The highest bidder will be issued a tax deed on the property. January 2022 sales tax rates color.ai author:

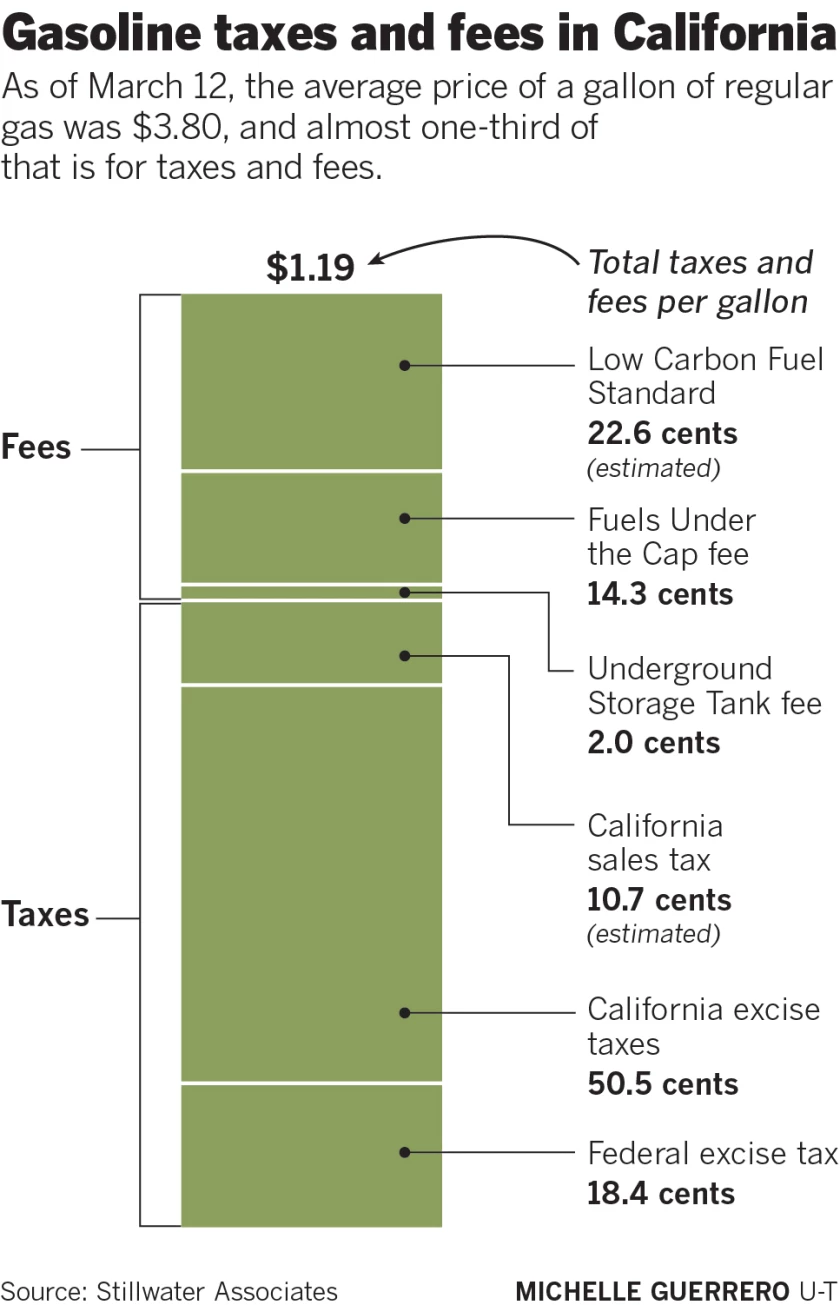

How Much Are You Paying In Taxes And Fees For Gasoline In California – The San Diego Union-tribune

Look up the current sales and use tax rate by address

Lake county sales tax 2020. For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. Has impacted many state nexus laws and sales tax collection requirements. Registration will be online through zeus auction.

Rates listed by city or village and zip code; Tax certificates are sold yearly by the tax collector on properties with delinquent taxes. Utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%.

Transient room taxes, tourism short term leasing taxes, tourism restaurant tax, e911 emergency telephone fee, telecommunications fees, and the municipal energy tax. Code local rate state rate combined. The lake county, florida sales tax is 7.00% , consisting of 6.00% florida state sales tax and 1.00% lake county local sales taxes.the local sales tax consists of a 1.00% county sales tax.

Attached is the 2021 lake county treasurers tax sale list: As of november 29, lake county, ca shows 40 tax liens. The local sales tax rate in lake county is 0%, and the maximum rate (including illinois and city sales taxes) is 8.75% as of november 2021.

At the sale, a tax buyer pays/buys the taxes, then the county collector distributes the money from the sale to each of the taxing bodies to make them whole. The 2018 united states supreme court decision in south dakota v. If you successfully signed up for the april 2021 commissioner's sale, there is no registration/paddle fee for this sale.

Location sales/use tax county/city loc. The lake county tax sale will begin september 17, 2021 @ 5:30 pm and will be online through www.zeusauction.com. Click here for a larger sales tax map, or here for a sales tax table.

If taxes are not redeemed in 2 years (vacant property) or 2.5 years (house), the homeowner could. How does a tax lien sale work? California city & county sales & use tax rates (effective october 1, 2021) these rates may be outdated.

This figure does not include any special assessment charges or delinquent taxes due. 2019 lake county residential property tax rates payable in 2020 multiply the market value of the home by the percentage listed below to determine the approximate real property taxes in each community. Groceries are exempt from the lake county and florida.

The salt lake, utah sales tax is 6.85%, consisting of 4.70% utah state sales tax and 2.15% salt lake local sales taxes.the local sales tax consists of a 1.35% county sales tax and a 0.80% special district sales tax (used to fund transportation districts, local attractions, etc). There are a total of 208 local tax jurisdictions across the state, collecting an average local tax of 2.053%. Interested in a tax lien in lake county, ca?

Tax deed sales are administered by the clerk's office online at www.lake.realtaxdeed.com. 72 rows the plan has been to slowly, but surely reduce the sales tax rate on. Upon request of the certificate holder for a tax deed sale, the certificate is forwarded to the clerk and a tax deed sale is held.

After the sale is completed the homeowner of record deals directly with the lake county clerk's office for the redemption. The lake county sales tax is collected by the merchant on all qualifying sales made within lake county. Any applicable tax or fee for a type of transaction is due in addition.

The other tax rates & fees chart shows additional taxes due on certain types of transactions subject to sales and use tax and includes: The redemption period for the treasurers tax sale is one (1) year and the minimum bid begins at the amount due by the property owner. The lake county sales tax rate is %.

The tax year 2019 is payable in year 2020. The december 2020 total local sales tax rate was also 7.750%. Tentatively, the lake county tax sale is scheduled for december 6, 2021.

Online auction opens on or before october 12, 2020, at noon online auction ends october 30, 2020, at 10:00am.

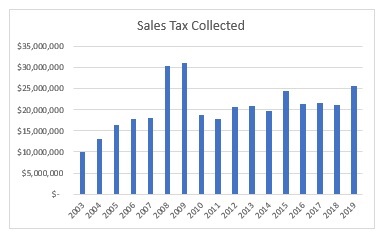

Sales Tax Collections St John The Baptist Parish

Lake County Looks At 4-cent Gas Tax Hike Using Law That Doubled State Gas Tax

How To File And Pay Sales Tax In Florida Taxvalet

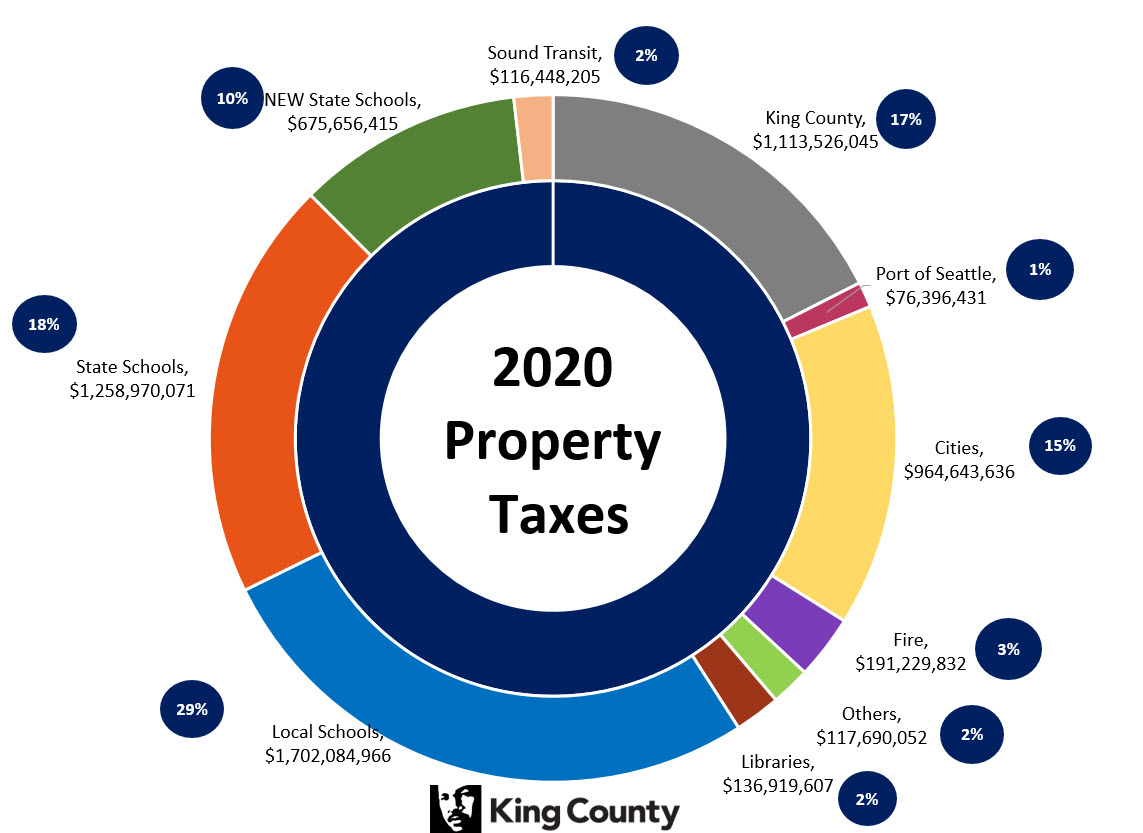

2020 Taxes – King County

Pin By Linda Currie On Bamboo Garden Bamboo Landscape Hanging Plants Indoor Plants

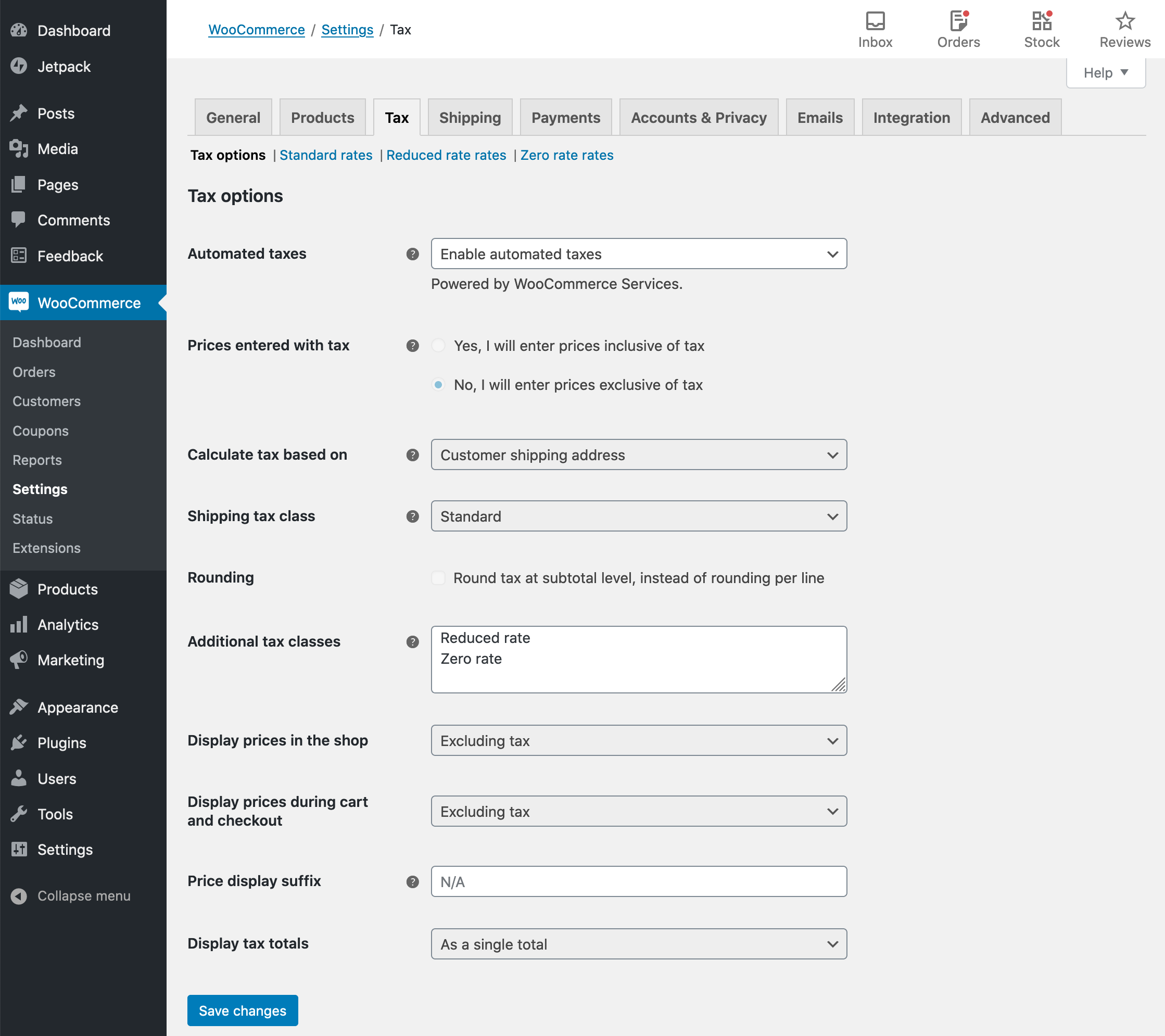

Woocommerce Tax Guide – Woocommerce

Greater Clevelands Wide Spread In Property Tax Rates See Where Your Community Ranks – Clevelandcom

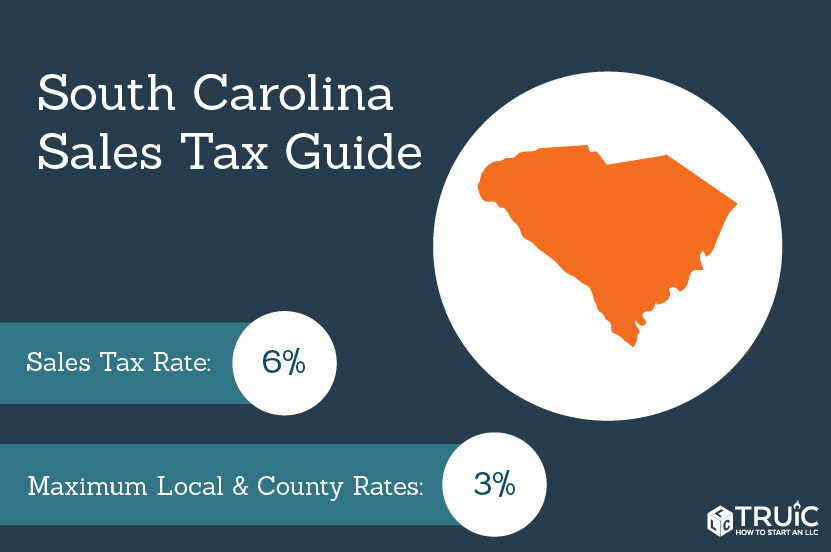

South Carolina Sales Tax – Small Business Guide Truic

Florida Real Estate Cash Buyers Lists For Real Estate Sales Find Verified Florida Real Estate Cash Buyers Flag Coloring Pages Florida State Flag State Symbols

Shop Lake Buena Vista Factory Stores Outlets With Store-front Parking For All Your Back To School Clothing Footwear An Tax Free Weekend Tax Holiday Tax Free

This Is The Most Expensive State In America According To Data Best Life

Sales Tax In Orange County Enjoy Oc

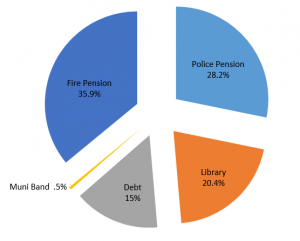

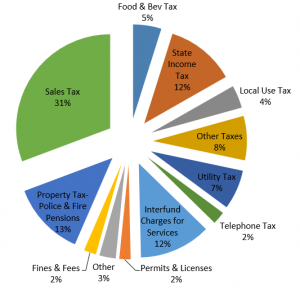

Where Do Your Tax Dollars Go – City Of Decatur Il

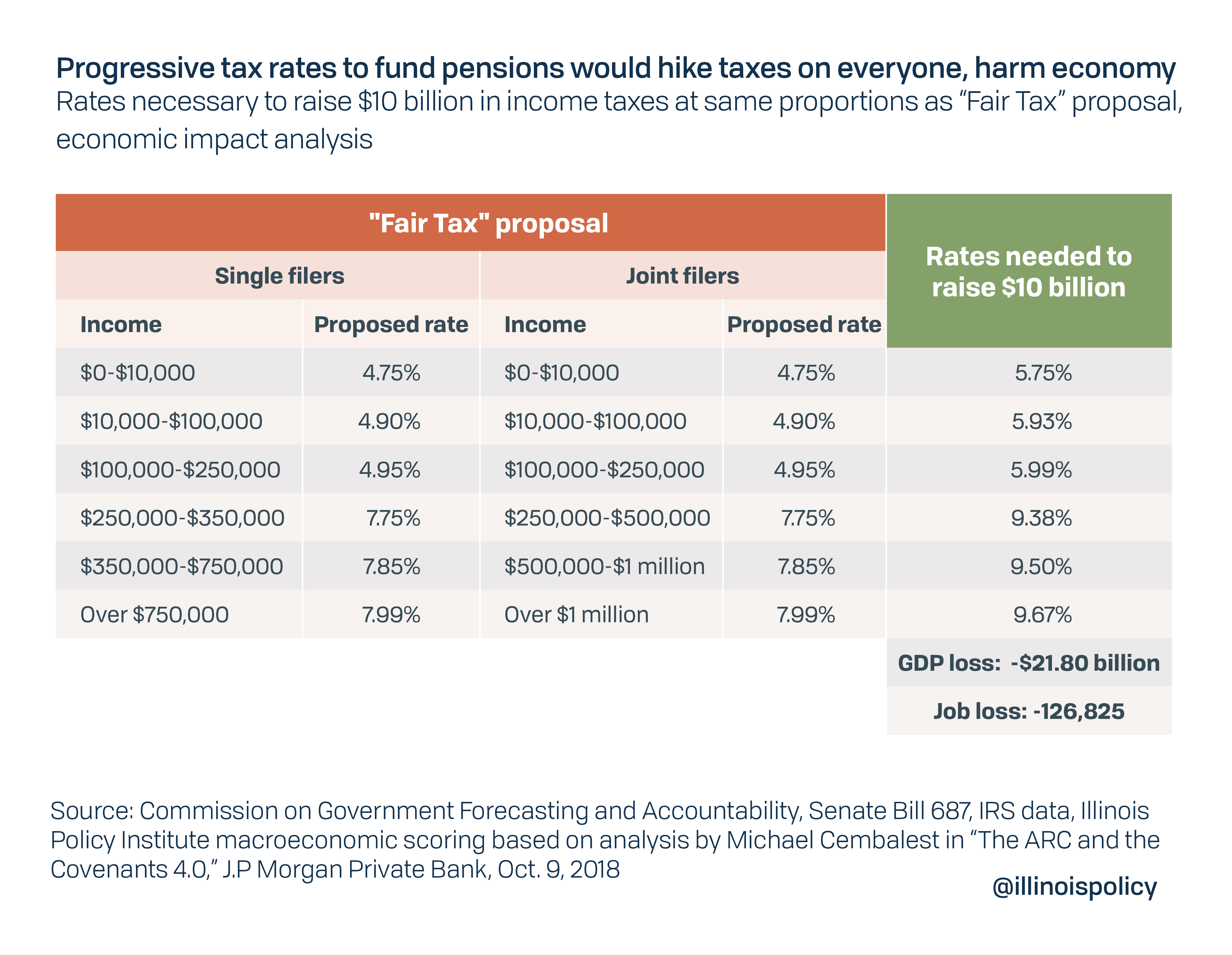

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Where Do Your Tax Dollars Go – City Of Decatur Il

Greater Clevelands Wide Spread In Property Tax Rates See Where Your Community Ranks – Clevelandcom

Grocery Food

Property Taxes Lake County Il

Real Estate Taxes Auditor