes property tax, as calculated by the state of maine property tax fairness credit program. How to calculate maine real estate property tax escrow. Maine sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a.

The typical maine resident will pay $2,597 a year in property taxes. The transfer tax is customarily split evenly between the seller and the purchaser. The median property tax on a $248,400.00 house is $2,707.56 in maine.

Maine has a withholding tax that is payable upon the sale of. That amount is then divided by the total local assessed valuation to get the local tax rate. Local government in maine is primarily.

Our office is also staffed to administer and oversee the property tax administration in the unorganized territory. The property tax credit established by the state of maine pursuant to 36 m.r.s.a. You will pay for some at the close and others at regular intervals during your ownership of the property.

Property taxes are assessed to the owner of record as of april 1 of the given year against real and personal property.

Combined State And Local General Sales Tax Rates Download Table

2

Maine Property Tax Calculator – Smartasset

What Maine Town Has The Lowest Mill Rate Maine Homes By Down East

2

Maps Itep

Jefferson County Ky Property Tax Calculator – Smartasset

Maine Property Tax Calculator – Smartasset

Hawaii Has The Lowest Property Tax Rates In The Us – Wailea Realty Corp

Historical Maine Tax Policy Information – Ballotpedia

Tax Maps And Valuation Listings Maine Revenue Services

Maine Property Tax Calculator – Smartasset

State Income Tax – Wikiwand

Maine Property Tax Rates By Town The Master List

Village Land Shoppe – Flagstaff Property Taxes Coconino County Taxes

Property Taxes By State 2017 Eye On Housing

Reforming New Jerseys Income Tax Would Help Build Shared Prosperity – New Jersey Policy Perspective

Maine Property Tax Rates By Town The Master List

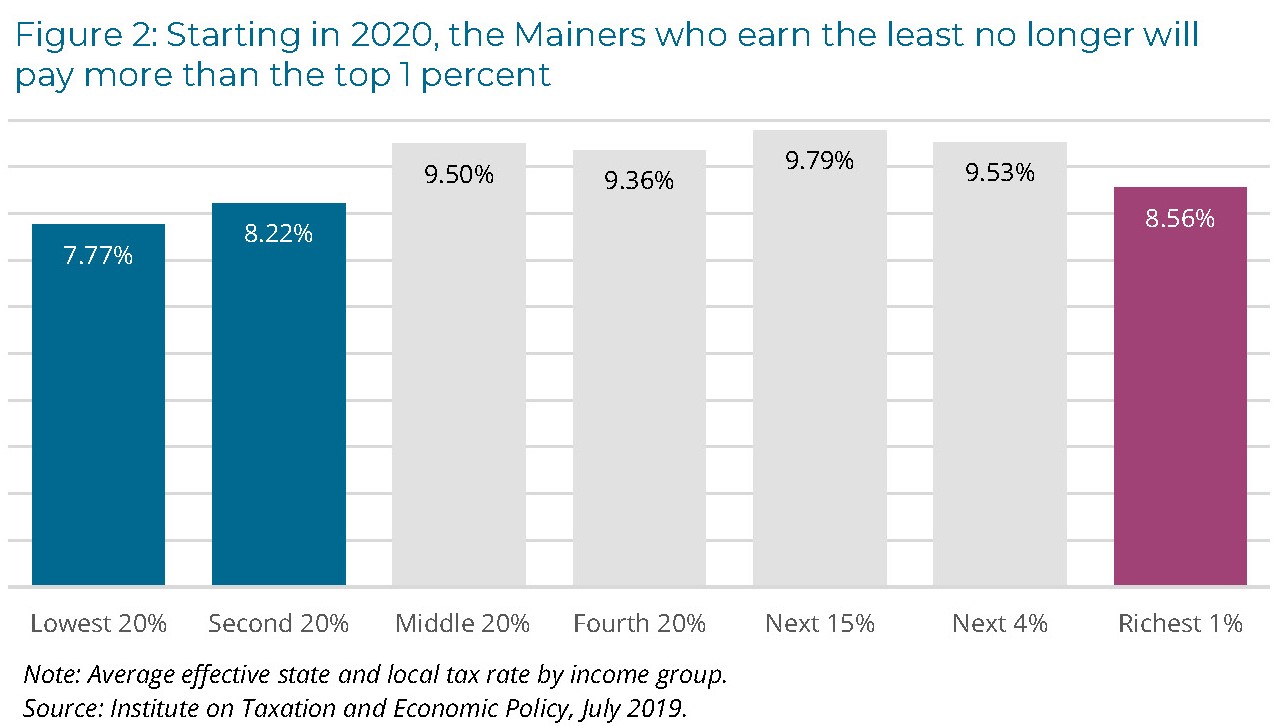

Maine Reaches Tax Fairness Milestone Itep