Senior citizens application for the 2% uut exemption (pdf, 51kb) Order a current secured property tax bill;

Measure A

For measures q and z:

Alameda county property tax senior exemption. No fee for an electronic check from your checking or savings account. There are a number of alternatives by which a disabled veterans' property tax exemption may be granted: Why am i hearing about it now?

This program gives seniors (62 or older), blind, or disabled citizens the option of having the state pay all or part of the property taxes on their residence until the individual moves, sells the property, dies, or the title is passed to an ineligible person. For payments made online, a convenience fee of 2.5% will be charged for a credit card transaction; How to change your mailing address;

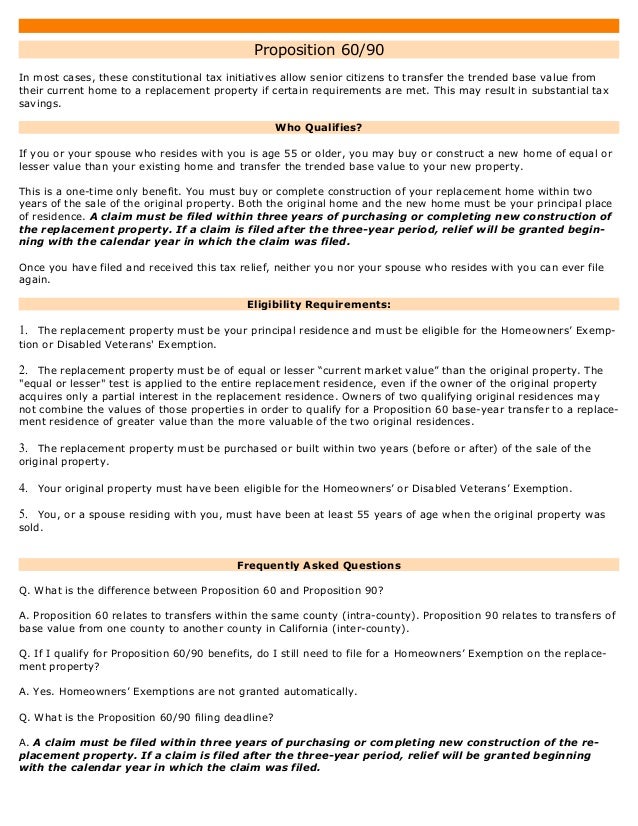

Most require seniors to apply by a certain date, often in may or june, to get an exemption for the tax year that starts july 1. Proposition 60 & proposition 90, revenue and taxation code section 69.5). If you have never heard of the alameda county property tax senior exemption, it is time to fire up donotpay and learn what exemptions you qualify for and how to lower your future tax bills.

The applicant must turn 65 yearsold on or before june 30, 2016 and own and occupy his/her property as a primary residence. Alameda county has one of the highest median property taxes in the united states, and is ranked 68th of the 3143 counties in order of median property taxes. Some will grant an exemption retroactively for applicants who miss.

June 30 deadline for parcel tax exemption. Senior citizens & disabled persons. Pay current year and supplemental, secured and unsecured tax bill;

California property tax senior exemption—school district taxes you can qualify for a homestead exemption for school district taxes if you are: This article will show you some of the most common property tax exemptions for seniors and how to determine whether you’re eligible for them. Alameda county collects, on average, 0.68% of a property's assessed fair market value as property tax.

You must meet the minimum age for a senior property tax exemption ; The exemption application has been approved for measure z only. Revenue from the parcel tax will be used to bring ausd employee salaries, which have long lagged behind those of neighboring districts.

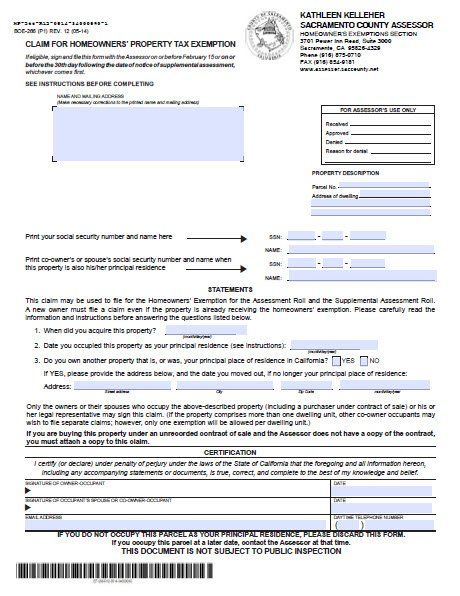

The following documents are provided in portable document format (pdf) and require the free adobe reader. Property owned by an entity organized and operating exclusively for religious purposes that was granted a property tax exemption from the alameda county assessor’s office according to california law. Assessor la encourages alameda county homeowners to apply for the homeowners’ property tax exemption that can save owners of residential property $70 off their property tax bill each year.

Look up unsecured property tax Claim for disabled veterans' property tax exemption. California propositions 60 and 90.

The notice of special tax lien is not a traditional financial lien and does not mean that any amount of property tax is delinquent or has not been paid. Under certain conditions, persons aged 55 and older or severely disabled persons of any age may transfer the proposition 13 factored base year value of their principal residence to a residence acquired or built as its replacement (ref. This is how it works:

Look up secured property tax ; The exemption application has been approved for measures d & q only. The person claiming the exemption must live in the home as their primary residence

A person filing for the first time on a property may file anytime after the property or claimant becomes eligible, but no later than february 15 to receive the full exemption for that year. The park district recorded the current “notice of special tax lien” in the alameda county office of the clerk recorder on january 31, 2019 and in the contra. The tax type should appear in the upper left corner of your bill.

Once a homeowner submits an application and qualifies for the exemption, the property’s assessed value is reduced by $7,000, thereby lowering the property tax bill by approximately. The exemption discount will be applied 2 billing cycles after receipt of the application. The exemption shall apply in the same proportion that is exempted from ad valorem property tax.

The median property tax in alameda county, california is $3,993 per year for a home worth the median value of $590,900. Assessed value, exemption and tax payment information; The deadline to file for an exemption from the alameda unified school district’s measure a parcel tax is june 30.

Propositions 60 and 90 are pieces of legislation that allow homeowners 55 or older to move into a new home without substantially increasing their property tax obligation. Office hours, location and directions; The exemption is available to an eligible owner or the veteran spouse of an owner of a dwelling.

Look up supplemental property tax ;

How To File Your Form 571-l Business Property Statements Bps – San Mateo County Assessor-county Clerk-recorder Elections

Senior Citizens Disabled Persons – Alameda County Assessor

Alameda County Property Tax Due Date 2019 – Tax Walls

How Did Thousands Of Contra Costa Tax Bills Miss Senior Exemption

Property Tax Calculator – Smartasset

2

Grand Jury Santa Clara County Schools Impede Tax Exemptions

Property Tax Calculator – Smartasset

2

Prop 60 And 90 Faqs Want To Own A Palm Springs Area Home And Pay Le

Alameda County Business Personal Property Tax – Property Walls

City Of Oakland Check Your Property Tax Special Assessment

Alameda County Property Tax Due Date 2019 – Tax Walls

2

Understanding Californias Property Taxes

Horgan Seniors Be Aware Of A Possible Tax Exemption

Alameda Property Tax Due Date 2016 – Property Walls

Homeowners Over 65 Can Often Get Property Tax Exemptions

Formsbrochures – Alameda County Assessor