The assessed value is then applied to the mill levy (set by the board of county commissioners) to derive the exact tax dollar amount due each year. The 2021 state personal income tax brackets are updated from the wyoming and tax foundation data.

Wisconsin Sales Tax – Small Business Guide Truic

The state sales tax rate in wyoming is 4.000%.

Wyoming tax rate lookup. To access the tax information system please click here. • if the total tax rate was 68 mills, the formula would look like this: See the publications section for more information.

This is primarily due to the cowboy state’s complete lack of state or local income taxes. Counties, cities, towns, villages, school districts, and special districts each raise money through the real property tax. Fifty percent (50%) of the taxes are due by november 10 in each year and the remaining fifty percent (50%) of the taxes are due by may 10.

Click here for a guide to assist with using the system. Find real property tax services information, such as assessment data, web mapping, and more. Tax bill lookup instructions tax estimator tax rates parks and recreation recreation.

Wyoming has a statewide sales tax rate of 4%, which has been in place since 1935. This site is now available for your review. The minimum combined 2021 sales tax rate for bill, wyoming is.

The balance of any tax not paid is delinquent after the day on which it is payable and shall bear interest at 18% per year until paid or collected. Updates and tax rate liability for technical questions about searching for your address or improving the results, contact the gis team. Some cities in colorado are in process signing up with the suts program.

The use tax is the same rate as the tax rate of the county where the purchaser resides. Search results will be listed, click on the parcel number in blue next to the correct record. Prescription drugs and groceries are exempt from sales tax.

State wide sales tax is 4%. Use our tool to estimate your upcoming property taxes. The county sales tax rate is %.

The wyoming (wy) state sales tax rate is currently 4%. Enter your search criteria, either last name, address or parcel number. Taxes are due and payable at the office of the county treasurer of the county in which the taxes are levied.

C corporations versus s corporations. The median property tax in wyoming is $1,058.00 per year for a home worth the median value of $184,000.00. Depending on local municipalities, the total tax rate can be as high as 6%.

For questions about the taxability of your business, contact a tax specialist. Please use the following credentials to enter the system: The $1,352 median annual property tax payment in wyoming is also quite low, as it's around $1,200 below the national mark.

Wyoming property tax rate 2021. Wyoming has recent rate changes (thu apr 01 2021). Currently, the level of assessment is 11.5% for industrial use property and 9.5% for residential, agricultural and all other property.

Wyoming county assessor's office services. Cities that have not yet signed up will be shown with a red exclamation mark beside their sales tax rate. Click the link below to access the tax bill lookup.

Wyoming has among the lowest property taxes in the united states. The wyoming county assessor's office is pleased to make assessment data available online and free of charge. Printable pdf wyoming sales tax datasheet.

For example, let’s say you make $50,000 per year. The office makes every effort to produce the most accurate information possible. In addition, local and optional taxes can be assessed if approved by a vote of the citizens.

On the left hand side of the screen click on “tax information search.”. The page will open in a new window. No warranties, expressed or implied are provided for the data herein, its use, or interpretation.

They are another one of the tax advantages of living in wyoming. The wyoming county tax assessor is the local official who is responsible for assessing the taxable value of all properties within wyoming county, and may establish the amount of tax due on that property based on. This is the total of state, county and city sales tax rates.

With local taxes, the total sales tax rate is between 4.000% and 6.000%. The bill sales tax rate is %. • taxable value x tax rate = tax due or $9,500 x 0.068 = $646.00.

The money funds schools, pays for police and fire protection. In new york state, the real property tax is a tax based on the value of real property. The tax history will be located at the bottom of the page,.

Wyoming has 167 cities, counties, and special districts that collect a local sales tax in addition to the wyoming state sales tax.click any locality for a full breakdown of local property taxes, or visit our wyoming sales tax calculator to lookup local rates by zip code. Calling wyoming home means living in a state with a minimal tax burden, which is excellent news for your paycheck. See detailed property tax report for 628 route 20a, wyoming county, ny.

Welcome to the sales and use tax simplification (suts) lookup tool! The result is assessed value. 31 rows wyoming (wy) sales tax rates by city.

Legislation ( hb 13) increasing the dtc. The wyoming sales tax rate is currently %.

44 Fresh New January Arrivals From Amazon Fashion Were Guessing Your Winter 2020 Fashion Arsenal Is Looking Pretty Sparse Blusas Bonitas Moda Estilismo Bonito

Philadelphia-county Property Tax Records – Philadelphia-county Property Taxes Pa

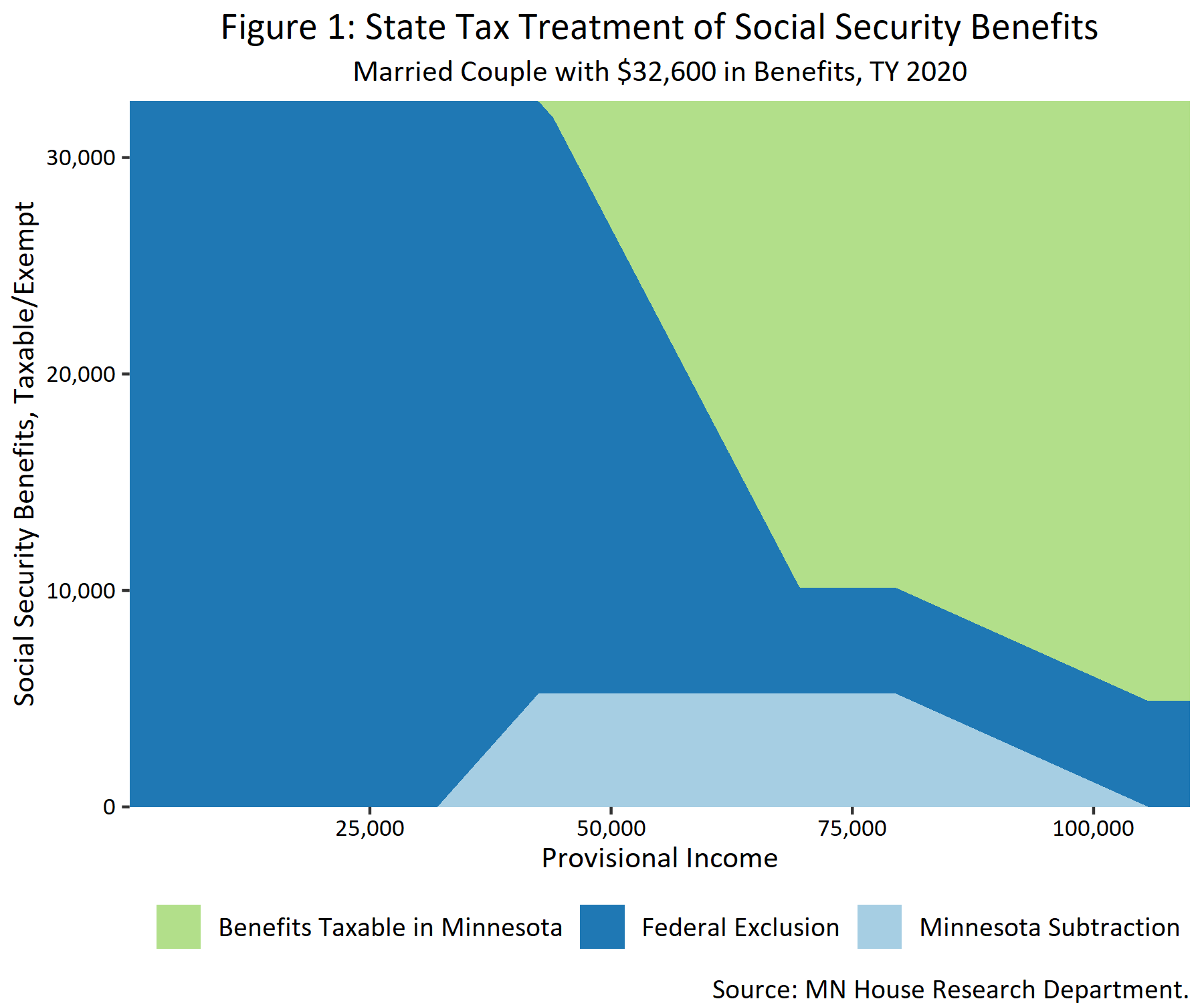

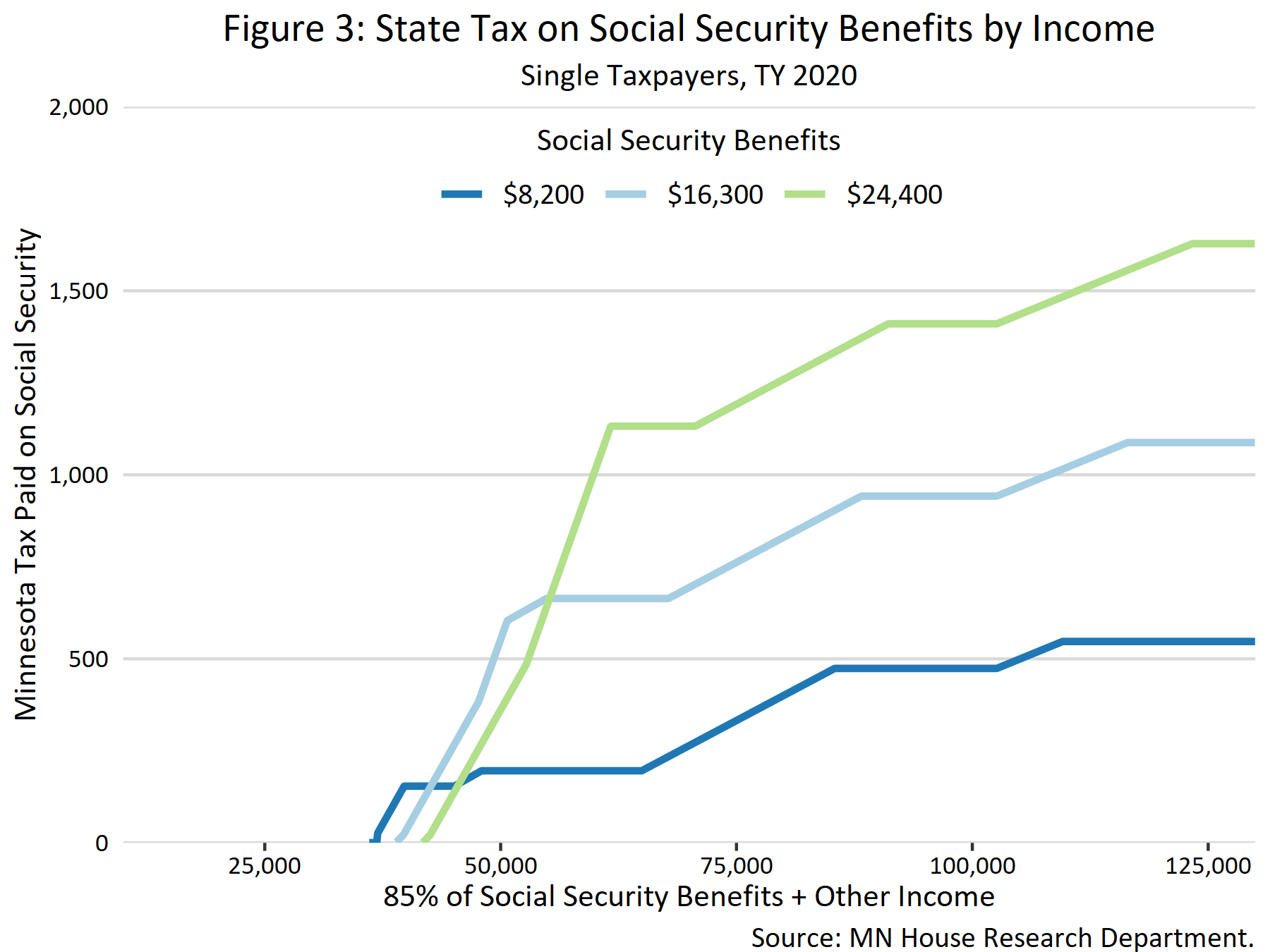

Taxation Of Social Security Benefits – Mn House Research

Taxation Of Social Security Benefits – Mn House Research

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Car Tax By State Usa Manual Car Sales Tax Calculator

City Of Powell Ohio Taxes

Car Tax By State Usa Manual Car Sales Tax Calculator

Account Id And Letter Id Locations Washington Department Of Revenue

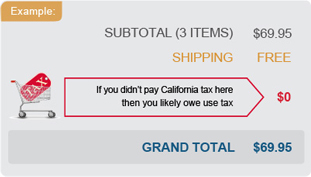

California Use Tax Information

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

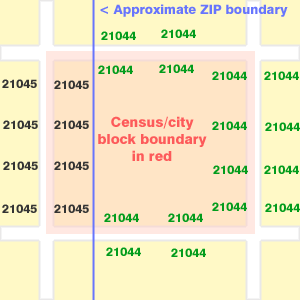

Free Zip Code Map Zip Code Lookup And Zip Code List Zip Code Map Coding Map

Suffolk-county Property Tax Records – Suffolk-county Property Taxes Ny

Account Id And Letter Id Locations Washington Department Of Revenue

Look Uppay Property Taxes

Car Tax By State Usa Manual Car Sales Tax Calculator

Look Uppay Property Taxes

Wyoming Sales And Use Tax Rates Lookup By City Zip2tax Llc

Usa Gst Rates Explained – Wise