Posted wed, jul 29, 2020 at 9:30 am pt | updated wed, jul 29, 2020 at 10:11 am pt reply (1) voters in the city of concord will decide in november whether to extend a. Select board member shannon chapman was.

Lez_ud0yok1wwm

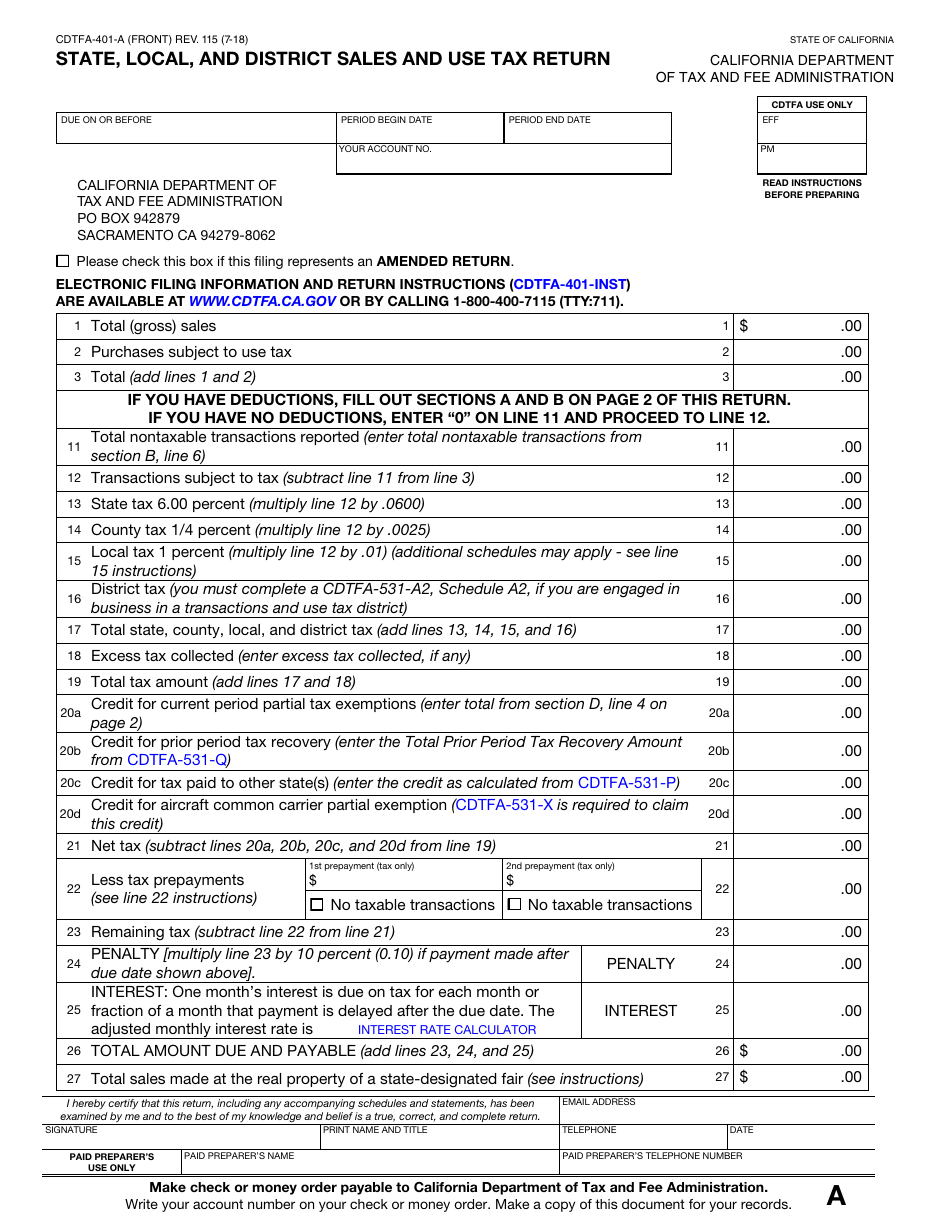

For tax rates in other cities, see california sales taxes by city and county.

Concord ca sales tax 2020. City of concord finance department source: The sales tax rate is always 8.75% the sales tax rate is always 8.75% every 2021 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25%), the california cities rate (0.5%), and in some case, special rate (2%). The 9.75% sales tax rate in concord consists of 6% california state sales tax, 0.25% contra costa county sales tax, 1% concord tax and 2.5% special tax.

City of el cerrito 10.25%. Measure v is not a property tax or a tax on your home. Concord voters will say yes or no on nov.

41 rows concord, california, measure v, sales tax (november 2020) concord measure. This is the total of state, county and city sales tax rates. The california travel industry was even more affected, experiencing an estimated decline of 55% in travel spending.

The concord, california, general sales tax rate is 6%. There is no applicable city tax or special tax. The concord sales tax rate is %.

The december 2020 total local sales tax rate was 8.750%. City of crescent city 8.50%. Del norte (unincorporated area) 2 8.50% el dorado

The county sales tax rate is %. The combined rate used in. 2020 riley ct is a house currently priced at.

Hdl companies $13.1m q1 2021 31.6% from q1 2020 $325k q3 2021 9% from q3 2020 current vacancy & lease rates (as of quarter 3, 2021 | change since quarter 3. , ca sales tax rate. The california sales tax rate is currently %.

101 rows the 94520, concord, california, general sales tax rate is 8.75%. City of pleasant hill 9.25%. The 8.125% sales tax rate in concord consists of 6.5% arkansas state sales tax and 1.625% cleburne county sales tax.

Of that $8.75, the city of concord currently receives just $1.50. The minimum combined 2021 sales tax rate for concord, california is. New 2020 kia k900 in concord, ca.

Concord officials recently conducted a tax sale for five properties with delinquent taxes going back to 2018. Travel spending in concord declined 55.8% from $184 million in 2019 to $81.3 million in 2020. Measure q/v) transient occupancy tax revenue q3 2021 1,263 source:

Brenda thomas, of hercules, drops her ballot into a ballot box located in front of the contra costa county elections department in martinez, calif., on. The concord, california sales tax is 8.75%, consisting of 6.00% california state sales tax and 2.75% concord local sales taxes.the local sales tax consists of a 0.25% county sales tax, a 0.50% city sales tax and a 2.00% special district sales tax (used to fund transportation districts, local attractions, etc). If the measure is approved in november, concord’s overall sales and use tax rate would rise from 8.75 percent to 9.25 percent.

City of concord community development department source: City of san pablo 9.25%. You can print a 9.75% sales tax table here.

For example, for every $100 you spend on taxable goods in concord, you pay $8.75 in sales tax. 2020 riley ct is a 1,296 square foot house on a 10,019 square foot lot with 3 bedrooms and 1 bathroom. House located at 307 emmet pl, concord, ca 94521.

The current total local sales tax rate in concord, ca is 9.750%. Measure v is not applied to prescription medicine or food purchased as groceries. View sales history, tax history, home value estimates, and overhead views.

Burnaby Property Tax 2021 Calculator Rates – Wowaca

Property Tax Calculator

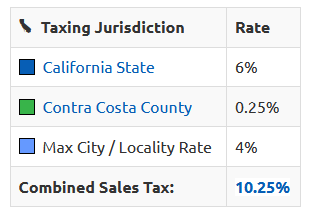

Form Cdtfa-401-a Download Fillable Pdf Or Fill Online State Local And District Sales And Use Tax Return California Templateroller

25391 Prado De Las Peras Calabasas Ca 91302 Mls Sr20127770 Zillow Calabasas Prado Exterior Design

Taxes Contra Costa Herald

2

Charleston Traditional Rivermark – These Stairs Down From The Covered Deck Are Great In 2020 Model Homes New Home Designs Curb Appeal

Pre-owned Rolex Ladies Datejust Steel 18k White Gold Black Diamond Sapphire Watch Jubilee Quickset Diamondjewellery Diamond Diamond Jewelry Accessories

California Sales Tax Rates By City County 2021

2

101 Mesa Ln Unit A Santa Barbara Ca Santa Barbara Beach Home Santa Barbara

Hair Stylist Resume Is A Must Thing To Have And To Offer When You Already Have Your Soul In Dressing Accountant Resume Sample Resume Templates Resume Examples

How To Use A California Car Sales Tax Calculator

![]()

Llc California – How To Start An Llc In California Truic

Form Cdtfa-401-a Download Fillable Pdf Or Fill Online State Local And District Sales And Use Tax Return California Templateroller

Taxes Contra Costa Herald

4328 Monterey Ct Discovery Bay Ca 94505 Home Discovery Bay Home Decor

California Food Tax Is Food Taxable In California – Taxjar

Budget 101