If you need access to a database of all ohio local sales tax rates, visit the sales tax data page. The current total local sales tax rate in salt lake county, ut is 7.250%.

Property Tax – City Of Decatur Il

Utah has state sales tax of 4.85% , and allows local governments to collect a local option sales tax of up to 3.35%.

Lake county sales tax rate 2019. The other tax rates & fees chart shows additional taxes due on certain types of transactions subject to sales and use tax and includes: 2022 1st quarter rate change. The tax year 2019 is payable in year 2020.

Taxes are payable the calendar year after the tax year. Updated for 2019, the general sales tax rate for the state of florida is 6%. Sales and use tax and discretionary sales surtax rates.

For mobile homes only, set the tax year to the calendar. Depending on the zipcode, the sales tax rate of salt lake city may vary from 4.7% to 7.75%. Transient room taxes, tourism short term leasing taxes, tourism restaurant tax, e911 emergency telephone fee, telecommunications fees, and the municipal.

The 7.75% sales tax rate in salt lake city consists of 4.85% utah state sales tax, 1.35% salt lake county sales tax, 0.5% salt lake city tax and 1.05% special tax. This is largely due to salt lake county and salt lake city increasing their local sales taxes by and 0.25 and 0.5 percent, respectively.7 nebraska saw the largest decrease in sales taxes this year. Ad with secure payments and simple shipping you can convert more users & earn more!.

College of lake county #532: The lake county sales tax is collected by the merchant on all qualifying sales made within lake county Map of current sales tax rates.

2021 4th quarter rate change. The salt lake city's tax rate may change depending. Sales tax and discretionary sales surtax are calculated on each taxable transaction.

There are a total of 208 local tax jurisdictions across the state, collecting an average local tax of 2.053%. After the sale is completed the homeowner of record deals directly with the lake county clerk's office for the redemption. At the sale, a tax buyer pays/buys the taxes, then the county collector distributes the money from the sale to each of the taxing bodies to make them whole.

California city & county sales & use tax rates (effective october 1, 2021) these rates may be outdated. This figure does not include any special assessment charges or delinquent taxes due. Every 2021 combined rates mentioned above are the results of utah state rate (4.85%), the county rate (0.35% to 1.35%), the salt lake city tax rate (0% to 1%), and in some case, special rate (0.8% to 1.05%).

Look up the current sales and use tax rate by address Boost your business with wix! Build the online store that you've always dreamed of.

2019 lake county residential property tax rates payable in 2020 multiply the market value of the home by the percentage listed below to determine the approximate real property taxes in each community. For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The sales and use tax rate for paulding county (63) will increase from 6.75 % to 7.25 % effective january 1, 2022.

For example, payment for 2019 taxes is due in calendar year 2020. Florida's general sales and use tax rate is 6% with the following exceptions: The sales and use tax rate for paulding county (63) will decrease from 7.25 % to 6.75 % effective october 1, 2021.

If taxes are not redeemed in 2 years (vacant property) or 2.5. , ut sales tax rate. Average sales tax (with local):

4% on amusement machine receipts, 5.5% on the lease or license of commercial real property, and 6.95% on electricity. Lake county, illinois has a maximum sales tax rate of 8.75% and an approximate population of 583,986. The entire combined rate is due on all taxable transactions in that tax jurisdiction.

The lake county, ohio sales tax is 7.00%, consisting of 5.75% ohio state sales tax and 1.25% lake county local sales taxes.the local sales tax consists of a 1.25% county sales tax.

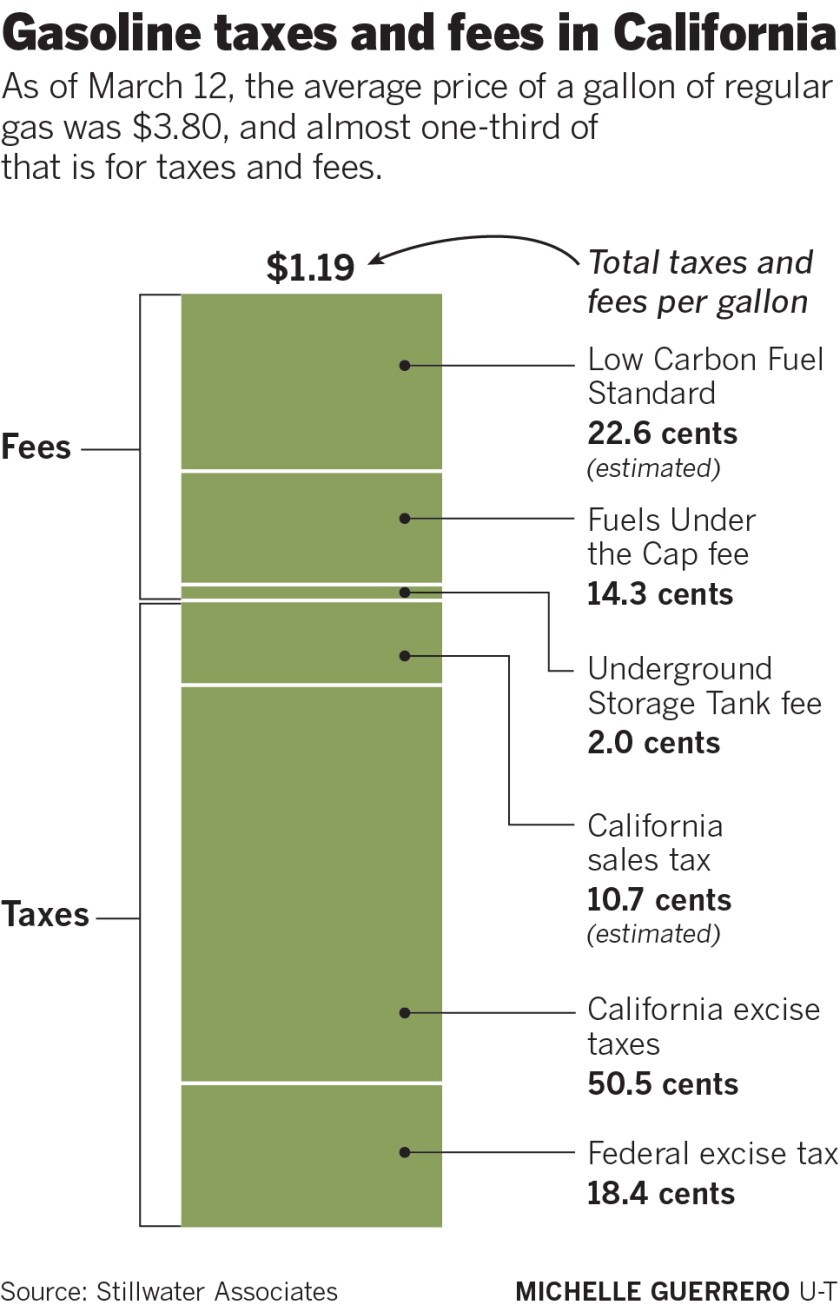

How Much Are You Paying In Taxes And Fees For Gasoline In California – The San Diego Union-tribune

What Is The Austin Texas Sales Tax Rate – The Base Rate In Texas Is 625

How To Calculate Sales Tax Definition Formula Example

The Snohomish County Washington Local Sales Tax Rate Is A Minimum Of 65

Florida Sales Tax Rates By City County 2021

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Clevelandakron Area – Clevelandcom

Louisiana Doesnt Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nolacom

Us Property Taxes Comparing Residential And Commercial Rates Across States – The Journalists Resource

Total Sales Tax Per Dollar By City – Oklahoma Watch

California Sales Tax Rates By City County 2021

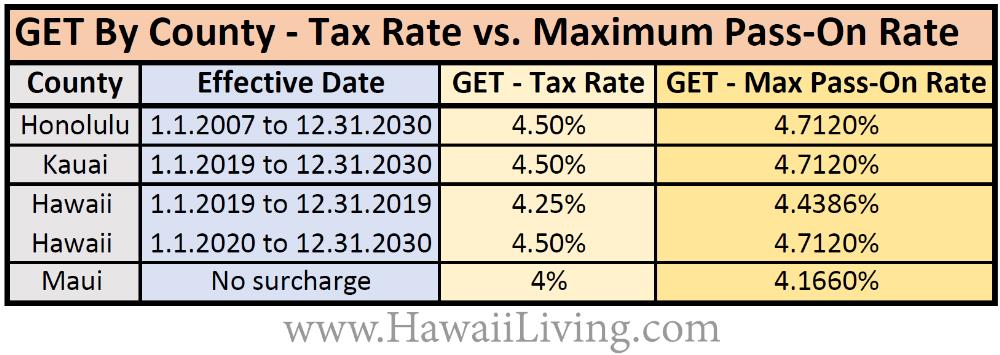

Hawaiis Revised Get Tax Rates By County New Tat Requirement 2019 –

Louisiana Doesnt Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nolacom

Sales Tax In Orange County Enjoy Oc

Budget And Tax Facts City Of Lewisville Tx

2

Grocery Food

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Orlando Hotel Tax Rates – 2019 Tax Rates For All Of Florida

Local Tax Information City Of Enid Oklahoma