Build the online store that you've always dreamed of. There is no city sale tax for fremont.

Food And Sales Tax 2020 In California Heather

The minimum combined 2021 sales tax rate for fremont, california is 10.25%.

Fremont ca sales tax rate 2019. There is no applicable county tax, city tax or special tax. There is no applicable county tax, city tax or special tax. The sales tax rate is always 9.25% every 2021 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25%), and in some case, special rate (3%).

The rates display in the files below represents total sales and use tax rates (state, local, county, and district where applicable). Level as the last four quarters, we will finish fy 2019/20 with a $5.8 million sales tax shortfall compared with the revised budget revenue estimate. Ad with secure payments and simple shipping you can convert more users & earn more!.

You can print a 10.25% sales tax table here. Build the online store that you've always dreamed of. You can print a 6% sales tax table here.

The current total local sales tax rate in fremont, ca is 10.250%. The fremont's tax rate may change depending of the type of purchase. There are approximately 25,714 people living in the fremont area.

Overall, general fund revenues and transfers in are estimated to grow just 0.9% in. The california sales tax rate is currently 6%. I've reached out to corporate subway to address this, so hopefully they will reach out to rectify this issue of sales tax fraud.

Ad with secure payments and simple shipping you can convert more users & earn more!. Year property class assessment value total tax rate property tax; Boost your business with wix!

1788 rows california city* 7.250%: The fremont sales tax rate is 0%. Historical tax rates in california cities & counties.

To view a history of the statewide sales and use tax rate, please go to the history of statewide sales & use tax rates page. The fremont, california, general sales tax rate is 6%. The state tax rate, the local tax rate, and any district tax rate that may be in effect.

This is the total of state, county and city sales tax rates. The county sales tax rate is 0.25%. There is no applicable city tax.

Boost your business with wix! , ca sales tax rate. There is no applicable city tax.

As of july 1, the sales and use tax rate is 9.5 percent in los angeles, 9.25 percent in san jose, 8.5 percent in. The 6% sales tax rate in fremont consists of 6% michigan state sales tax. Changes in various fees and rates.

101 rows the 94538, fremont, california, general sales tax rate is 9.25%. The sales and use tax rate in a california locale has three parts: The 10.25% sales tax rate in fremont consists of 6% california state sales tax, 0.25% alameda county sales tax and 4% special tax.

Current tax rate in fremont ca as of 08/2019. The fremont, ohio sales tax rate of 7.25% applies in the zip code 43420.

Sales Tax On Cars And Vehicles In Nebraska

Sales Tax Rates In Major Cities Tax Data Tax Foundation

How To File And Pay Sales Tax In California Taxvalet

What Are Californias Income Tax Brackets – Rjs Law Tax Attorney

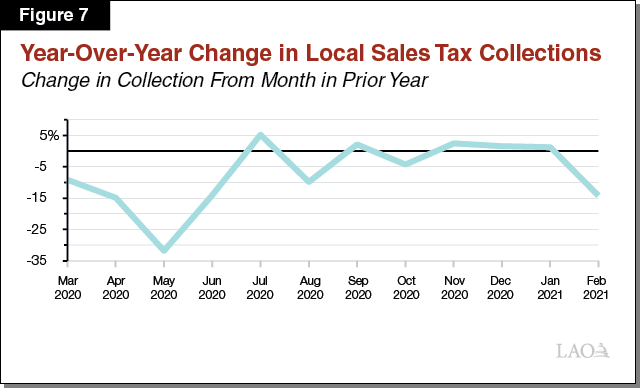

An Initial Look At Effects Of The Covid-19 Pandemic On Local Government Fiscal Condition

Food And Sales Tax 2020 In California Heather

How To File And Pay Sales Tax In California Taxvalet

How To File And Pay Sales Tax In California Taxvalet

New York Sales Tax Rates By City County 2021

How To File And Pay Sales Tax In California Taxvalet

Iowa Sales Tax Rates By City County 2021

California Sales Tax Rates By City County 2021

Is Shipping In California Taxable – Taxjar

Food And Sales Tax 2020 In California Heather

Ohio Sales Tax Rates By City County 2021

How To Use A California Car Sales Tax Calculator

How To File And Pay Sales Tax In California Taxvalet

Tax Checklist For The Self-employed Military Spouse – Nextgen Milspouse Tax Checklist Military Spouse Milspouse

How To File And Pay Sales Tax In California Taxvalet