Chicago based and nationally focused, kane & co. If the tax bills are mailed late (after may 1), the first installment is due 30 days after the date on your tax bill.

Cook County Property Tax Bills In The Mail This Week

Kane county treasurer michael j.

Kane county illinois property tax due dates 2021. So if you pay on the due date, your payment must reach 12:00 p.m. After the initial application is approved, you will be mailed a renewal form. Kane county collects, on average, 2.09% of a property's assessed fair market value as property tax.kane county has one of the highest median property taxes in the united states, and is ranked 32nd.

Property valuations are certified to the county clerk by the chief county assessment officer. Kilbourne, mba, would like to remind taxpayers the second installment of property tax is due on or before september 1 st. I paid my tax online.

The life estate must be recorded with the kane county recorder); Payments made online can take up to 72 hours to receive in treasurer's office. Late penalties for the first installment began to be assessed on august 20, 2021 and late penalties for the second installment began to be assessed on october 20, 2021.

You must apply for the exemption with the county assessment office. Court wedding/civil union ceremony announcement. The county clerk tax staff calculates the tax rate (set within statutory limits by the local board for each taxing district) t o each property's valuation set by the township assessor.

The county collector is charged by the county clerk to collect all of the taxes levied by approximately 270 local taxing bodies within kane county. Kane county treasurer, michael j. And use the property as your principal residence on both january 1, 2020 and january 1, 2021;

Kane county illinois property taxes 2021. Pritzker and the illinois general assembly for passage of sb 685, which automatically renews three homestead exemptions for the next property tax year, among other changes. $5,112 9 hours ago the median property tax in kane county, illinois is $5,112 per year for a home worth the median value of $245,000.

But that still gives delinquent taxpayers an opportunity to make their property tax payments. And have a total household income $65,000 or less in 2020. The median property tax in illinois is $3,507.00 per year for a home worth the median value of $202,200.00.

Counties in illinois collect an average of 1.73% of a property's assesed fair market value as property tax per year. Kane county collects, on average, 2.09% of a property's assessed fair market value as property tax. Upon receipt of the collector books from the county clerk, the county collector prepares tax bills for real estate taxes within the county and mails them to owners of record.

Kane county has one of the highest median property taxes in the united states, and is ranked 32nd of the 3143 counties in order of. Illinois has one of the highest average property tax rates in the country, with only six states levying higher property taxes. Kilbourne announced today (thursday, april 22, 2021) that kane county property tax bills will be mailed on april 30.

The median property tax in kane county, illinois is $5,112 per year for a home worth the median value of $245,000. See the marriage license page for full details regarding scheduling appointments. Because if your payment doesn't reach by the due date then your tax will become delinquent and you will be charged a penalty.

The chief judge has opened the courts to perform marriages by appointment only. Cook county assessor fritz kaegi today commended governor j.b. County officials will conduct a tax sale on feb.

Kane county treasurer david j. County boards may adopt an accelerated billing method by resolution or ordinance. The first installment will be due on or before june 1, 2021, and the second installment will be due on or before sept.

Second installment property tax due date reminder. The extension of taxes is computed according to the state statute and. In most counties, property taxes are paid in two installments, usually june 1 and september 1.

Rickert on tuesday reminded taxpayers that the second installment of property taxes is due sept. Is dedicated to helping companies navigate the complex world of property tax and incentives. If your property is assessed under the mobile home privilege tax,

The first installment of kane county property tax bills can be paid without penalty on or before july 1, treasurer david rickert said thursday. If you are a new or existing homeowner and need a copy of the. According to the treasurer’s office website, payments must be received by close of business, 4:30 p.m.

Will county and kane county property taxes are dune on june 1 and residents and businesses alike are concerned about their ability to pay their bills, and on time.

Egg Harbor Cafe One Of My Favorite Restaurants For Breakfast And Lunch Harbor Cafe Egg Harbor Cafe Breakfast Restaurants

Illinois Doubled Gas Tax Grows A Little More July 1

How To Appeal Property Taxes In Geneva Il Beautiful Places Chicago Suburbs Valley View

Capsim Compxm Winning Guides And Tips Part 2 Tips Guide Strategies

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/shawmedia/4YLNBN5WBJH3BJNRYP5YLMYNW4.jpg)

Will County Delays Due Dates For 2021 Property Taxes Shaw Local

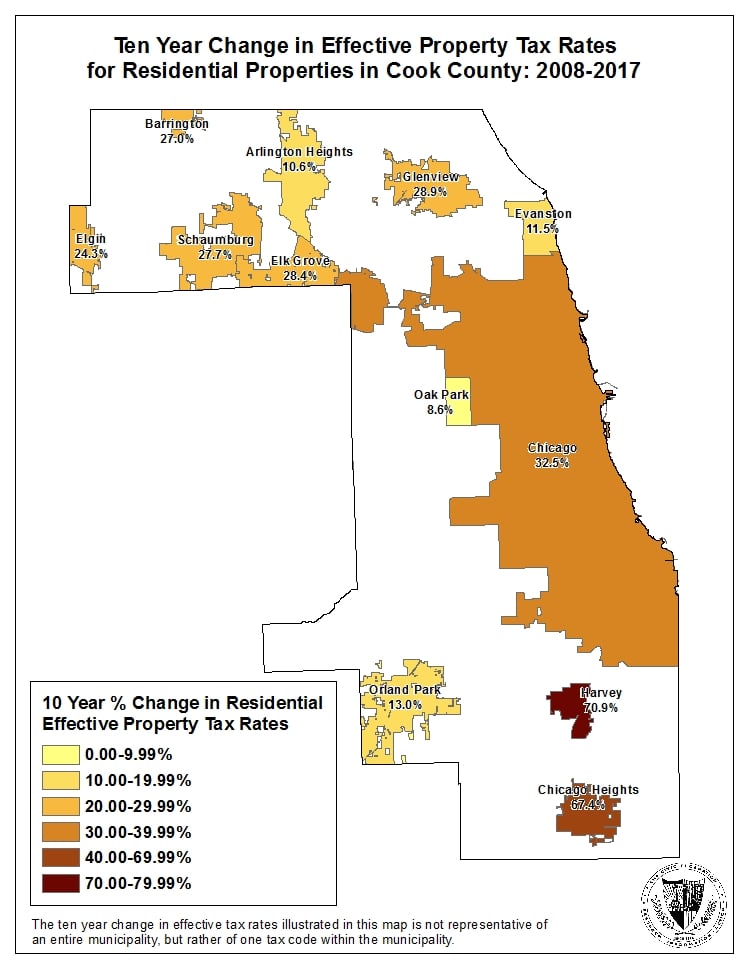

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Pin On Accounting Accountants And Cpas In Video Games

Home Improvement Exemption Cook County Assessors Office

What Is Taxable Income In 2021 Income Federal Income Tax Filing Taxes

Chicagoland Il – Area Counties 2020- 2nd Installment Property Tax Due Dates Chicagoland Mchenry Dekalb County

S2hogqzqrxcf7m

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

How To Pay Your Property Tax Bill In Kane County Il Kane County Connects

Get Free Tax Estimate With Global Prime Taxation Llc In 2021 Filing Taxes How To Plan Global

Property Tax Bills Will Be In The Mail By May 1 First Installment Due June 1 Kane County Connects

How To Compute Real Estate Tax Proration And Tax Credits Illinois

What Is Taxable Income In 2021 Income Federal Income Tax Filing Taxes

Property Tax Deadlines Pushed Back But Lenders Want Cash – Loop North News

Strawberry Moon Strawberry Moons Wauconda Martini Bar