According to autolist.com , buyers are required to register. If the seller has purchased a new vehicle and transferred the license plate, the seller must apply for.

Do You Need A Bill Of Sale To Transfer Title In Florida Etags Vehicle Registration Title Services Driven By Technology

A valid license plate may be transferred to the new vehicle.

Who pays sales tax when selling a car privately in florida. Complete title transfer in a motor vehicle service center. Florida collects a six percent sales tax on the purchase of all new or used vehicles. By law a dealer has 20 days to send your title transfer and sales tax to the secretary of state s office.

You will pay less sales tax when you trade in a car at the same time as buying a new one. Therefore, the profit on its sale or transfer will not be subjected to income tax. According to autolist.com, buyers are required to register and collect vehicles on every vehicle they sell.

Car used for personal purpose will be personal effect and not treated as capital asset as per definition in section 2 (14). So if you bought the car for $14,000 and sold it for $8,000, you would have a capitol loss of $6,000. It is time consuming, can be complicated and confusing, and a hassle.

Doing so protects you from civil liability and other headaches that could occur if the buyer. Florida law requires motor vehicle dealers to register and collect taxes on each vehicle it sells. According to nj.com, the state assesses a 6.625 percent sales tax on the purchase price of any used or new vehicle.

Any portion of the sales price paid by the purchaser is subject to tax. If you buy a car for $30,000, you would typically owe a six percent sales tax, which comes to $1,800. According to the internal revenue service, the tax rate, which is based on the net capital gain, is usually no.

However, no depreciation is admissible on personal effects. In florida, the only vehicle you can sell privately is a car that you own. When you purchase a vehicle through a private sale, you must pay the associated local and state taxes.

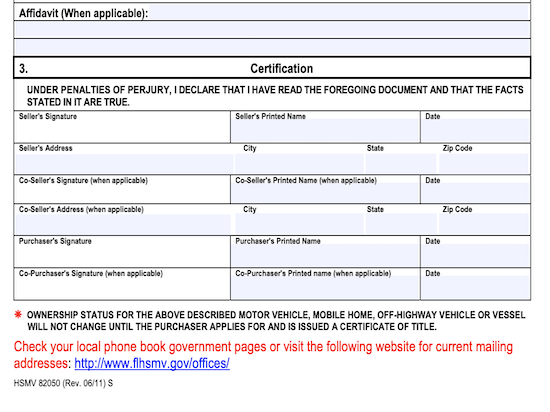

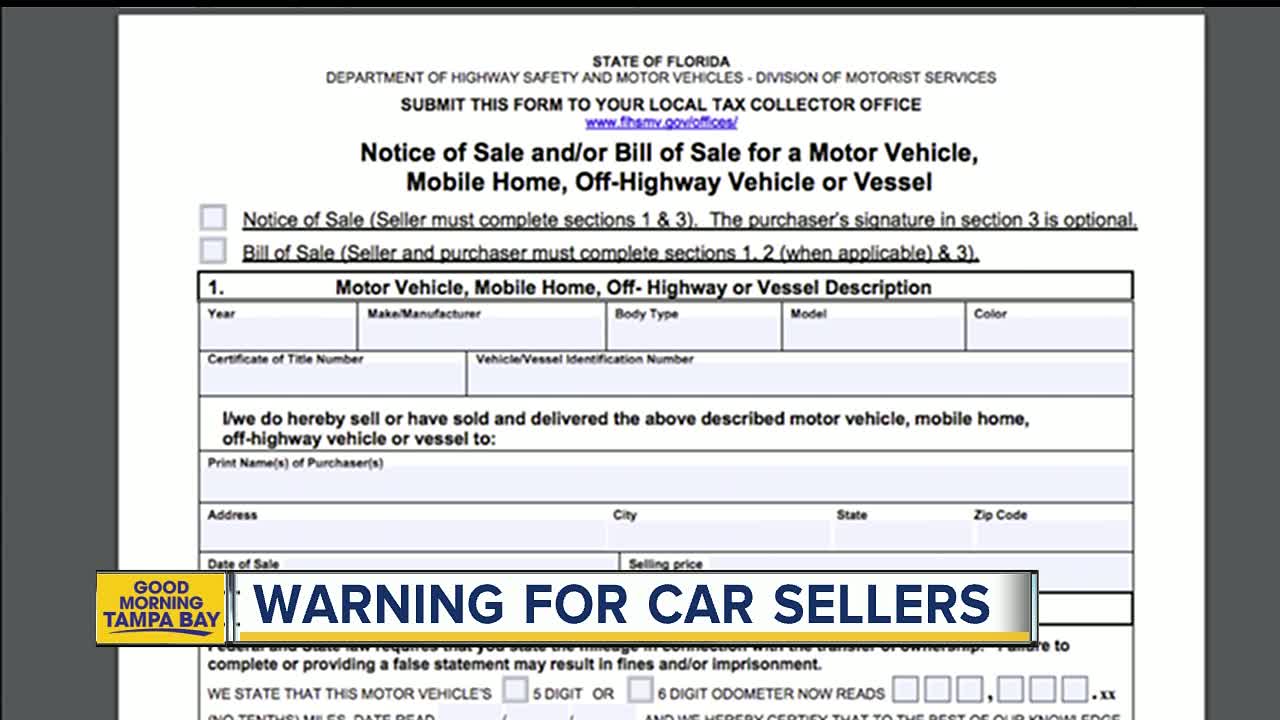

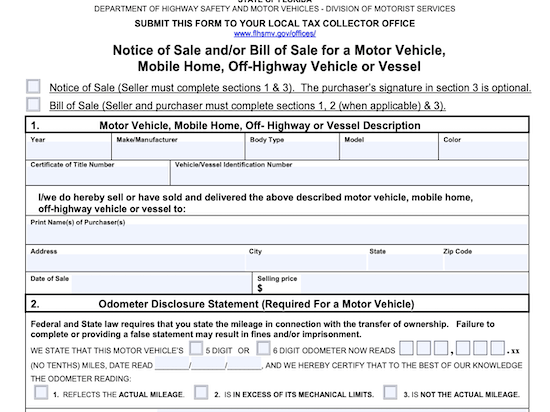

Florida collects a 6% state sales tax rate on the purchase of all vehicles. But if the original sales price plus the improvements add up to $8,000 and you sell the car for $10,000, you'll have to pay capital gains tax on your $2,000 profit. As of july 2009, florida law requires all sellers to file a notice of sale.

However, if you bought it for $14,000 and sold it for $15,000, earning a $1,000 capital gain, you would report this on your tax return, using schedule d on form 1040 that's appropriately titled capital gains and losses. the form. What is a notice of sale. In most states, you’ll need to bring your bill of sale and signed title to the department of motor vehicles (dmv) or motor vehicle registry agency to pay your taxes and obtain your registration, new title, and.

If you spend $7,000 on a car and an additional $1,000 on improvements but you sell the car for $7,000, it's considered a capital loss, and you don't need to pay tax on the sale. When the purchaser does not pay florida sales and use tax to the seller for a boat purchase, any sales and use tax, plus any applicable discretionary sales surtax, is paid to the county tax collector, licensed private tag agency, or the department of highway safety and motor vehicles when registering the boat in florida. The tax imposed is the amount of state sales tax that would be imposed by.

Collect the buyers home state rate up to florida 6%; As you can see, the process of selling a car in florida can be complex. That said, if you buy a car from someone privately, you.

Who pays sales tax when selling a car privately in florida? In the vast majority of circumstances, selling your old car to a private party or to a dealer shouldn’t bring a tax bill with it. Sales to someone from a state with sales tax less than florida.

What is a notice of sale? Thereafter, only 6%state tax rate applies. Be certain that the process is completed properly by understanding the seller’s rights and responsibilities.

To calculate how much sales tax you’ll owe, simply multiple the vehicle’s price by 0.06625. According to autolist.com, buyers are required to register and collect vehicles on every vehicle they sell. • when the sale of a motor vehicle to a resident of another state that imposes a sales tax of less than six percent and the purchaser takes possession of the vehicle in florida, the purchaser’s home state tax rate is applied when:

The buyer must pay florida sales tax when purchasing the temporary tag. However, the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in with a maximum tax rate of 1.5%. Florida collects a six percent sales tax on the purchase of all new or used vehicles.

It should be noted that the local tax is only applied to the first 5,000 dollars of the cost of the vehicle. The buyer must pay 95 to the secretary of state and a tax to the department of revenue. However you do not pay that tax to the individual selling the car.

Vehicle registrations that expire between march 16 2020 and june 14 2020 are being extended through june 15 2020. The internal revenue service considers all. It will need to be complete and then filed with your local county tax collector office.

If applicable, surrender the license plate. Florida collects a six percent sales tax on the purchase of all new or used vehicles. However, the scenario is different when you profit from the sale.

License plates and registrations buyers must visit a motor vehicle service center to register a vehicle for the first time. The local surtax only applies to the 1st $5,000. Registration taxes are based on the weight of the vehicle.

Selling a vehicle in a private sale can be beneficial for both the buyer and seller. If a car wasn’t titled in florida, a complete vehicle identification number (vin) check must be done by the seller. Tax obligation when you buy a car through a private sale.

For example, a $15,000 car will cost you $993.75 in state sales tax. The buyer must pay florida sales tax when. Vin checks must be verified by either a florida dhsmv compliance officer, a licensed florida.

Remove license plates from the sold car. You would not have to report this to the irs.

Selling A Car In Florida A Former Dealers Advice

Steps To Take Before Selling Your Car In Florida

Bmw Isetta 300 1957 Bmw Isetta Isetta Bmw Isetta 300

Do You Need A Bill Of Sale To Transfer Title In Florida Etags Vehicle Registration Title Services Driven By Technology

Loaner Car Agreement Template Free Printable Templates Printable Free Payroll Template Agreement

Free Vehicle Private Sale Receipt Template – Pdf Word Eforms

Sell Your Damagedused Car Today Used Cars Commercial Vehicle Damaged Cars

Purchase Agreement Free Purchase Agreement Form Us Contract Template Separation Agreement Template Purchase Agreement

Get Our Example Of Sales Rep Commission Template For Free Contract Template Agreement Sales Agent

Vehicle Sales Purchases – Orange County Tax Collector

Sale Receipt – General Car Discussion Vehicle Documentation Registration Import Le – Pakwheels Forums Lettering Bill Of Sale Car Save

Nj Car Sales Tax Everything You Need To Know

Thanks Diane And Danny For Your Feedback We Appreciate Your Trust In Us And Look Forward To A Lifetime Relat Investing Real Estate Investing Investment Group

How To Transfer The Title Of A Car Yourmechanic Advice

Free Vehicle Private Sale Receipt Template – Pdf Word Eforms

Do You Need A Bill Of Sale To Transfer Title In Florida Etags Vehicle Registration Title Services Driven By Technology

Car Sales Invoice Template

Trade In Car Or Sell It Privately – The Math Might Surprise You

26 Tax Write Offs For Freelance Photographer Tax Deductions Tax Write Offs Business Expense Tracker Traveling By Yourself