You can file your return anytime and return on the 20th to submit your payment. Therefore, sales made beginning with january 2020 will be due and payable directly to the city.

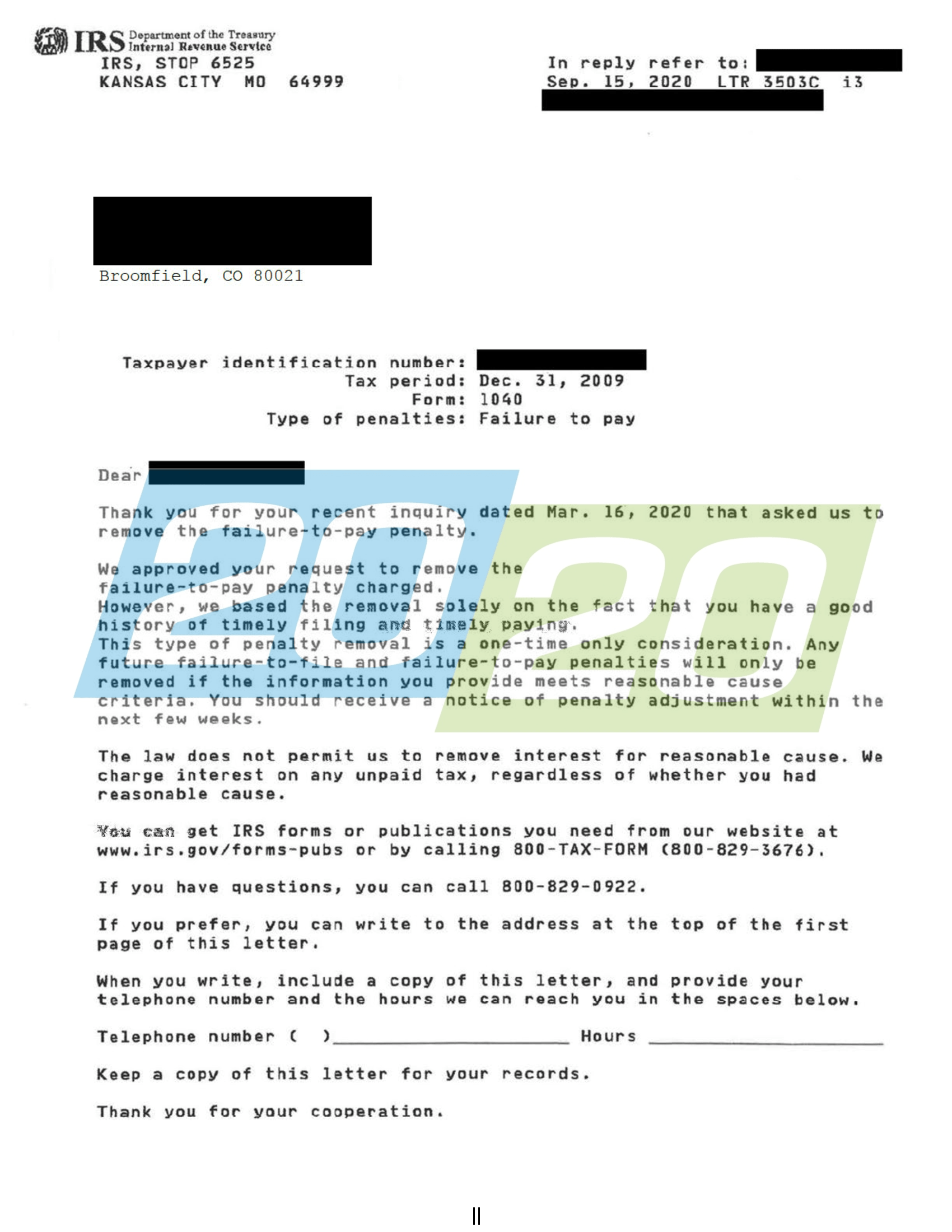

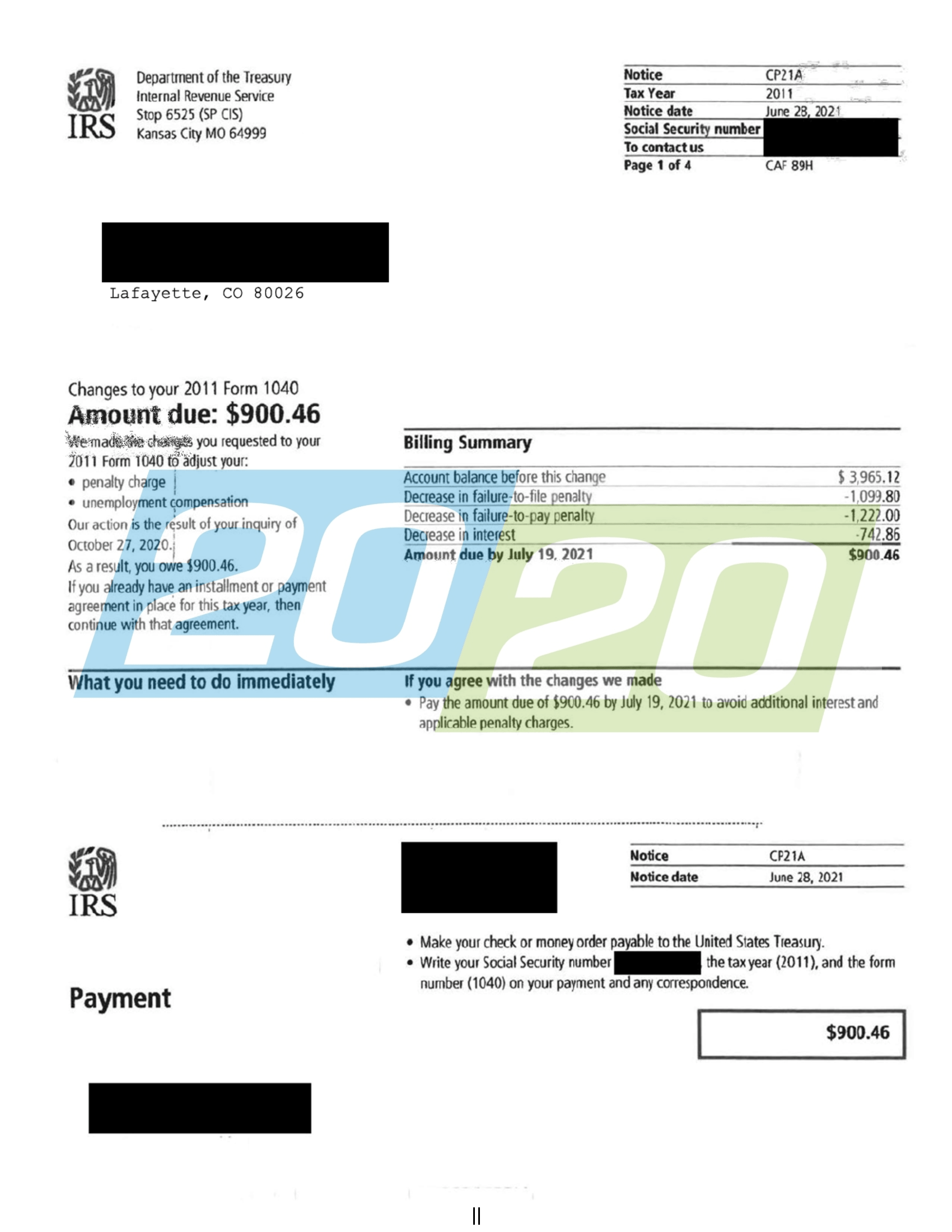

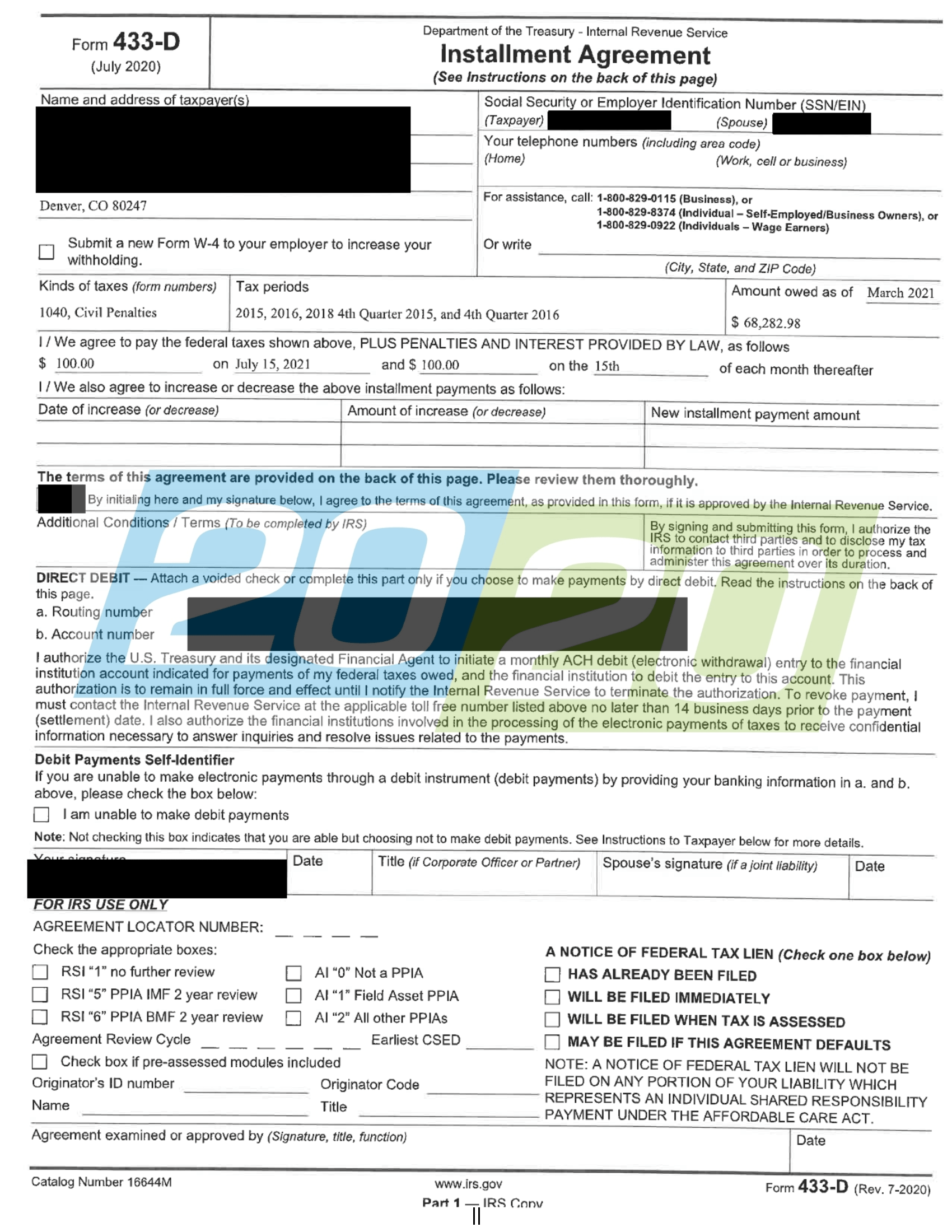

Tax Resolutions In Colorado 2020 Tax Resolution

The lakewood sales tax is collected by.

Lakewood co sales tax online filing. Sales tax returns may be filed annually. Click here to download a sales tax application This website allows you to:

Once a license is issued, returns must be remitted by the 20th of the month following the end of the filing period. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance. If there were no sales for the period, a zero return is expected.

Munirevs tutorial and frequently asked questions (pdf) Due april 20, july 20, october 20, january 20. For a list of these types of goods and services please refer to ordinance no.

City of lakewood 480 s. On april 2, 2019, the voters of grand junction authorized a 0.5% increase in the sales and use tax rate for the city of grand junction. Returns can be accessed online at lakewood

Filing of sales tax returns sales tax returns and payments shall be made monthly before the twentieth (20th) day of the following month. Filing frequency is determined by the amount of sales tax collected monthly. The finance director may permit businesses whose monthly collected tax is less than three hundred dollars ($300) to make returns and payments on a quarterly basis.

The tax rate for most of lakewood is 7.5%. Please consult your local tax authority for specific details. The city of englewood has partnered with munirevs to provide an online business licensing and tax collection system this system allows businesses to access their accounts and submit tax returns and payments online.

The town imposes a 4% sales tax rate on certain goods and services. Welcome to city of louisville sales tax and licensing. $15 or less per month:

Annual returns are due january 20. Please note that all transactions will be processed the same day they are initiated. Sales tax returns may be filed quarterly.

Due on the 20th of the following month. Ad save time editing & signing pdf online. The new 3.25% sales and use tax rate becomes effective for transactions occurring on or after january 1, 2020.

File a sales tax return. Sales tax is a transaction tax that is collected and remitted by a retailer. Download or email tax forms & more fillable forms, register and subscribe now!

The following links change the page section content. The town of parker partners with xpress bill pay to provide a service that will allow you to both file and pay your sales tax returns online (including $0 and past due returns). Sales and use tax returns are due on the 20th day of each month following the end of the filing period.

Allison parkway lakewood, co 80226 main: Automate sales tax preparation, online filing, and remittance with avalara returns for small business. This means the new sales and use tax rate will first be reported on the tax returns due on february 20, 2020 or later.

Download or email tax forms & more fillable forms, register and subscribe now! After you create your own user id and password for the income tax account, you may file a return through revenue online. To qualify for exemption, an organization must complete an application for certificate of exemption.

File a tax return and pay online. The city of lakewood allows qualifying 501 (c) (3) organizations an exemption from lakewood sales tax when they purchase goods and services for their regular charitable functions and activities. If you have more than one business location, you must file a separate return in revenue online for each location.

The lakewood, colorado sales tax is 7.50% , consisting of 2.90% colorado state sales tax and 4.60% lakewood local sales taxes.the local sales tax consists of a 0.50% county sales tax, a 3.00% city sales tax and a 1.10% special district sales tax (used to fund transportation districts, local attractions, etc). Ad save time editing & signing pdf online. If you are sending a phyiscal return or business license application please make sure the address is 8720 spruce mountain road, larkspur co 80118.

Every taxpayer shall file a return, whether or not tax is due, and remit any tax due to the town on or before the 20th day of the month following the reporting tax period. Online business licensing and sales tax system. A fast, simple & convenient way to file and manage your business taxes with lakewood business pro.

Sales tax return due date. The town also has a 2% lodging tax. Manage my business/tax account (password required) online payment options!

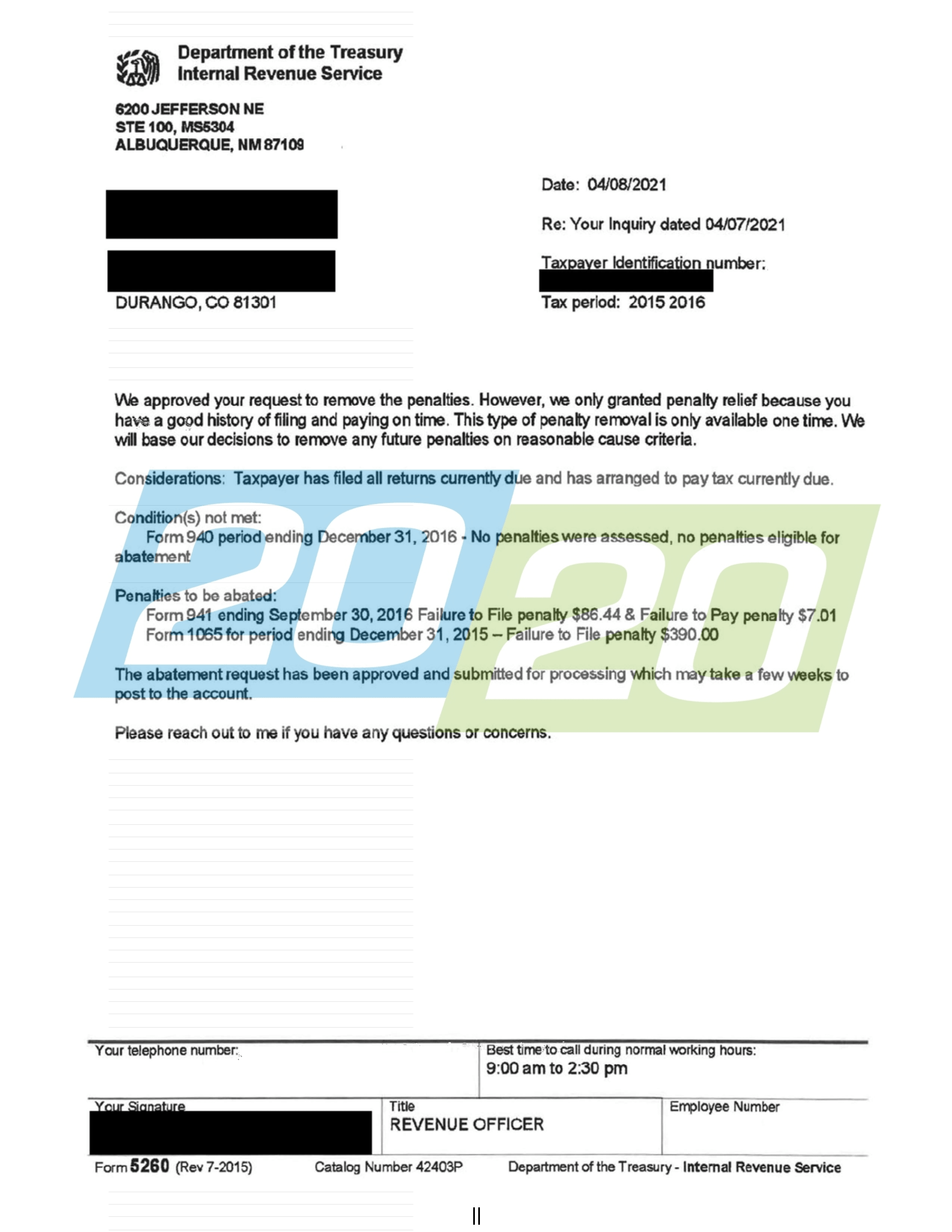

Failure to file a return can incur additional penalties and interest as well as collection activity and assessments. Businesses located in belmar or the marston park and belleview shores districts have different sales tax rates. January sales tax is due february 20th) quarterly.

License my business determine if your business needs to be licensed with the city and apply online. Start my free trial look up any lakewood tax rate and calculate tax based on address

Tax Resolutions In Colorado 2020 Tax Resolution

How To Organize Your Receipts For Tax Time Tax Time Small Business Tax Business Tax

Usa India F-1 J-1 Tax Treaty Students Business Apprentice Og Tax And Accounting

Tax Resolutions In Colorado 2020 Tax Resolution

Top 10 Jokes For Tax Season Atbs

How To Deal With 941 Payroll Tax Problems Los Angeles Tax Services

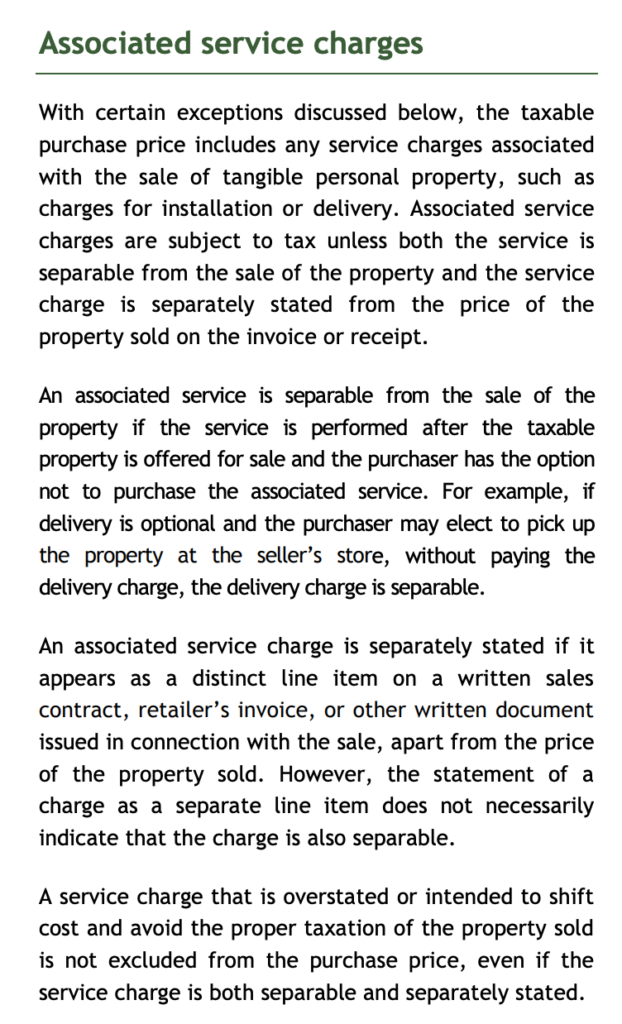

Is Shipping Taxable In Colorado – Taxjar

Online Tax Plan Moving Forward Amid Stimulus

Taxes Governments Finance Their Expenditure By Imposing Charges On Citizens And Corporate Entities Tax Debt Relief Tax Lawyer Tax Help

Beeswax Bookkeeping – Home Facebook

6c3eqfkpspo0mm

2

Tax Resolutions In Colorado 2020 Tax Resolution

What Colorado Suts Means For Businesses Taxops

Computing Your Tax Basis Infographic Real Estate Infographic Helping People

Tax Resolutions In Colorado 2020 Tax Resolution

License My Business – City Of Lakewood

Sales Use Tax – City Of Lakewood

Rent Income Excel Template Online Tax File Rent Expense Tracker Tax Filling Report Net Income For Tax Return Excel Spreadsheets Technology Street Names