Sales tax is expected to erode in 2020 due to the stay at home order and recession. The minimum combined 2021 sales tax rate for wichita, kansas is.

S-4 1 A2242944zs-4htm S-4 Use These Links To Rapidly Review The Document Table Of Contents Index To Financial Statements Table Of Contents Table Of Contents As Filed With The Securities And Exchange Commission On March 12 2021

In wichita the rate is six percent.

Wichita ks sales tax rate 2019. The kansas sales tax rate is currently %. The tax rate has ticked up over time, from under 5% in the 90s to 6.5% today. 2% lower than the maximum sales tax in ks.

, ks sales tax rate. Agents from the kansas department of revenue (kdor) accompanied by sheriff officers on the 16th day of april, 2019 executed tax warrants and seized the assets of casa ramirez llc for nonpayment of sales and withholding totaling $4,467.58. In some cases, jurisdictions may levy additional taxes that may not be paid to the kansas department of revenue.

City documents were mistaken, which raises more issues. Jurisdiction codes are used by retailers in completing their sales and use tax returns. Kdor seizes assets in execution of wichita county tax warrant.

The zip code rate table lists by city and zip code, the tax rate and jurisdiction code that applies to the. Wichita, ks sales tax rate. This is the case with the wichita city tourism fee, which took effect on january 1, 2015.

The city of wichita receives approximately 58% of collections. Recent increases have come in response to the budget problems caused by the great recession and income tax cuts. Publication 1700 is no longer available online as a pdf, but can be requested by email at kdor_forms@ks.gov.

The current total local sales tax rate in wichita, ks is 7.500%. There is no applicable city tax or special tax. Kansas sales and use tax rate locator.

There is no applicable special tax. There was no successful wichita city sales tax election. The december 2020 total local sales tax.

The 8.5% sales tax rate in haysville consists of 6.5% kansas state sales tax, 1% sedgwick county sales tax and 1% haysville tax. Higher sales tax than 84% of kansas localities. Depending on the zipcode, the sales tax rate of wichita may vary from 6.2% to 7.5% depending on the zipcode, the sales tax rate of wichita may vary from 6.2% to 7.5%

The county sales tax rate is %. This site provides information on local taxing jurisdictions and tax rates for all addresses in the state of kansas. You can print a 7.5% sales tax table here.

One half of sales tax collections are received by the general fund. In this case, wichita is a bargain, due to our lower. For residential property taxes, wichita ranks below the national average.

The city had passed a one cent per dollar sales tax. Choose one of the following options: The wichita sales tax rate is %.

The purpose, function, and nonprofit status of this organization and the exempt status for federal income tax purposes: The agenda packet for this week’s meeting of the wichita city council held a surprise: Sedgwick county, kansas has a maximum sales tax rate of 8.5% and an approximate population of 399,040.

The 7.5% sales tax rate in wichita consists of 6.5% kansas state sales tax and 1% sedgwick county sales tax. For a property valued at $150,000, the effective property tax rate in wichita is 1.19 percent, while the national average is 1.34 percent. The wichita, kansas, general sales tax rate is 6.5%.

For best results, use complete and accurate address information when submitting your query. For tax rates in other cities, see kansas sales taxes by city and county. The distribution is based on taxing effort and population;

The results for a $300,000 property were similar. This is the total of state, county and city sales tax rates. Kansas register 06 2 1 9 sept.

Sales tax rates in sedgwick county are determined by twelve different tax jurisdictions, derby, kechi, maize, sedgwick county, cheney, bentley, mulvane, wichita, park city, haysville, mount hope and valley center.

Marin County California Property Taxes – 2021

2019 Legislators Budget Guide Taxing Remote Sales Sports Gambling – Kansas Policy Institute

Wheres My Refund Kansas Hr Block

Governor Pushing To End Kansas High Sales Tax On Groceries

Hot Sales The Promised Neverland Emma Cosplay Wig Short Blonde Hair Gradient Curly Cap Buy Best -jabarbkkbngoid

S-4 1 A2242944zs-4htm S-4 Use These Links To Rapidly Review The Document Table Of Contents Index To Financial Statements Table Of Contents Table Of Contents As Filed With The Securities And Exchange Commission On March 12 2021

2

Governor Pushing To End Kansas High Sales Tax On Groceries

S-4 1 A2242944zs-4htm S-4 Use These Links To Rapidly Review The Document Table Of Contents Index To Financial Statements Table Of Contents Table Of Contents As Filed With The Securities And Exchange Commission On March 12 2021

2

Casio Se-g1 Tax Rate Programming Setting The Tax To Be Add In – Youtube

2

S-4 1 A2242944zs-4htm S-4 Use These Links To Rapidly Review The Document Table Of Contents Index To Financial Statements Table Of Contents Table Of Contents As Filed With The Securities And Exchange Commission On March 12 2021

Property Taxes For In Arizona Everything You Need To Know – Kake

Kansas Department Of Revenue – Sales Retailers Forms And Publications

2019 Legislators Budget Guide Taxing Remote Sales Sports Gambling – Kansas Policy Institute

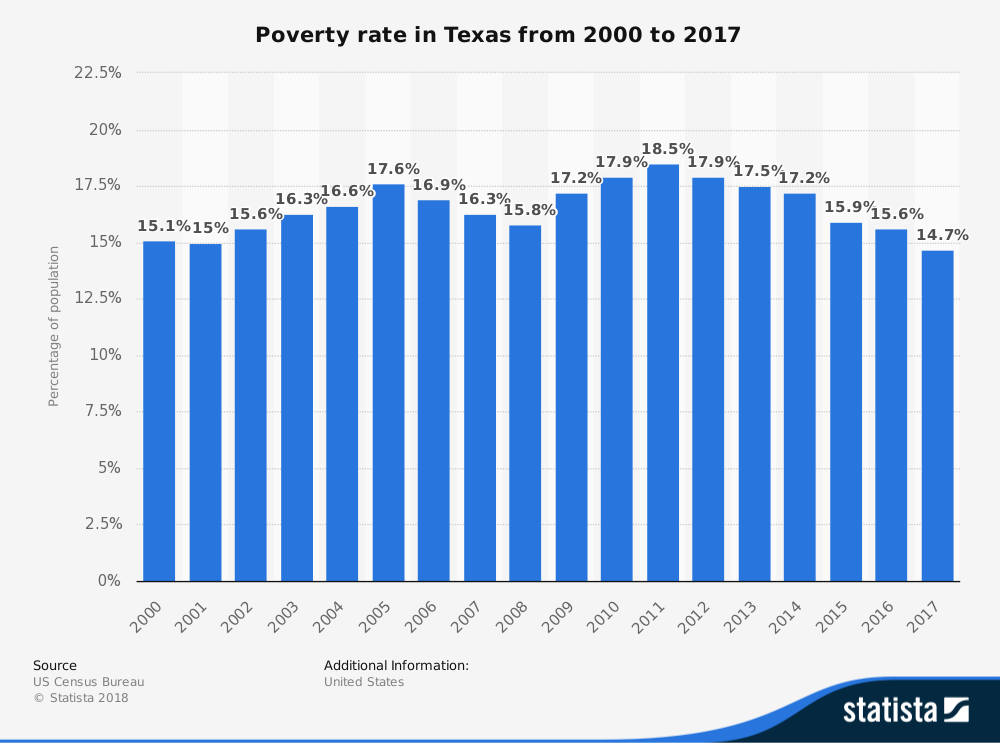

22 Living In Texas Pros And Cons Vittanaorg

2

2