Cle taxes have grown at a fairly steady rate, averaging around 2.9% over the past decade. Please be advised that notification of local sales tax rate changes will no longer be mailed.

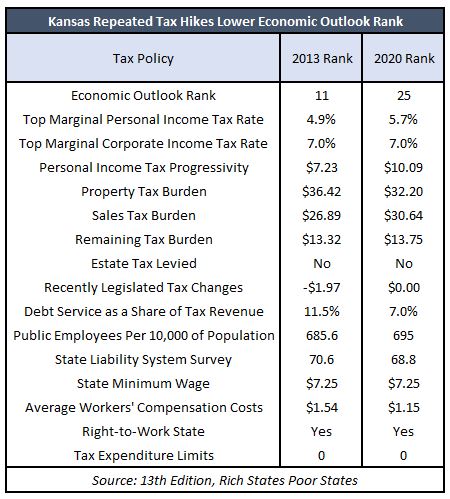

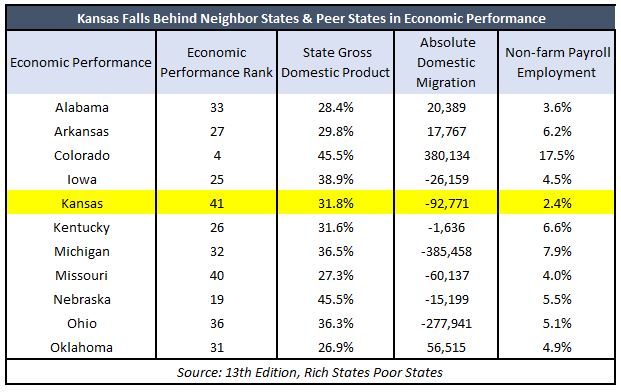

Kansas Ranks 41st On Economic Performance With Repeated Tax Hikes – Kansas Policy Institute

Kansas sales and use tax rate locator.

Wichita ks sales tax rate 2020. Average sales tax (with local): You can print a 7.5% sales tax table here. The current total local sales tax rate in wichita county, ks is 8.500%.

State and local sales/use tax rate changes this notice addresses changes to the kansas sales and use tax rates. 20 waterville 5.00% 7/1/2020 12 wellington 6.00% 7/1/2004 02 wichita 6.00% 7/1/1990 64 wilson 3.00% 4/1/2020 08 winfield 6.00% 10/1/2014 city totals cities (including spec dists) with a transient guest tax rate 115 city and county totals cities and counties with a transient guest tax rate 149 kansas dept of revenue/policy and research Lower sales tax than 57% of kansas localities.

This table shows the total sales tax rates for. The kansas sales tax rate is currently %. The county sales tax rate is %.

The minimum combined 2021 sales tax rate for wichita, kansas is. The 2018 united states supreme court decision in south dakota v. The december 2020 total local sales tax rate was also 7.500%.

Kansas sales and use tax rate locator. Click here for a larger sales tax map, or here for a sales tax table. The latest sales tax rates for cities in kansas (ks) state.

Choose one of the following options: 3% lower than the maximum sales tax in ks. The december 2020 total local sales tax rate was also 8.500%.

Every 2021 combined rates mentioned above are the results of kansas state rate (6.5%), the county rate (1%). The wichita sales tax rate is %. For october 2021, kansas tax revenue was 11.1 percent greater than october 2020, and 24.4 percent less than september.

How 2021 sales taxes are calculated in wichita. Wichita county collects a 2% local sales tax, the maximum local sales tax. The current total local sales tax rate in wichita, ks is 7.500%.

The december 2020 total local. Kansas has a 6.5% sales tax and sedgwick county collects an additional 1%, so the minimum sales tax rate in sedgwick county is 7.5% (not including any city or special district taxes). Combined with the state sales tax, the highest sales tax rate in kansas is 10.6% in the city of.

The sales tax added to the original purchase price produces the total cost of the purchase. Olathe, ks sales tax rate: The december 2020 total local sales tax rate was also 7.500%.

Special districts (community improvement, transportation development, star. Depending on the zipcode, the sales tax rate of wichita may vary from 6.2% to 7.5% depending on the zipcode, the sales tax rate of wichita may vary from 6.2% to 7.5% Kansas has state sales tax of 6.5% , and allows local governments to collect a local option sales tax of up to 4%.

Kansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 4%.there are a total of 377 local tax jurisdictions. The current total local sales tax rate in wichita, ks is 7.500%. 31 rows newton, ks sales tax rate:

Wichita county, ks sales tax rate. This is the total of state, county and city sales tax rates. Jurisdiction code combined tax rate.

The 7.5% sales tax rate in wichita consists of 6.5% kansas state sales tax and 1% sedgwick county sales tax. The wichita county sales tax is collected by the merchant on all qualifying sales made within wichita county; 101 rows the 67216, wichita, kansas, general sales tax rate is 7.5%.

The wichita county, kansas sales tax is 8.50%, consisting of 6.50% kansas state sales tax and 2.00% wichita county local sales taxes.the local sales tax consists of a 2.00% county sales tax. This site provides information on local taxing jurisdictions and tax rates for all addresses in the state of kansas. Kansas has a 6.5% sales tax and wichita county collects an additional 2%, so the minimum sales tax rate in wichita county is 8.5% (not including any city or special district taxes).

The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. Publication 1700 is no longer available online as a pdf, but can be requested by email at kdor_forms@ks.gov. For best results, use complete and accurate address information when submitting your query.

There is no applicable city tax or special tax. This table shows the total sales tax rates for all cities and towns in wichita county, including all local taxes. Choose one of the following options:

Rates include state, county and city taxes. The current total local sales tax rate in wichita county, ks is 8.500%. , ks sales tax rate.

Bracket cards for all kansas sales and use tax rates may be obtained by emailing: There are a total of 376 local tax jurisdictions across the state, collecting an average local tax of 1.555%. The wichita, kansas, general sales tax rate is 6.5%.

Lower sales tax than 57% of kansas localities.

Kansas Property Tax Calculator – Smartasset

2

Kansas Sales Tax Rate – 2021

Kansas Sales Tax Rate – 2021

Kansas Sales Tax Rate – 2021

Kansas Ranks 41st On Economic Performance With Repeated Tax Hikes – Kansas Policy Institute

Kansas Property Tax Calculator – Smartasset

Kansas Ranks 41st On Economic Performance With Repeated Tax Hikes – Kansas Policy Institute

Stop Laundry Tax Legislation And Lobbying In Laundry

Kansas Income Tax Calculator – Smartasset

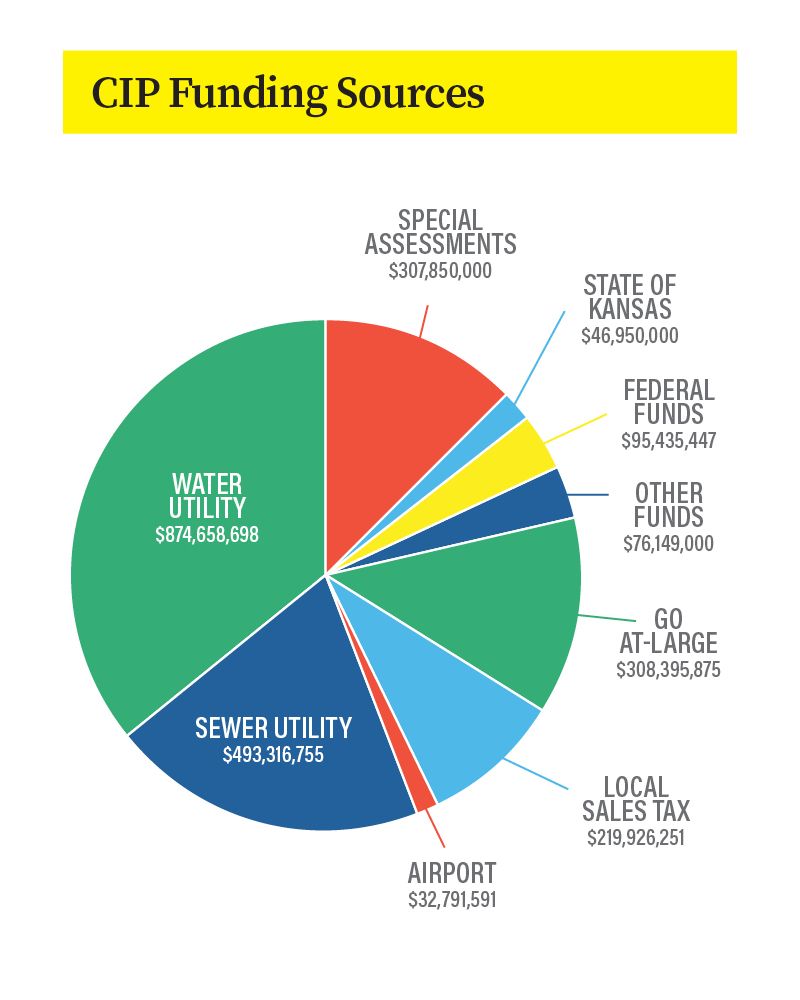

The Cip Explained

Kansas Sales Tax Rate – 2021

2

For Sale 2015 Porsche Panamera Gts 2015 Porsche Panamera Gts Under Warranty Until 2022 Cape Verde Islands Porsche Panamera United States Report

Flow Toyota Of Statesville – Home Facebook

Kansas Income Tax Calculator – Smartasset

9oz5mmdni3ph6m

Louisiana Property Taxes By County – 2021

Kansas Sales Tax Rate – 2021