The deed book and property tax records are only in my grandmother’s name. In this article we go over laws specific to west virginia as well as ways that you can receive your inheritance cash now.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

The value of these minerals in based on wv code procedures and is the same for all counties in wv.

Wv state inheritance tax. County of _____, state of west virginia, being of sound mind, not acting under duress or undue influence, and fully understanding the nature and extent of all my property and of this disposition thereof, do hereby make, publish, and declare. Hawaii and washington state have the highest estate tax top rates in the nation at 20 percent. Estate and inheritance taxes payable by reason of my death in respect of all items

If the gross estate does not exceed the exemption equivalent in effect during the year of death you will not have to file a federal estate tax return (form 706) and you will not have to file a west virginia estate tax return. Pennsylvania, for instance, has an inheritance tax that applies to any assets left by someone living in the state, even if the inheritor lives out of state. The surviving spouse’s share depends on the length of the marriage, up to 50 percent if the couple was married 15 years or more.

Special needs planning ensures that the inheritance you leave for your loved ones does not disqualify them from receiving governmental assistance. If you do not make a will before that time, all of your assets are considered intestate and are distributed according to this system. Most states, including west virginia, don't currently collect an estate tax.

West virginia death inheritance laws. Estate and inheritance tax laws when you go through probate administration it’s important to keep in mind the specific. You will pay 60% of the appraised value on the minerals at the levy rate for your county.

Tax planning is an integral part of estate planning and is often the motivation for doing estate planning in the first place. (b) upon the occurrence of an event terminating or partially terminating a trust, the trustee shall have and exercise all powers appropriate to wind up the administration of the trust and shall proceed expeditiously to distribute the trust property to the persons entitled to it, subject to the right of the trustee to retain a reasonable reserve for the payment of debts, expenses and taxes. However, estates in west virginia may still be subjected to the federal estate tax.

Inheritence / estate tax everyone is pleased to learn that west virginia has adopted the federal guidelines with regard to inheritance and estate tax. This allows turbotax to include credits you may be due for paying tax in another state. Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the state tax department’s primary mission is to diligently collect and accurately assess taxes due to the state of west virginia in support of state services and programs.

The state tax is payable at the time of delivery, acceptance, or presenting for recording of the document. Quickly find answers to your inheritance rights questions with the help of a local lawyer. Does west virginia have an inheritance tax or an estate tax?

However, state residents must remember to take into account the federal estate tax if their estate or the estate they are inheriting is. That means if you inherit property, either real property, personal property, or intangible property like financial accounts or cash, you will not have to pay an inheritance tax in wv west virginia inheritance tax on the value of the inherited property. Is there an inheritance tax in west virginia?

The sales record for the house also lists the owner as the estate of and my grandmother’s name. Like most states, there is no west virginia inheritance tax. Eight states and the district of columbia are next with a top rate of 16 percent.

Surviving spouses in west virginia have the right to take what is called an elective share of the estate instead of inheriting under the will or as provided under intestacy laws. Effective jan 1, 2013, if congress does nothing about the federal estate tax, then the tax will return to the status that existed on jan 1, 2000, which would make the estate tax equal to the federal tax credit given against payment of state estate tax. You will be taxed only on income sourced in west virginia and not on your other income.

They all use the same formula methodology. There is no inheritance tax in west virginia. If you make a will, but leave out some.

For an estate of $150,000, the tax would be $1,440. However, you could owe inheritance tax in a different state if someone living there leaves you property or assets. Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the state tax department’s primary mission is to diligently collect and accurately assess taxes due to the state of west virginia in support of state services and programs.

There are three main federal tax returns that you'll need to consider filing in the year after someone has died, but it's unusual to file all three.in addition, you'll have to file an individual state income tax return for the decedent, and, in some states, a state estate or trust income tax return, or a state inheritance or estate tax return. Massachusetts and oregon have the lowest exemption levels at $1 million, and connecticut has the highest exemption level at $7.1 million. Mineral interests in wv are taxed the same as your home.

West virginia collects neither an estate tax nor an inheritance tax. Learn about inheritance rights on west virginia today. In addition to the state excise tax described in this subsection, there is assessed a fee of $20 upon the privilege of transferring real estate for consideration.

Before january 1, 2005 west virginia did collect an estate tax that was in proportion to the overall federal estate tax bill, but when the federal tax law changed west virginia's estate tax was effectively eliminated. West virginia law establishes a system for distributing the intestate portion of your assets when you die. West virginia inheritance and gift tax.

Wv has no inheritance or estate tax.so, the answer is $0.

How Is Tax Liability Calculated Common Tax Questions Answered

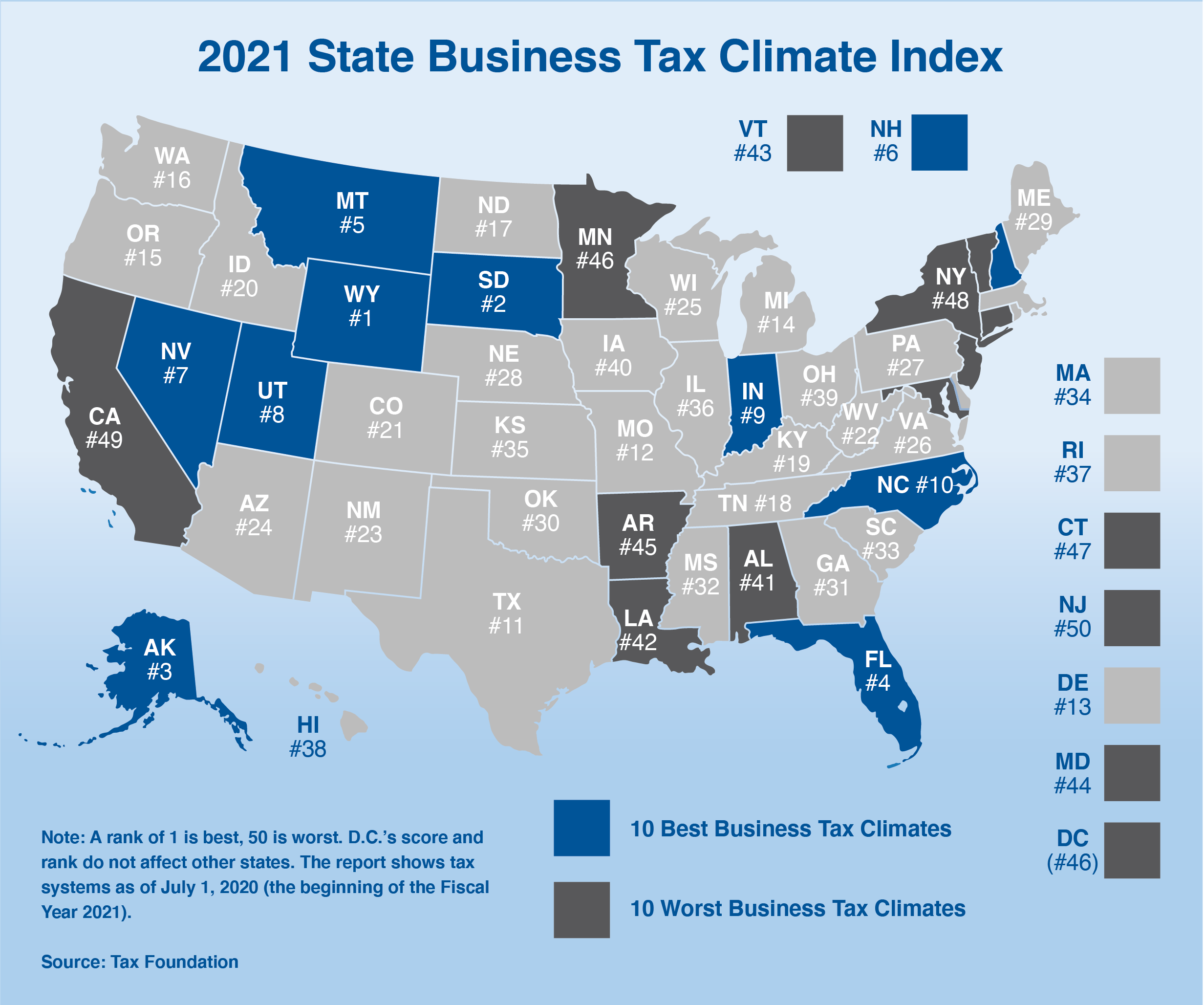

Jobs Research And Development And Investment Tax Credits As Of July 1 2012 – Tax Foundation Map State Tax Business Tax

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

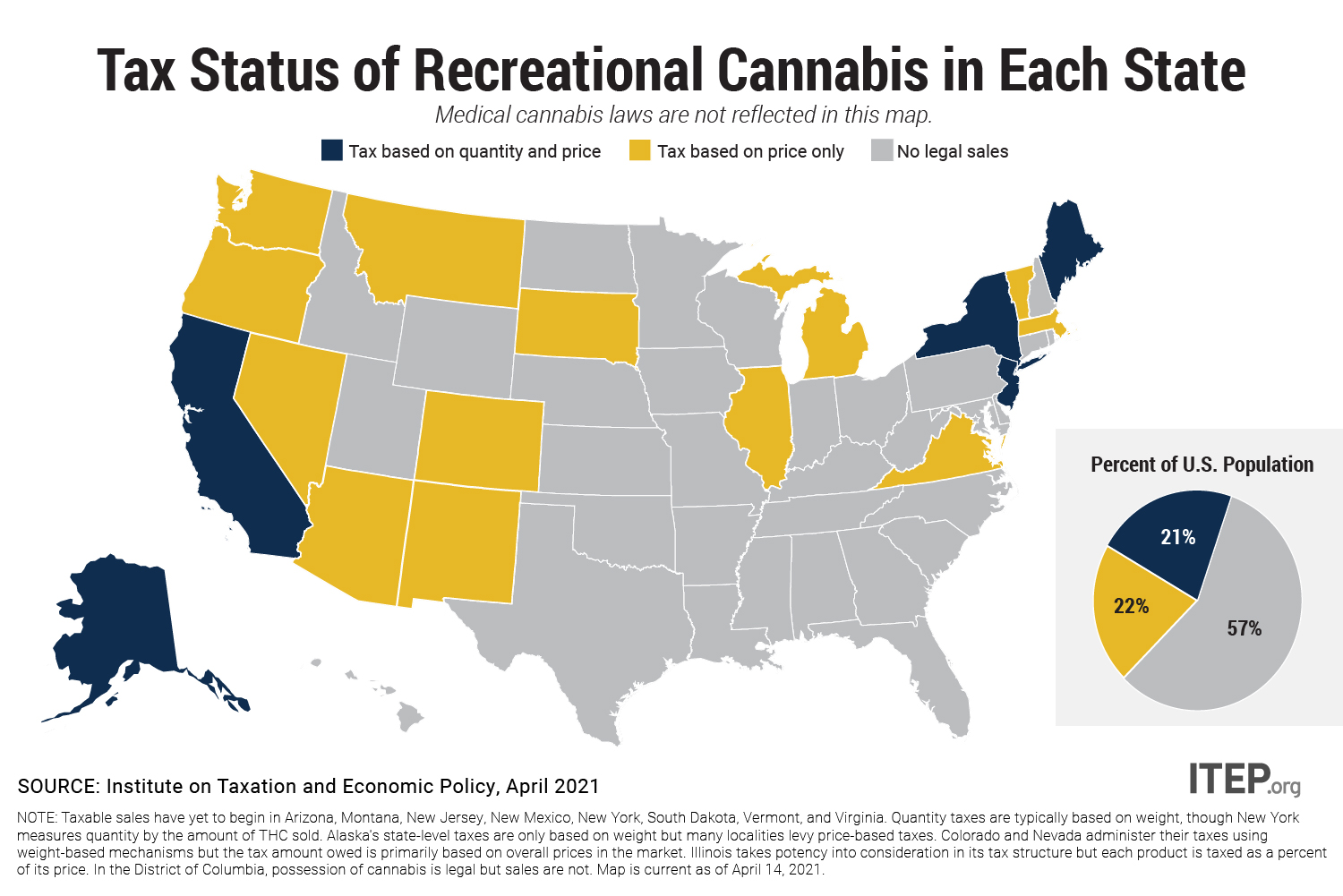

Maps Itep

Virginia Estate Tax Everything You Need To Know – Smartasset

States With Highest And Lowest Sales Tax Rates

Maps Itep

Virginia Estate Tax Everything You Need To Know – Smartasset

Moving Toward More Equitable State Tax Systems Itep

How Is Tax Liability Calculated Common Tax Questions Answered

Altered State A Checklist For Change In New York State – Empire Center For Public Policy

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Is Tax Liability Calculated Common Tax Questions Answered

Wheres My Tennessee Tn State Tax Refund Taxact Blog

State Estate And Inheritance Taxes Itep

Panoramio – Photo Of Pineville West Virginia Wyoming County West Virginia Appalachia

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The States With The Highest Capital Gains Tax Rates The Motley Fool