The county auditor is the selling agent for the state and is required by law to maintain a list of forfeited properties seized due. The buyer of the tax lien has the right to collect the lien, plus interest based on.

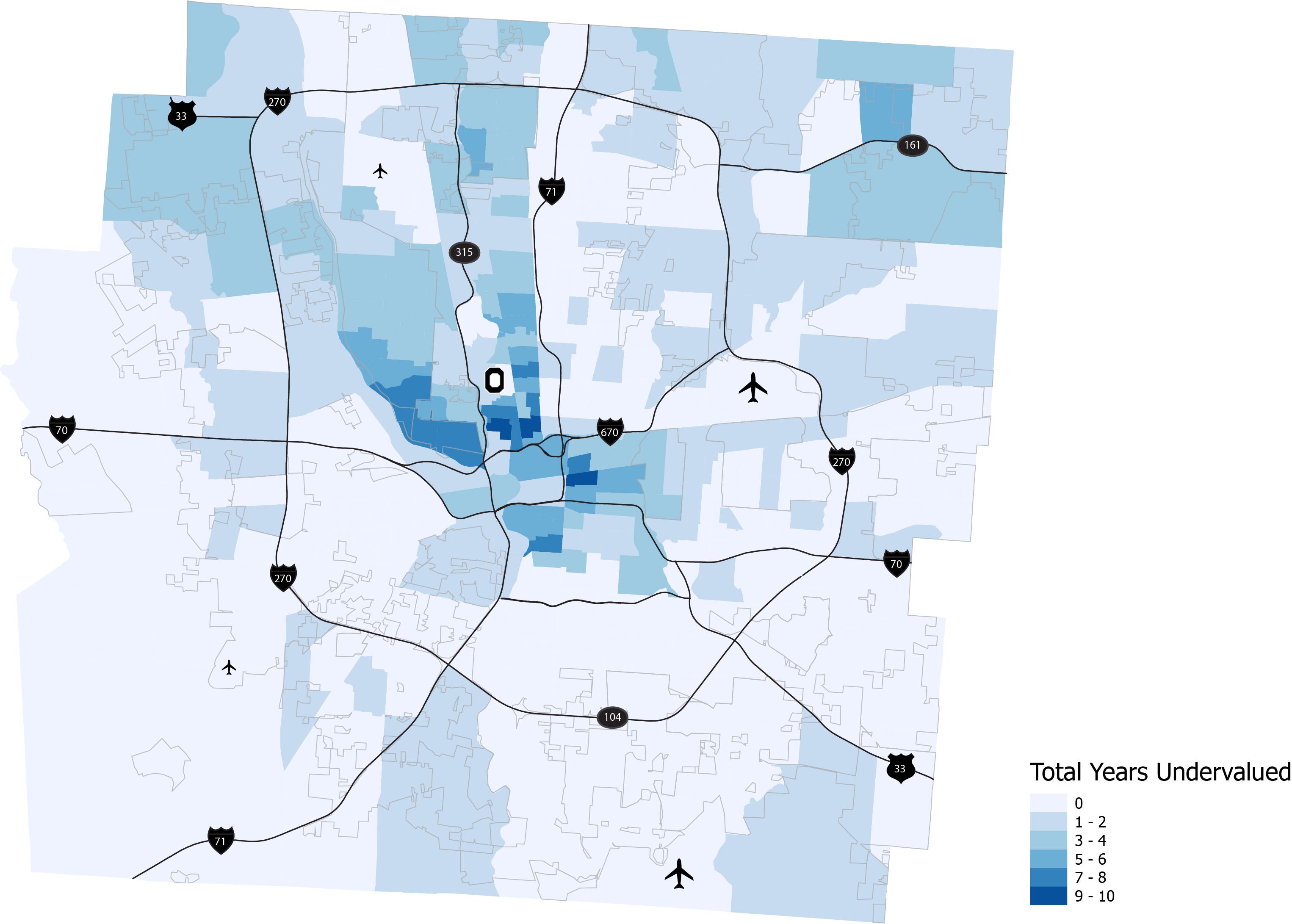

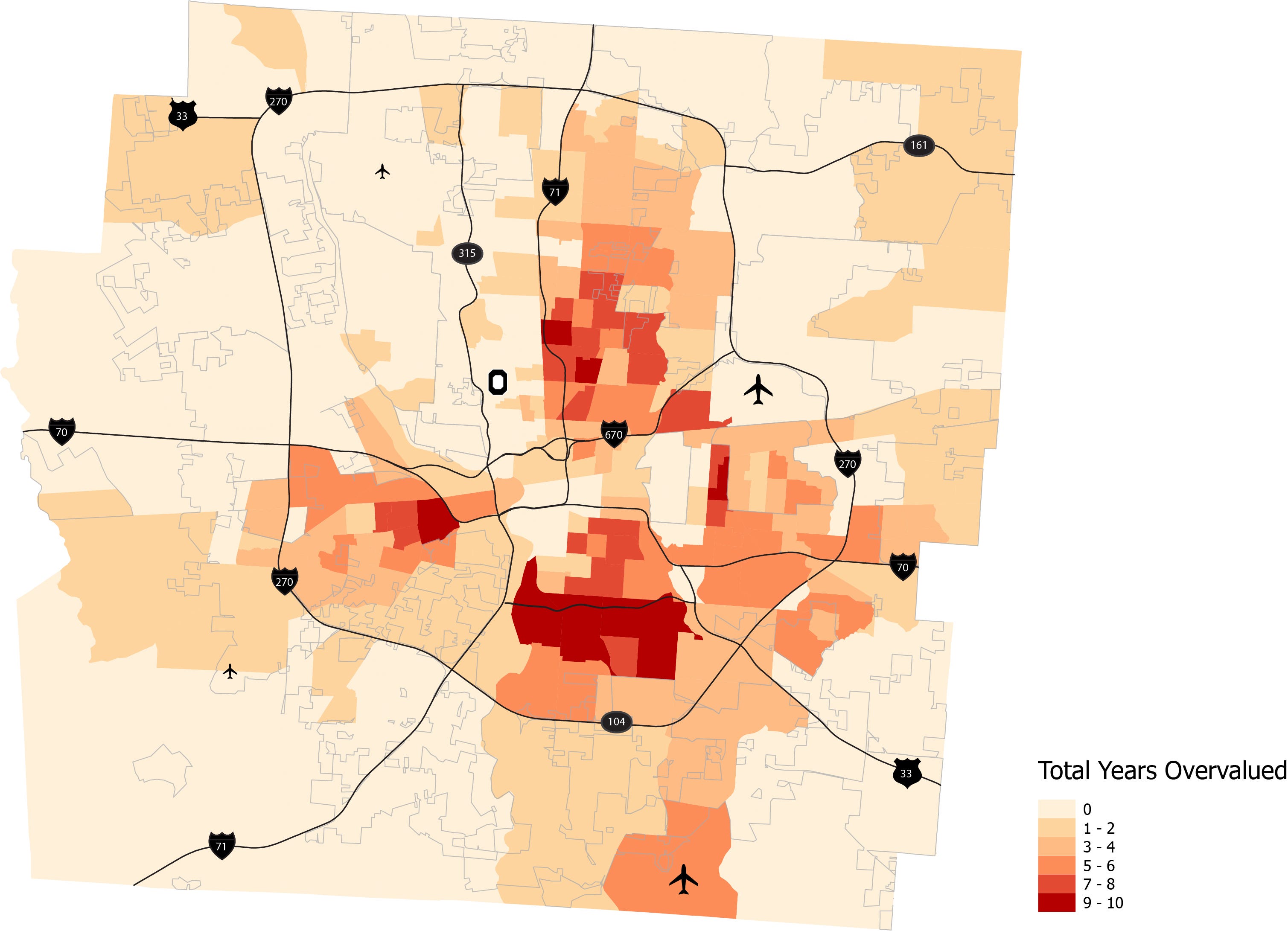

Franklin County Real Estate Taxes Overvalued Poor Black Neighborhoods

In ohio, the county tax collector will sell tax deeds to winning bidders at the franklin county tax deeds sale.

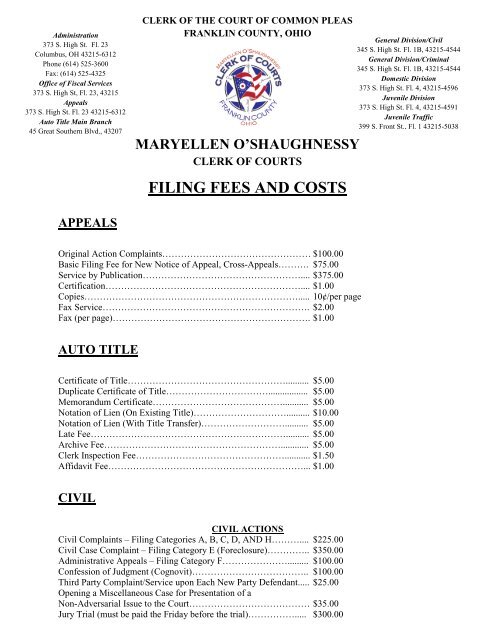

Franklin county ohio tax lien sales. Look for lien certificate auctions in franklin county (columbus), cuyahoga county (cleveland), and hamilton county (cincinnati). Franklin county clerk of courts clerk.franklincountyohio.gov 614.525.3600 franklincountyautotitle.com 614.525.3090 administration offices 373 s. Our office receives many requests for a list of case filings with “excess funds.” there are three separate

How does a tax lien sale work? How does a tax lien sale work? Tax lien and tax deed:

At any time, the public can search properties owned by franklin county on this website through the property tax inquiry parcel search, by typing franklin county on the owner search line. Payment should include 100% of the amount due for each certificate and the $30.00 lien assignment fee for each certificate listed: Payment plans ask how to set up a payment plan to pay delinquent taxes.

Edward leonard, franklin county, oh, treasurer makes this clear: All properties held by franklin county are sold by public auction. After the tax lien sale, you get one year to pay off all lien charges and interest property.

Franklin county clerk 2021 tax bill sale timeline (for 2020 delinquent taxes) april 16, 2021: Ask the clerk how much additional money you owe to the court in additional court costs and fees. Public outcry to highest bidder:

For tax lien certificates, investors can get yields as high as 18% per annum with a one year right of redemption. Tax lien sale find out about our annual tax lien sale and access. Search for franklin county sheriff's foreclosure listings by sales date, case number, property street name, defendant's name, or zip code.

The certificate is then auctioned off in franklin county, nc. The state of ohio can obtain a judgment lien against a taxpayer when a tax has been assessed, but has not been paid and is past due. Sheriff turns unpaid tax bills over to county clerk at the close of business:

View general information about franklin county annual tax lien sales, and list of properties that were included in the previous sale. Looking over the procedure of the franklin county sale and give insight into what to look for when looking make this type of investment. Franklin county property records are real estate documents that contain information related to real property in franklin county, ohio.

Floor 23 columbus, ohio 43215 (614).525.3600 excess funds access information. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. This office is selling the tax lien (or the right to collect the delinquent taxes).the outstanding tax dollars are paid in full to the franklin county treasurer and the purchaser of the tax lien is owed the balance plus any additional fees and interest, this is referred to as the redemption amount.

Unpaid property taxes are beyond the scope of this guide. The franklin county treasurer holds the state's first and best lien against real property located in franklin county These are liens for unpaid income, payroll or business taxes.

Ohio is unique in that it offers both tax lien certificates and tax deeds. Generally, the minimum bid at an franklin county tax deeds sale is the amount of back taxes owed plus interest, as well as. Interested in a tax lien in franklin county, nc?

If you are able, you can come into our general division (address below) and remit copies of the lien satisfaction letters, as well as payment, and we can file those in our office. The buyer of the tax lien has the right to collect the lien, plus interest based on. Tax deeds are sold to the.

The following is a list of the services and duties of the delinquent tax division at the franklin county treasurer's office. This guide addresses the problem of ohio tax liens (also called judgment liens). Sales occur only in counties with a population of 200,000 or more.

Most county tax lien sales are in june and are limited to institutional investors. Franklin county ohio tax sale. Payment is accepted by way of a cash, certified check or money order (made payable to the “franklin county clerk of courts”) only for such a transaction.

Interested in a tax lien in franklin county, oh? The certificate is then auctioned off in franklin county, oh. The franklin county auditor's office will be conducting an auditor's sale on tuesday, november 9, 2021 beginning at 9:00 am in the auditorium on the first floor of the frankin county courthouse, 373 s.

“the purpose of the annual tax lien sale is to collect the delinquent real estate taxes owed to the county’s school districts, agencies and local governments.” local governments, like those listed here, depend on property taxes to operate. Some areas, such as franklin county, ohio, holds a standing tax lien sale held annually in the second week of november. Ohio conducts tax deed sales and they are open to the general public.

2

Filing Fees And Costs Appeals – Franklin County Ohio

Ohio Property Tax Lien Sales

Franklin County Treasurer – Foreclosure

Ohio Republican Partys Headquarters Is On A List Of Tax Liens The Statehouse News Bureau

Ohio Property Tax Lien Sales

Satisfying Tax Liens In Franklin County – Ohio Tax Liens – Libguides At Franklin County Law Library

2

Ohio Republican Party Settles Tax Bill After Getting Hit With Lien – Clevelandcom

Franklin County Treasurer – Delinquent Taxes

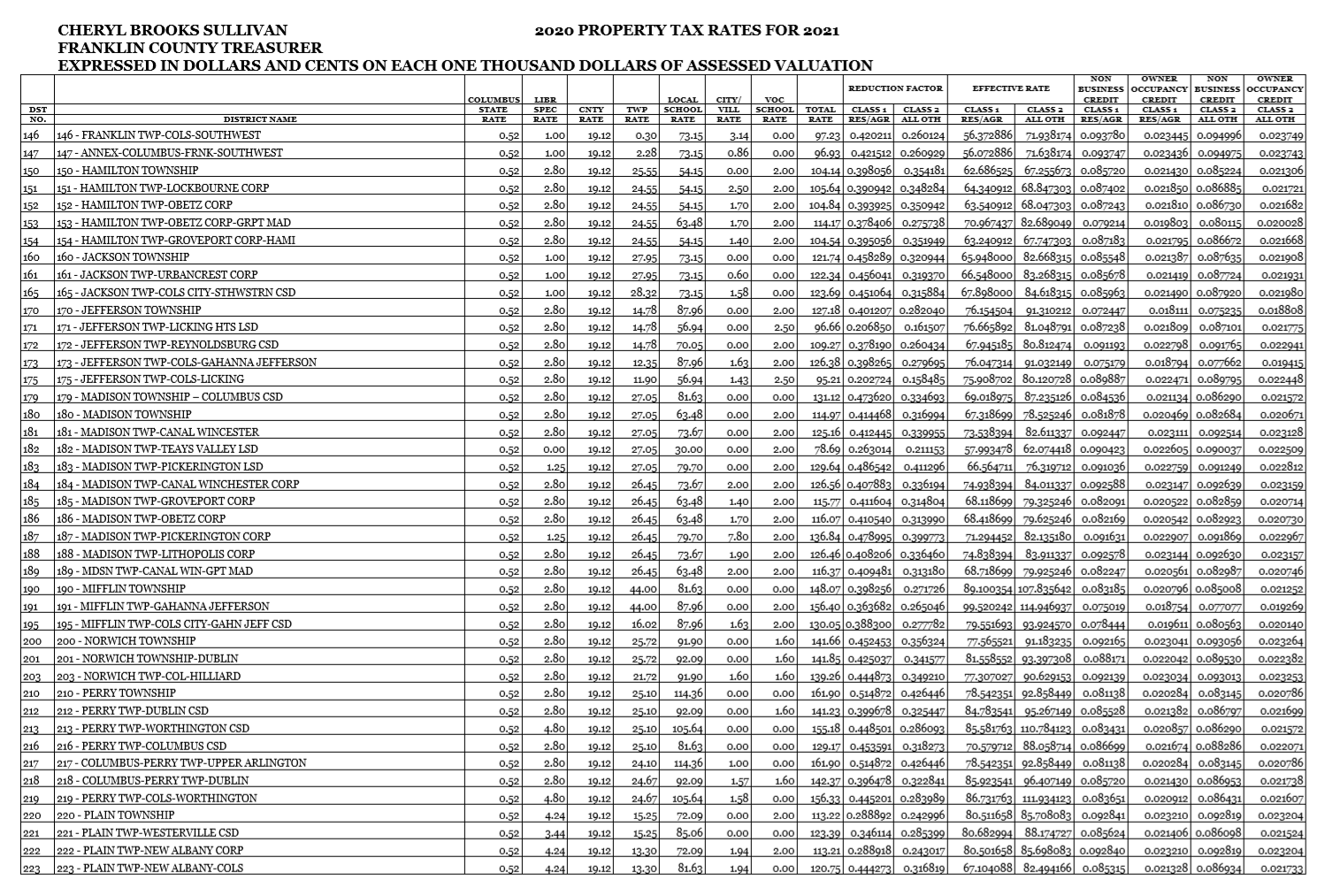

Franklin County Treasurer – Tax Rates

Satisfying Tax Liens In Franklin County – Ohio Tax Liens – Libguides At Franklin County Law Library

Ohio Foreclosures And Tax Lien Sales Search Directory

Franklin County Treasurer – Tax Rates

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Franklin County Treasurer – Delinquent Tax

Franklin County Real Estate Taxes Overvalued Poor Black Neighborhoods

Auto Title Manual – Franklin County Ohio

Franklin County Auditor – Auditors Sale