For additional special event sales tax licensing information, refer to fyi. While colorado's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes.

Housing Information For Residents Colorado Springs

Retailer engaged in business in city

Colorado springs sales tax license. The city of steamboat springs is a home rule municipality with its own municipal code, collecting its own sales tax. Steamboat springs’ sales tax is levied on tangible personal property and taxable services that are purchased, sold, leased or rented within the city of steamboat springs. This means the city is authorized to levy and collect its own sales and use tax.

For more information, visit the local government sales tax. Must supply a copy of driver's license. Does my license ever expire?

A retailer uses this license to collect and remit city sales tax, lodgers tax, automobile rental tax, use tax, motion picture theater taxes and/or bicycle excise tax Owners may be subject to a different tax rate if the vehicle was purchased within the entity where they reside (fountain, manitou springs, or monument). A sale may be exempt due to the type of product sold (food for home consumption, prescription drugs, gasoline, etc.), the status of the purchaser (governmental entity, charitable, religious, etc.) or the nature of the sale (sale for resale, shipped out of.

Tax records include property tax assessments, property appraisals, and income tax records. Apply for a sales tax license online in city of colorado springs seamlessly with papergov. Nevada ave., suite 101, colorado springs, colorado 80903.

Business may not be conducted until a business / sales tax license has been issued. Please visit the sales & use tax web page for information on how to obtain a sales tax license, set up a sales tax account, and how to collect and remit state sales tax. These applications & certificates do not cover the colorado department of revenue, cities other than the city of colorado springs or counties within the state of colorado.

Sometimes taxpayers refer to this as a business registration, but it is an application for a colorado sales tax account or sales tax license. If your business is in colorado springs and For all questions regarding business licensing, contact the city clerk's office.

Be it property taxes, utility bills, tickets or permits and licenses, you can find them all on papergov. Ø a sales tax license is required for any person engaged in the business of selling tangible personal property or taxable services at retail in the city of colorado springs. Business is in colorado springs and you have a customer in colorado springs, you need to have a city of colorado springs and department of revenue sales tax license to collect a tax rate of 8.25%.

No, the licenses are valid and active unless an account closure notice is received. If the sale is for the licensed retailer’s own use or consumption, rather than for resale, it is not exempt. For general business or retail sales tax.

$20 if payment is received after january 31,. When is my sales tax return due? Types of tax id numbers.

Complete the sales tax application and submit with a copy of the owner's driver's license and $50.00 application fee. Sales tax license application sales tax. Colorado springs tax records include documents related to property taxes, business taxes, sales tax, employment taxes, and a range of other taxes in colorado springs, colorado.

Certain tax records are considered public record, which means they are available to the public, while some tax records are. Anyone who sells retail in colorado without obtaining a sales tax license commits a class 3 misdemeanor and may also be subject to civil penalty of $50 per day to a maximum penalty of $1,000. How much does a sales tax license cost in colorado?

Springs sales tax license or if located outside the city a copy of the state retail sales tax license. To apply for a standard sales tax license, complete the colorado sales tax withholding account application, cr 0100ap. The city of colorado springs is home rule.

The sale or purchase of an article of tangible personal property is subject to city sales or use tax unless the sale is exempt under the city code. Annual license fee (due december 31, 2018): Tax id number obtain a tax id form or a colorado springs tax id application here.

Sales/use tax the following table is intended to provide basic information regarding the collection of sales and use tax and reflects rates currently in effect. 20 business / sales tax license application. The temporary sales tax license $20.00 license fee (city of colorado springs) form is 2 pages long and contains:

Welcome to the city of colorado springs sales tax filing and payment portal powered by. Sales tax returns are due on the 20th of the month following the end of the reporting period (i.e. In colorado, many cities and counties collect their sales and use tax, instead of the colorado department of revenue.

Temporary sales tax license $20.00 license fee (city of colorado springs) on average this form takes 8 minutes to complete. Apply for tax id number information, federal tax identification number, a tax identification number (ein), and or a federal tax identification number, which is used to identify a colorado springs business. Sales shipped out of the city and/or state

There are four types of tax ids: Days for processing and approval. Licensees renew their sales tax license by the end of the calendar year.

Colorado Springs Ranked No 3 Best Place To Live By Us News World Report Colorado Springs

Covid-19 Response Helping Businesses Colorado Springs

New Sign Will Greet Drivers As They Enter Colorado Springs Colorado Springs

Sales Tax Information Colorado Springs

Introduction Vision Map Colorado Springs

Pin On Travel

Procurement Services Colorado Springs

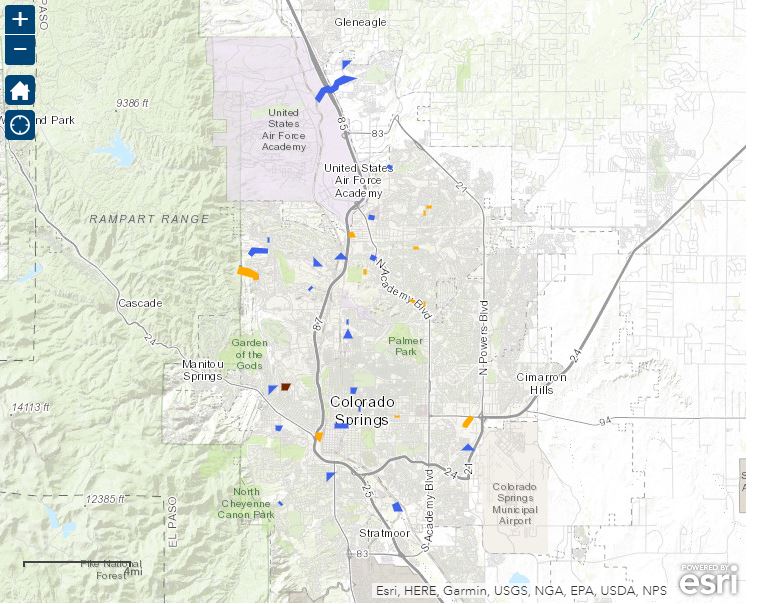

Stormwater Project Map Colorado Springs

2

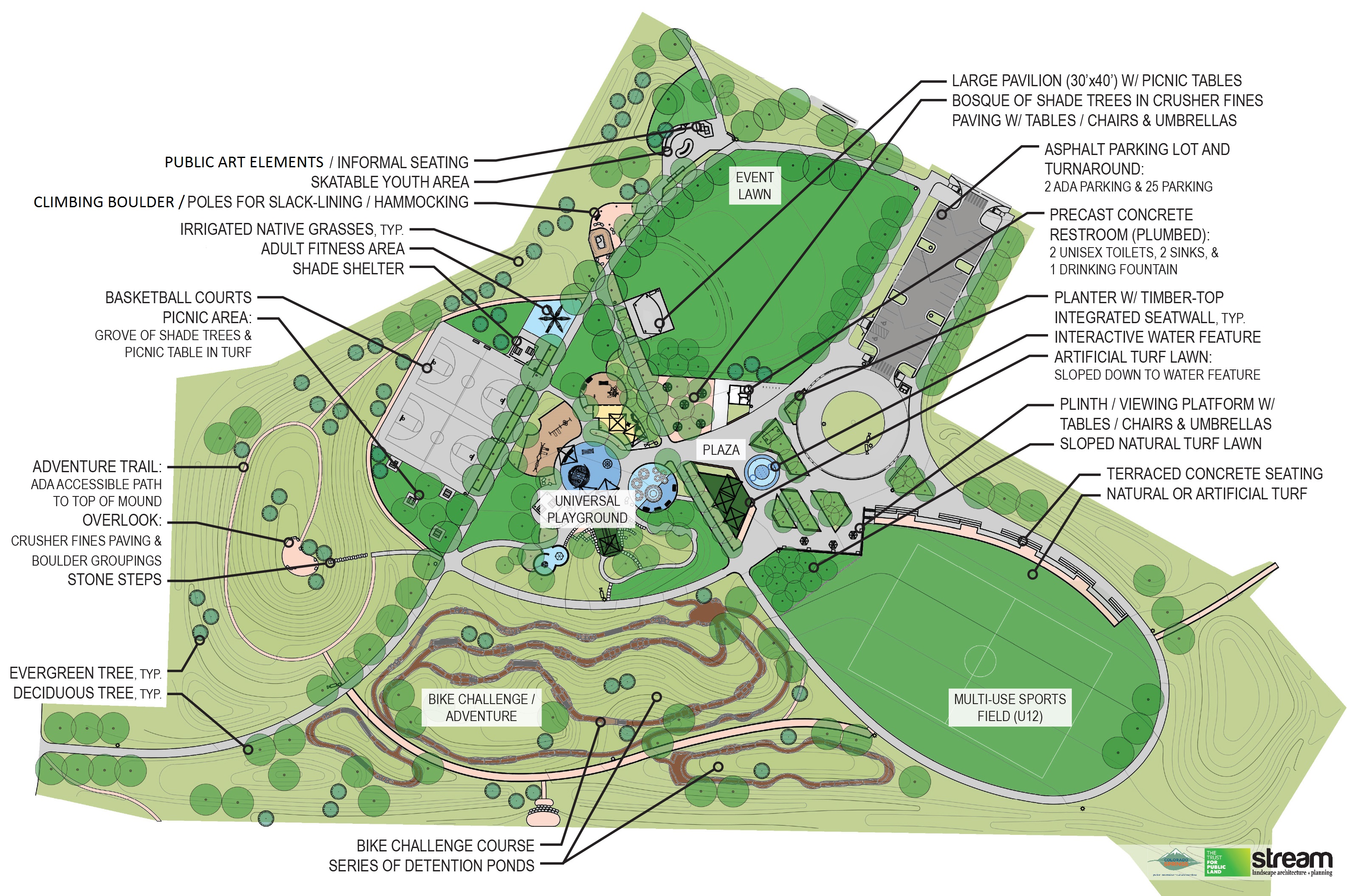

Panorama Park Renovation Colorado Springs

Sales Tax Information Colorado Springs

Shared E-scooter Pilot Program Colorado Springs

City Of Colorado Springs Continues To Garner National Attention Colorado Springs

2

2

Pin On Wilcoxson Auto Specials

2

New Downtown Parking Rates And Hours Go Into Effect Colorado Springs

Cheap Flights From Phoenix Sky Harbor To Colorado Springs From 40 Phx – Cos – Kayak