If you are a new florida resident or you did not previously own a home, please see this. No estate tax or inheritance tax

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Estate tax is calculated on all of your assets when you die, and there’s a nonrefundable credit equal to the tax that would be charged on the lifetime exemption ($4,577,800 in 2020).

Florida estate tax exemption 2020. However, the personal representative of an estate may still need to complete certain forms to remove the automatic florida estate tax lien. The estate tax exclusion is $4,000,000 as of 2021, after the district chose to lower it from $5,762,400 in 2020. Starting in 2022, the exclusion amount will increase annually based on.

As of november 2020, there are no plans to increase the amount of the exemption in 2021. Estate in florida with a just value less than $250,000, as determined in the first tax year that the owner applies and is eligible for the exemption, and who has maintained permanent residence on the property for at least 25 years, is 65 or older, and whose household income does not exceed the household income limitation. Accordingly, if you gift away $5m, your remaining estate tax exemption would be $6.58m.

In september, the state also increased it’s progressive estate tax rate to as high as 20% for estates valued at more than $10 million. A florida resident who dies may still owe an estate tax for property located in other states. Since florida's estate tax was based solely on the federal credit, estate tax was no longer due on estates of decedents that died on or after january 1, 2005.

No estate tax or inheritance tax. However, if the current federal tax laws remain in place, the exemption amount will be decreased by 50% in 2026. This is the amount that taxpayers can pass free of transfer tax imposition.

One of the central components of the nation’s transfer tax system is the federal estate tax exemption. This may sound complicated, but the end result is actually quite simple: Questions answered every 9 seconds.

Estates valued above the threshold may be taxed on a graduated scale of up to 40 percent. If you’re a florida resident and the total value of your estate is less than $11.4 million, you will pay neither state nor federal estate taxes. Any assets left to your heirs will be taxed at a 0% rate up to $11.58 million and at a.

While over the last 100 years the size of this exemption has fluctuated, congress most recently increased it exponentially, jeopardizing the vitality of. With the estate tax level so high (which doubles to $23.4 million for a married couple), very few people/estates need to worry about the federal estate tax. 2020 estate tax exemption november 19, 2019 posted by rla estate planning law , news and press , probate , real estate law , tips , trust administration the estate tax exemption for 2020 is $11.58 million, an increase from $11.4 million in 2019.

$11.58 million exemption per person (an increase of $118,000) this is a combined federal gift and estate tax exemption limit. Your base payment is $70,800 on the first $250,000. Subtracting the exemption of $11.18 million, creates a taxable estate of $320,000.

This tax exemption does not apply to school district taxes. An additional homestead exemption for persons 65 and older as of january 1 of the filing year, and whose household adjusted gross income does not exceed the income limitation of $30,721 for 2020. Legislation was passed in 2019 to establish the current estate tax exemption of $5,490,000.

The federal estate tax only applies if the value of the entire estate exceeds $11.7 million (2021), and the tax that's incurred is paid out of the estate/trust rather than by the beneficiaries. Ad a tax advisor will answer you now! That, plus the base of $70,800, means your total estate tax burden is.

Questions answered every 9 seconds. If you are moving from a previous florida homestead to a new homestead in florida, you may be able to $11.4 million exemption per person.

On january 1, 2020, the connecticut estate and gift tax rates increased and now range from 10% (for Exemption for totally and permanently disabled persons (income limitation) any real estate used and owned as a homestead less any portion thereof used for commercial purposes by a paraplegic, hemiplegic or other totally and permanently disabled person, as defined in section 196.101(4), f.s., who must use a wheelchair for mobility or who is legally blind, shall be exempt. Ad a tax advisor will answer you now!

The federal estate and gift tax exemption amounts (approximately $11.58 million, plus the additional federal inflation adjustment relevant for 2023). The internal revenue service announced today the official estate and gift tax limits for 2020: You also pay 34% on the remaining $70,000, which comes to $23,800.

For example, if someone who dies in florida owns valuable property in another state,. Constitutional amendments require 60% voter approval. This means that, if a married couple were both to die this year, their estate would only owe estate taxes if it were valued at more than $23.16 million.

The estate and gift tax exemption is $11.58 million per. The estate tax exemption for 2020 is $11.58 million per decedent, up from $11.4 million in 2019. $50,000 senior exemption (florida statute 196.075):

Form 4768, application for extension of time to file a return and/or pay u.s. The top estate tax rate is 12 percent and is capped at $15 million (exemption threshold: The exemption amount will rise to $5.1 million in 2020, $7.1 million in 2021, $9.1 million in 2022, and is scheduled to match the federal amount in 2023.) delaware:

Florida Inheritance And Estate Tax Definition Alper Law

Florida Estate And Inheritance Taxes – Estate Planning Attorney Gibbs Law – Fort Myers Fl

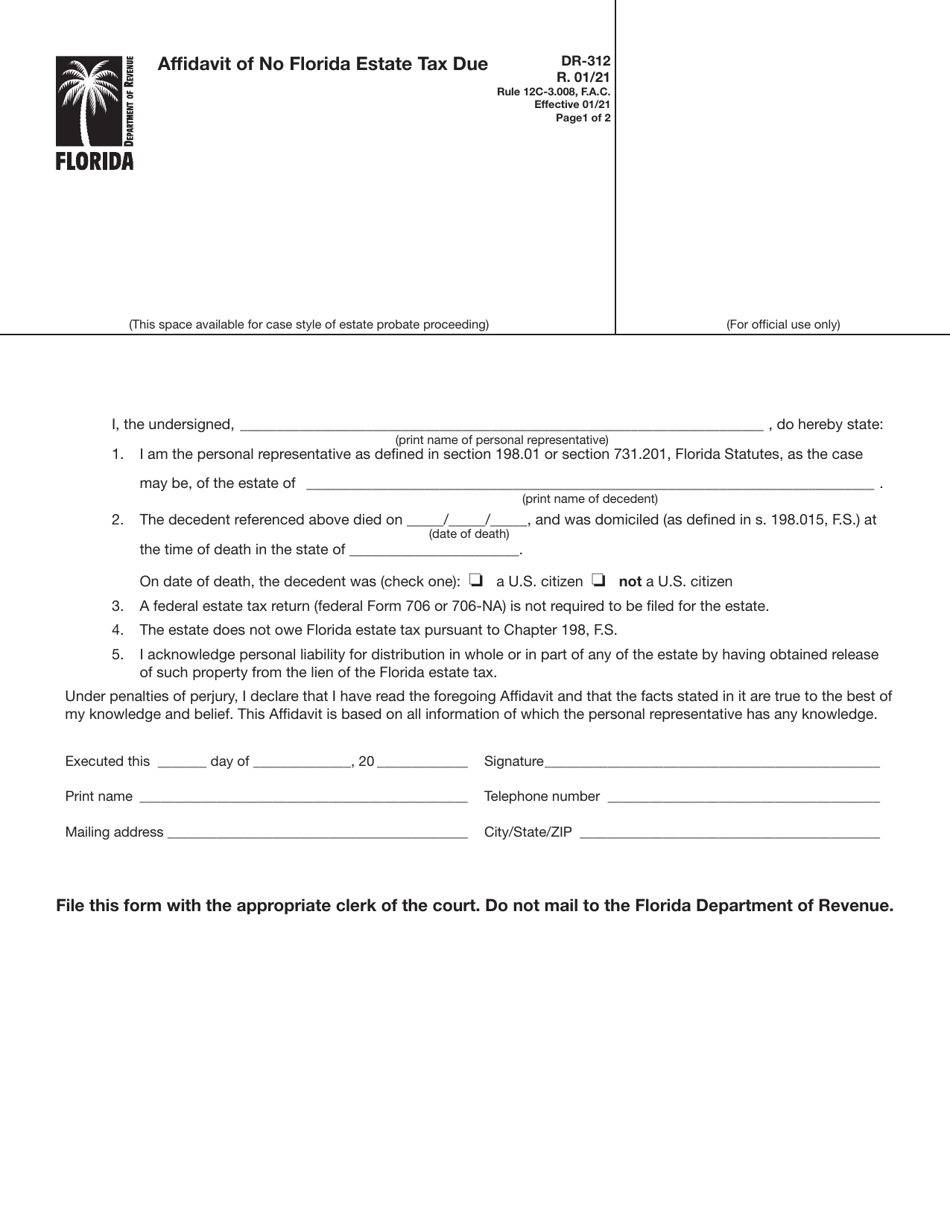

Form Dr-312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Florida Estate Planning For Non-citizens – Estate Planning Attorney Gibbs Law – Fort Myers Fl

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax Landscape For 2021 And Beyond

![]()

Florida Inheritance And Estate Tax Definition Alper Law

Form Dr-312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Form Dr-312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Florida Property Tax Hr Block

Florida Attorney For Federal Estate Taxes Karp Law Firm

Florida Estate And Inheritance Taxes – Estate Planning Attorney Gibbs Law – Fort Myers Fl

Relocating To Florida Understanding Estate Taxes On Your Property – The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Florida Inheritance And Estate Tax Definition Alper Law

How Can I Avoid The Massachusetts Estate Tax – Heritage Law Center

Florida Estate Planning Guide Everything You Need To Know

Florida Estate Planning Guide Everything You Need To Know

Will My Florida Estate Be Taxed

Florida Estate Tax – Rules On Estate Inheritance Taxes