It is the purchaser’s responsibility to ensure the eligibility of the exemption being claimed. Pick the web sample from the catalogue.

Printable Michigan Sales Tax Exemption Certificates

For resale at retail in section 3, basis for exemption claim.

Michigan sales tax exemption lookup. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. The university of michigan, as an instrumentality of the state of michigan, is exempt from the payment of sales and use taxes on purchases of tangible property and applicable rentals. On november 4, 2021, governor gretchen whitmer signed public act 108 of 2021 into law which exempted feminine hygiene products from michigan’s 6% sales tax.

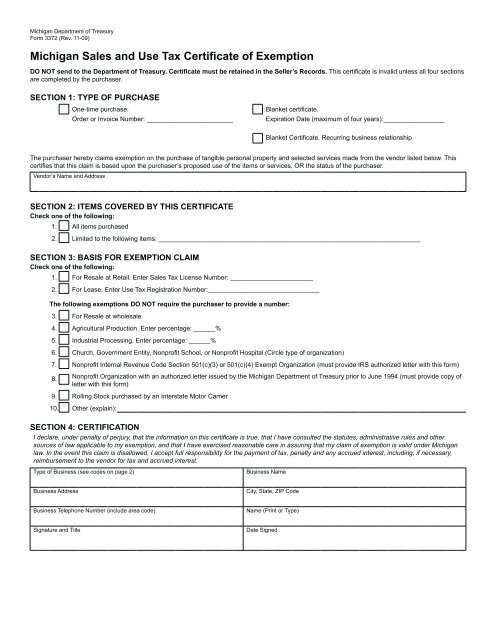

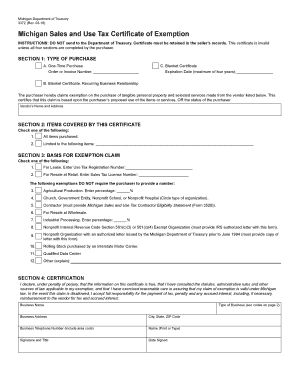

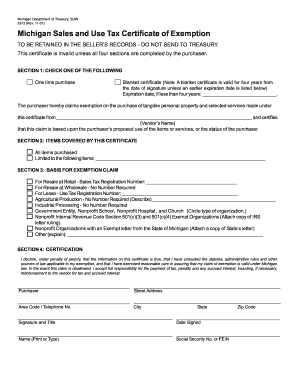

A copy of the federal exemption letter or a letter previously issued by this department must accompany a completed michigan sales and use tax certificate of exemption, form 3372. There are approximately 80 different exemptions. Do not send a copy to treasury unless one is requested.

Register for sales tax if you: Michigan has a 6% statewide sales tax rate , and does not allow. Get and sign form 3372 michigan sales and use tax certificate of 2021 and use tax certificate of exemption form 3372 purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions.

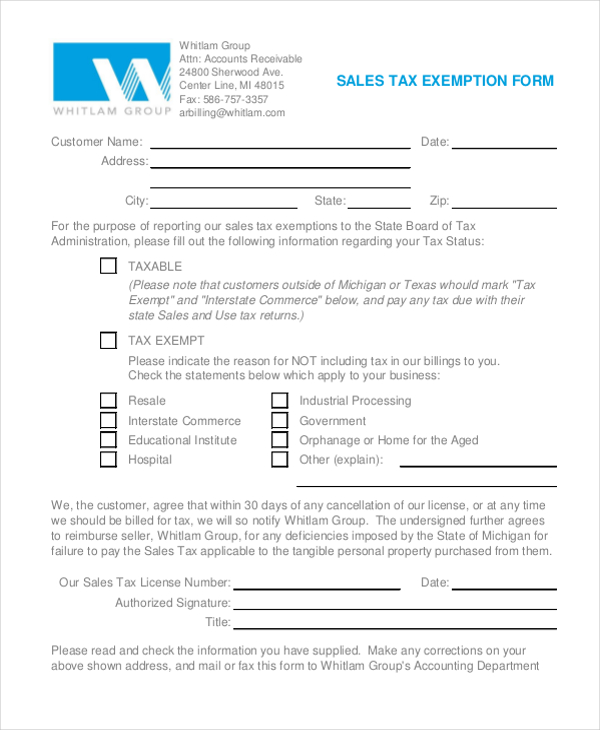

This exemption claim should be completed by the purchaser, provided to the seller, and is not valid unless the information in all four sections. Send a michigan sales tax certificate to michigan gas utilities customer service, p.o. This form can be found.

Iron county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in iron county, michigan. 2020 rates included for use while preparing your income tax deduction. You can use our michigan sales tax calculator to look up sales tax rates in michigan by address / zip code.

Instead, complete form 2271, concessionaire's sales tax return and payment. All claims are subject to audit. Instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions.

Michigan department of treasury 3372 (rev. Ife, nez, crec, cfec, opra, npp, air and water pollution control, and cnph property tax exemption applications can now be submitted electronically to pte@michigan.gov. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

The bipartisan bills were sponsored by reps. Effective november 1, 2021, the new prepaid diesel fuel sales tax rate is 17.2 cents per gallon. This rate will remain in effect through november 30, 2021.

Adhere to our simple steps to get your michigan sales tax exemption well prepared quickly: The purchase or rental must be for university consumption or use, and the consideration for these transactions must move from the funds of the university of michigan. All claims are subject to audit.

Find iron county tax records. Now, creating a michigan sales tax exemption requires at most 5 minutes. Their sales tax license number must be included in the blank provided on the exemption claim.

They are also exempt from sales tax on the fixed charge if they have no use. New property tax exemption comparison chart. It is the purchaser’s responsibility to ensure the.

Effective november 1, 2021, the new prepaid gasoline sales tax rate is 16.6 cents per gallon. For example, article ix, section 4 of the constitution of 1963, exempts nonprofit religious organizations organized as ecclesiastical corporations from real and personal property taxes. Some customers are exempt from paying sales tax under michigan law.

The latest sales tax rates for cities in michigan (mi) state. Sales tax for concessionaires if you will make retail sales at only one or two events in michigan per year, do not complete form 518. 3372, page 2 instructions for completing michigan sales and use tax certifi cate of exemption purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions.

Rates include state, county and city taxes. Instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. By stevejedinak | nov 8, 2021 | michigan taxation |.

Sell tangible personal property to the end user from a michigan location (wholesalers do not need to register). There are a variety of exemptions from the michigan state sales tax, including food, prescribed drugs, and magazines/newspapers. Both unincorporated nonprofit organizations and nonprofit corporations may be exempt from some taxes.

House bills 4939 and 4940 passed the michigan house earlier this week. The following day, on november 5, 2021, the governor signed public act 109 of 2021 into law which further exempted feminine hygiene products. Complete all required information in the necessary.

It is the purchaser’s responsibility to ensure the eligibility of the exemption being claimed. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Prepaid diesel sales tax rate.

These records can include iron county property tax assessments and assessment challenges, appraisals, and income taxes. While not technically sales taxes, a special service tax is collected on restaurant meals and a $0.10 bottle deposit tax.

How To Get A Certificate Of Exemption In Michigan – Startingyourbusinesscom

Mi Sales Tax Exemption Form – Animart

Michigan Sales Tax Guide

Sales Taxes In The United States – Wikipedia

Resale Certificate Michigan – Fill Out And Sign Printable Pdf Template Signnow

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales Tax Exemption – Fill Online Printable Fillable Blank Pdffiller

Free 8 Sample Tax Exemption Forms In Pdf Ms Word

Michigangov

Michigan – Attwiki

Michigangov

Resale Certificate Michigan – Fill Out And Sign Printable Pdf Template Signnow

Michigan Resale Certificate – Fill Out And Sign Printable Pdf Template Signnow

Michigan Sales And Use Tax Certificate Of Exemption

Form 3372 – Fill Online Printable Fillable Blank Pdffiller

How To Get A Sales Tax Exemption Certificate In Indiana – Startingyourbusinesscom

Ysuedu

Michigan Sales Tax Guide

How To Get A Sales Tax Exemption Certificate In Missouri – Startingyourbusinesscom