The sales tax jurisdiction name is atlanta (fulton co) , which may refer to a local government division. 2019 budget millage rate fy2018 actual results fy2019 final budget revenue expenditures.

Georgia Income Tax Rate And Ga Tax Brackets 2020 – 2021

Fulton county, georgia june 2019 financial results unaudited, cash basis.

Fulton county ga sales tax rate 2019. The homeownership rate in fulton county, ga is 53.1%, which is lower than the national average of 64.1%. May ytd 2019 unaudited, cash basis $0 $50 $100 $150 $200 $250 $300 $214.3 $48.4 $5.7 $4.9 $33.7 $32.2 s actual other revenues actual sales taxes actual property taxes total $253.7 total $85.4 may 18 may 19 This is the total of state and county sales tax rates.

Ad a tax advisor will answer you now! Between 2018 and 2019 the median property value increased from $333,200 to $357,500, a 7.29% increase. There are a total of 315 local tax jurisdictions across the state, collecting an average local tax of 3.527%.

Fulton county, georgia has a maximum sales tax rate of 8.9% and an approximate population of 844,428. The georgia state sales tax rate is currently %. The fulton county, georgia sales tax is 7.75% , consisting of 4.00% georgia state sales tax and 3.75% fulton county local sales taxes.the local sales tax consists of a 3.00% county sales tax and a 0.75% special district sales tax (used to fund transportation districts, local attractions, etc).

Fulton county collects, on average, 1.08% of a property's assessed fair market value as property tax. The tax commissioner takes the appraised value and the exemption status provided by the board of tax assessors, along with the millage rates set by the board of commissioners and other. Fulton county property tax assessment notices have been sent and, to no big surprise, confusion has resulted.

The 8.9% sales tax rate in atlanta consists of 4% georgia state sales tax, 3% fulton county sales tax, 1.5% atlanta tax and 0.4% special tax. The fulton county sales tax rate is %. The median property tax in fulton county, georgia is $2,733 per year for a home worth the median value of $253,100.

Georgia has state sales tax of 4% , and allows local governments to collect a local option sales tax of up to 4%. Fulton county has one of the highest median property taxes in the united states, and is ranked 220th of the 3143 counties in order. Ad a tax advisor will answer you now!

The minimum combined 2021 sales tax rate for fulton county, georgia is. Fulton county collects the highest property tax in georgia, levying an average of $2,733.00 (1.08% of median home value) yearly in property taxes, while warren county has the lowest property tax in the state, collecting an average tax of $314.00 (0.51% of median home value) per year. The current total local sales tax rate in fulton county, ga is 7.750%.

The median property value in fulton county, ga was $357,500 in 2019, which is 1.49 times larger than the national average of $240,500. The fulton county tax commissioner is responsible for collecting property taxes on behalf of fulton county government, two school systems, and some city governments. , ga sales tax rate.

Code jurisdiction rate type code jurisdiction rate type code jurisdiction rate type Questions answered every 9 seconds. Average sales tax (with local):

Click any locality for a full breakdown of local property taxes, or visit our georgia sales tax calculatorto lookup local rates by zip code. Questions answered every 9 seconds. If you need access to a database of all georgia local sales tax rates, visit the sales tax data page.

Sales tax rates in fulton county are determined by twelve different tax jurisdictions, atlanta, decatur, east point, college park, south fulton, fulton county, sandy springs, clayton county, atlanta (fulton co), roswell, alpharetta and union city. The 2018 united states supreme court decision in south dakota v. Actual sales taxes actual property taxes total $262.9 total.

Georgia Income Tax Rate And Ga Tax Brackets 2020 – 2021

Ohio Sales Tax Rates By City County 2021

Tax Commissioner

Opinion The Rich Already Pay A Lot In Taxes

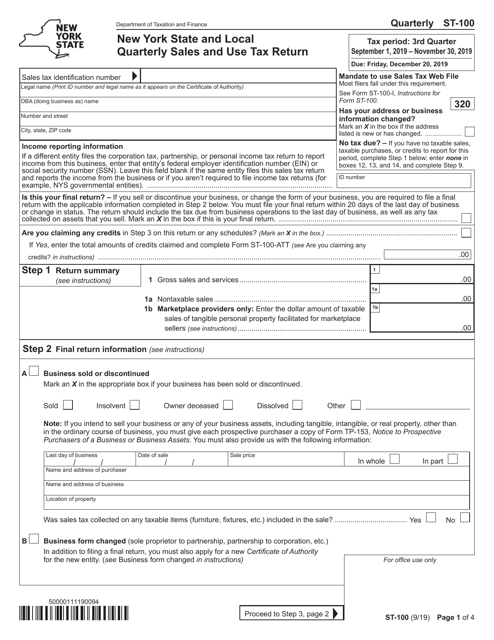

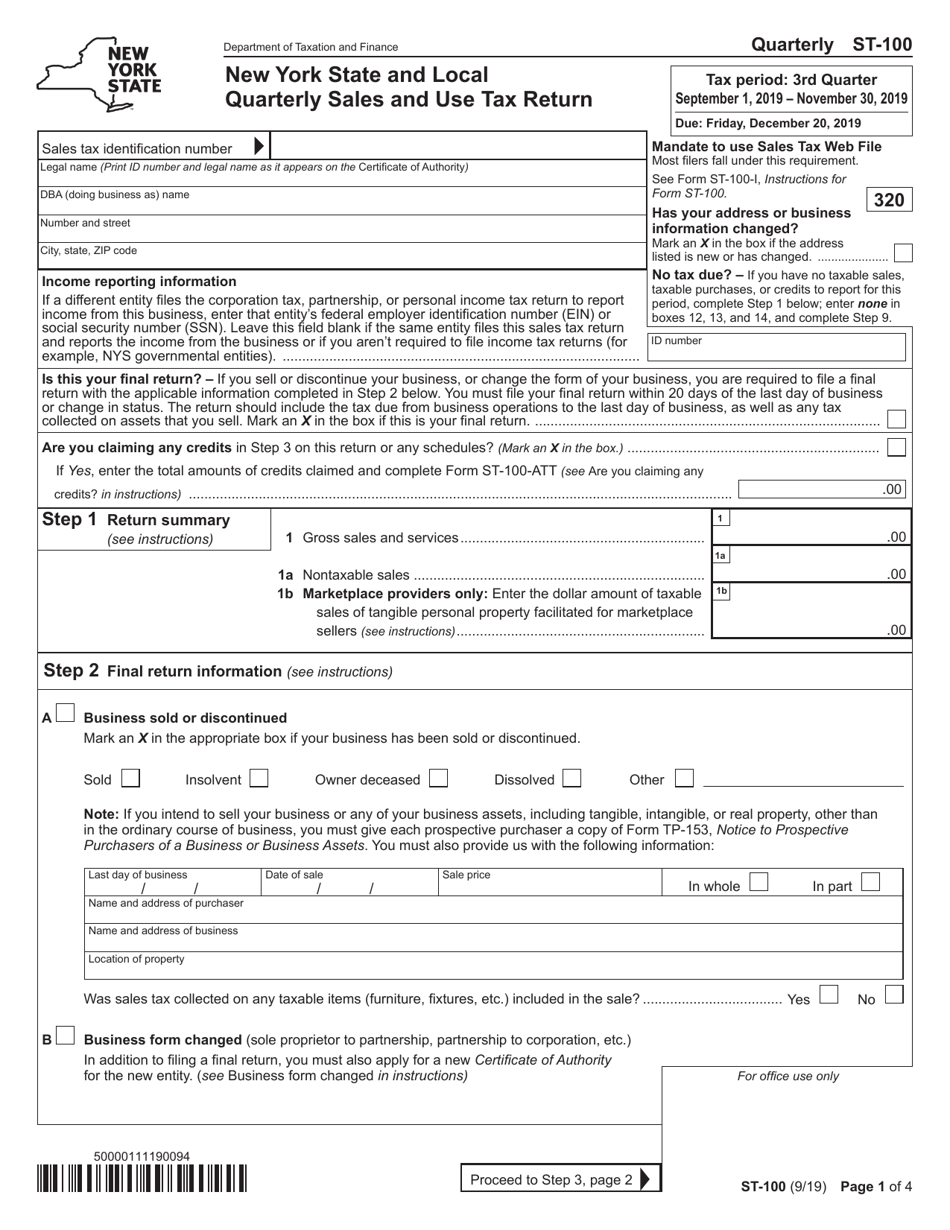

Form St-100 Download Printable Pdf Or Fill Online New York State And Local Quarterly Sales And Use Tax Return New York Templateroller

Home Depot Is Latest Retailer Found Charging Atlanta Sales Tax In Sandy Springs – Reporter Newspapers Atlanta Intown

Pdf Wayfair Its Implications And Missed Opportunities

New York Sales Tax Rates By City County 2021

Tennessee Property Taxes By County – 2021

2

Pdf Wayfair Its Implications And Missed Opportunities

What Is The Dekalb County Sales Tax – The Base Rate In Georgia Is 4

What Is The Dekalb County Sales Tax – The Base Rate In Georgia Is 4

What Is The Dekalb County Sales Tax – The Base Rate In Georgia Is 4

How Much Are Tax Title And License Fees In Georgia – Langdale Ford

Georgia Income Tax Rate And Ga Tax Brackets 2020 – 2021

Maryland Property Taxes By County – 2021

Tax Commissioner

Form St-100 Download Printable Pdf Or Fill Online New York State And Local Quarterly Sales And Use Tax Return New York Templateroller