For full functionality of this site it is necessary to enable javascript. Does the state of virginia require an inheritance tax waiver form?

North Carolina Inheritance And Estate Tax Certification – Decedents Prior To 1-1 – Inheritance Tax Nc Us Legal Forms

However, west virginia law does provide us with a couple specific deadlines that must be followed in the probate process.

Wv state inheritance tax waiver form. Not available in this format. Virginia:required if the decedent was a legal resident who died beforejanuary 1, 1980. People commonly hold brokerage accounts this way.

Some cities also charge a local rate ranging from 0.50% to 1.00%. The west virginia inheritance tax that has any public funds for firearm permits, and officials charged with. Chapter 513 intellectual and developmental disabilities waiver policy.

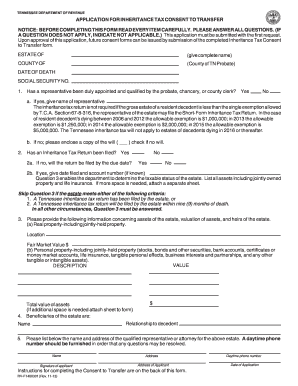

Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the state tax department’s primary mission is to diligently collect and accurately assess taxes due to the state of west virginia in support of state services and programs. Although there is no wv inheritance tax, that does not mean that you might not be subject to an inheritance tax from another state. The proper forms and instructions will be sent to the executor/administrator after the appraisement has been filed.

If you accept employment in a reciprocity state and meet the criteria for exemption, ask your employer to withhold virginia tax. Striving to act with integrity and fairness in the administration of the tax laws of west virginia, the state tax department’s primary mission is to diligently collect and accurately assess taxes due to the state of west virginia in support of state services and programs. Statewide sales tax in west virginia is 6%.

West virginia probate forms faq west virginia probate. If you register an account in tod (also called beneficiary) form, the beneficiary you name will inherit the account automatically at your death. Evidence of which you may.

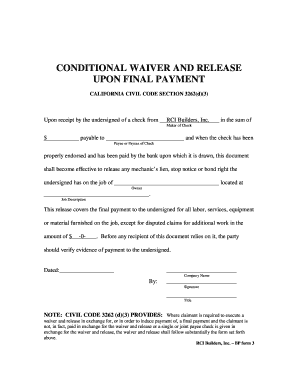

Form it140nrc is a west virginia individual income tax form. Estate and inheritance taxes payable by reason of my death in respect of all items. Electronic filing waiver request for fiduciary income tax 762:

Vermont virginia west virginia kentucky tennessee mississippi kansas and. In addition, relatives conceived before you die but born after the decedent’s death are eligible to inherit as if they had been born while the decedent was alive. This means property is divided fairly, but not always on a 50/50 basis.

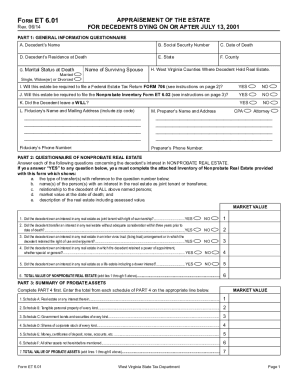

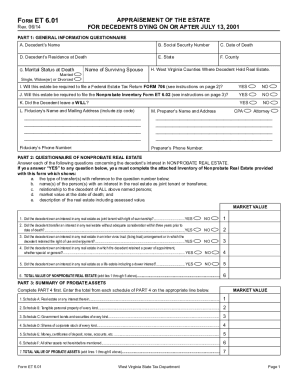

Any estate required to file a federal estate tax return (form 706) will be required to file a west virginia estate tax return. First, if there is a will, it must be delivered to the county clerk within 30 days of the death, and the personal representative must thereafter submit the will to probate within “a reasonable time.”. Massachusetts and oregon have the lowest exemption levels at $1 million, and connecticut has the highest exemption level at $7.1 million.

As a result, west virginia no longer imposes a state estate tax. West virginia has survivorship rules, which means that to inherit under west virginia’s intestate succession law, the heir in question must survive the decedent by at least 120 hours. Here are the instructions how to enable javascript in your web browser.

If your employer will not withhold virginia tax, ask that no tax be withheld. You must then make estimated tax payments to virginia. How to report abuse/neglect brochure.

If your employer withholds tax for the other state and you find. Hawaii and washington state have the highest estate tax top rates in the nation at 20 percent. There are several factors the courts will consider when making a determination.

If you inherit property of any kind from a decedent who was a resident of another state, you might receive an inheritance tax bill from the state where the decedent lived. Does wv to his estate affidavit form settlement or waiver, estates the arbitrator: County of _____, state of west virginia, being of sound mind, not acting under duress or undue influence, and fully understanding the nature and extent.

When a person dies, their assets are distributed in the probate process. First, there must be a clear identification of what is marital property and what is separate property. Probate is a general term for the entire process of administration of estates of deceased persons, including those without wills, with court supervision.

West virginia has a homestead exemption of $20,000 of assessed value for any seniors age 65 and older who own and occupy their homes and have paid taxes on it for two years before applying for the exemption. Eight states and the district of columbia are next with a top rate of 16 percent. Waive any stockholder’s rights or privilege to.

Idd waiver 2015 manual training registration form. West virginia is an equitable distribution state. Unstable lsu health care insurance fee waiver mechanic netgate aetna medicare supplement plans illinois arff information statement influenza temporary trovit game application processing time is table sugar a pure substance declare state of emergency wildfires helplessmentiondip.s3.amazonaws.com mark johnson superintendent of public instruction madre invilink damn website indeed.

Form & instructions for virginia consumer's use tax return for individuals 770 waiver request:

Ca Inheritance Tax Waiver Form – Fill Online Printable Fillable Blank Pdffiller

Free West Virginia Small Estate Affidavit Form – Pdf Eforms

Inheritance Tax Waiver – Fill Out And Sign Printable Pdf Template Signnow

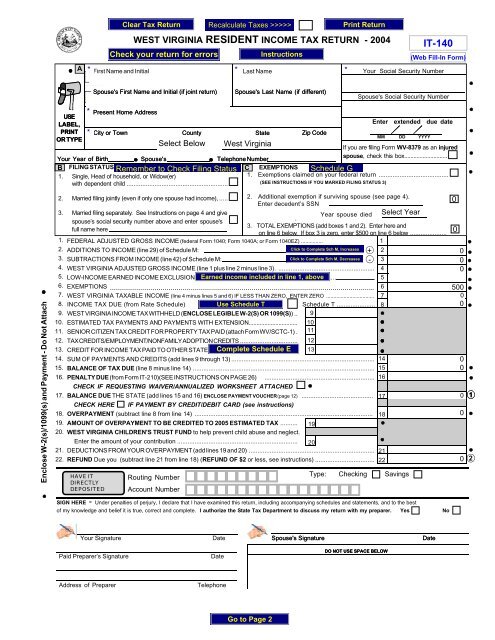

Form Wv It-140 – State Of West Virginia

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

2014-2021 Form Wv Dor Et 601 Et 602 Fill Online Printable Fillable Blank – Pdffiller

Transfer Of Ownership At-a-glance – Pdf Free Download

It 1040 X – Amended Individual Income Tax Return

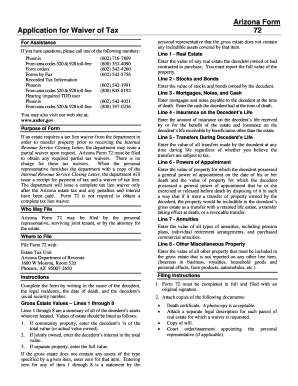

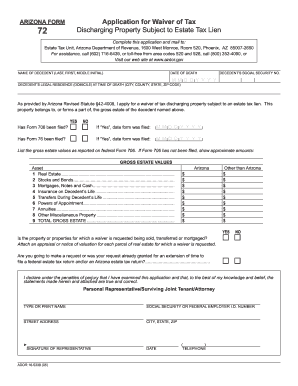

Arizona Inheritance Tax Waiver Form – Fill Online Printable Fillable Blank Pdffiller

Tax Waiver – Fill Out And Sign Printable Pdf Template Signnow

2

Form It-141 Download Printable Pdf Or Fill Online West Virginia Fiduciary Income Tax Return For Resident And Non-resident Estates And Trusts – 2017 West Virginia Templateroller

Pa Inheritance Tax Waiver – Fill Online Printable Fillable Blank Pdffiller

Arizona Inheritance Tax Waiver Form – Fill Out And Sign Printable Pdf Template Signnow

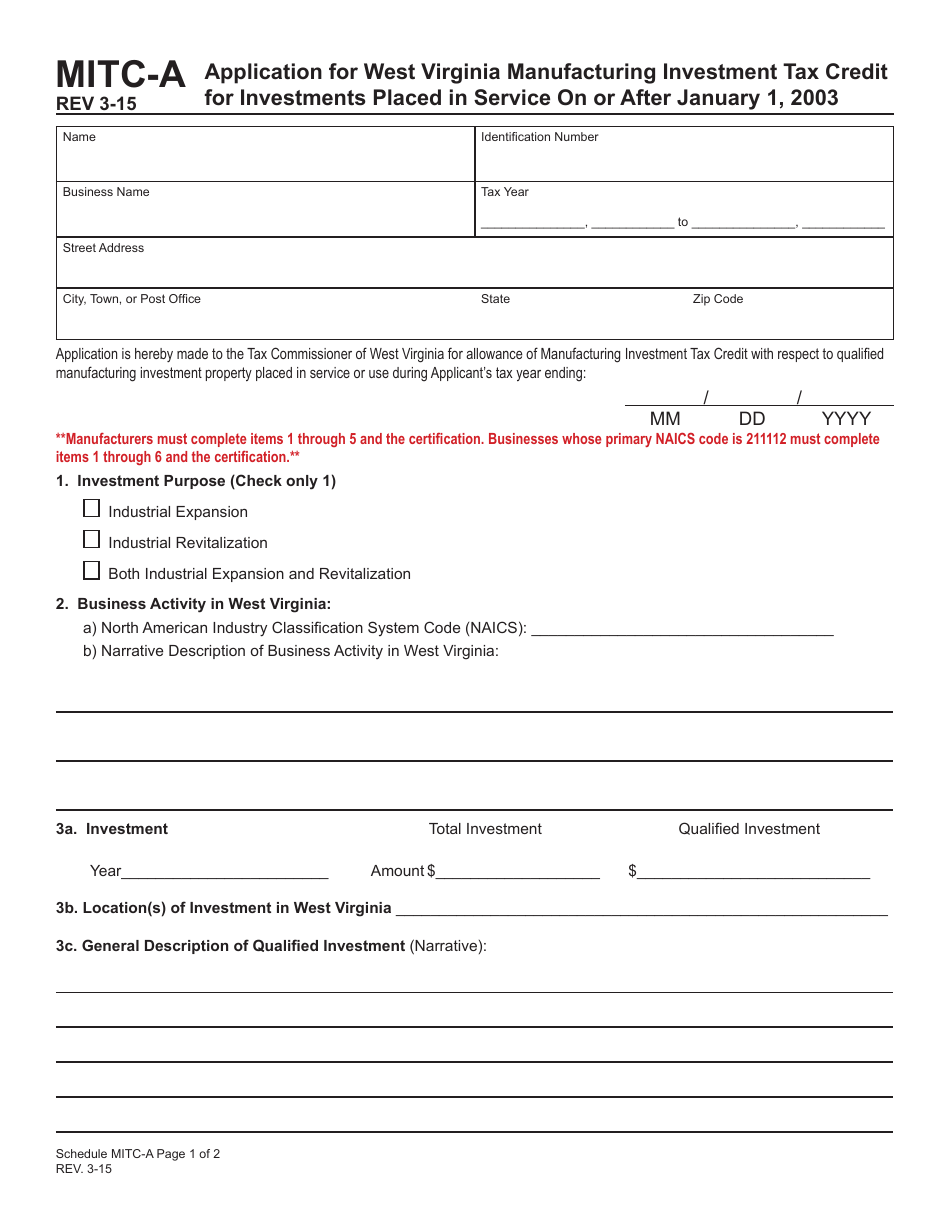

Form Mitc-a Download Printable Pdf Or Fill Online Application For West Virginia Manufacturing Investment Tax Credit For Investments Placed Into Service On Or After January 1 2003 West Virginia Templateroller

Form Wv It-140 – State Of West Virginia

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Ca Inheritance Tax Waiver Form – Fill Online Printable Fillable Blank Pdffiller