This is the total of state, county and city sales tax rates. Let’s take a look at the biggest expense within city government:

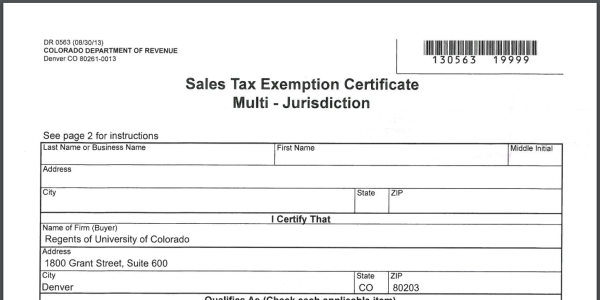

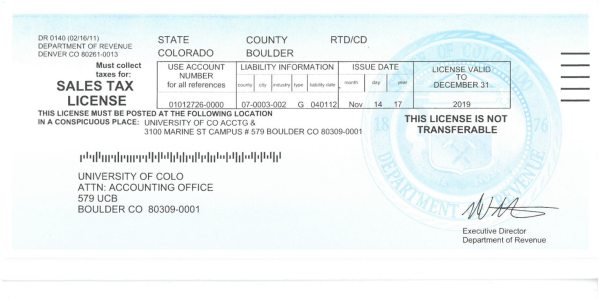

Sales Tax Campus Controllers Office University Of Colorado Boulder

101 rows how 2021 sales taxes are calculated for zip code 80910 the 80910, colorado springs ,.

Colorado springs sales tax rate 2021. Starting in 2021, the 2c sales tax rate will decrease from 0.62% to 0.57% throughout the extension. The county sales tax rate is %. 2021 local sales tax rates.

The five states with the highest average local sales tax rates are alabama (5.22 percent), louisiana (5.07 percent), colorado (4.75 percent), new york (4.52 percent), and oklahoma (4.45 percent). The glenwood springs sales tax rate is %. As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate.

The colorado sales tax rate is currently %. The colorado springs, colorado sales tax is 2.90% , the same as the colorado state sales tax. Beginning february 1, 2022, all retailers will be required to apply the destination sourcing rules.

No states saw ranking changes of more than one place since july. The base state sales tax rate in colorado is 2.9%. Colorado (co) sales tax rates by city the state sales tax rate in colorado is 2.900%.

Colorado sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. The colorado sales tax rate is currently %. Method to calculate colorado springs sales tax in 2021.

This exception applies only to businesses with less than $100,000 in retail sales. Depending on the zipcode, the sales tax rate of. How 2021 sales taxes are calculated in colorado springs the colorado springs, colorado , general sales tax rate is 2.9%.

Colorado taxpayers will get a break on their income taxes and a refund payment because the state’s cap on government growth and spending under the taxpayer’s bill of rights was exceeded last fiscal year. Surging colorado springs sales tax revenue showed no sign of slowing in the new year as online sales and a hot housing market continued to fuel strong gains in. With local taxes, the total sales tax rate is between 2.900% and 11.200%.

The county sales tax rate is %. Even though the city is financially sitting pretty, suthers still presented his 2022 budget to the public that’s 16.26% ($56 million) higher than 2021. This system will greatly improve our business’s experience by allowing businesses to file and pay taxes at any time via an internet connected device, view their account history on demand, and delegate access to tax professionals, for filing on their behalf.

Colorado has state sales tax of 2.9% , and. This is the total of state, county and city sales tax rates. On july 12, 2021, the city of colorado springs sales tax office will be transitioning to a new online licensing and tax filing system, powered by munirevs.

Find your colorado combined state and local tax rate. The local sales tax rate in colorado springs, colorado is 8.2% as of november 2021. The extension will focus on improving road conditions near neighborhoods.

He has shown just how well the city is doing by approving raises and bonuses to city employees. The minimum combined 2021 sales tax rate for glenwood springs, colorado is. The minimum combined 2021 sales tax rate for colorado springs, colorado is.

The colorado springs sales tax rate is %. Effective january 1, 2021, the city of colorado springs sales and use tax rate has decreased from 3.12% to 3.07% for all transactions occurring on or after that date. While colorado law allows municipalities to collect a local option sales tax of up to 4.2%, colorado springs does not currently collect a local sales tax.

The income tax rate will drop to 4.5% in 2021, down from 4.55%, and individual taxpayers will get an additional sales tax refund payment, on. Local tax rates in colorado range from 0% to 8.3%, making the sales tax range in colorado 2.9% to 11.2%. Please note that the department will need to verify that you

Also, if your internal point of sale system supports it, the gis information can be accessed through an application programming interface (api).this api can automatically reference current tax information directly from the cdor. 431 rows 2021 list of colorado local sales tax rates. The colorado sales tax rate is 2.9%, the sales tax rates in cities may differ from 3.25% to 10.4%.

How To Calculate Cannabis Taxes At Your Dispensary

Pin On Fort Lewis

Sales Tax Information Colorado Springs

25 Teacher Tax Deductions Youre Missing In 2021 Teacher Tax Deductions Diy Taxes Tax Deductions

Sales Tax Information Colorado Springs

How To Make Tax Season Less Stressful 5 Ways To Prepare Year-round For Tax Time In 2021 Business Tax Tax Prep Filing Taxes

File Sales Tax Online Department Of Revenue – Taxation

Pin On Realtor Associations Ethics Fiduciary

Sales Tax Information Colorado Springs

See Which States Do Not Have Income Tax Sales Tax Or Taxes On Social Security Start Packing Income Tax Tax Sales Tax

File Sales Tax Online Department Of Revenue – Taxation

Colorado Sales Tax Rates By City County 2021

Sales Tax Information Colorado Springs

Sales Tax Campus Controllers Office University Of Colorado Boulder

Colorado Sales Tax – Taxjar

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

The Best Place To Retire Isnt Florida Best Places To Retire Retirement Locations Retirement

File Sales Tax Online Department Of Revenue – Taxation

Sales Tax Information Colorado Springs