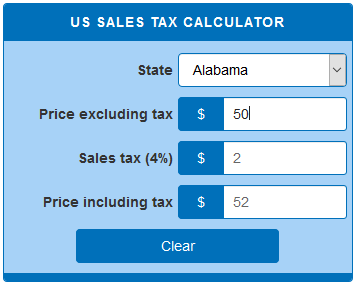

See iowa sales and use tax: Iowa, all you need is the simple calculator given above.

How To Charge Your Customers The Correct Sales Tax Rates

The firm must pay sales tax on the binders when purchasing them since they are not being sold to their customers.

Iowa sales tax calculator. Total price is the final amount paid including sales tax. Create your own online store and start selling today. Iowa state tax quick facts.

Iowa taxes about 75 services; Find your iowa combined state and local tax rate. Cities and/or municipalities of iowa are allowed to collect their own rate that can get up to 1% in city sales tax.

All businesses selling tangible personal property or engaging in retail sales must register with the state. You can use our iowa sales tax calculator to look up sales tax rates in iowa by address / zip code. Iowa has a 6% statewide sales tax rate , but also has 609 local tax.

The state sales tax rate in iowa is 6%, and there is a local option tax of 1% in effect in parts of the state as well. Dealerships may also charge a documentation fee or doc fee, which covers the costs incurred by the dealership preparing and filing the sales contract, sales tax documents, etc. For state, use and local taxes use state and local sales tax calculator.

After a few seconds, you will be provided with a full breakdown of the tax you are paying. Iowa has 893 cities, counties, and special districts that collect a local sales tax in addition to the iowa state sales tax.click any locality for a full breakdown of local property taxes, or visit our iowa sales tax calculator to lookup local rates by zip code. That means that even within a county.

Depending on local municipalities, the total tax rate can be as high as 8%. Our iowa state tax calculator will display a detailed graphical breakdown of the percentage, and amounts, which will be taken from your $30,000.00 and go. Enter the “amount” you want to enquire about.

The combined rate used in this calculator (7%) is the result of the iowa state rate (6%), the 51501's county rate (1%). Please select a specific location in iowa from the list below for specific iowa sales tax rates for each location in 2022 or calculate the sales tax now using the iowa sales tax calculator. Sales of services are not subject to iowa sales tax unless specifically taxed by state law.

That’s why we came up with this handy iowa sales tax calculator. How do you figure tax title and license on a vehicle? Rounded up to nearest $500 increment.

The 51501, council bluffs, iowa, general sales tax rate is 7%. Create your own online store and start selling today. The iowa (ia) state sales tax rate is currently 6%.

The 2018 united states supreme court decision in south dakota v. Earlier this decade, iowa enacted one of the largest tax cuts in the state’s history. These fees are separate from.

Net price is the tag price or list price before any sales taxes are applied. This calculation is based on $1.60 per thousand and the first $500.00 is exempt. The sales tax rate for winneshiek county was updated for the 2020 tax year, this is the current sales tax rate we are using in the winneshiek county, iowa sales tax comparison calculator for 2022/23.

Every 2021 combined rates mentioned above are the results of iowa state rate (6%), the county rate (0% to 1%), the iowa cities rate (0%. Enter the total amount paid. If you need access to a database of all iowa local sales tax rates, visit the sales tax data page.

To know what the current sales tax rate applies in your state i.e. In addition to taxes , car purchases in iowa may be subject to other fees like registration , title , and plate fees. So, whilst the sales tax rate in iowa is 6%, you can actually pay anywhere between 6% and 7% depending on the local sales tax rate applied in the municipality.

To calculate the sales tax on a vehicle purchased from a dealership, multiply the vehicle purchase price by. If this rate has been updated locally, please contact us and we will update the sales tax rate for winneshiek county, iowa. Local tax rates in iowa range from 0% to 2%, making the sales tax range in iowa 6% to 8%.

Has impacted many state nexus laws and sales tax collection requirements. These local option taxes are voted on at the county level, but they apply only in cities and unincorporated areas within the county in which a majority voted in favor. Iowa sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache.

30.5 cents per gallon of regular gasoline, 32.5 cents per gallon of diesel. The wayne county sales tax rate is %. Try it now & grow your business!

The taxes that are taken into account in the calculation consist of your federal tax, iowa state tax, social security, and medicare costs, that you will be paying when earning $30,000.00. How 2021 sales taxes are calculated for zip code 51501. To use our iowa salary tax calculator, all you have to do is enter the necessary details and click on the calculate button.

The state general sales tax rate of iowa is 6%. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Calculate a simple single sales tax and a total based on the entered tax percentage.

Try it now & grow your business! Food and prescription drugs are exempt from sales tax. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs.

How 2021 sales taxes are calculated in iowa. 2020 rates included for use while preparing your income tax deduction. The latest sales tax rates for cities in iowa (ia) state.

The iowa state sales tax rate is currently %. Rates include state, county and city taxes. Iowa real estate transfer tax calculator.

To review the rules in.

Us Sales Tax Calculator – Calculatorsworldcom

Iowa Sales Tax Calculator

Sales Tax Calculator And Rate Lookup Tool – Avalara

Sales Tax Calculator And Rate Lookup Tool – Avalara

Iowa Sales Tax Rates Us Icalculator

Us Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Tuesday 2018 Iowa – Insightfulaccountantcom

Mississippi Sales Tax Calculator Reverse Sales Dremployee

Iowa Sales Tax – Small Business Guide Truic

Iowa Sales Tax Information Sales Tax Rates And Deadlines

States With Highest And Lowest Sales Tax Rates

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Iowa Sales Tax Rate Rates Calculator – Avalara

Idr Property Tax – Tax Rate Lookup

Sales Tax Calculator

Iowa Sales Tax – Taxjar

Car Tax By State Usa Manual Car Sales Tax Calculator

Combined State And Local General Sales Tax Rates Download Table

Iowa Fuel Tax Rate Change Effective July 1 2020 Iowa Department Of Revenue