Visit the tax payment options page to verify if your tax bill can be paid in cash. To figure out the taxes on a piece of property with a total assessment of $233,778.08 (the average assessment for a residential property in lakewood township in 2011) you would divide $233,788.08 by 100 ($2,337.88) and multiply that figure by the tax rate, 2.308 in 2010, the 2011 rate has not yet been struck ($2,337.88 x 2.308 = $5,395.83).

Essays About Classical Music In 2021 Essay Examples Essay Research Paper

The city charges an application fee of $15 for a sales tax.

Lakewood co sales tax online. The belmar business area’s tax rate is 1%. (seller's permit wholesale license resale state id) tuesday, june 9, 2020. An application can be completed online in lakewood business pro (accessed via.

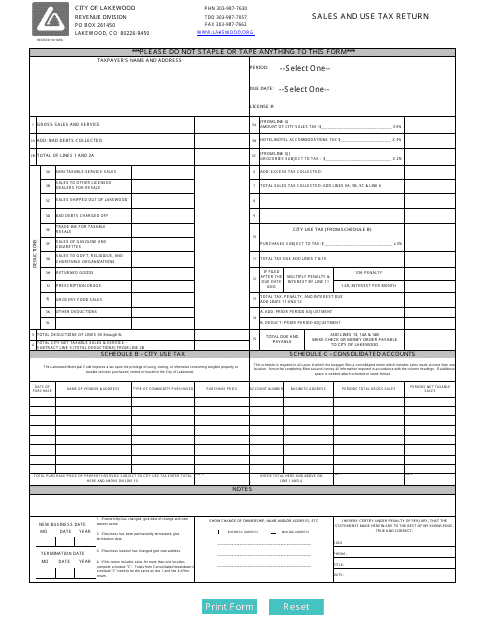

The finance department performs all financial functions for the city of lakewood: What is the tax rate in lakewood? Tax sales www.lakewood.org city of lakewood account please mail this return along with a check or money order to:

This is the total of state, county and city sales tax rates. To qualify for exemption, an organization must complete an application for certificate of exemption. After you create your own user id and password for the income tax account, you may file a return through revenue online.

Lakewood, california sales tax rate 2021 the 10.25% sales tax rate in lakewood consists of 6% california state sales tax, 0.25% los angeles county sales tax, 0.75% lakewood tax and 3.25% special tax. The city of lakewood website has excellent information for those that are beginning the process of opening their own business as well. If paying via electronic funds transfer (eft), credit/debit card or check/money order is not an option, some tax types can be paid with cash.

The pif is not a city tax, but rather a fee the If you have more than one business location, you must file a separate return in revenue online for each location. This means the new sales and use tax rate will first be.

The st3 sales and use tax rate of 0.50% is effective april 1, 2017, bringing the total sales and use tax rate for sound transit to 1.40%. The city of lakewood receives 1% of the 10.0% sales tax rate. Accounting, budgeting, financial reporting, cash and debt management, investments, sales and use tax revenue collection, utility billing, purchasing, shipping, receiving and mailroom services and real property management.

Opening my own business lakewood colorado online store art co llc formation permits and tax ids required to start your own new business : File a sales tax return. A fast, simple & convenient way to file and manage your business taxes with lakewood business pro.

There is no applicable city tax or special tax. Businesses located in the centerra fee districts sales tax rate is 1.75% and is in addition to the district fees. You can print a 5.9583% sales tax table here.

License my business determine if your business needs to be licensed with the city and apply online. Revenue online (rol) sales & use tax system (suts) geographic information system (gis) help with online services; Revenue division po box 17479 denver, co 80217 letter revenue division po box 17479 denver, co 80217 city use tax account number gross sales and services (total receipts from city activity must

Cash payments can only be made at the pierce street department of revenue location (inside. For tax rates in other cities, see new mexico sales taxes by city and county. Do not send cash through the mail.

Report tax evasion & fraud; Ad ask verified tax pros anything, anytime, 24/7/365. The lakewood, colorado sales tax is 7.50%, consisting of 2.90% colorado state sales tax and 4.60% lakewood local sales taxes.the local sales tax consists of a 0.50% county sales tax, a 3.00% city sales tax and a 1.10% special district sales tax (used to fund transportation districts, local attractions, etc).

The minimum combined 2021 sales tax rate for lakewood, colorado is. The 5.9583% sales tax rate in lakewood consists of 5.125% new mexico state sales tax and 0.8333% eddy county sales tax. The colorado sales tax rate is currently %.

The lakewood sales tax rate is %. The county sales tax rate is %. Sales tax rates with the exception of the belmar business area, the sales tax for lakewood is 3%.

The city of loveland’s sales tax rate is 3.0%, combined with larimer counties 0.80% sales tax rate and the state of colorado’s 2.9% sales tax rate, the overall total is 6.70%. The new 3.25% sales and use tax rate becomes effective for transactions occurring on or after january 1, 2020. The city of lakewood allows qualifying 501(c)(3) organizations an exemption from lakewood sales tax when they purchase goods and services for their regular charitable functions and activities.

The breakdown of the 10.0% sales tax rate is as follows: Applicants can also choose to complete the online application in person with the assistance of taxpayer services.

Business Licensing Tax – City Of Lakewood

Sales Use Tax – City Of Lakewood

Taxes Fees In Lakewood – City Of Lakewood

Rppc Real Photo Postcard Of Cute Baby In Stroller Squinting In Sun 1930s Child Ebay Postcard Photo Postcards Real Photos

How To Organize Your Receipts For Tax Time Tax Time Small Business Tax Business Tax

Local Developer Proposes Eco-friendly Townhome Plan For Bay Village Townhouse Townhouse Designs Luxury Townhomes

Pin By Northern Wood Design On For The Home Home Kitchens Kitchen Inspirations Kitchen Decor

Pin On Valuewalk Premium

Computing Your Tax Basis Infographic Real Estate Infographic Helping People

Bitcoin Vs Bolivar Venezuela Bitcoin Currency Bitcoin Crypto Currencies

Business Licensing Tax – City Of Lakewood

Business Licensing Tax – City Of Lakewood

Taxes Fees In Lakewood – City Of Lakewood

How Retailers Can Succeed On Google Shopping In 2015 Infographic Google Shopping Campaign Internet Marketing Infographics Shopping Infographic

Business Licensing Tax – City Of Lakewood

Business Licensing Tax – City Of Lakewood

Today Nov 14 Only The Good Folks At Beau Jos Will Donate 20 Of All Pre-tax Sales To The Cat Care Soc Free Birthday Stuff Colorado Style Food Truck Festival

Before After With Yardzen House Exterior House Front Front Yard Design

Taxes Governments Finance Their Expenditure By Imposing Charges On Citizens And Corporate Entities Tax Debt Relief Tax Lawyer Tax Help