You can search for any account whose property taxes are collected by the bexar county tax office. The following map displays mortgage and tax foreclosure notices.

Everything You Need To Know About Bexar County Property Tax

Provides services for property tax collections, motor vehicle registration, and titling functions.

Bexar county tax office property search. Please follow the instructions below. Get property records from 3 assessor offices in bexar county, tx. Unfortunately, when it comes to delinquent property taxes, texas still does everything bigger — bexar county is no exception.covering san antonio, texas and surrounding cities, bexar county property taxes.

Easily look up your property tax account, what you owe, print a receipt and pay your property taxes online. These records can include bexar county property tax assessments and assessment. Lisa anderson, pcc chief deputy of administration and operations stephen w.

How does a tax lien sale work? Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. For inquiries pertaining to foreclosures, please contact the county clerk's office.

2021 property taxes must be paid in full on or before monday, january 31, 2022 to avoid penalty and interest. Palacios, cpa, pcc chief deputy of financial reporting department and operations michael cuellar director, motor vehicle registration department. Prior year data is informational only and does not necessarily replicate the values certified to the tax office.

The delinquency date is tuesday, february 1, 2022 and 7%. Bexar county delinquent property taxes. The ability to change your mailing address and set up electronic billing.

They are maintained by various government offices in bexar county, texas state, and at the federal level. Bexar county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in bexar county, texas. As of december 4, bexar county, tx shows 968 tax liens.

After locating the account, you can pay online by credit card or echeck. To improve your search results use quotation marks when searching for a specific phrase. For inquiries or feedback regarding this application, please contact gis@bexar.org.

Box 830248 san antonio, tx 78283 2021 and prior year data current as of nov 5 2021 6:58am. Interested in a tax lien in bexar county, tx?

Within this site you will find general information about the district and the ad valorem property tax system in texas, as well as information regarding specific properties within the district. In order to determine the tax bill, your local tax assessor’s office takes into account the property’s assessed value, the current assessment rate, as well as any tax exemptions or abatements for that property. 411 north frio street san antonio, tx 78207 mailing address:

They are a valuable tool for the real estate industry, offering both buyers. Gutierrez, pcc director, property tax department richard salas, esq. Property owners who have their taxes escrowed by their lender may view their billing information using our search my property program.

Bexar county, tx tax liens and foreclosure homes. You will be able to find: 2022 data current as of dec 2 2021 1:21am.

Address main office 233 n pecos la trinidad vista verde plaza building san antonio, tx 78207. 2021 property tax statements will be mailed the week of october 18th. Whether your taxes are paid or the balance that is due.

Your original, current and previous year’s tax statements. Bexar appraisal district is responsible for appraising all real.

Bexar Appraisal District – Posts Facebook

Bexar County Tax Assessor Collector – 30 Reviews – Tax Services – 233 N Pecos La Trinidad San Antonio Tx – Phone Number – Yelp

Evictions Property Tax Foreclosures In Bexar County Suspended Due To Covid-19 Concerns San Antonio News San Antonio San Antonio Current

Bexar County Commissioners Approve Slightly Reduced Tax Rate For 2022

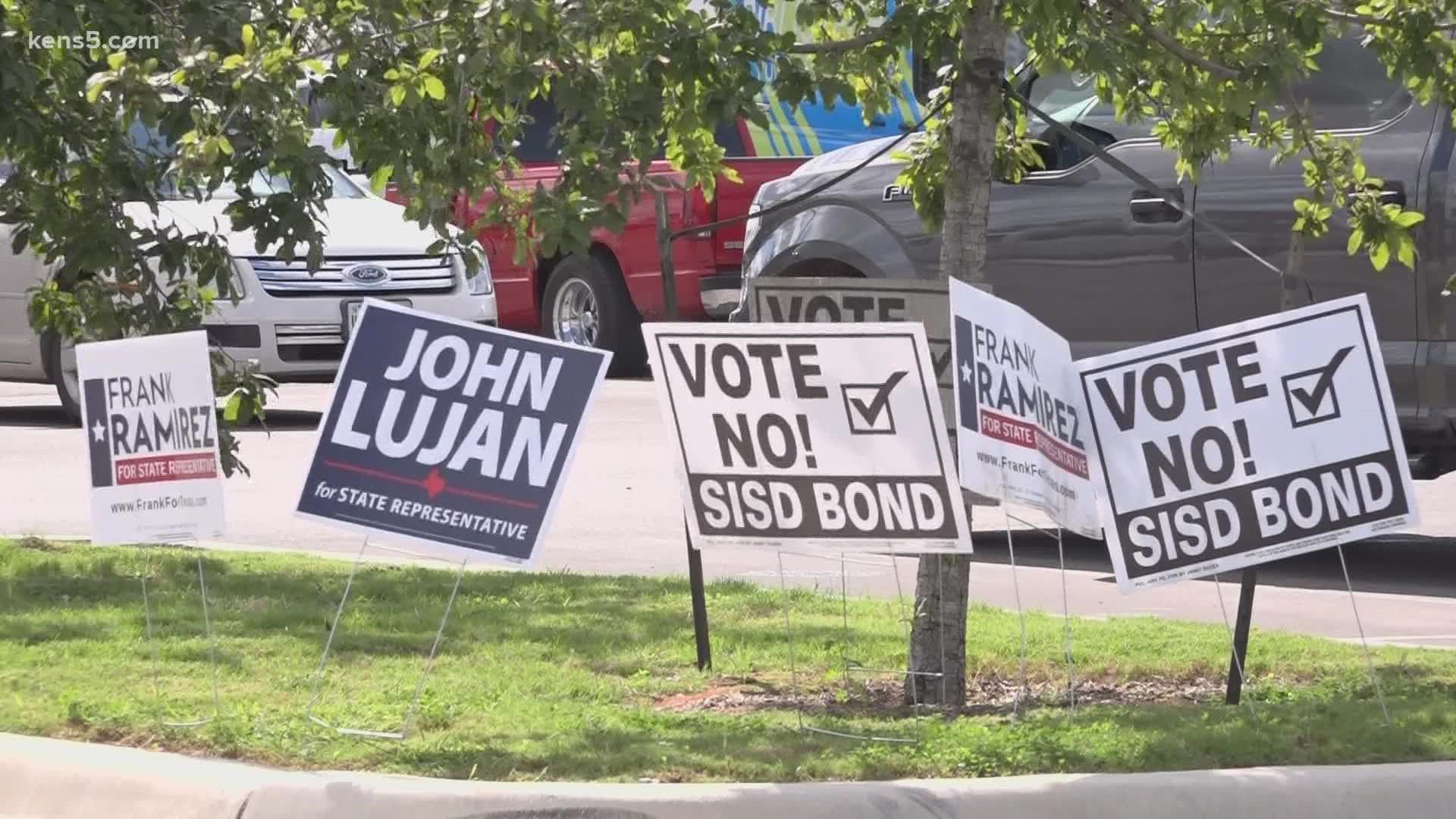

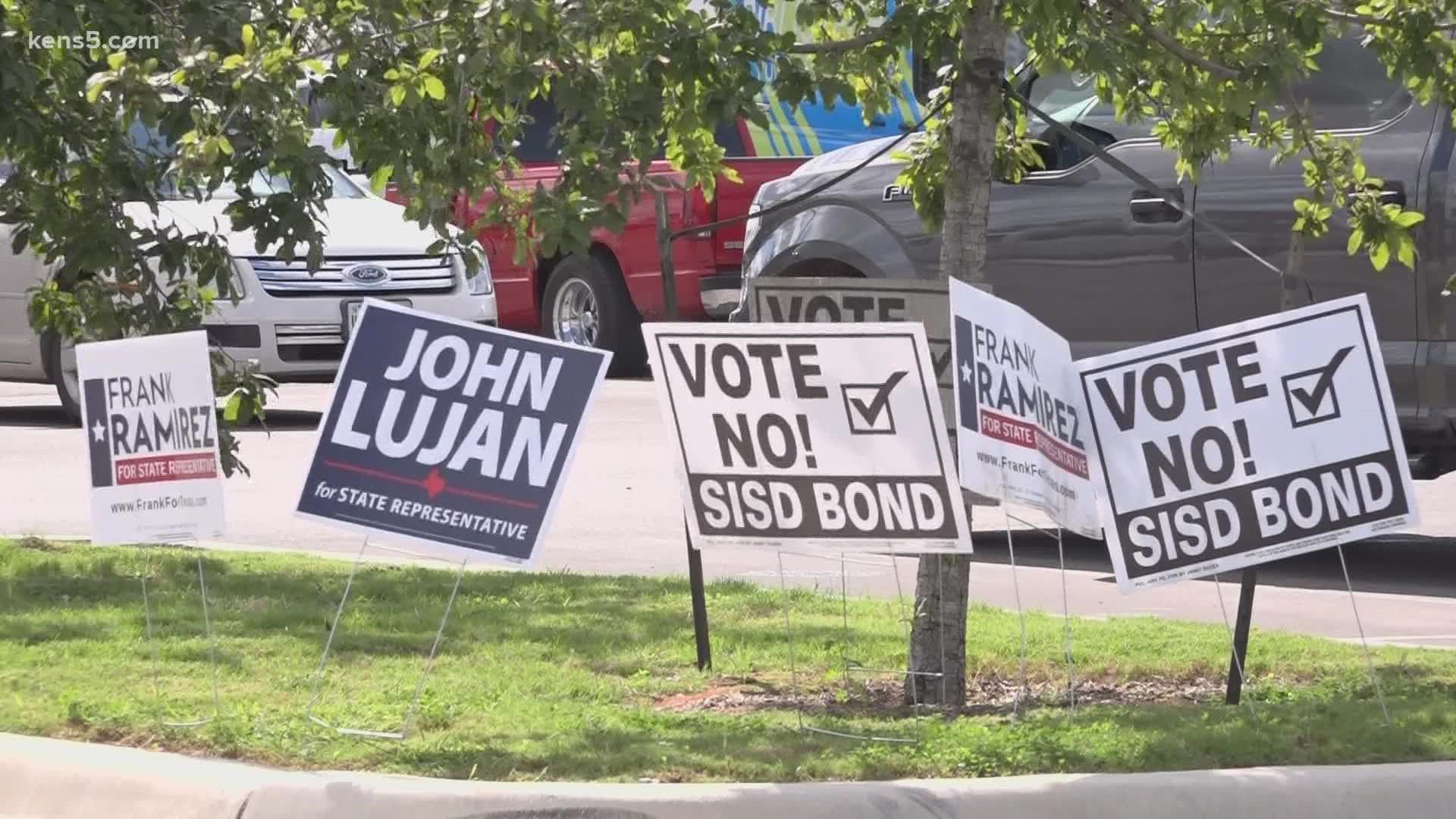

Bexar County Voting In Runoff Outpacing September Turnout Despite Confusion Of Two Separate Elections

Information Lookup Bexar County Tx – Official Website

Human Resources Bexar County Tx – Official Website

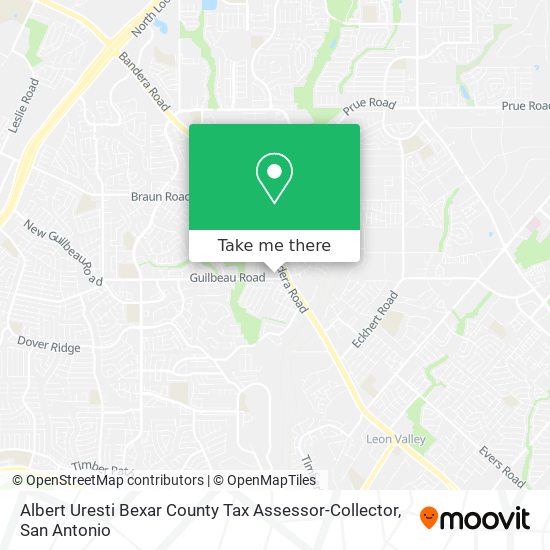

How To Get To Albert Uresti Bexar County Tax Assessor-collector In San Antonio By Bus

Funding Shortfalls Hamper Bexar County Courts Tpr

Real Propertyland Records Bexar County Tx – Official Website

Bexar County Commissioners Approve 28 Billion Budget After Contentious Debate Tpr

Bexar County Texas Property Search And Interactive Gis Map

As Property Tax Bills Arrive Protesters Are Encouraged To Act Now Woai

Bexar County Tax Office To Stay Open But Close Lobbies What That Means For You

Property Tax Information Bexar County Tx – Official Website

Bexar County Appraisal District Bcad And Incorrect Information

Bexar County Tx Almanac

Bexar County Tax Assessor-collector 7663 Guilbeau Rd San Antonio Tx Tax Consultants – Mapquest

Voter Turnout Behaviors Pointing To Results On Bexar County Election Night Kens5com