Amt is a supplemental income tax imposed on individuals and businesses that have exemptions or special circumstances allowing for lower payments of standard income tax. The general sales tax act requires a taxpayer (e.g., a retail seller) to collect the sales tax on transfers of tangible property and remit the tax to the state.

Michigan – Attwiki

Most common agricultural input expenses are exempt from michigan sales tax.

Michigan sales tax exemption for farmers. There is no such thing as a “sales tax exemption number” for agriculture; Based on the language of the statute, however, the technical assistance unit (tau) at the florida department of revenue posits that a taxpayer’s purchase of machinery and equipment used for cultivating medical cannabis could be exempt from florida sales tax, where the machinery and equipment purchased is included in florida’s definition of power farm and irrigation equipment, since. Farms are defined as “any place from which $1,000 or more of agricultural products were produced and.

Exemption certificates without an exemption number will expire and no longer be valid as of july 1, 2022. Questions answered every 9 seconds. Ad a tax advisor will answer you now!

There are certain tax exemptions for people who own farms and work in agricultural production, but to claim the exemption you must meet the requirements for qualification. Under the bills, which are strongly supported by farm bureau, equipment and technology are exempt, and the exemption will be retroactive six years. All claims are subject to audit.

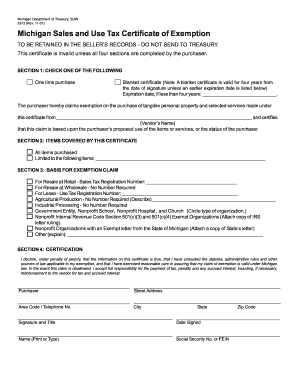

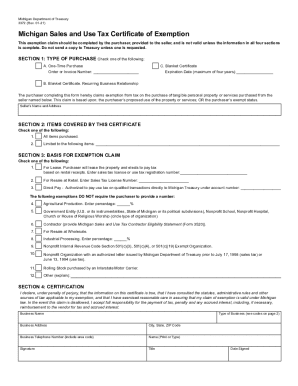

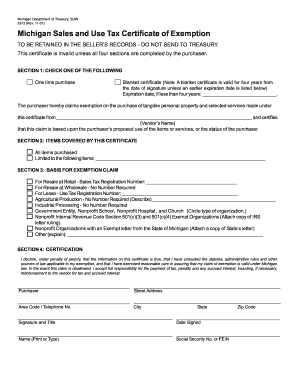

The certificate that qualifying producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption or form 3372 found at website: The depreciation period for farm equipment and machinery is 7 years. Michigan state university extension will often get phone calls from farmers wondering how they can get a tax exempt number so they do not have to pay sales tax on items used for their farm.

It is the purchaser’s responsibility to ensure the eligibility of the exemption being claimed. Many kinds of transactions are exempt from the sales tax, such as sales to nonprofit organizations, churches, schools, farmers, and industrial processors. Law defines “gross proceeds” and “sales price” broadly.

For more information, farmers may contact the. 3372, page 2 instructions for completing michigan sales and use tax certifi cate of exemption purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. One way is for a parcel, with or without buildings, to be classified as agricultural property on the local assessment roll by the first monday of march of each year.

Shortens the depreciation period for farm equipment and machinery to 5 years. Be cautious, farmers should not use their social security number as proof for a sales tax exempt purchase. It is the purchaser’s responsibility to ensure the eligibility of the exemption being claimed.

However, if provided to the purchaser in electronic format, a signature is not required. How do i get a farm tax exempt in michigan? You should never use your social security number for retail purchases.

To clarify, there is no such thing as a “sales tax exemption number” Ad a tax advisor will answer you now! Several examples of exemptions to the state's sales tax are vehicles which have been sold to a relative of the seller, certain types of equipment which is used in the agricultural business, or some types of industrial machinery.

, sales tax exemption for farmers michigan state university extension applies research from msu to help michigan residents solve everyday problems in agriculture munity development nutrition state and local sales tax information taxjar individual state and local sales tax information provided by taxjar state sales tax list by state taxman123 the sales tax charged by state list of states sales tax rates , Instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. Tax exemption statutes are interpreted according to ordinary rules of statutory construction, although they are strictly construed against the taxpayer.

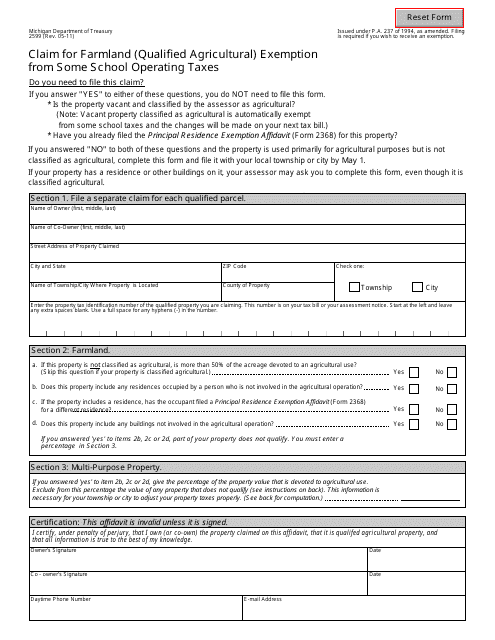

In order to qualify for the exemption, owners of parcels that are not classified agricultural must file an affidavit, form 2599, claiming the exemption with the local assessor by may 1. Michigan sales tax and farm exemption. Must file an affidavit, form 2599, claiming the exemption with the local assessor by may 1.

Instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. In situations where the land may not be actively farmed on may 1, the parcel may still be eligible for the exemption. Exemptions from the sales tax are not allowed unless specifically provided for by law.

An assessor will use the status of the land on may 1st in making their determination for qualification. Questions answered every 9 seconds. Sales tax is set at 6 percent in the state of michigan for all taxable retail sales, with some concessions, however.

All claims are subject to audit. Michigan state university extension will often get phone calls from farmers wondering how they can get a tax exempt number so they do not have to pay sales tax on. In michigan, there are two ways to qualify property for the “ag exemption,” which exempts agricultural property from school operating taxes up to 18 mills.

To treasury’s credit, park said, it originally asked for the bills to help create some clarification and logical framework for.

2021 Form Mi Dot 3372 Fill Online Printable Fillable Blank – Pdffiller

2

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Sales And Use Tax Exemption Certificate Form 149 Tax Exemption Filing Taxes Tax

Form 2599 Download Fillable Pdf Or Fill Online Claim For Farmland Qualified Agricultural Exemption From Some School Operating Taxes Michigan Templateroller

Illinois Grain Farms Impacts Of Removal Of Sales Tax Exemptions Agfax

2021 Form Mi Dot 3372 Fill Online Printable Fillable Blank – Pdffiller

Facebook

Michigan Tax Exempt Form – Fill Online Printable Fillable Blank Pdffiller

Michigan Sales And Use Tax Certificate Of Exemption

Its Official Farms Remain Exempt From State Sales And Use Tax Michigan Farm News

Michigan Resale Certificate – Fill Out And Sign Printable Pdf Template Signnow

Michigan Tax Exempt Form – Fill Online Printable Fillable Blank Pdffiller

2

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

2

2

How To Get A Sales Tax Exemption Certificate In Iowa – Startingyourbusinesscom

How To Get A Certificate Of Exemption In Michigan – Startingyourbusinesscom