Thank you for visiting polktaxes.com, the official website of the tax collector’s office for polk county, florida. So if the assessed value of your home is $200,000, but the market value is $250,000, then the assessment ratio is 80% (200,000/250,000).

Hammock Reserve

Your property tax is calculated by first determining the taxable value.

How are property taxes calculated in polk county florida. Appraisers determine florida property tax rates by county, and each county property appraiser assesses all real property by jan. Has impacted many state nexus laws and sales tax collection requirements. The rates are expressed as millages (i.e the actual rates multiplied by 1000).

Actual property tax assessments depend on a number of variables. To get your exact property tax liabilities, contact the polk county tax assessor. At polktaxes.com we are focused on providing quick access to online payment services and information.

After the local governments determine their annual budgets, the county tax collector sends a tax bill to each property owner in late october or november. If the taxable value of a property is $75,000 and the taxing authority’s millage rate is 7.2 mills, then the taxes due would be calculated as follows: Polk county collects relatively high property taxes, and is ranked in the top half of all counties in the united states by property tax collections.

County property appraisers assess all real property in their counties as of january 1 each year. 75 x 7.2 mills = $540 in city taxes due. 3) multiply line 1 by line 2 (equals your gross taxable value) $56,410.

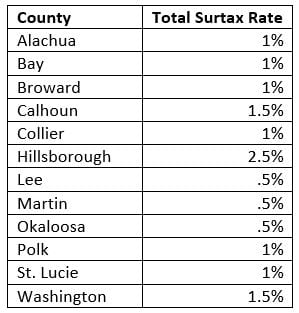

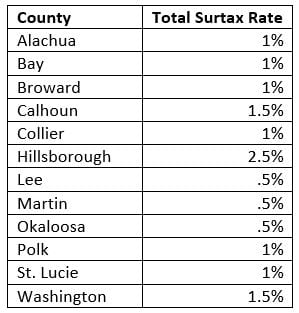

Polk county in florida has a tax rate of 7% for 2022, this includes the florida sales tax rate of 6% and local sales tax rates in polk county totaling 1%. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. In florida, polk county is ranked 45th of 67 counties in assessor offices per capita, and 25th of 67 counties in assessor offices per square mile.

Polk county sales tax rates for 2022. The current rates of tax are for lake, monroe, orange, osceola, & polk county are as follows: The property appraiser sends an annual notice of proposed property taxes in august to each property owner.

Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. The florida state sales tax rate is currently %. Automating sales tax compliance can help your business keep compliant with.

197.472 (4), the part described in the tax lien certificate. The percentage is based on the classification, determined by the type of property or how it is used. The florida state tax rate is 6% plus a discretionary rate applied per county.

Polk county calculates the property tax due based on the fair market value of the home or property in question, as determined by the polk county property tax assessor. 197.4725 (2) interest on the polk county held florida tax lien. Rates vary widely across the country, typically ranging from less than 1% at the low end, to about 5% at the high end.

The median property tax (also known as real estate tax) in polk county is $1,274.00 per year, based on a median home value of $141,900.00 and a median effective property tax rate of 0.90% of property value. The median property tax in polk county, florida is $1,274 per year for a home worth the median value of $141,900. The taxable value is your assessed value less any exemptions.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in polk county. The purchaser of the polk county held florida tax lien certificate must pay the polk county florida tax collector the face amount plus all interest, costs, and charges or, subject to f.r.s. Mh decals are issued by the department of highway safety and motor vehicles and purchased from your local county tax collector’s office.

Please note that we can only estimate your property tax based on median property taxes in your area. There are 3 assessor offices in polk county, florida, serving a population of 652,256 people in an area of 1,797 square miles.there is 1 assessor office per 217,418 people, and 1 assessor office per 598 square miles. The rental income that you collect on your own bookings is subject to both sales & use tax and tourist development tax.

The tax collector collects all ad valorem taxes levied in polk county. 4) enter the tax levy for your tax district 2. If the taxpayer resolves the matter of a vab petition with the property appraiser, the taxpayer must immediately notify the vab that the petition is withdrawn by submitting a withdrawal form.

What is the property tax in polk county fl? How property tax is calculated in polk county, florida polk county, florida property taxes are typically calculated as a percentage of the value of the taxable property. You can find more tax rates and allowances for polk county and.

2) enter the rollback 1. What is the property tax rate in polk county florida? Taxable property value of $75,000 / 1,000 = 75.

The 2018 united states supreme court decision in south dakota v. Once value has been determined, the assessor calculates a percentage of that value to arrive at assessed value. Base tax is calculated by multiplying the property's assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay.

The polk county sales tax rate is %. The total of these two taxes equals your annual property tax amount. The florida property tax calculator is based on property appraisals, considering just value and assessed value.

The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes. As you make your way through our website, please know we want to hear about your experience, including how we can improve. The taxable value is then multiplied by your local millage rate to determine your ad valorem taxes.

Polk county collects, on average, 0.9% of a property's assessed fair market value as property tax.

Property Search

Groveland Fl New Home Builders Communities – Realtorcom

Buying A Home Or Condo In Orlando Metro City Realty Buying First Home Home Buying Process First Home Buyer

2

Changes Ahead The 2019 Sales Tax Rates Are Out – James Moore

Hernando-county Property Tax Records – Hernando-county Property Taxes Fl

Floridians Planning A Flight On Or After October 1 2021 Should Make Sure Theyre Real Id Compliant – Orange County Tax Collector

New Smyrna Beach Fl New Home Builders Communities – Realtorcom

Hernando-county Property Tax Records – Hernando-county Property Taxes Fl

Hernando-county Property Tax Records – Hernando-county Property Taxes Fl

Property Search

2

Changes Ahead The 2019 Sales Tax Rates Are Out – James Moore

Hammock Reserve

1515 New Jersey Oaks Ct Lakeland Fl 33801 – Realtorcom

339 Howard Ave Lakeland Fl 33815 Realtorcom

Hernando-county Property Tax Records – Hernando-county Property Taxes Fl

How To File A Florida Sales Tax Return – Youtube

3842 Sleepy Hill Oaks Loop Lakeland Fl 33810 Realtorcom