The jefferson parish sales tax is collected by the merchant on. 3.50% on the sale of food items purchased for preparation and consumption in the home;

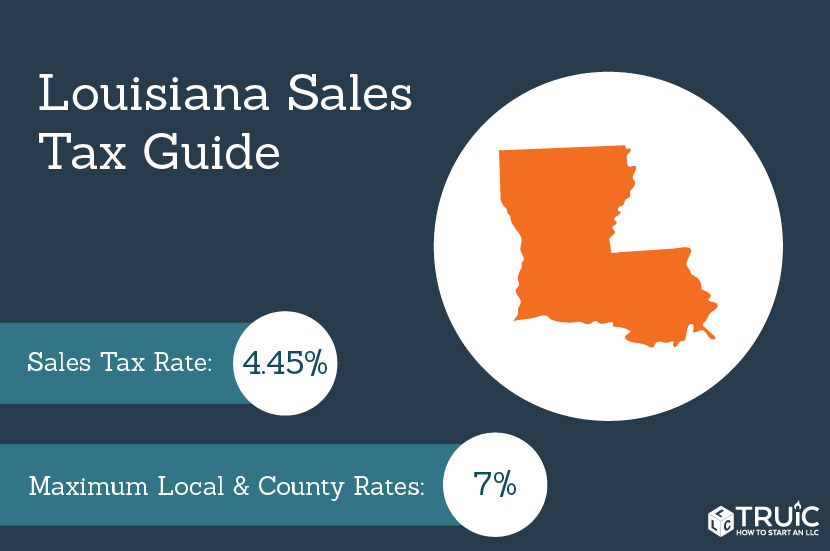

Louisiana Sales Tax – Small Business Guide Truic

Find jefferson parish residential property tax assessment records, tax assessment history, land & improvement values, district details, property maps, tax rates, exemptions, market.

Jefferson parish sales tax office. The tax sale is held at the jefferson davis parish courthouse, located at 300 n. You can find the sales/use tax registration form there: To 4:30 p.m., monday through friday.

The link below will take you to the jefferson parish sheriff's office 'forms and tables' page of their web site. You may file and remit in person at the jefferson parish government building. Its duties also include organizing and directing annual tax sales.

200 derbigny street, suite 4400. Where can i file and pay in person jefferson parish sales/use tax returns? Monday through friday, 8:00 am to 4:30 pm.

You may also send an email to me at amber.hymel@jdpsbk12.org. Box 248, gretna, la 70054 year amended return fill circle filing period state tax identification number account no. Monday through friday, 8:00am to.

During the examination, an issue arose as to whether certain purchases What is the rate of jefferson parish sales/use tax? The local sales tax rate in jefferson parish is 4.75%, and the maximum rate (including louisiana and city sales taxes) is 9.2% as of november 2021.

The jefferson parish, louisiana sales tax is 9.75%, consisting of 5.00% louisiana state sales tax and 4.75% jefferson parish local sales taxes.the local sales tax consists of a 4.75% county sales tax. The following local sales tax rates apply in jefferson parish: Presumptively, the contractor’s operations take place within jefferson parish.

Its office is located in the jefferson parish general government building, 200 derbigny street, suite 1200, gretna and is open to the public from 8:30 a.m. Government building 200 derbigny, 4th floor, suite 4200 gretna, la 70053 phone: 1 hours ago the jefferson parish, louisiana sales tax is 9.75%, consisting of 5.00% louisiana state sales tax and 4.75% jefferson parish local sales taxes.the local sales tax consists of a 4.75% county sales tax.

Yenni building 1221 elmwood park blvd., suite 101 jefferson, la 70123 phone: This website will assist you in locating property ownerships, assessed values, legal descriptions, estimated tax amounts, and other helpful information that pertain to the. As per la rs 47:2153, all unsettled property taxes are read aloud to the people or tax buyers who are present.

Our objective is to assess all property within jefferson parish, both real and personal, as accurately, and as equitably as possible. West bank office 1855 ames blvd., suite a Generally, the minimum bid at an jefferson parish tax deeds (hybrid) sale is the amount of back taxes owed, as well as any and all costs associated with selling the property.

Location address delinquent on the 20th year: 4.75% on the sale of general merchandise and certain services; Welcome to the jefferson parish assessor's office.

3.5% on the sale of prescription drugs and medical devices prescribed by a physician 1855 ames blvd., suite a. (summer hours) please visit the jefferson davis parish tax office site:.

The jefferson parish sales tax is collected by the merchant on all qualifying sales made within jefferson parish In louisiana, the county tax collector will sell tax deeds (hybrid) to winning bidders at the jefferson parish tax deeds (hybrid) sale. Jefferson parish sheriff's office bureau of revenue and taxation sales tax division p.

State st., in jennings, at 10 a.m. East bank office joseph s. Free jefferson parish assessor office property records search.

Should Louisiana Simplify Sales Tax Collections Natchitoches Times

/cloudfront-us-east-1.images.arcpublishing.com/gray/RKNQUADYWRGUTD64ZW2FBK5GZI.jpg)

Timeline A Review Of The Jefferson Parish Sheriff Race

Abandoned Mansion In Pearland Texas By – Destroyed And Abandoned Abandoned Mansion Abandoned Houses Abandoned Places

Staff Directory Jefferson Parish Sheriffs Office La Civicengage

E-services Jefferson Parish Sheriff La – Official Website

St Tammany Parish Seeks Sales Tax To Pay Criminal Justice Costs As Money Runs Out One Tammany Nolacom

Faqs Jefferson Parish Sheriffs Office La Civicengage

Les Voyageurs Internationaux Qui Visitent La Louisiane Decouvre Un Paradis Pour Le Shopping Avec Notre Programme De Louisiana Tax Free Shopping South Louisiana

City Comes Out Against Amendment 1 But Some Opsb Members Express Support The Lens

/cloudfront-us-east-1.images.arcpublishing.com/gray/23RZJ3PAW5DK7CNEJ7LLJIQYLA.jpg)

Jefferson Parish Collected 323152 Less In Taxes In June

Louisiana Car Sales Tax Everything You Need To Know

Money Running Out St Tammany Parish Council Puts Sales Tax For Jail Courthouse Back On Ballot One Tammany Nolacom

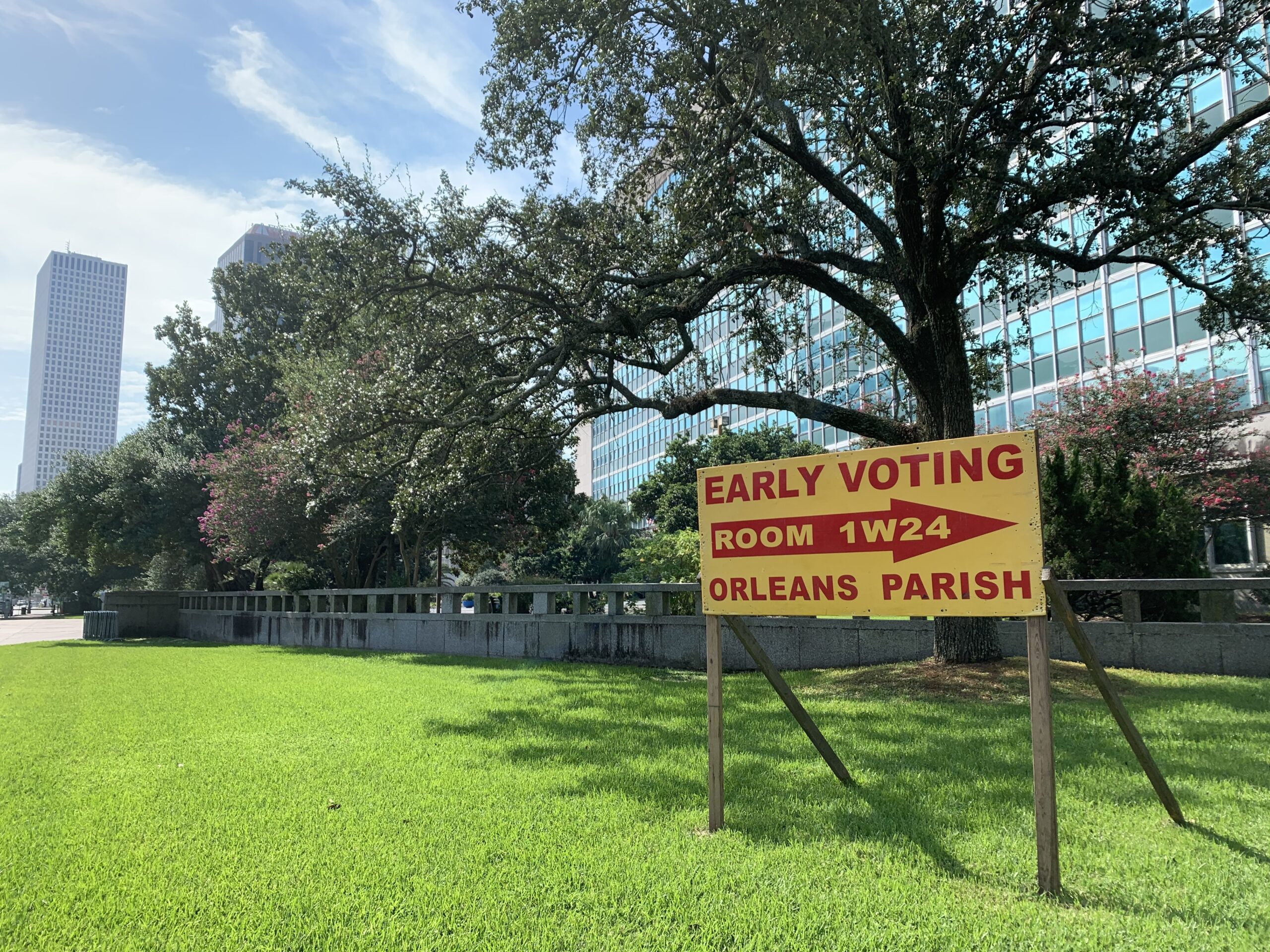

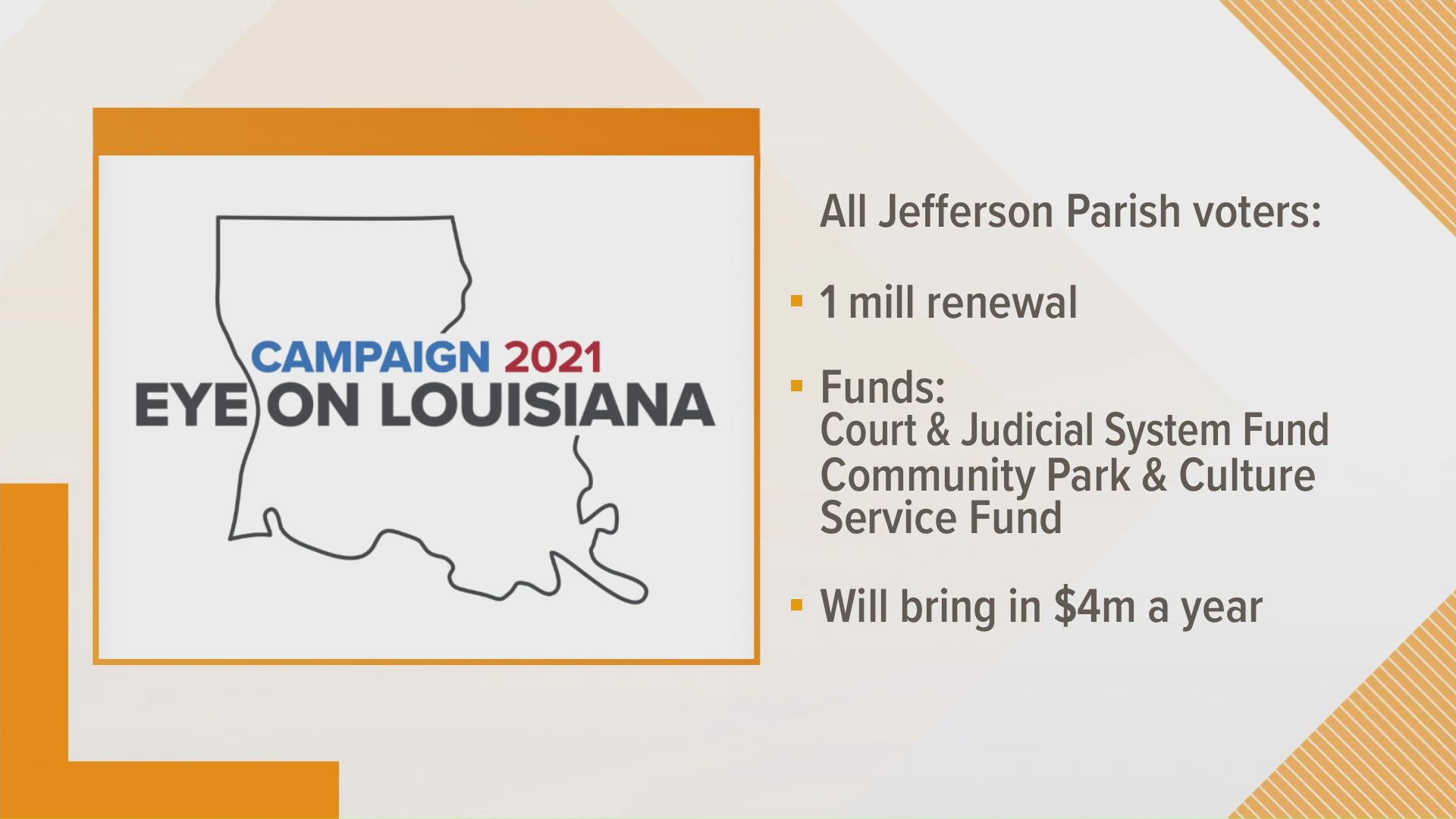

Tax Proposals On Jefferson Parish Ballots Wwltvcom

Louisiana Amendment 5 Payments In Lieu Of Property Taxes Option Arklatexhomepage

/cloudfront-us-east-1.images.arcpublishing.com/gray/HVZBKS75QJAANKNYJQYTIAULGM.jpg)

Jefferson Parish Collected 323152 Less In Taxes In June

![]()

Property Tax – Jefferson County Tax Office

Faqs Jefferson Parish Sheriffs Office La Civicengage

Louisiana How Do I Add My State Sales Tax Return To My Parish E-file Account – Taxjar Support

E-services Jefferson Parish Sheriff La – Official Website