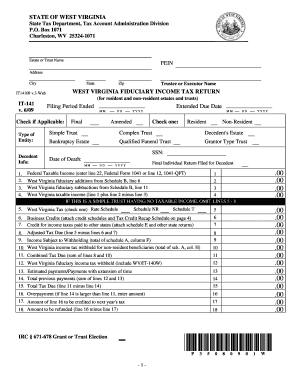

Tax return will also be required to file a west virginia estate tax return. Install the signnow application on your ios device.

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

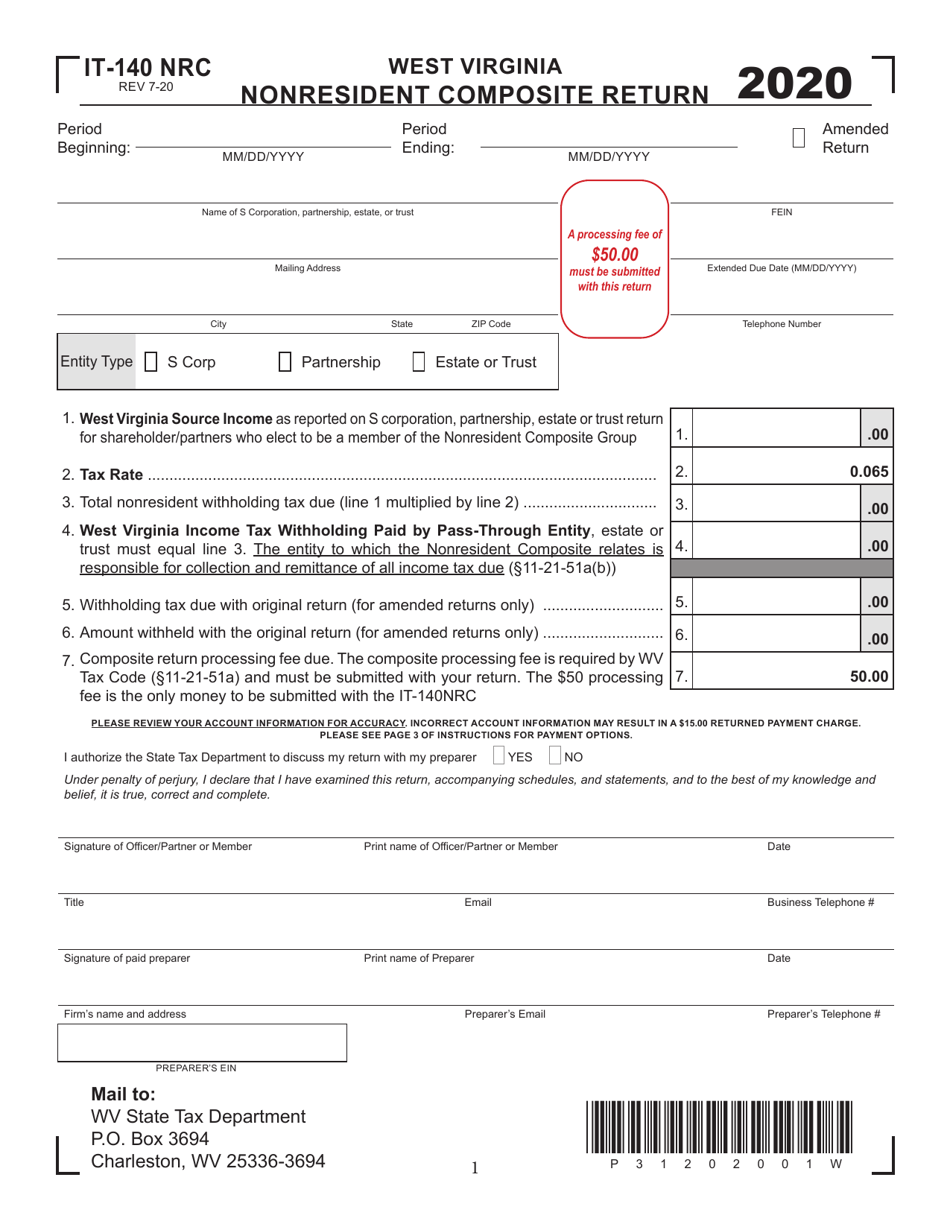

The due date for each income tax return type can be found in the.

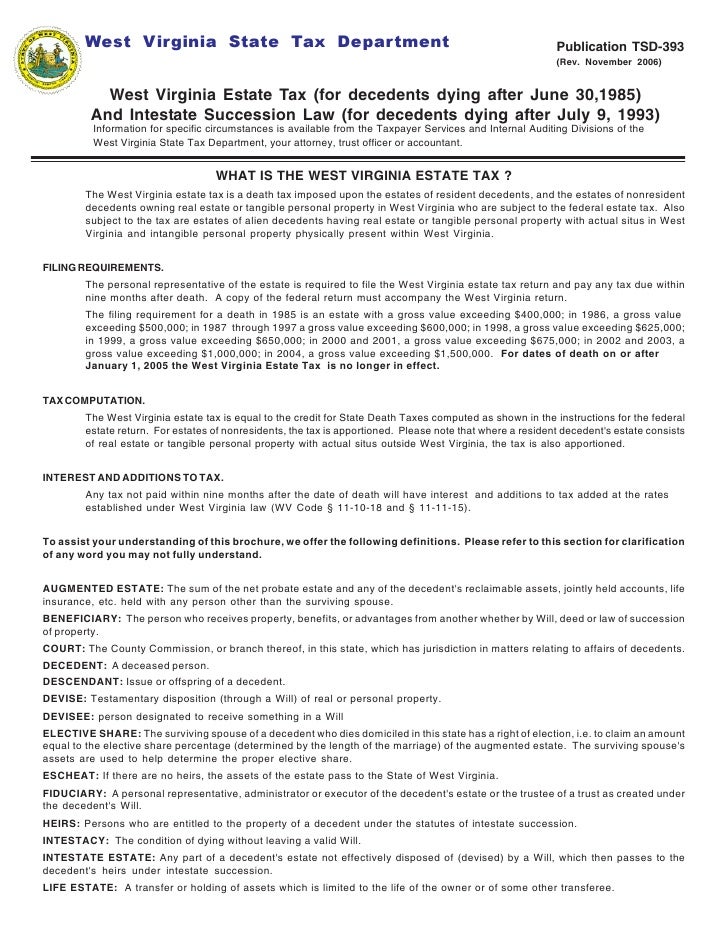

Wv estate tax return. Income tax return for estates and trusts, is required if the estate generates more than $600 in annual gross income. Or personal property located in wv must file a wv income tax return. The proper forms and instructions will be sent to the executor/administrator after the appraisement has been filed.

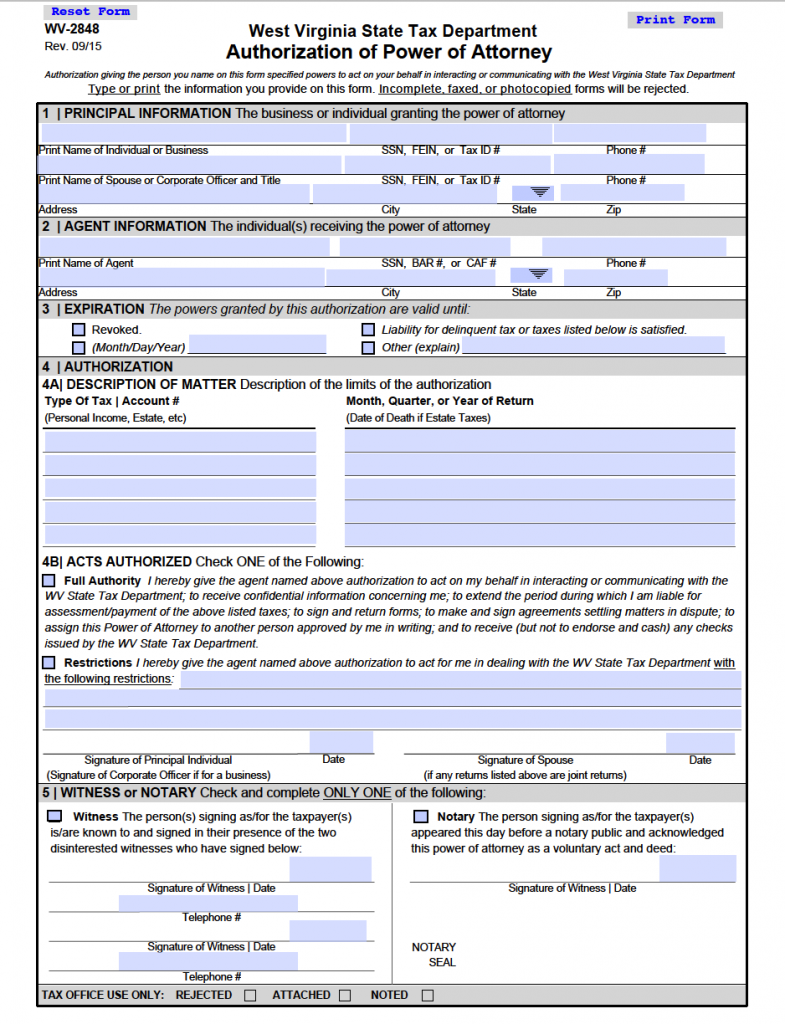

Filing thresholds for estate taxes paid to another state must be documented — attach a copy of the other state’s closing letter certifying the amount of tax paid or a copy of the tax return filed in the other state(s). Generally, the estate tax return is due nine months after the date of death. To sign a wv state tax department fiduciary estate tax return forms 2008 right from your iphone or ipad, just follow these brief guidelines:

Payment of additional estate taxes in wv. Before filing form 1041, you will. West virginia won’t tax your estate, but the federal government may if your estate has sufficient assets.

Most state residents do not need to worry about a state estate or inheritance tax. It's also called a fiduciary return, because you file it in your capacity as executor of the estate. If you, as executor, decided to go by.

Virginia has no estate tax. The taxable year of the estate or trust for west virginia income tax purposes is the same as the one used for federal tax purposes. This comes out to 0.22% of the final closing price.

What is the estate tax? The appropriate income tax return must be filed for the year in which the transfer of the real property occurred. If not paid on time, interest and additions to tax at the rates established by.

Available for pc, ios and android. An inheritance tax is one method states use to tax the transfer of wealth. As a virginia beach, va cpa firm with a reputation for honesty, you can trust that griff tax and accounting llc will calculate your estate taxes with the greatest care.

September 15 would be the fifteenth day of the fourth month following that date. Create an account using your email or sign in via google or facebook. The exemption jumped after the new tax bill was signed in 2017.

Start a free trial now to save yourself time and money! Any estate required to file a federal estate tax return (form 706) will be required to file a west virginia estate tax return. With the elimination of the federal credit, the virginia estate tax was effectively repealed.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Return to virginia department of taxation, processing operations, p.

The gift tax return is due on april 15th following the year in which the gift is made. Total remittance the west virginia estate tax is due and payable by the personal representative at the time the west virginia estate tax return is required to be filed. Upload the pdf you need to.

In addition to state transfer tax, individual counties in west virginia also charge their own excise tax on real property transfers. For uncle bartholomew, if the tax year began in june, when he died, it would end on may 31 of the subsequent year; Fill out, securely sign, print or email your wv state tax department fiduciary estate tax return forms 2009 instantly with signnow.

Not to be confused with an estate tax, which is payable from the estate of the deceased, an inheritance tax is paid by a person who inherits from the deceased. Prior to july 1, 2007, virginia had an estate tax that was equal to the federal credit for state death taxes. The proper forms and instructions will be sent to the fiduciary once the appraisement has been received by the state tax department.

But some states do have these kinds of taxes, which are levied on people who either owned property in the state where they lived (estate tax) or who inherit property from someone who lived there (inheritance tax). We have both the skills and expertise to ensure that estate and gift taxes are properly considered as part of your overall tax plan, and that your tax returns are filed with. The income tax return form for estates is irs form 1041.

For tax year 2015, the due date for an annual estate or trust west virginia fiduciary income tax return is april 18, 2016. (an executor is a fiduciary—that is, someone who is entrusted with someone else's money—and has a legal duty to act honestly and in the best interests of the estate.) It is sometimes referred to in the media as the “death tax.”

However, certain remainder interests are still subject to the inheritance tax. The estate tax is a tax levied against the estate of a recently deceased person, before the money is passed on to their heirs. In addition to the individual tax return and the estate income tax return, it may also be necessary for an executor to file a us estate tax return (form 706).

The federal estate tax exemption is $11.18 million for 2018. The decedent and their estate are separate taxable entities. It will further increase to $11.40 million in 2019.

In west virginia, there is a state deed transfer tax of $1.10 for every $500 of property value, or $2.20 for every $1,000 of property value. Today, virginia no longer has an estate tax* or inheritance tax. It is one of 38 states not to levy a tax on an estate of any size.

The estate income tax return is due on the fifteenth day of the fourth month after the end of the tax year. For anyone who has received or is anticipating an inheritance, following is a short guide to west virginia inheritance tax.

Free Tax Power Of Attorney West Virginia Form Adobe Pdf

Estate Taxes In Wv Filing A Final Estate Tax Return And Other Responsibilities Blog Jenkins Fenstermaker Pllc

State-by-state Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

/8379InjuredSpouseAllocation-1-03b68023b499432fabbad2fdc66b4b5e.png)

Form 8379 Injured Spouse Allocation Definition

Filing Llc Taxes – Findlaw

Rental Property Management Template- Long Term Rentals Rental Income And Expense Categories Rental Property Management Property Management Rental Property

Tsd393 Statewvus Taxrev Taxdoc Tsd

Whats An Estate Tax Do You Have To Pay It In Ohio – Estate Tax Issues

2022 Tax Brackets 2022 Federal Income Tax Brackets Rates

How Taxes On Property Owned In Another State Work For 2021

Sheriff-tax Office –

Form It-140 Nrc Download Printable Pdf Or Fill Online West Virginia Nonresident Composite Return – 2020 West Virginia Templateroller

Gov Justice Announces Extension Of State Tax Filing Deadline For Individuals To May 17 2021

Crowdfunding And Franchising The Perfect Fit Company Structure Franchising Crowdfunding

The Us Court System Is Criminally Unjust Personal Injury Attorney Attorney At Law Law Firm

31114 Income Tax Returns For Estates And Trusts Forms 1041 1041-qft And 1041-n Internal Revenue Service

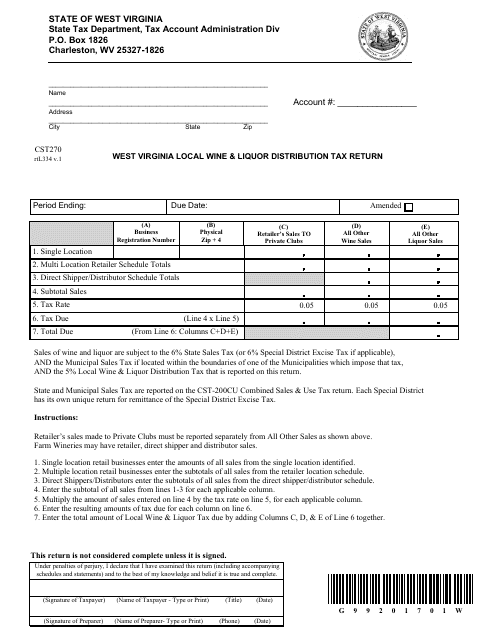

Form Cst-270 Download Printable Pdf Or Fill Online Local Wine Liquor Distribution Tax Return West Virginia Templateroller

2

Pengadilan Agama Padang Website Resmi Pengadilan Agama Padang